There are many parts to personal finance, but the one I think about all the time is investing.

It wasn’t always like this. At the beginning of my journey, I was more about saving — trying to “hack” things like credit card benefits and loyalty points — to try save money. You could say I’ve reached financial stability, so saving RM 10 on a meal won’t make an impact anymore — but figuring out how I can get 1% more returns will.

Roughly eight months ago, I started on a financial planning program with a team of licensed financial planners. We’d already covered some other parts of personal finance (e.g. cashflow, insurance, estate planning), but the one session I was really waiting for was: Investments.

We finally did it last month. My advisers reviewed all my investments with me, and proposed an action plan. It’s the most major change to my investment portfolio since I started investing, so I wanted to document it here.

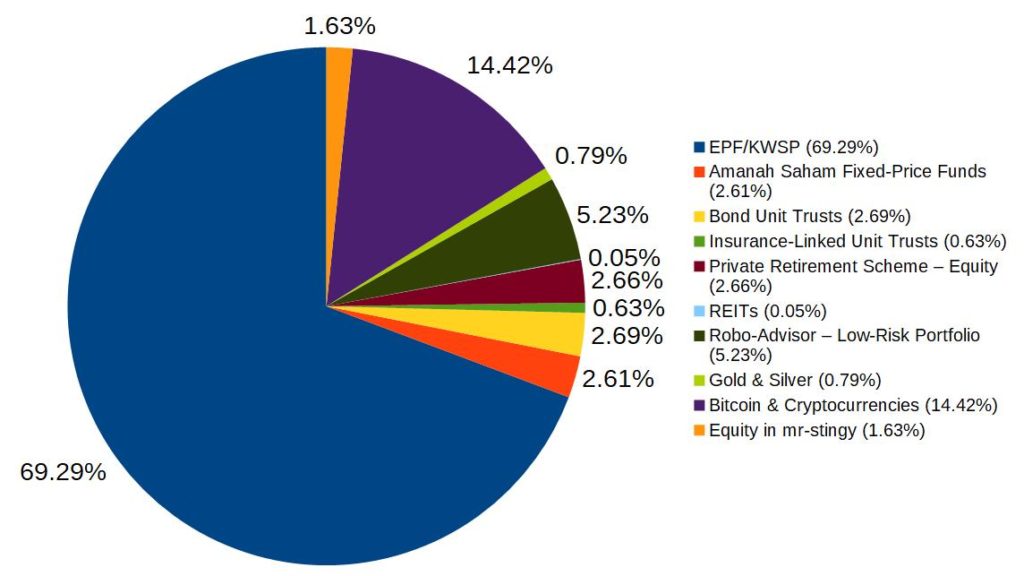

Let’s start with a recap of my investment portfolio from July 2020.

mr-stingy’s Investment Portfolio — July 2020

I considered this an 80% safe, 20% risky portfolio. The 80% safe portion consisted mostly of: EPF retirement funds, a low-risk robo-advisor portfolio, Amanah Saham and bond unit trusts.

Meanwhile, the 20% high-risk-high-return portion consisted of: cryptocurrencies, an equity Private Retirement Scheme (PRS), equity in my company (mr-stingy LLP), and precious metals.

Rationale: With the majority of funds in safe assets, I was hoping the riskier stuff (e.g. Bitcoin) would bring me high returns. That was my “barbell” way of balancing risk and reward.

I’d built my entire portfolio without professional advice. It was DIY via my own reading and beliefs about investing. I was proud of it, like how a father thinks his imperfect son is perfect.

Where I’m At in Life

Before I go on, I wanted to share my personal circumstances. Just so you understand which stage of life I’m at and where I’m coming from.

I’m 37 this year; based in Kuala Lumpur, Malaysia. I work a full-time job for 45-50 hours/week, plus spend another ~12 hours on this blog. The only financial commitment I currently have is my home loan. (I paid off my student loan before I turned 32.) I’m blessed enough to not have any other expensive health or family-related commitments.

I don’t consider myself a great success in any particular area of life, but rather I take pride in maintaining balance.

My wife has a good full-time income too. Planning for kids in the near future. We’re financially stable, but far from financial independence or early retirement.

A Different Point of View

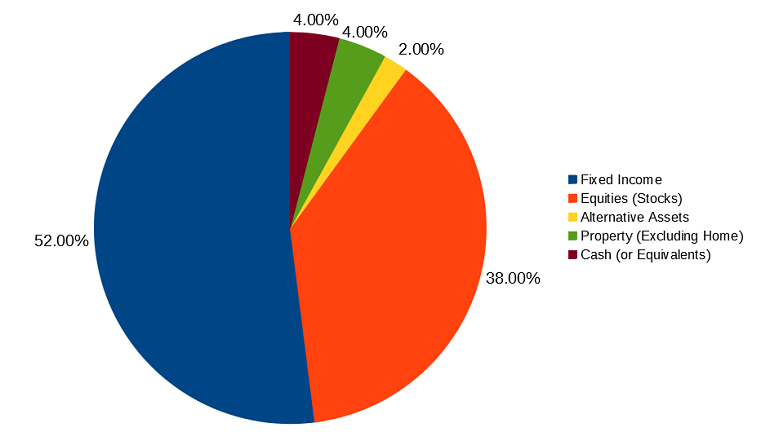

The first thing my advisers (let’s call them “CS”) made me understand, was they viewed my portfolio in a different way. Here’s my investment portfolio through the lens of different asset classes:

mr-stingy’s Investment Portfolio — May 2021

- This is purely investments, so it doesn’t include emergency savings or the value of my home.

- Since it excludes my home, I was initially surprised to see 4% of my portfolio in property. This actually comes from the EPF, who invest in 50% Fixed Income, 40% Equities, 5% Property and 5% Cash. As part of their review, CS had broken down my EPF holdings into the asset classes above.

- If you think about it from convenience + cost factors, the EPF is actually really cool. Without lifting a finger, you already get a nicely-balanced portfolio.

- I’ve excluded the Bitcoin and crypto portion. More on that later.

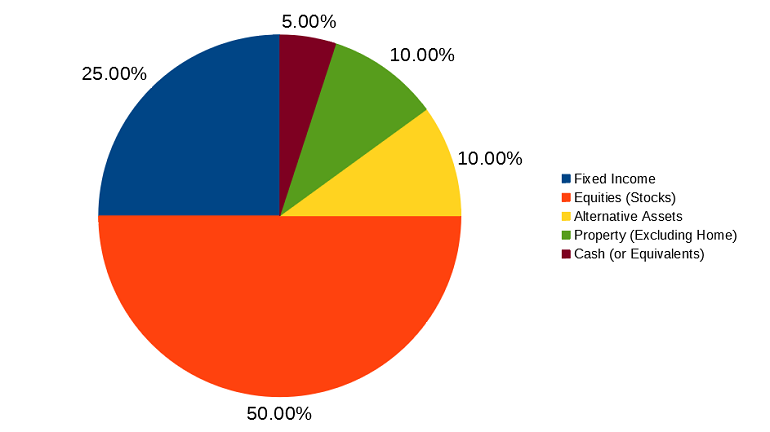

Meanwhile, CS recommended me the below:

Recommended Investment Portfolio — May 2021

- My risk profile is “Moderately Aggressive.”

- Investing is a very personal thing. CS considered multiple factors like my age, risk appetite and income before they gave me their recommendation. Your recommended portfolio might be very different to mine.

Comparing my existing portfolio vs the recommended one, it was clear I had a lot to change. “Why so much bonds?!” Here’s what CS suggested I do:

Recommended Actions

- Sell all my underperfoming bond unit trusts.

- Top up my emergency savings to 6 months of expenses. Maintain 3 months expenses in my flexi-home loan, and invest another 3 months in a bespoke iFAST Income Portfolio.

- Switch my Robo-advisor (StashAway) portfolio from the 6.5% Risk Index to the 22% one.

- Start monthly investments into:

- 70% Equities, 30% Bonds iFAST Managed Portfolio

- 67% Equities, 33% Bonds Akru Robo-advisor

Me being me, I had some additional angles to consider:

- Initially, CS suggested rebalancing my oversized crypto portfolio — sell some crypto to buy more equities. Even though I decided not to, CS still reviewed my overall crypto portfolio. They’re (somewhat) relieved most of my holdings are in Bitcoin, and not shitcoins. 🙂

- Likewise, CS suggested moving some of my virgin EPF funds into higher-performing assets. Similarly, I said no. This is more emotional than anything, but I think I’ll find a sense of joy when I’m old someday and withdraw the money — tweeting to my remaining 55 followers: “This is what compounding can do after 32 years.”

- I’m still figuring out how much I want to invest in the monthly investment plans. It’ll likely be: 8% of my salary into the Managed Portfolio, 8% into the Robo-advisor and 2% into Bitcoin.

- At face value, the Managed Portfolio fees seem expensive (up to 1.5% per year), so I’ll be watching its performance very closely.

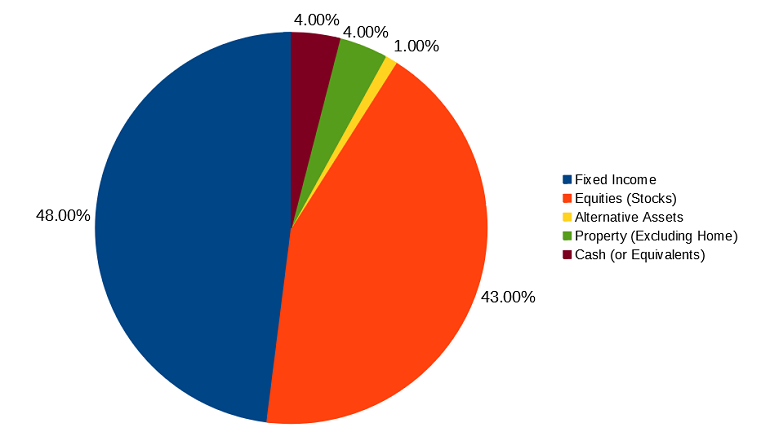

This is what things will look like after rebalancing in June 2021:

Based on this plan (factoring in two kids, and completely ignoring my crypto) — I should be able to retire by 56.

A Note About Crypto

I’ve removed the Bitcoin & crypto portion from my portfolio discussion as it would skew things otherwise. To be clear, I view crypto as a supplementary portfolio now, which I’ll manage separately. Even if it goes to zero (super-low likelihood IMHO), it won’t affect my life plans one bit.

Meanwhile, if it continues to outperform, I’ll be able to accelerate all my life goals, and buy some nice things for my family. Over the last five years of crypto investing, I have roughly an overall 357% gain.

How to get 357% gains over five years? The bulk of my gains have been from buying Bitcoin and Ethereum, then holding for the long term. I’ve dabbled in a lot of altcoins, but either I make just a little, or I crash and burn. I probably wouldn’t make a very good day trader.

Closing Thoughts: What I’ve Learned About Investing

Focus. I used to wanna tightly control every aspect of my money. Now that I’m older, I realize I’m running out of time. To leverage my efforts, it’s often better to get professional help. Yes this means I’ll have to pay some fees, but expertise is valuable.

Find an adviser you’re comfortable with. Don’t know if I’m viewed as a difficult client, but I have tons of granular questions going into every session. Because investing is such a personal thing, it’s important to find someone who really listens and empathizes with you.

Admit what you suck at and cut your losses. When I started investing many years ago, I DIY-ed into FSMOne. I thought I could pick good unit trusts — plus it was the cheapest, simplest way to get started. Unfortunately, I’ve made roughly only 2% per year. That’s horrible. I could have just snoozed my money into the EPF and done much better.

This isn’t a diss on FSMOne or unit trusts.

It’s about understanding strengths and weaknesses. I have a terrible track record. Plus reading fund fact sheets doesn’t spark joy like when I was 25 anymore.

Meanwhile, I’ve done okay as a crypto investor. And looking at the amount of innovation happening in the crypto space, and how it fits into my interests and capabilities — I’ve decided it’s where I want to spend the bulk of my future investing decisions.

As for everything else, well that’s what my financial planner is for.

– – –

Further Reading: My Experience With a Licensed Financial Planner in Malaysia (includes details on fees plus a FREE consultation session with Wealth Vantage Advisory).

Article contains affiliate links, meaning if you sign up for something I might get a small fee — but at no cost to you.

Pic from Pexels: Marek Piwnicki

Hey Aaron,

Great write up as always. In your articles titled ‘ Lifetime Earnings, Lifetime Savings’ , you ended it with a point -‘ If you’re not even beating a passive index fund (~10% a year), perhaps it’s time to reconsider your strategy?’

Question 1 would be – after getting the services of financial advisors and ignoring crypto, did they manage to achieve an overall average of 10% ? I’m of the same school of thought with you with regards to EPF in that it’s underrated – thus next question would be has the reallocation of your assets by financial advisors help you achieve an overall higher that EPF’s average of 6% ?

Thank you.

Hi Aman,

Thanks for dropping by. Yeah, currently my financial advisors and funds aren’t doing as well as either the S&P 500 or the EPF.

That being said, markets have been quite crazy recently so I’m giving it a bit of time. Guess if things don’t improve then I might fully go passive index funds.

Hi Aaron,

Thanks for laying out your journey so nicely. Would love a sequel on year 2 of your experience with the financial advisor!

Thanks Kamini!

Will try my best!

Hi Aaron,

It’s always nice to read your posts and the articles shared by you.

Would like to hear your view on this – will you encourage self contribution of up to RM60k in EPF?

Thanks and look forward to your reply.

Thanks Yong,

Appreciate you dropping by and your kind words.

Personally I don’t do self-contribution to the EPF (because once it’s in the EPF, it’s hard to take out until retirement age), but maybe that’s just me.

Hope you find that helpful!

Hi Aaron,

Thanks for the sharing! Great article as always. I have some comments and some questions.

You mentioned that you DIY-ed into FSMOne and made roughly only 2% per year. May I know which unit trust fund you invested in and what why did you pick said funds back then?

Looking forward to your reply!

Hi Nicholas,

Thanks for dropping by. It was a few unit trusts actually. Don’t think I want to specifically give the names out, but they were all bond unit trusts. My investment thesis back then was I wanted more exposure to bonds to protect against market downturns.

Hi Aaron, my investment risk appetite is pretty much similar to yours, conservative. I went through the financial planner way too and got my hands on unit trusts as well. I am also like you I have no time to do my own research on types of funds but I had some funds in Singapore as well and I am heavily invested in ETF. My favourite is S&P 500, hence I have put in more money into Akru (Portfolio 10). During the March 2021 there is some correction but of course the portfolio bounced back thereafter. My personal view is that Index-linked fund will beat any units trusts return in the long term and it can withstand more volatility. Even Warren Buffet’s portfolio performance does not beat S&P 500 in the long term, despite him actively managing the funds. In addition, i feel local unit trusts had too much fees in it, opportunities cost wise is too great. If you are looking at some stable return of 5-6% i would highly recommend to focus on S&P 500 which in Malaysia only Akru provided access to this.

Hi Yee-Li,

Thanks for sharing. Appreciate it.

Just wanted to point out a few things. Actually, over the past 40 years, Warren Buffett has beat the S&P 500 overall, by quite a big number. In recent years, he has underperformed, however his early gains more than make up for it (In the first 20 years, he beat the S&P 500 by more than 10% every year). Source: https://www.indexologyblog.com/2019/05/03/buffetted-performance/

Additionally, there are multiple ways to get exposure to the S&P 500. I don’t think it’s just Akru. Note: Akru’s Portfolio 10 is merely 54.15% Vanguard S&P500, with the remaining allocations split up in other assets.

Hope this is helpful. All the best!

Hi Aaron,

Just wonder if you could also share what are other cheaper and easier alternatives for folks like us which intend to invest in small capital via DCA in S&P 500?

Thank you in advance.

Hey CP,

Thanks for reaching out. The most cost effective way is likely via robo-advisors like Akru.

Hello Aaron,

Thanks for this useful article sharing.

I investing constantly in Stashaway right now and considering should I start FSM Managed Portfolio. I wondered why the CS recommended you to monthly deposit into managed portfolio instead of Stashaway.

Fee for Stashaway is lower than Managed Portfolio. For all FSM managed portfolio, I thought the fee is 0.5% p.a? But there is an up-front charge varies for different risk.

Thanks in advance for your reply.

Hi Iris,

Thanks for dropping by. FSM managed portfolio fees depend on what type of risk profile (higher for the more aggressive ones). Balanced funds and above the fees are definitely higher.

I had the same concerns as well, especially on the high fees. But ultimately my advisors CS suggested I can try split my funds (half into robo-advisory, half into managed portfolio) and see which performs better over time. That’s the approach I’m taking.

Thanks for sharing Mr Stingy!

Great insights.

Personally, I view my EPF as the Bonds/Fixed Income part of my portfolio…since we have no control over EPF, and it pays minimum 2.5% and an average ~6% for past 20 years. Even if it pays ~5% going forward, that’s like Bonds/Fixed Income, without the risk.

Agree with you, leave it there, and let it compound.

Based on past experience, and the ‘wisdom’ the comes with that, I’d avoid unit trusts(fees to high), and go for Robo advisors, and then move direct into ETFs via an offshore brokerage.

Thanks Steven,

Really appreciate you dropping by and your advice. Very keen to see what happens in a couple of years and how my portfolio performs!

Thanks for the sharing! I have been a follower for a long while. I have some comments and some questions.

Your past blog posts had inspired me to maintain my EPF monies. Previously, I had used the EPF member investment scheme to go off to invest in unit trusts. The overall returns were barely beating the EPF returns (or sometimes could be less). I have liquidated all my EPF unit trusts and will not touch this until retirement.

I also have a financial advisor and I am also now on the iFast platform. Still early days for me.

I am a big fan of robo advisors and been with StashAway from the very start. From the post above, you will now be in both StashAway and Akru Now.

My questions are: what is the thinking to be on multiple robo advisor platforms? Will that be for further diversification of risk? Could the balance between equities and bonds all be maintained by starting a different risk index portfolio on StashAway rather than starting fresh on Akru Now?

LS

Hi LS,

Thanks for dropping by. I am convinced the EPF is HUGELY underrated. Maybe they’re just not as great at marketing as the fund management houses.

StashAway and Akru have different methodologies when it comes to investing (even for the similar risk profiles). Akru is more low-cost Bogleheads kinda portfolio, very focused on ETFs. StashAway appears to take a more “active” approach, based on macro economic data and cycles.

Also, StashAway invests in commodities like gold, which isn’t great for me given I’ve already got a big allocation to alternative investments (crypto!)

Hi Aaron,

Great article and this might compel me to get a financial planner service as well. Just one question – CS recommended you to put some money into iFast Income and Managed Portfolios. Since iFast is the owner of FSMOne, can’t the same be done through FSMOne?

If the answer to the question above is yes, then what’s the value add here from iFast if you already have the recommendation from CS?

Looking forward to your reply!

Hi Yan Lam,

Yup you can also do managed portfolios DIY via FSMOne. The funds are very similar.

The value add from iFast is the investments can be monitored by my financial advisers. Rationale: I don’t have time to monitor my investments anymore hence would prefer professional advisers looking at it for me. (Of course I’ll have to pay fees though).

Hope this helps!