When I bought my first bit of Bitcoin in September 2016, I never imagined the adventure I was starting on.

Since then, Bitcoin prices have gone up 3,400% (34x), dropped 84% from the peak, and recovered to USD 9,500 per bitcoin. In layman’s terms, when I first dipped my toes in, 1 bitcoin could buy one entry-level 32GB iPhone 6S. Today, 1 bitcoin buys 11 premium 256GB iPhone 11s.

On the career front, I believed so much in the promise of Bitcoin that I quit a job I really loved; and dived full-time into the cryptocurrency industry. My first few months were a baptism of fire — I was calling furious customers to explain why they couldn’t get their cash out immediately, pleading with them for time to solve issues with our then-bank.

But we persevered; eventually solving the banking problem, and fighting on until we relaunched full operations in October 2019 with governmental approval — almost two years later.

There’s this scene that sometimes replays in my mind: One day my CEO sat my boss and me down and said we had shown tremendous resilience in tough times. I looked at my boss and thought for a while. We had been so focused on daily tasks that we’d never once stepped back and doubted: “Is this all gonna fail? Have we taken the wrong path? Should we look for another job?”

Today, millions of people around the world continue to believe in Bitcoin, and the message continues to spread. Whereas once mainstream media would associate it with drugs and money laundering, today it’s largely covered by business news as a new investment asset. I guess you could say our faith has been rewarded.

But why? Why so much faith in this funny Internet money that nobody can see?

Allow me to get personal; allow me to share why. Almost four years on in my Bitcoin adventure, here’s why I believed in Bitcoin back then. And here’s why I believe in Bitcoin more than ever now.

Change Is Human Nature

10 years ago, if you predicted that one day I would push some buttons on my phone, a random car would show up at my doorstep with a stranger driving, I’d get in confidently, and the stranger would take me exactly where I wanted without discussing the price — even a tech geek might have called you crazy.

Today, 65-year old aunties regularly use Grab.

Interesting how the world changes eh? We don’t necessarily like thinking about it, because change is painful. But everything we’re used to is actually being “disrupted” all the time. Change itself is human nature.

Think of some other things you use today that were once radical concepts themselves:

- Social Media, which disrupted newspapers (for getting news)

- Online Marketplaces like Lazada, which disrupted large shopping malls (for buying stuff)

- Instagram, which disrupted Facebook (for picture sharing)

Even Money Changes

Which brings me to money. Money might seem like a static concept that hasn’t changed in our lifetimes. But it’s not. Look through history, and you’ll see money has evolved with everything else — over decades, centuries and millennia. Long before we used today’s money, humans used barter to trade, then animal skins, then precious metals, and so on.

Here’s a more recent example: For most of us, mention “money” and we think about those nice-smelling pieces of paper in your wallet.

But I’ve just spent the last eight weeks isolated at home without using physical money for the first time in my life. I’ve paid for everything using online banking, e-wallets and credit cards. (I’m sure this isn’t how the government wanted to launch a “cashless” society, but guess the coronavirus just proved it’s possible.)

We already live in the age of digital money. And we know that everything changes. So what’s next?

“I do think there is something very strange about this world of fiat money and exactly about the way it ends.”

– Peter Thiel, early Facebook investor –

Money Can Be Confusing

What’s the first rule of money?

“Don’t spend more than you earn,” say the responsible adults in the room.

But read the business news and you’ll know governments “break” this rule all the time, which is why most countries end up with budget deficits. Why and how? Are there different money rules for individuals, corporations and governments? Explore down the money rabbit hole, and you’ll start to question this.

Here’s my tip: If you wanna understand money (from a global-level perspective), first throw out everything you believe about money from a personal level.

Another tricky one: What determines the amount of money flowing within a country? If you said “the amount of gold/resources a country has,” you’d be in good company. In our personal accounts, the absolute amount of cash you can withdraw is proportionate to assets you have: savings, property, unit trusts, and so on. This makes sense.

But again, this doesn’t apply to countries and governments. The gold standard was ditched in the 1970s, and governments have been free to control their own monetary supply ever since. In other words, nowadays it isn’t gold that determines money. It’s governmental policy around money. Or if we’re being blunt: it’s politics.

At this point, you might think you’ve just stumbled upon the latest conspiracy theory website on the Internet, written by a good-looking but crazy fake news bro. You might be skeptical, because it goes against everything you believe in. But I assure you, everything above is true. If you’re still in doubt, please continue to do your own research — here’s an article by the UK Central Bank to start getting your mind blown.

But what does all this have to do with the money in my pocket?

The World Isn’t Running Out of Money; It Has Too Much Money

In the last financial crisis of 2008-2009, the US government was faced with a critical situation: due to insane risky practices in the previous decade, huge companies (including banks and insurance companies) were on the brink of going bankrupt. Experts feared the global economy would collapse; an unprecedented clusterfuck caused by human greed.

The US government acted decisively: bailing out several companies which were “too big to fail” by loaning them emergency money. In its effort to save the economy, the Federal Reserve (central bank of the USA) also pumped huge quantities of money into the financial system via a process called Quantitative Easing. In layman terms, some would call it “printing money from thin air.”

Over the next few years, almost 4 trillion USD of “new money” was added to the US monetary supply — which grew more than five-fold.

(I’m not great at explaining the crisis above, but for more, catch The Big Short on Netflix. It’s my favorite money movie of all time, and even features Margot Robbie teaching a finance lesson from a bathtub.)

Okay… back to reality. Printing money was supposed to be temporary. It was supposed to help us fix the Great Recession then scaled back. But while it was once an unconventional idea, central banks started warming up to it.

It’s 2020 now, with economies all around the world sick from the coronavirus. Central banks are scrambling — and the money printing has started once again.

Quiz time: What happens when the supply of something goes up by a huge amount but demand remains the same? Right, thank your economics 101 teacher: the value goes down.

My Money Loses Value?

Of course it does. You already feel it in this thing called inflation. Every year, the cash in your wallet loses 2-3% of its value.

One of the biggest criticisms against previous Quantitative Easing plans was it would lead to huge devaluation of the US dollar. Devalue a currency too much and you end up with hyperinflation: like Zimbabwe in 2008-2009, where a loaf of bread cost 550 million Z-dollars at one time.

But don’t take my word for it. Ray Dalio, head of the world’s largest hedge fund recently published a breathtaking article titled “The Changing Value of Money.”

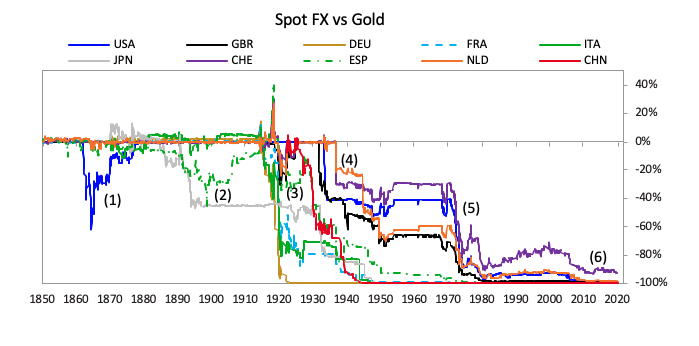

Mr. Dalio presents that relative to gold, most major currencies (including USD, GBR and JPY) have continued to lose their value over time, especially during crises like major wars and recessions. Here’s an interesting chart for you, showing more than 90% devaluations in all major currencies:

“So if my money is losing value against the US dollar, which in turn is continuing to lose value against gold, what do I do? Do I wind back the clock and convert everything I own into gold?”

Well, probably not everything. Gold is valuable because people have demanded it for thousands of years, and it’s hard to get. But it’s also difficult to store and move: When was the last time you bought anything using a nugget of gold?

Wouldn’t it be amazing if there was something valuable like gold, but we could send to each other easily like an e-wallet? What if there was digital gold?

Bitcoin: Better Than Digital Gold

Like gold, Bitcoin is hard to get hold of. But it has an additional quality that even gold doesn’t: the supply of Bitcoin is fixed, predictable, and has a maximum limit: only 21 million bitcoins will ever be created.

In a world where unlimited money printing can happen, this should capture your attention.

Here’s Paul Jones, billionaire investor who predicted the 1987 “Black Monday” stock market crash:

“It is literally the only large tradeable asset in the world that has a known fixed maximum supply.”

“Owning Bitcoin is a great way to defend oneself against the Great Monetary Inflation,”

Throw in Bitcoin’s advantages in portability and storage — you can store, send and receive Bitcoin simply using apps on your phone — and you have the closest thing to digital gold; only better.

Bitcoin Is Insurance

Will Bitcoin continue to rise in price and make me a lot of money? I hope so; and if we’re being honest — so does everyone else who’s invested. My personal price target is >USD 100,000 per bitcoin before I’d consider selling.

But there’s a bigger reason to park some money in Bitcoin. Like Peter Thiel, Ray Dalio, and Paul Jones, I don’t think the way our global monetary system is heading is sustainable. Historically, this has always led to some kind of major disruption, like a war.

Of course, nobody can predict exactly what happens. But I think it’s prudent to park some money in an alternative asset, which is the least-connected asset to everything else happening in the world of governments and money.

In other words, Bitcoin is my hedge against a crisis in the existing financial world. It’s insurance.

Part of me hopes I’m wrong. Part of me hopes for things to stay the same, even though I know change always happens. If Bitcoin remains at 10,000 USD for eternity in exchange for a stable, peaceful world where people continue to have enough to eat and lead comfortable lives, I would gladly take it.

But what if our fears come true?

Bitcoin Is Uniquely Democratic

Near the start of this article, we established that money is kinda complicated. Well, if we’re being honest, Bitcoin is kinda complicated too. In the words of comedian John Oliver, Bitcoin is “everything you don’t understand about money combined with everything you don’t understand about computers.”

I’ve found this from my experiences giving talks about Bitcoin: Because it’s so different from anything they’re used to, people often cannot believe what they’re hearing.

People tend to have trouble with:

- Who controls Bitcoin? (Answer: Nobody, it’s decentralized. There’s no one party that governs it.)

- If no one controls it, how does it run? (Answer: It’s all computer code that runs automatically on the Internet. The code is “open source” meaning anyone can check the code to see it’s legitimate.)

- How can something like money be decentralized? (Answer: It can, we’ve just lived in centralized systems all our lives — that’s why it sounds so crazy.)

The decentralization thing is powerful. It’s not obvious, but it’s insanely powerful. This means no group of politicians can ever suddenly decide they want to issue more Bitcoin (lowering its value), or block certain people from using it. This means even a superpower country wouldn’t be able to shut it down.

Bitcoin is the first major asset class in history that’s independent — a technology that doesn’t belong to anyone; and so, actually belongs to everyone. It’s the democratization of money.

Like most people, I first came to Bitcoin because I wanted to make money. But when I studied deeper into these concepts, that’s when it really hit me: Decentralized cryptocurrencies like Bitcoin were gonna change the world.

The Government Is Always Right, No?

“But isn’t it bad that nobody controls Bitcoin? What if someone misuses it? Shouldn’t we leave important things like this to THE GOVERNMENT?”

Well, disruptive technologies tend to behave the same way. First, there’s a bunch of hardcore believers who’re willing to break the rules. Then come speculators trying to make quick money. Then, sex, drugs and dirty money get involved. Finally, regulation comes in and cleans things up.

There’s no doubt that a small portion of people use Bitcoin for bad stuff, like drug trafficking. Just like how money launderers and terrorists surely use WhatsApp. You can’t throw out good technology just because of some bad apples. Besides, any pro knows that good ol’ US dollar notes is the most common way to launder money.

But there’s another weak point with the “Government knows best” argument. We’re all very familiar with corrupt regimes where the government of the day was screwing the people *cough cough 1MDB. It’s a tale as old as time: the government watches the people and makes sure they follow the rules. But who watches the government?

What if some party gained so much power they corrupted the entire system: including the military, police, and courts? We’ve seen this happen in many failed countries — what makes us think it won’t happen here?

Now you might think I’m a crazed anarchist who shows “fuck the government” signs at street demonstrations. But I’m not. I pay my taxes, vote for the politician I think is least bad (like you), and regularly support government-linked programs, especially in financial education.

I’m just saying an asset that’s not controlled by any government isn’t crazy. It’s disruptive — something so radical it makes us uncomfortable. But it 100% makes sense. It’s time.

Bitcoin Has Momentum

When I started my Bitcoin journey, I viewed it as an experiment. I was a noob with surface-level knowledge. Four years on — with 28 months working full-time in crypto — I’ve got some personal experience and data now.

Will Bitcoin fail? That’s the wrong question. Bitcoin has already succeeded. Progressive governments across the world (including countries like Japan, USA, France, Singapore and Malaysia) have accepted it’s here to stay; they’re passing laws around it. In 2017, the CEO of JPMorgan Chase, the largest bank in the USA called Bitcoin “a fraud.” Last week, JPMorgan Chase said it’s started banking with cryptocurrency exchanges.

The only question now is, how big does Bitcoin get?

Here’s an interesting statistic: A survey last year found that 27% of millennials (18-34) prefer investing in Bitcoin vs the stock market. Quite insane if you think about it. One’s a baby technology that’s only 11 years old; the other’s been a core part of the financial system for centuries.

To be clear, I’ve got nothing against traditional assets. I believe in using a mix of investments to manage risk, and have invested only <10% of my net worth in crypto. I think most people should keep most of their money in low-risk investments. If you’re new to Bitcoin, start with a small amount you’d be willing to lose.

But no one can hide from the data: it’s clear which direction young people are headed in — just as they enter their prime years of earning money.

They want Bitcoin.

The Story of the Future

11 years ago, the Bitcoin source code was released to the Internet. Out of all the billions of lines of code that’s released online, why did this one grow into a centi-billion (perhaps trillion soon) dollar industry?

Nobody knows — the odds are probably close to zero that such disruptive technology would come from an open-source website that only geeks know, thrive despite opposition from big banks and governments (in its earlier years), and spread to millions of people around the world.

When we’re considering the success of Bitcoin, remember there was never a charismatic “CEO of Bitcoin Corp.” to manage the project and promote it at conferences. There was never funding from the UN or IMF to pay for software developers. There wasn’t government-sponsored SMSes to convince you to use it.

Bitcoin just grew organically from believers; people and companies who believed they were building a better future. It’s a story that shows what’s possible when groups of people work together for a common objective. It’s a tale of collective human ingenuity.

If you ask me, and I know I’m being romantic here — it’s a rather miraculous story. A story that will continue to spread; just like how it came to me a few years ago and totally altered the direction of my life.

Now I’m passing it on.

– – –

Everything above is based on my personal experience. It’s not investment advice. Always make sure you do your own research before investing in Bitcoin or anything else.

If you’re keen to start your Bitcoin adventure in Malaysia, the best platform is Luno — where I work. Use the code MRLUNO to get RM 50 when you buy RM 500 of Bitcoin (for new Luno customers).

*Not an affiliate link; I don’t get paid anything when you use my code. I just get the pleasure of welcoming you to the future.

Pics from: Pexels: Pixabay, George Desipris & Flickr: Ya, saya inBaliTimur

![Why Invest in Bitcoin? [2020 Edition]](https://kcnstingy-95ad.kxcdn.com/wp-content/uploads/2020/11/Investment-Charts-and-Color-Pencils-150x150.jpg)

Hi Aaron,

Great article about bitcoin! Love it haha.

I personally have a really high-risk tolerance to investments because I’m only 19 haha. Just to give you an idea of how much of a risk-taker I am, I have over 90% of my portfolio in Tesla stock because I trust the company as it is also very innovative and disruptive like bitcoin.

I stumble upon bitcoin when I couldn’t find any more good investments with an asymmetrical return like Tesla. So I just have some doubts and am looking for experts that could explain to me haha. I get the point about scarcity (21mil), decentralised system and how it is backed by heavy computing power and algo and stuff. But I have 4 questions to ask.

1)

Looking further ahead 10-20 years, when this reaches 10tril or more, the governments might start to feel threatened and ban people from having crypto, because they cant collect tax from citizens, what happens then and if this even possible?

2)

If governments embrace Bitcoin, how are they going to collect tax from people if it is decentralised?

3)

As bitcoin is a deflationary financial system, this encourages people not to spend and their money would grow. How will it impact the economy if people just don’t spend and wait for it to rise like small businesses might not survive if people don’t spend.

4)

What do you think is the biggest risk of Bitcoin?

Sorry to be asking these much questions haha, its completely fine if you cant answer all of them and any answer is appreciated!

Personally have 6% in Bitcoin, planning to increase it to 15-25%

Hi Derrick,

Thanks for your kind words, and based on your Insta, impressive work at the gym.

Some thoughts:

1. I think most people within the industry think the risk of government bans is getting lower and lower. Evidence: most democratic countries around the world have built regulations around crypto, not regulations to ban crypto. The risk of government bans was probably something more worrying in the early days maybe 8 years ago. Appears to be behind us now. p.s. even in the recent USA elections, a Bitcoin believer was elected to Congress, and it’s rumored that Joe Biden might be picking someone who’s a Bitcoin believer to monitor Wall Street: https://www.coindesk.com/biden-beats-trump

2. Interesting point. I don’t think taxes will ever be paid in Bitcoin (could be wrong). However I also don’t think we’re ever going to be in a situation where it’s ALL BITCOIN or NOTHING. More likely would be Bitcoin exists as a reserve asset, and people still do their daily transactions in government currency (including paying taxes). Something like how gold (reserve asset) and government currency co-exist.

3. If we’re being technical, Bitcoin is not deflationary. Bitcoin is dis-inflationary. Meaning it still has inflation, but the inflation rate goes down over time. Anyways, my view is Bitcoin becomes a reserve asset (not something people keep spending). But I certainly hope people continue spending their government currency and continue to help grow the economy.

4. Hard to predict this one, but maybe it’s either financial regulators building TOO many rules around Bitcoin that people start using other things AND/OR a large powerful nation (e.g. Russia/China/USA) trying to attack Bitcoin’s Blockchain.

Thanks for the questions again. Appreciate you’re super risk-loving, but please do remember to protect your downside and also have some “buffer” in case anything crashes yeah? Take care and all the best!

Hi there! I stumbled upon your articles this year, and they are all nicely written.

Initially for this post I was wondering why was this blog post much longer and also more ‘advocative’ than usual… was thinking maybe you’re receiving very high commissions or something… until I read towards the end you’re having a managerial position in Luno 😀 (always suspicious of people/posts overly-passionate advocating for something)

So here’s my question. Based on your above comments, you believe bitcoin has potential to be sort of a ‘digital gold’ function and as an investment, instead of a ‘currency’ function (or at least for now, until it becomes widely adopted). However, there are plenty of ‘digital gold’ alternatives as well, such as digital gold offered by banks, gold ETF’s, etc. which are directly or indirectly backed by gold itself. And since gold is itself demanded by governments and institutional investors (who are the biggest players in the investing world, and not retail investors), why should investors look to invest in bitcoin, when gold has a higher demand?

Also not withstanding the above question, since we’re talking about using bitcoin as a hedge against monetary inflation, we are currently seeing stock markets rally as a result of asset inflation there as well (for example, the price of Apple shares is at record levels, despite having a balance sheet structure weaker than pre-covid). In other words, even stocks itself seem to be having a store of inflation-adjusted value as well. Hence, why would investors even touch gold, let alone relatively new and unproven assets such as bitcoin?

Thanks!

Thanks Michael,

Appreciate your comments and kind words.

On the first point about gold demand vs Bitcoin demand. It’s all about upside potential. The total market cap of gold today (~10 trillion) is probably somewhere between 40-50 times the market cap of Bitcoin (~200 billion). So even if Bitcoin becomes 10% of gold’s market cap, that implies a price upside of 5x. Gold might continue to be THE most popular safe haven asset — but does it have potential to still rocket up 5x (or even if it does, will it go up faster than Bitcoin)? I don’t think so.

On a side note, a JP Morgan research paper recently showed that the world is kinda split into two right now when it comes to safe haven assets. The older folks like gold, but the younger ones are buying Bitcoin. As generational wealth spills into millennials and younger, this is gonna have a big impact.

On your second point it’s more about diversification and portfolio management. For example, recently the glove stocks in Malaysia went crazy. But should anyone invest most of their money into hot glove stocks? Probably not. Even traditional “investment portfolio” advice was never 100% stocks. The most popular ratio is likely the 60-40 stocks/bond ratio. 40% bonds to protect you if/when the stock market crashes.

Hence I think it makes sense for some people to have some exposure to Bitcoin. As to the percentage/risk appetite/time period, well that’s a long story for another day. 😀

Hie Aaron, thank you for putting up an enlightening article here. I’m just wondering, how is cryptocurrency treated here in Malaysia? Suppose I made profits with my investments/trades… what local authorities do I declare? What are the taxation laws that are involved and are they considered capital gains? Would be grateful for any help or information here that I could look up to =)

Also, since you’re with Luno, is there an OTC exchange as a service by Luno here in Malaysia? What are your rates and fees, and is there a maximum amount? As well as possible taxation figures with said exchange. Hypothetically, was wondering if cashing out 7-8 figures of MYR is feasible here.

Thank you again for your time Aaron and keep up your great work with your blog. You’re doing good work here for us Malaysians =)

Hi Angeline,

Thanks for writing in and hopefully this helps:

– As you probably already know, there’s no capital gains tax in Malaysia. So I wouldn’t think that investments into crypto need to be declared and taxed. (It’s different if you’re day trading or doing it for regular income though, in that case then you should declare.) LHDN has also been pretty silent on that matter.

– Regarding Luno, would it be okay if I contacted you via formal means from there? Hope to discuss with you further.

Thanks so much for your kind words Angeline — really appreciate it!

Hi Mr Stingy,

Thanks for the great write up. To me Bitcoin seems poised to be the digital gold of the future more than a usable currency due to the transaction times, which some alt-coins seem to have the potential to fill. Was wondering: what are your thoughts on alt-coins such as Ethereum or even more newer ones with crypto prepaid cards that link real world currency with crypto such as crypto.com?

Hi Rachel,

Thanks for dropping by and your kind words. I think Ethereum is very powerful as a base-level solution to building complex applications on top of it. We’re already seeing huge amounts of money flowing in Decentralised Finance (e.g. lending and interest using Blockchain), and most of these are built on Ethereum. Very exciting.

As for crypto prepaid cards, debit or even credit cards: I think they’re a useful tool to connect between the traditional world of finance (fiat currencies) and the future of finance: crypto. However I don’t think they’re hugely disruptive in their own way.

Lastly, as for Bitcoin being digital gold — I agree with you that this is where we’ll probably get first. There are a lot of interesting “Layer 2” solutions being built on top of Bitcoin however. So perhaps the future is one where Bitcoin is the reserve currency, and then for small transactions we use technology built on top of Bitcoin e.g. Lightning Network.

What are your thoughts on Tether?

It seems that the entire cryptocurrency market is valued based on USDT, which is a centralised source that is ‘trusted’. Over $10 billion printed, with half of that printed just within 3 months. It also went from 100% backed (unaudited), to now backed by other assets and receivables (still unaudited).

It all seems super shady to me that the whole crypto market harps on decentralisation, yet places a fiat value to back up their arguments on its investment potential.

Would be great if you could also share your thoughts on the immense environmental cost of Bitcoin.

Thanks for the question YJ,

I think Tether today plays a big part in people transferring value (exchanging in and out) of crypto. Would the crypto prices drop tomorrow if Tether goes down as a complete fraud? I think so. Would it drop and not recover? I don’t think so. (And I don’t think the drop will be that huge either.) As much as there’s a lot of trading happening on USDT-coins, there’s still a huge amount of “real” fiat e.g. USD – BTC being traded.

As to whether we can consider USD “real” fiat anymore (re: the enormous money printing recently), maybe USD and USDT deserve each other 😀

I agree with your point that it’s weird that people place a dollar value on crypto. Fundamentally 1 Bitcoin is worth 1 Bitcoin right? However, practically not many use Bitcoin for transactions today, so it’s convenient to still convert it back into US dollars. Perhaps we should compare the price of Bitcoin to a better “hard money” instead. I think several people have charted Bitcoin vs Gold prices before. Quite interesting.

Lastly on the environmental impact of Bitcoin. We’re used to seeing headlines like “Bitcoin uses more energy than the entire country of Denmark.” However I’ve also read research debunking earlier claims on the huge power cost of Bitcoin (i.e. using unsound assumptions). If anything, what we’re seeing today is “energy arbitrage” happening. In simple terms, energy is actually hugely expensive to store and transfer. If a hydro dam in China (or wind turbine in California) generates too much power for the current energy grid, much of that power is wasted. It’s not a matter of switching off the dam/turbine either — you can’t really do that. So instead of letting the power go to waste, more and more people are starting to use that excess power to hook up to help mine Bitcoin.

Also, if we take analogies of what Bitcoin is supposed to become vs the incumbent, you’ll likely find Bitcoin is cheaper. For example, what’s the cost of Bitcoin vs the cost of mining gold? (digital gold analogy) Next: what’s the cost of Bitcoin vs the entire energy usage of the banking & payments industry (payment method analogy)?

awesome article. nails it

Thank you sir!

Hi Aaron, I’m basically like what you described “knows nothing about money”, but I do not a little about technology. I think for me to really think about investment seriously at 40 must be horrendous to all. First of, I think it was really because I can’t get over everything is “controlled”, until I came across Bitcoin. This is what I want to say to those asking the 3rd question, if no one owns Bitcoin, certainly a government can’t control it, well, not directly. I was with Luno when it was in Malaysia earlier on. Of course i only put like some pocket change there then Luno was frozen. I checked regularly and finally it is back. To be honest, I do have doubts that perhaps this is the end of Luno, finally the government is here to “control” it (impose laws for investors, the trade process etc). During this MCO, i must admit I have up my purchase, but not so in Bitcoin, but XRP you’ve mentioned in one of your webinars. It just crossed my mind Bitcoin grew so much because people are constantly talking about it. Sceptical, but still people are actually passing news about Bitcoin. and those got hold of the news, those who are willing to take a shot, go for it. Lastly, I am really surprised you are with Luno. Personally, this generated a lot of faith and confidence. Thank you Aaron, for your generosity in sharing.

*do know a little

gah typossss

Thanks for dropping by and your comment Faith. Yeah it really is a new paradigm — the age of decentralized things, where we don’t rely on “authority” any more. Wishing you all the best in your crypto journey, and please let me know if there’s anything I can help with!

hi Aaron, just found out about your blog after some googling on Stashaway, good to know the country manager of Luno is also a blogger haha.

we had lunch at the Segambut yong tau foo once with Arif if you remember.

anyway just thought I’d give my 2 cents on bitcoin, I think there are 2 camps on this, on one side is the traditional economists who do not focus too much on money itself in economics, and the other side is bitcoiners who attribute all problems and ills in the economy to the “evil” fiat money.

the first camp studies the supply and demand, economic output and growth with money being abstracted away, the second camp focuses only on money itself with less regard on how the economy actually works.

I think economics is much more complex with a lot more nuance than what bitcoiners think.

Ultimately money is an intermediary good, a representation of the wealth that an economy generates, in other words, a store of value; on its own money has got no intrinsic value.

However the value that money supposedly stores would evaporate if the economy goes to shit, so the economy is the thing that matters most, and the job of the government, policy makers etc is to help create a healthy and growing economy.

A fixed supply currency that cannot be managed like bitcoin will not work in managing an economy, if the world is perfect and markets are efficient, maybe, but the world isn’t and markets are not, which is why governments have to step in, measures have to be taken when the inevitable crisis hits, otherwise, a downward spiral ensues and things become a lot worse that isn’t necessary.

For this reason bitcoin can’t be money or good money. However, bitcoin, for many reasons, has the potential to become a widely adopted store of value, like gold, and a hedge against crises and hyperinflation. I think bitcoin is the greatest speculative asset ever created in mankind lol, and humans are greedy by nature, which is why I remain bullish on bitcoin.

TLDR, bitcoin has the potential to go up a lot higher in price, I think an investor should allocate a small portion to it as diversification and hedge.

Thanks William,

It’s great to hear from you again! Yeah, living in the age of Twitter I sometimes get annoyed reading one-sided arguments about how Bitcoin is rat poison, and on the other side “Bitcoin solves everything.” Like everything in life, the truth will probably play out somewhere in the middle. Nuance and highly-intelligent takes are getting rarer than ever (and they’re especially getting buried under the algorithms that present BS instead).

I’m with you on the “digital gold” use case for Bitcoin. Additionally I think the “censorship-resistant” use case makes sense too. As to whether one day we’ll use Bitcoin to pay for coffee that remains to be seen.

So… since we’re on the topic. Any price targets, and what do you think is a good percentage to put into Bitcoin? 😀

Thanks for an extremely well written (and reasoned) article, Aaron.

Crypto has always mystified me but your article and responses to the comments help shed some light.

I will definitely start including crypto as part of my networth.

Thanks Imran,

Appreciate this very much. All the best ya!

Hi Mr. Stingy

Thanks for your sharing, I really enjoyed reading your article. I always have a few concerns about the development of Bitcoin and I would be happy to know your opinion regarding these issues. My concern is more inclined towards the development of Bitcoin as a currency instead of its return as an investment.

First of all, I think we can all agree that human psychology plays a major role in the function of an economy. For instance, the gold prices will usually rise during times of crisis because people perceived it as a safe-asset. The store of value is very important if not the most characteristic of a currency.

Given the drastic volatility in the prices of bitcoin throughout the years, don’t you think that the general public had already lost faith in Bitcoin ( setting aside the institutional investor) and Bitcoin had diverted from its original purpose as a decentralized currency into an investment vehicle in the eyes of the public?

With that fundamental psychology change in people’s perception towards Bitcoin, do you think that the public will still have faith going back to Bitcoin as a currency instead of other cryptocurrencies that might be developed in the future? Because I believe that if people’s perception of Bitcoin doesn’t change, it will also affect the price movement of Bitcoin and its usability in the future, and public perception is something very hard to change.

Hi Jayden,

Thanks for your detailed thoughts. Here are mine:

I think the volatility in any early technology is to be expected. As to whether the general public has already lost faith in Bitcoin, with only perhaps 1% of the world ever owning any cryptocurrency — it’s too early to say. However the demographic data shows resoundingly that day by day, more and more people believe in crypto and are joining in.

Finally, in terms of adoption into a currency: not many would use Bitcoin as a cryptocurrency today because its price is too volatile. For that to happen it needs to be widely owned first. In other words, the path to mass adoption is likely to be: Speculation >> Investment >> Widely owned by many people >> Widely used to trade. We are still in the early stages of Speculation >> Investment. It might take a few more years (and maybe 20% of the population owning Bitcoin) before we start seeing Bitcoin used for transactions.

My personal opinion is also Bitcoin in its current state is very much like digital gold. Taking that analogy, none of us use gold to buy stuff daily (it’s not used as a daily currency). But central banks hoard it. In that sense gold is a reserve currency, and I expect Bitcoin in its current state to continue growing as a reserve currency. For mass use, I expect future technologies that build on the foundation of Bitcoin to lead the way. After all, Bitcoin is built on computer code — so there’s a lot of brilliant programming that can build on the foundation which has already run for 11 years.

Who knows in future we might see something like Facebook’s Coin (Libra) used to transfer money between people, but pegged to the price of Bitcoin.

Lastly, perhaps even at a pessimistic scenario where Bitcoin remains as a “reserve digital currency”, we can look at the market capitalization of gold for hints on how big Bitcoin could get. People estimate the current market cap of gold to be about 7-10 Trillion USD. Even if Bitcoin gets to just half of that market cap, that implies a price of USD 238,095 per bitcoin.

Thanks for the article and it reassures me to venture into something that i should have ventured into a few years ago but the fear of the unknown made me postponed the plan. I have registered for a Luno account and am awaiting for the money to be deposited into Luno before i can make my first ever purchase. By the way, does your code has an expiry date and what are your thought on the recent declining price of Bitcoin?

No problem Dylan,

My code doesn’t have an expiry date. So the price of Bitcoin is volatile — it goes up and down. I like to focus on long-term windows (e.g. Bitcoin is the best performing asset class of the last ten years), which helps stomach the ups and downs. I hope this helps!

Thanks again Aaron for sharing with us your gained experience & views. I feel that I can reconcile myself better with investing in Bitcoin now rather than viewing it is a reckless, risky gimmick to make money. Sure, I’ve made some money pre-halving (God I wished I put in more capital), but your article has made me feel trust the asset better knowing fiat money is ladden with problems the govt doesn’t want to come clean about.

Thanks Andrew. Yeah, I tried to give as realistic a take as possible around Bitcoin. I really think it makes sense to have a bit allocated here.

Wow didn’t know you are working for Luno! Great article. You converted me into a believer.

Thank you doctor!

Please let me know if the promo code works 😉 And all the best on your writing journey!

Which platform u use to trade bitcoin in Malaysia?

Luno. I even included a promo code in this article 🙂

Good article bro. Thank you for sharing your thoughts and experience on crypto. Looking forward for more related articles from you. All the best.

Thanks!

Really appreciate your kind words!