I was 25 years old. And I knew it was time to go. I had already worked two years for the national oil company, PETRONAS but I knew my future wasn’t there.

There was a problem though — if I quit, I would have to pay back a large sum of money. After all, they had sponsored my education for five years from 2002 – 2006.

The contract required me to work two years for every year of sponsorship. So I had a ten-year employment bond. Having served only two years, I would have to pay back 80% of the sponsored amount.

I was scared. I had no money. But then I prayed — and somehow found faith that God would help me find a way to pay. So I quit.

During the exit process, I had to stop by the Education Sponsorship department in the iconic twin towers. The smiley lady looked my name up on the computer and pressed a button. “OK you’re a scholar,” she said, “That’s all.”

“And the payment?” I asked nervously. I was fully expecting her to issue me a letter of payment immediately. And half-expecting her to call security if I couldn’t pay.

“Finance will contact you for that.”

I walked out a free man.

It would be another five years before I heard back.

The Letter and the Offer

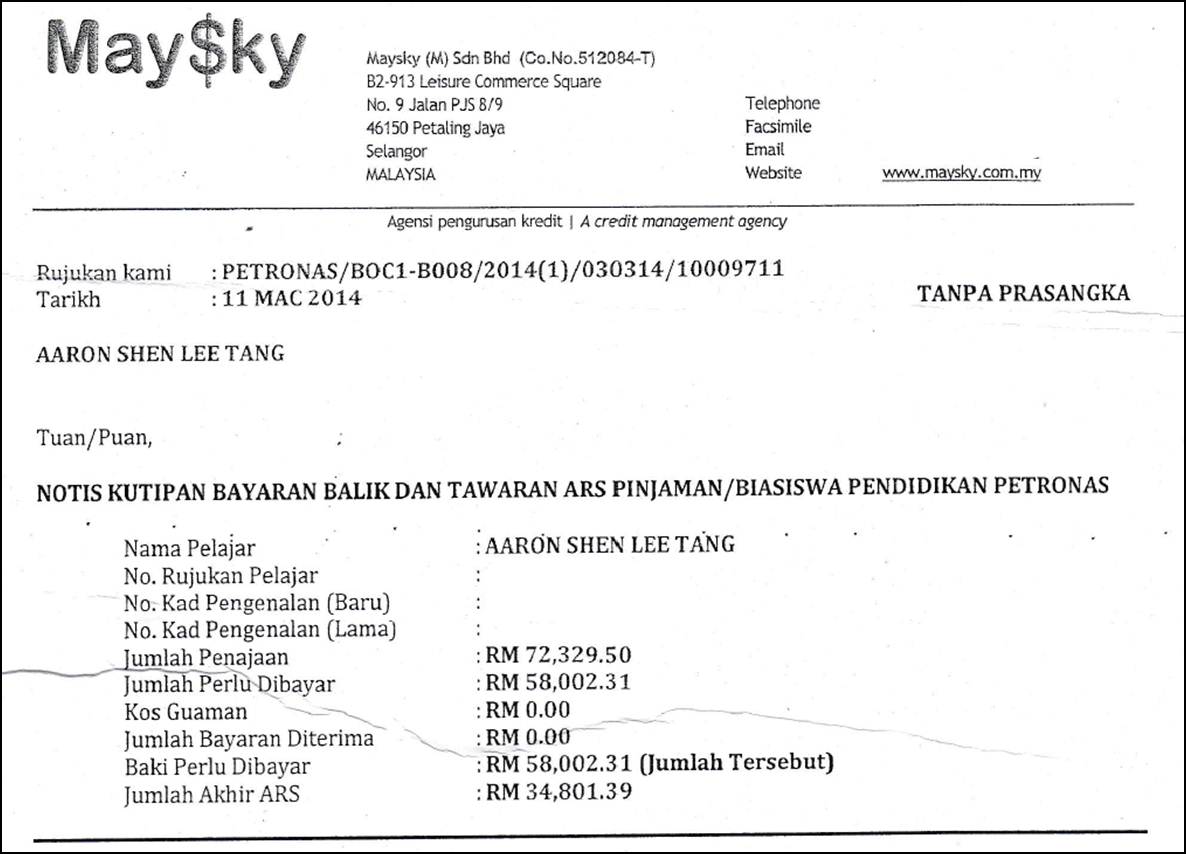

The payment letter finally arrived in March 2014. It was via a debt collection company, called Maysky. The total amount PETRONAS had spent on me was RM 72,329.50 ($ 20,665).

Considering the two years I worked with the company, the prorated amount was: RM 58,002.31 ($ 16,572).

Thankfully, the letter also came with an attractive only-in-Malaysia discount. Pay in a lump sum within the allocated time frame, and they’d give me 40* percent off.

I had three months.

Lump Sum Payment or Monthly Payments?

At first, I briefly considered not taking the lump sum payment discount. The other option allows you to spread the payment out, but you have to pay the full amount. The length of time depends on how much you owe. When I called Maysky to discuss, they told me I could stretch my payment up to 7 years.

(And just because I’m a nice guy, I just called them to ask how long the interest free repayment period is for other amounts):

RM 10,000 – 30,000: 4 Years

RM 30,000 – 55,000: 7 Years

RM 55,000 – 100,000: 10 Years

I was hoping for one of those super-long repayment periods, like 35-40 years. 7 years didn’t sound appealing. And it didn’t make any financial sense. Taking the 40% discount was the right thing to do.

Now I just had to find a way to raise RM 34,800 ($ 9,942) in less than twelve weeks.

Where to Find RM 34,800?

In anticipation of this day, I had been saving money for the past five years. But I hadn’t saved enough. There was about 10K cash I could easily withdraw. But if I needed the whole amount, I would have to sell all my liquid assets. Not something I wanted to do.

So I started to think of other options:

- Borrow from my parents — Didn’t like this option because my huge ego doesn’t let me borrow money from my parents.

- Borrow money from other people — Better than above. I would have been willing to pay interest. But I don’t like paying interest either.

- Withdraw from my retirement fund (EPF) — This was a promising one, until someone told me EPF does not allow withdrawal for “breach of contracts”, which is what I did when I resigned.

- Borrow money from the Government a.k.a. PTPTN loan — But after reading their website, I found out you can’t use the PTPTN to pay a debt like mine. You have to still be in university.

- Borrow money from the bank — The final solution, but banks charge high interest. Most personal loans in the market charge at least a 10% effective interest rate.

But I thought — Hey! Surely there’s an exception for people like me, who are struggling to pay their education debts. There must be some kind of low-interest loan to help. So I continued to search. A few education loans from local banks popped up — but again, these are funds to pay for your fees while you’re still in university.

I finally found redemption — but from an unlikely source.

The Unlikely Savior: Credit Cards

Here’s something that’s always bothered me: in the personal finance world, many experts treat credit cards like scum.

I beg to differ though. I think credit cards offer wonderful privileges — often for free — but only if you’re disciplined enough and know what you’re doing.

I can’t recall exactly when I got the idea of using credit cards to pay off my education loan. It was probably a combination of reading Mr. GenXGenYGenZ‘s blog and my hobby: collecting credit card points. Initially I was just thinking of all the points I would get if I paid with a credit card.

This wouldn’t have solved my problem though. If I swiped 34.8K, I would still have to pay this amount the next month. Just that I’d be paying the bank — instead of the debt collectors.

And then I realized — Hey, why don’t I do a balance transfer? Transfer the balance to another credit card, and pay the balance over a longer period of time: like 6 months or 1 year.

So I looked in the market for balance transfer promotions. There were a few good ones, but I found one that had absolutely zero charges:

Now that I had a plan, I called up Maysky to verify that they would accept credit card payments. They did. (And due to my love affair with American Express, I also asked if they accept AMEX. Unfortunately they don’t — just Visa and MasterCard).

Paying the Accelerated Repayment Scheme (ARS)

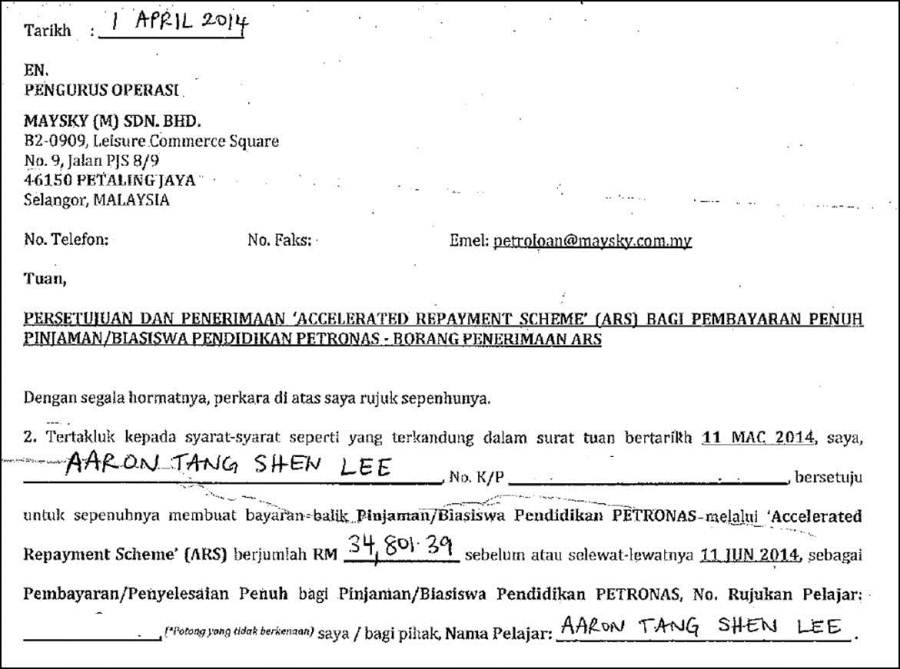

On 1st April 2014, I submitted the paperwork — confirming that I accepted the 40% discount, and that I would pay the full amount by 11th June.

Meanwhile, I called up Maybank to ask them to extend the credit limit on my MasterCard. After a few questions, they gladly agreed to. And then I went to the nearest RHB branch to apply for an RHB credit card. It took about two weeks for the new credit card to arrive. And now, I was finally ready.

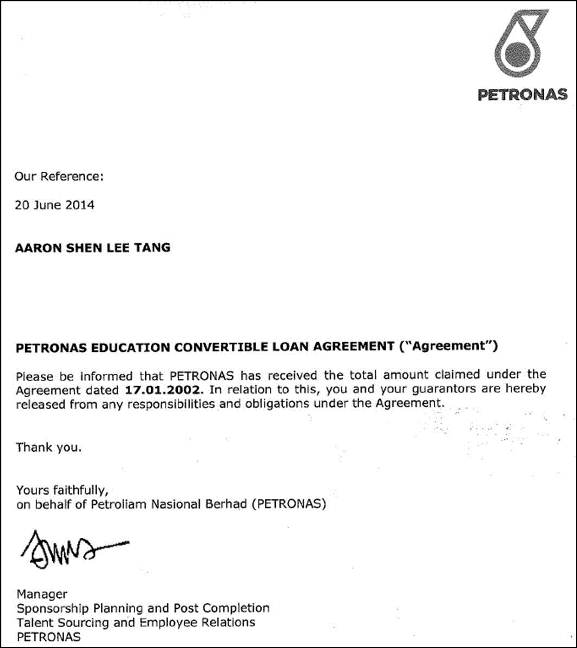

One afternoon in the middle of May, I submitted my credit card details to Maysky. Within a few hours, I got the notification SMS on my phone — the transaction was done. Now it was time for Phase 2 of my plan.

Applying for a balance transfer plan is surprisingly easy. All you need to do is fill up a simple form and submit a copy of your credit card statement. Once I had emailed my documents — it took just a few working days — then RHB notified me that my balance transfer was successful. I checked my Maybank MasterCard balance online, and indeed like magic — it was gone!

I was happy. My plan was working. My 34.8K lump sum debt had now become 6 months of 5.8K instead.

A Surprise Twist

I had planned all the payments out in a spreadsheet. The RM 5,800 a month hurt — it would burn through my emergency cash reserves rapidly — but the 6-month period would make it possible. I would scrape through without having to liquidate any other assets.

But after three months, in September 2014, another promotion came out — this time from Maybank: a 12-month balance transfer which also had zero percent interest. And waived all other charges. I’m not sure if it was divine intervention, or just capitalism — but another idea hatched in my mind.

Could I transfer my outstanding debt back to Maybank and pay the balance over 12 months, interest free instead?

I wasn’t sure. It felt like cheating the system. Transferring the balance from one bank to another, and then transferring it back — getting extensions without any charges. So I called both banks to confirm. But they assured me it was fine.

So I did it — I transferred the remaining (3-months) amount onto another 12-month payment plan. In effect, I had converted a lump sum debt into a 15-month interest free loan.

And my monthly payment was now a very much more manageable RM 1.45K.

Could It Work For You?

It worked for me — but I realize the steps above probably won’t work for everyone. Here are a few factors to consider, if you’re even thinking about it.

- Credit limit: You can only swipe as much as your credit limit allows. But if you don’t have enough credit, you can always get around it by asking the bank to temporarily increase your credit limit. Or perhaps split the amount over two or three credit cards.

- Risk: Guess what happens if you miss a payment or pay late? You get hit with the huge 18% interest, and late payment charges. No kidding — there’s significant risk involved here — it’ll only work if you have discipline. If you’re the type that can’t control credit card usage, it’s definitely not for you.

- Timing: Zero percent interest balance transfers don’t happen all the time. In a worst case scenario, you might need to pay a bit of interest (1-3%). However, the market is very competitive and banks are always trying to outdo each other. When I was searching for my balance transfer, I always had 2-3 different banks to look at. Where to find latest updates on balance transfers? Try iMoney.

In summary, here’s how I paid off my education loan:

- Reduced debt from 58K to 34.8K (40% discount) by agreeing to pay a lump sum.

- Paid 34.8K on my Maybank MasterCard.

- Transferred that 34.8K balance onto a 6-month interest-free payment plan on my RHB MasterCard.

- Paid 3 installments of 5.8K (Ouch!)

- Transferred the remaining 17.4K onto a 12-month interest-free payment plan on my Maybank Visa.

- I’m still paying that 1.45K every month till the loan amount finishes this year.

The only charges I paid were the RM 50 service tax (each) for the two credit cards I used.

And the benefits? 34,800 points (worth an equivalent of RM139.2) for me, two very happy banks, a very happy debt collection company, and peace of mind knowing that I’ve settled my education debt. Thank you PETRONAS. I’ll be forever grateful.

I’ll make the last payment for my education loan this September. In retrospect, quitting was one of the best things I ever did. I’m glad the money issue didn’t stop me from making a career choice I really wanted. It worked out in the end.

If you’re ever in a situation where you need money to pay off your education loan, just know that there’s help. You don’t have to be scared like how I was. Search, ask for it, and you’ll find sources who can help. There’s the banks. There’s plenty of personal finance websites now. There’s mr-stingy.

And you can always pray.

– – –

A truncated version of this article first appeared at iMoney.

Update April 2017: You can now even pay PTPTN loans using credit cards.

In initial versions of this article, I wrongly wrote “30% discount” when it’s actually a 40% discount. 58K to 34.8K is a 40% discount. Sorry for my poor math.

Pic Credit: “Graduation 07” by David Joyce

I believe Maysky doesn’t accept credit card payment/transfer anymore since 2017. Only bank transfer, cheque or KWSP account 2.

Hi Naz,

Thanks for sharing!

Coming back here to say that I finally manage to pay off mine!

If it helps (to new readers who stumbled upon this article), do ask about the discounts if you’re planning to pay once-off at some point (they used to email the ARS offer every year but for some reason, they stop that since pandemic).

#WAGMI

Congratulations Naz!

Hey Aaron, the monthly installments that you have paid to settle the education loan, was it tax deductible?

Recently, I have just terminated my employment contract (3 years) after one year into the job, which I have to reimburse a lump sum back to the employer. I’m wondering if this amount is tax-deductible?

Hi Kyle,

Unfortunately I don’t think they’re tax deductible…

Thanks for the article Aaron, it was some great insight shared!

How would you advise though, on another hand, when the education loan amount is RM 200K & above, AND needed to be paid in lump sum.

Do you think it’s possible to get any of your proposed solutions to work in this scenario?

Hi Karen,

Thanks for your kind words and support!

200K seems like quite a huge amount. The problem here is getting enough credit limit to fully pay the 200K. May I suggest that you instead try to negotiate with the loan provider? Usually in this country they’ll allow you to pay off in installments… But you’ll need to be patient and willing to negotiate hard.

Dear Mr Stingy ,

Thank you for always writing great and wonderful articles about personal financing , I have always found your articles very useful and enjoyable to read , your strategy of paying off your loan is great but thank God I dont have a loan to repay . and yep I money is a great website to compare different loan prices and so are other websites such as Ringgit Plus , Loan Street and Qompanion , perhaps you would like to write an article about Fintech companies in Malaysia , here is Qompanion website I find it really useful to compare travel insurances and they also write great articles .

https://qompanion.my/articles/everything-you-need-to-know-about-home-insurance

Thanks Sara — appreciate you dropping by here.

Luckily gov sometime come out with bargaining PTPTN payback scheme. I managed to settled my study loan of about RM18K when gov offered 20% discount with one time settlement. This loan been dragged for almost 10 years and I am quite happy for finally get rid of the loan.

Hi Noraini — awesome to hear about that! Well done and thank you for being a responsible PTPTN borrower. Best wishes ahead ya…

Well executed plan… Good write-up brother.. Keep going..

Thank you bro Ganesh!

Usually zero cost balance transfer is just for 6 months. Of late I have been using alot of balance transfer with Pbbank which charges a one time charge of 7% for a 36-month instalment. This worked out to be an effective interest of below 5%, a good option to tie you over and ease cashflow.

Thanks for the suggestion Josephine! I’m not a fan of one-time charges, so hopefully the banks come back with long-term zero cost balance transfers soon!

Hello Mr. Stingy,

First of all, I would like to say well done and good job on all the great articles written. They are inspiring, humble and yet, connected to many, if not every single reader of yours.

Apparently I had the same case as yours. I was also a scholar of a GLC company where I could hardly see how I could grow in the position offered, and decided to leave after a mere 5-months of tenure. The letter only came 5 years later too (Is this their SOP? Hahaha..!) and the payment methods offered were almost identical except it was a 30% discount if paid lump sum.

The lump sum settlement gave my bank account a real hit but as what you said, the peace of mind knowing that I had cleared THAT debt is definitely priceless!

Hi bakkutteh,

Thanks for your kind words! It’s fascinating to hear about your journey as well. Wishing you all the success in the world ahead, and if you ever have any more feedback for me — do write to me again!

Thanks again.

Great one man! Been following your blog for a while now, kudos and this one really strikes home with me as I am in a similar situation, albeit a contract bond.

if one were to break the contract bond with less than 20% length to go, do u think a company will enforce the full bond break fee? in your experience, how open will a company be to negotiation?

thinking hard haha

Hey Adam,

Thanks for your support.

I think most companies (in Malaysia especially) are pretty open to discussion. After all, this is the land of discounts right? I suggest you have an open conversation with your company and see how things go?

Hi Aaron,

I really enjoy reading your articles and the way you articulate what you felt at that moment when the decision was made. I am a scholar too at my final year and I am about to go back to serve the country I love. I have had the opportunity to work at a corporate in automobile industry during my studies and gained some insights about corporate working experience. It is not the way I envision my future career will be. May I know the reason you why left Petronas? You can drop me an email if it is more convenient.

Great minds think alike. Thank you mr. stingy 😉

Cheers,

Simon C.

Hi Simon,

Thanks for dropping by and your kind words. Copying one of my previous comments to answer why I left PETRONAS:

Here’s the reason why I think most people wanna get into PETRONAS:

1. Big salary

2. Big bonus

3. Prestigious Fortune 500 company (probably the best and most famous Malaysian company too)

4. Good benefits

5. Stable job

All the above are true. And any honest PETRONAS staff (especially the ones who left) will agree.

It just wasn’t for me because I wanted something more than that. I’m an idealist who also wants challenge, meaning and a progressive work environment. I would trade some of the above 5 points for a more challenging, meaningful job with a better environment. So I did. I traded 3 of the above points for something that was high risk, high reward.

And I have not regretted a single day of it. You might find it interesting too, that among all the people that I’ve ever met who left PETRONAS — only one has ever said that she regretted it.

Hi Aaron,

Thanks for your reply. I could not help but think that are big companies always like that? Like the work is just so one-dimensional that we all get bored after two or three years? Does working cultural in the country play a big part in defining how the company works? I do not want to generalize but I just want to hear more about your opinion since you have worked in different countries before and with different people.

I wish you all the best. Continue your work and thumbs up!

Cheers,

S

Hi Simon,

I’ve only worked in a few companies, so it would be hard for me to make any generalizations about big companies. What I will say is, sources say Gen-Y workers change jobs every 2-3 years. It’s not just the companies that are pushing people away, but I think young people today approach work differently too.

What I would recommend for you is to keep reading and talking to as many people as possible — but when you eventually work someday — also to feel and experience it for yourself. Then you’ll be able to make your own wise decisions.

Wishing you the very best too!

Hi Aaron, you mention in your comment that you drop a job in Petronas because it’s not challenging enough. Why issit? Issit because of the monotony of the job? Or the fact that working under someone never gives you enough freedom to live the lives of your dream? If so may I know what kind of job you are working on now that makes it so tempting for you to leave a stable job? No stalking, I’m just impressed by your story and will be glad to have a little more insight into the world of Petronas. FYI, I’m also a to-be-Petronas scholar and this article arouses my interest on your experience with Petronas and your overall thoughts on it. If this gets too private I understand. But I’m just another junior about to take the same footsteps so your advice will be priceless to me.

Hey Zhe Wei,

Why I left PETRONAS? It was a combination of factors really. And I just knew that long term — my future was not with the company. But I did spend two very fruitful years there though, which I don’t regret at all. Even though I left, but I gave it a very fair try. More details in my email 🙂

From the number of years that you have worked in a career. most of your money is tied in your liquid investment which you could not liquidate them to pay for a study loan of RM34.8K?

Hello Lily,

I could have liquidated all my investments to pay off the debt — yes. But I really didn’t want to. That’s why I forced myself to find a way to do it without touching my investments.

This is just brilliant. Using the system to work for you.

Good job bro,

Thank you Dr. Khairul — wishing you the best ahead!

wow.. how did u manage to convince Maybank to increase your credit limit to more than RM34,800?

Hi Ai,

Mmmm… It was pretty easy really. I have a long history with them, always pay on time, and my salary isn’t too low. But banks are always willing to entertain credit limit requests — if they’re pretty confident you can pay I guess…

having a good credit record goes a long way

Hey Mirul,

Thanks for chipping in. Yes it certainly does 🙂

Great article man. But I’m curious, why is it you don’t see your future in Petronas? I mean, people want to get into it so badly.

Thanks Wong,

Here’s the reason why I think most people wanna get into PETRONAS:

1. Big salary

2. Big bonus

3. Prestigious Fortune 500 company (probably the best and most famous Malaysian company too)

4. Good benefits

5. Stable job

All the above are true. And any honest PETRONAS staff (especially the ones who left) will agree.

It just wasn’t for me because I wanted something more than that. I’m an idealist who also wants challenge, meaning and a progressive work environment. I would trade some of the above 5 points for a more challenging, meaningful job with a better environment. So I did. I traded 3 of the above points for something that was high risk, high reward.

And I have not regretted a single day of it. You might find it interesting too, that among all the people that I’ve ever met who left PETRONAS — only one has ever said that she regretted it.

(Now, 7 years later — I’m about to trade again — take a huge cut in salary for something I think will be meaningful for me. I’ll write that post soon!)

Applaud your bravery to show the behind the scene. Am not bonded but still serving and have felt how it is slowly changing me to be “smarter” (somewhat scary when we don’t live to be great) and I know I will not look back when opportunity comes.

Thanks for dropping by Lynn,

Yes — when it’s time to go, it’s time to go. I wish you the best ahead!

Hi, Very good move to get away from the debt. Can you share what is the fine from the bank for Transfer to & back ?

Thanks SH,

There was no fine. I got everything done for free.

For me, the outstanding statement you made about “praying” causes me to stand and applaud you. In my years on this planet I must admit that fervent prayer always becomes a “high priority” element of working out a solution to any problems which always appear and be dealt with. We live in a world which increasingly is “godless”. And, if that continues, we just might live to see the end of civilization for all humanity on planet Earth. Yes, pray now…pray often !

Thanks Tom!

Hi Aaron, we hail from the same alma mater, but I don’t think you recognize me. I am in the same shoes. Received the same letter from ESU and Maysky. However, my salary is not so high. Yet I can still survive living in KL, because I don’t have a car and renting a room at RM200/month. I use LRT/monorail all the time. But my mission to be debt-free by 33 y.o. still living. Good info here, yeap2!

Thanks for dropping by Nabbiha,

Wonderful to hear your story. Keep it up and let me know if you manage to reach your target!

That, was brilliant.

I took out a student loan to help with the massive cost to pursue my passion in art, but it’s always hanging above my head how I’d deal with it when I graduate. This was a very encouraging read. Thanks.

Thanks Mads,

Wishing you the best ahead.