Everyone has credit cards, but most people don’t understand how they really work.

Me — I’m the kind of crazy person who likes reading the Terms and Conditions booklet that comes with every credit card. It can be lonely, so here I am sharing my thoughts on how to optimize your credit cards. Here are the risks, the rules and the rewards.

Hopefully they’ll help you understand your credit cards better — so you can avoid common problems. And can use them for your maximum benefit.

1. Learn The Risks

Many famous personal finance advisers highly discourage credit cards. For good reason. Here are the three main risks:

- Finance charges — The infamous 18% interest (per year) that banks charge if you don’t pay on time.

- Late payment charges — In addition to the 18% interest, the banks also hit you with additional fees if you don’t pay on time.

- Uncontrollable spending — Countless people around the world end up in debt and become broke because they can’t stop themselves from swiping their credit cards. Better to stay away if you don’t have discipline.

Don’t treat credit cards like an ATM machine. Treat them like the velociraptors in Jurassic World. They’re cool but dangerous creatures.

You only get to play with them if you’re in control.

2. Pay The Monthly Balance in Full, On Time

The most important rule in credit card usage is this: Pay the bill in full. On time.

Ignore all the “minimum payment” nonsense. If you pay only the minimum, every month you get hit with interest charges which just makes your debt bigger and bigger.

Understand that if you can’t afford to make the full payment, you can’t afford those things you’re swiping your card for. Reduce your spending to match what you can afford.

“But what if I’m already deep in credit card debt? How do I get out?”

Glad you asked. That’s beyond the scope of this article, but check out my friend’s story on how he got out of 60,000 credit card debt here.

Feed your credit cards on time every month. If not, you’ll get bitten.

3. Get All Your Fees Waived

In today’s competitive card market, nobody should pay annual fees.

That’s because most banks are actually happy to waive them. All you have to do is call the number at the back of your card and ask. If they refuse, politely inform them that you can’t afford the fees and need to cancel the card. Then — they’ll usually waive the fees.

I’ve heard of certain foreign banks refusing to waive annual fees. But that’s OK. You can go ahead and cancel them. Local bank cards have better benefits than the foreign banks anyway.

Here’s another tip you should remember. In case you forget to pay your bills on time, and get hit with some charges: Just call the bank and ask them to waive it. If you have a good payment history like you should, and make the due payment asap — they’ll likely waive it too.

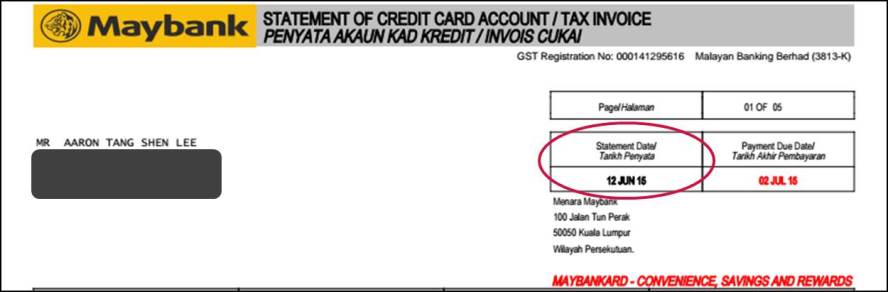

4. Understand your Credit Card Bill, and Billing Date

Every month, banks bill your credit cards on a fixed date. For my cards (Maybank and Alliance), it’s always the 12th of every month.

From billing date, you get 20 interest-free days to pay the bill. If you don’t pay within this period, you start getting charged interest. That means I have to pay my credit card bills by the 1st of every month.

Knowing your billing date lets you “time” your major purchases. For example, if I wanted to buy a pair of tickets to an upcoming Bon Jovi concert:

- If I buy the tickets early in July (before the 12th), the transaction will likely show up on my bill on 12th July. I then have to pay for the tickets within the next twenty days. By the 1st of August.

- If I need a bit of time though, I can choose to purchase the tickets on 13th July. That way, the transaction will only appear in next month’s bill on 12th August. And I only need to pay on the 1st of September. I’ve effectively increased my interest-free period to about 50 days.

If you have multiple cards (and if your banks allow it), call them and arrange all your cards to be billed on the same date. That way, you don’t get confused with different dates to pay.

p.s. The last time I tried to do this with CIMB bank, they refused — saying the billing date was fixed. But give it a try. Maybe if enough people ask — they’ll start doing it.

Where to find your credit card billing date

Where to find your credit card billing date

5. Maximize The Benefits: Cashbacks And Points

The two most common credit card benefits are cashbacks and points. Here’s how to optimize them:

- Cashbacks

- Cashbacks are free money the bank gives based on your spending. For example, if my card has a 5% cashback on petrol, and I spend RM 200 on petrol — the bank credits RM 10 back into my account.

- Most cashbacks are conditional. Some cards only give you cashbacks on groceries. Some only give you cashbacks on weekends. Some limit your cashback to RM 50 a month. Which reminds me — my friend recently used his credit card to pay the downpayment on his home. It was an unlimited 1% cashback; the bank gave him ~RM 1,400 from that one swipe.

- Understand which cards give you cashbacks for your own situation. Then you can choose the correct card to use.

- This applies to discounts too. Certain shops give you a discount if you pay with a certain credit card. Don’t be shy to ask: “Any credit card promotions?” when paying.

- Points

- Basic cards give you one point for every Ringgit you spend. Great cards give you 5x points or more.

- Like uncontrolled spending, credit card points can quickly add up. Especially if you use your cards for business or work.

- A few months ago I discovered I had accumulated about 750,000 worth of credit card points over 5 years. At that point in time, the (Maybank) exchange rate was 250 points = RM 1. So I exchanged that for RM 3,000 worth of free stuff.

- The exchange rate isn’t always so good. Check your bank’s points redemption page for the updated rates. Sometimes banks hold “Redemption Fairs” at shopping malls — where they offer special exchange rates.

- Credit card points expire. Unless they’re stated as “timeless”. Make sure you exchange them for stuff before the expiry date.

6. Use 0% Interest Payment Plans (If You Can Afford It)

Let’s say you have money and want to buy something expensive. Like a big Italian leather sofa.

The coolest thing to do at the furniture store is to pay using a thick stack of cash. Like a boss.

The wiser thing to do is to sign up for a 0% interest payment plan on your credit card. Firstly, because it’s not safe walking around with thick bundles of cash. Secondly, because you get points and cashbacks from your card. And thirdly, it’s good for your cashflow.

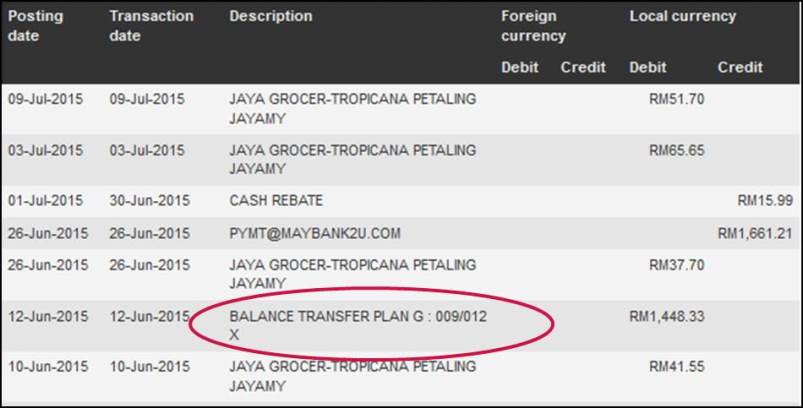

These plans usually come with a minimum of 6-months, or if you’re really lucky — they can stretch as long as 36-months, interest-free. Now you can keep your big sum of money in the bank (or in some other good investment) and slowly pay off the balance every month. It’ll appear in your credit card statement looking somewhat like this:

A 12-month “Balance Transfer”, similar to a 12- month 0% interest payment plan

A 12-month “Balance Transfer”, similar to a 12- month 0% interest payment plan

Most stores which sell “expensive stuff” like furniture, home appliances, and mobile devices accept 0% interest payment plans.

Note that these plans are very different from blindly swiping, and then paying the minimum balance. Here, you don’t pay any interest at all. Just make sure you have enough money to pay on time every month.

7. Learn from the Masters

This article just covers the absolute basics of credit card optimization. For further information:

- RinggitPlus has a very good card comparison page, which prominently shows you sign-up offers: free gifts you get when your credit card application is approved.

- iMoney’s card comparison page isn’t bad either. A worthy second opinion. What they’re really good at though, is their Learning Center.

- And finally, I would never have developed my passion for credit cards without GenX GenY GenZ’s website. The ultimate authority on credit cards here.

If you’re interested to learn more about Malaysian credit cards, you won’t go wrong with the three sites above.

And if you have any further questions — write to me. I’d love to help!

If you need a recommendation for a credit card, iMoney’s Credit Card SmartSearch tool below is a great place to start. It’s an affiliate link — meaning if you get a card through it — I’ll get a small fee to support my website. But absolutely no additional cost to you.

This article first appeared as a guest post on KCLau.com

Pic Credit: Orin Zebest at Flickr, Pexels

Hi,

I got a cc with the intention of building my credit score. I read if your balance is always zero, it wouldn’t help as it would look like you are “inactive”. How do I improve my credit score without paying interest?

Hi,

Credit cards have interest-free payment periods. (If you pay the full balance within 20 days after your billing date, there is no interest/fees.)

So spend with your card >> always pay it on time = improve credit score without paying interest.

-repost-

-rm1400 cb for paying down payment.. means he swiped 140k? His cc so high credit limit? :O

-I thought sign up installation plan then won’t get any cb got it d?

Yeah,

My friend asked for a temporary increase in credit limit. Nowadays the credit card benefits are a bit more stingy. Back in those days, if you knew how to play the game can get lotsa free stuff.

Hye,

I’m relatively new to the usage of credit card, since before this my husband is the one handling our finance. However, I am now in charge, and I’ve found out that we (actually him,) have debts on all 3 cards. 1st card amounting to RM 6000, 2nd card, RM 2000 and 3rd card RM 700++. So we need to pay a minimum of ~RM500 for all the cards which we hardly can afford.

1) I am planning to make a personal loan and pay up all the cards, so we’ll be paying RM300 per month for 3 years. Do you think its a wise decision?

2)I’ve just read that balance transfer on a new card could also be advantageous. However, I don’t think my husband could apply for a new card. Thus, is it possible to transfer the balance to a card under my name? If so, which decision would you think is better? No 1 or 2?

Thanks in advance

Hi NS,

It’s good that you’re taking action to clear the debt!

Regarding your question, the principle is of course to take the option which charges less interest/fees. In that case, if you can apply for a 0% balance transfer credit card, that would be the best choice. You would of course need to strictly pay the balance on time. And I’m about 99% sure you could transfer the balance to a card on your name.

All the best!

Do you know any of the credit cards which allow me to have cashback for petrol . bil & yearly insurance payment ? If you have all in one card.. Pls. let me know… Thanks

Hi Sh,

I think we’re now in the age of having multiple credit cards to really optimize the benefits. This needs discipline though…

If you’re really looking for only one card, you can try the Hong Leong WISE card — where you can select up to 3 “categories” for cashback. I’m not a fan of the terms and conditions though.

https://www.hlb.com.my/main/personal/cards/WISE-card

https://www.imoney.my/credit-card/hong-leong/wise-gold-card

Another one of my readers asked about insurance recently, but unfortunately (to my knowledge) there isn’t a card with good cashback specifically for insurance.

Thanks for your replied. I do have the Wise card you recommended, but as you said the T&C is also not fan for me.

As recommended by banker, the OCBC Great eastern Platinum Master cards could be the best for yearly premium. as it give you 1.2% for the frist rm1000.. bal. is 0.5%.

Do you have any comments for Maybank Amex?

Any of the Cards that gives Cashback for petrol & groceries for 7 days a week?

Hey Sh,

I still like the Maybank 2 Cards. I use the Amex for weekend dining. 5X points and 5% cashback is still very good (although now limited only to dining). For other days, I use my other cards, but if there’s no special cashback/discounts — I still fall back to the Maybank 2 Cards.

Petrol & Groceries 7 days a week? Got the perfect one for you: Maybank Visa Signature. 5% cashback on petrol and groceries every single day.

https://www.imoney.my/credit-card/maybank/visa-signature

Hi,

When Maybank change the benefit for 5% petrol & groceries at weekend ? Today , I just saw the it on the Sep statement. which Effective from 1 August.

When the T&C change, How the customer get inform upfront ?

Yup — it was effective 1st August. From what I see from Maybank, they just inform customers on their Website. (It would be nice if they sent emails to us right?). The other way to find out is of course from informative websites 🙂

Thanks for this post.

I tried waiving my fees with Citibank for my Gold card, but they refused, so I asked to cancel. They didn’t want to see me go, so they offered me another credit card, the Choice card, which has no annual fee. I also didn’t have to pay the annual fees for the other card, thankfully.

Glad that I could help Adelynne.

And glad to hear that Citibank are waiving the annual fees too!