For those of you who are starting your very own micro business in Malaysia, a Limited Liability Partnership (a.k.a. Perkongsian Liability Terhad, PLT) is likely your best business model to start with.

I started mine about 1.5 years ago, and while I’m not a certified expert or anything — I’ve spent too many hours reading obscure documents by various government agencies to let it go to waste. This post covers the 5 Wives and 1 Husband on new LLPs in Malaysia. Who, What, When, Where, Why and How?

It’ll cover the “first cycle” of your new baby LLP’s life. Hopefully after you’ve gone through this first cycle, you’ll know what to do and just focus on running your core business smoothly.

Here’s the ultimate guide to starting your own LLP in Malaysia.

Why Limited Liability Partnerships?

Simon Sinek says great leaders start with “Why,” so we’ll start with that too.

If you recall what you learned in high school during Kemahiran Hidup, you’ll know that there are a few forms of businesses, each with their set of advantages and disadvantages. Of course, instead of listening to Puan Mariah, you were busy playing Command and Conquer with your pretty classmate Siti. So let me break it down for you:

There are sole proprietorships (Milikan Tunggal), partnerships (Perkongsian), cooperatives (Koperasi), private limited companies (Sendirian Berhad) and public limited companies (Berhad).

Know why you never heard of Limited Liability Partnerships when you were in school?

No, it wasn’t because Siti was flirting back with you, (she was actually just bored). It was because LLPs didn’t exist back then. They’re a new type of business entity — and they’re fascinating. Here’s why.

The Concept of Separate Entities

Okay, I actually hate the word entity because it doesn’t bring up the image of anything in my head. WTF is an entity?

In layman’s language, an entity is a thing that is independent. So for example: you’re an entity, I’m an entity, and Ah Chong Auto Services where you service your car is an entity. But here is where it gets interesting: some businesses are separate entities from their owners.

Now this doesn’t feel natural. Maybe because we’re brought up with traditional values that businesses are made up of the people that run them. So if you think of Tesla, you think of Elon Musk. If you think of Virgin (not that one perv), you think of Richard Branson. If you think of Tesco, you think of the kind Nepali guard named Bishal who helped secure your plastic bag.

But the great thing about separate entity is it allows you to keep your personal life and business life separate. And allows for some really cool things — like say, for the company you created to continue living on even after you’re gone. Since it’s a separate entity from you — it doesn’t need you to be around. This is called continuity of existence.

Here’s another example: Rich Dad, Poor Dad author Robert Kiyosaki’s supposed bankruptcy. Some people have been saying recently, “Oh, he’s a fraud — if he knows so much about money, how come he can go bankrupt?”

He didn’t go bankrupt, silly. One of his many companies declared bankruptcy. Note the difference: Kiyosaki’s company declared bankruptcy, not Kiyosaki. And it probably hasn’t affected his wealth much. He’s likely got it all stored in other safe places.

But if he had been running a business that wasn’t a separate entity from himself (e.g. a sole-proprietorship), then yes — he’d be in deep shit.

Deep Shit vs Limited Liability

Just like in Kiyosaki’s case, there are always risks that business will go bad, and you need to make things right.

The lawyers call this liability, but I prefer to call it “being responsible for deep shit.”

The good news is there are business forms that protect you from going bankrupt even if your business does. And as you’ve probably guessed by now — a Limited Liability Partnership does exactly that (like the much more common Sendirian Berhads). At worst, you’ll lose all the money you invested into your business — but nothing more.

“Why not a Private Limited (Sendirian Berhad) company then? My friend says this is the best business format!”

Because Private Limited companies are expensive to start and more difficult to maintain (~RM 1,500 to start, ~RM 2,500 per year to maintain). If you have lots of capital though, they might make sense for you.

If you’re getting confused by my long-winded explanations, TL;DR: Choosing the correct business model can protect you and your money.

The Who’s Who of LLPs

Feel free to skip this paragraph if you’re an experienced business owner. If you’re a noob like me though — it’s important to understand who the players are:

- Suruhanjaya Syarikat Malaysia, SSM (Companies Commission of Malaysia, CCM) — where you register your LLP, get its “birth certificate,” and do your annual declarations.

- Lembaga Hasil Dalam Negeri, LHDN (Inland Revenue Board, IRB) — who you pay your taxes to and where you register for tax filing.

- Other Government Agencies (e.g. Employees’ Provident Fund, EPF; Social Security Organization, SOCSO; Human Resources Development Fund, HRDF).

We’ll get into more detail on what you need to do with each of these agencies, but the point I wanted to make is this: a one-stop portal/counter where you can do everything does not exist. You will be dealing with multiple parties — each with their own ways of doing things. So please don’t get upset when the counter lady gives you the classic Malaysian line: “Oh, ini kena pergi jabatan lain…”

Again, the above will seem painfully obvious if you’re already a seasoned Jabatan runner. But sometimes I have people asking me, “Why can’t I open a bank account for my LLP at SSM?”

Because they’re separate entities.

“But why not just run my side business quietly, don’t declare anything, and keep all the income? My friend’s aunt teaches tuition quietly and she’s damn rich! It’s the ultimate life hack!

F*ck the government. Hihi.”

Yes, I totally understand your desire to pay as little tax as possible, and there are completely legal ways to do that. But I also believe in running legitimate businesses that are properly registered. It’s the ethical thing to do. Besides, you don’t want to mess with LHDN. I hear they can mess your life up pretty bad.

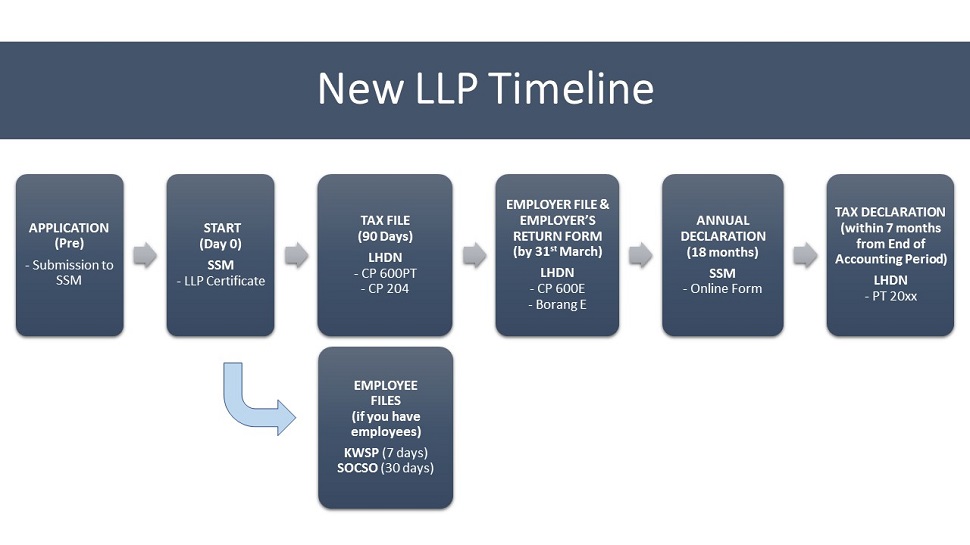

When Do I Need to Do What (First Cycle)?

Here’s where it gets exciting. Because here’s where we talk about what needs to be done, and when.

SSM and LHDN make up the majority of this section — because they’re the two major government agencies that you’ll need to report to.

(I don’t have experience running a business with employees, so my knowledge on dealing with the EPF and SOCSO is almost zero. If you know about that, and would like to add to this article — please comment below!)

Here’s a timeline of what needs to be done and when:

1. Application

Start by submitting your LLP application to SSM. Detailed instructions here.

2. Start

Once you’ve gotten your LLP certificate — we’ll call that Day 0.

3. Tax File

Register your LLP for a Tax File at a nearby LHDN branch:

- Use Form CP 600PT.

- You’ll also need to submit copies of your LLP certificate (from Step 1) and stamped LLP agreement.

- You can stamp your LLP agreement at any LHDN branch. It costs RM 10, and takes just a few minutes. Won’t go into detail on how to fill up the form here, but it’s really simple — just ask the helpful LHDN people at the counter.

Not sure how to do an LLP agreement?

Enquire here, or email my partner at info@axecute-consultancy.com;

and get a discount because I referred you:

LLP agreement packages start from RM 1,200.

Caution: When I went to LHDN Petaling Jaya, they said it’d take 3 working days, and in addition to LLP certificate and LLP agreement — they also needed IC copies of all the partners. That sucked, as I didn’t have the IC copies with me.

Pro Tip: So I went to LHDN Jalan Duta instead. And got it done within 15 minutes. (No IC copies required.)

Once you’ve registered your tax file, LHDN will issue you a letter which tells you your “No. Cukai Pendapatan” (Income Tax Number). It should look like this:

PT xxxxx xxxxx (10 digit number)

With your Income Tax Number, you can now do the next step: which is to file your LLP’s Income Tax Estimate:

- Use Form CP204.

- Since this is your first year in business, you have 90 days to submit your income tax estimate.

- For some reason, you can only submit Form CP204 (for LLPs) to the LHDN Branch in Bangi (by post/hand). Still waiting for their online system to be ready!

Pro Tip: If you’re an SME (less than RM 2.5 million paid-up capital, and not related to a company > RM 2.5 million capital), you don’t need to fill up the tax estimate portion for the first 2 years. As in, you fill submit Form CP204 anyway, but leave sections 2 and 6 blank.

Reference: CP204 for SMEs

Optional: If You Have Employees

I don’t have experience dealing with the EPF and SOCSO (because I don’t have any employees), but if you do, register them according to the timelines below:

4. Employer’s File & Employer’s Return Form

Here’s where it got a bit confusing for me. Since I have no employees, I thought I could skip this step. But apparently LHDN wants all LLPs to still register for an Employer’s File, and submit Employer’s Return Forms (Borang E) every year.

How to register your LLP for an Employer’s File (Fail Majikan)? You’ll need to head to a nearby LHDN branch and submit this form. (Remember to bring copies of your LLP certificate and ID too.)

For Employer’s Return Forms, it depends on when you start your business. You’ll always have to submit Borang E by 31st March of the following year. For example:

- If you start in November 2016, you’ll need to submit Borang E to LHDN by 31st March 2017.

- But if you start in January 2017, you’ll need to submit Borang E to LHDN by 31st March 2018.

Download Borang E at LHDN’s website.

5. Annual Declaration

If you’ve made it to this point, you’ve already been running a (hopefully) successful business for some point now. It’s time to do your first annual declaration to SSM.

Your first annual declaration needs to be done within 18 months from your LLP’s registration date.

For subsequent years, it needs to be done within 90 days from the end of your LLP’s financial year.

This allows you the flexibility to choose a financial year that makes sense. So for example, if your LLP was registered on 12th July 2017, here’s an example of a financial year that doesn’t make sense:

Financial year: 12th July – 11th July

First accounting period: 12th July 2017 – 11th July 2018

First Annual Declaration: 12th July 2017 + 18 months = by 11th Dec 2018

Future Annual Declarations: 11th July + 90 days = ???

Tax submission (more on that in section below): 11th July + 7 months = ???

Here’s a more straightforward financial year:

Financial year: 1st Jan – 31st Dec

First accounting period: 12th July 2017 – 31st Dec 2018

First Annual Declaration: 12th July 2017 + 18 months = by 11th Dec 2018 (the only time you’ll have a weird deadline)

Future Annual Declaration: 31st Dec + 90 days = by end March every year

Submission of Tax Declaration: 31st Dec + 7 months = by end July every year

So please make sure to choose a sensible financial accounting period.

Annual declarations cost RM 200, and can be done fully online at MyLLP Customer Portal. If you have all your documents and information ready, I’ll bet you can do it within an hour.

For SSM’s comprehensive guide on how to do Annual Declarations, click here.

6. Tax Declaration

This is perhaps the most complicated part of all. Why? Perhaps because LLPs are new business structures — good documentation on how to do things is lacking.

So let me try my best to explain LLP tax declaration in plain language:

- When to submit? Within 7 months from the end of your accounting period. For example, if your accounting period is 1st Jan to 31st Dec (like in previous section), you need to submit your tax declaration by end July. If your accounting period is 1st July to 30th June, you need to submit your tax declaration by end February.

- How to submit? For LLPs, tax submission is a fully manual process. Online tax submission for LLPs is not possible for now.

- What to submit? Form PT 20xx. For reference, here’s Form PT 2016 in Bahasa and English. (The English form is for reference only.) You need to submit the Bahasa Malaysia version of the form to LHDN.

- Where to submit? Submit Form PT 20xx by post/hand to the address below:

Pusat Pemprosesan Maklumat,

Lembaga Hasil Dalam Negeri Malaysia,

Menara Hasil,

No. 3, Jalan 9/10, Seksyen 9,

Karung Berkunci 221,

43659 Bandar Baru Bangi,

Selangor.

Note: Please do not submit the following for LLPs:

Form B (that’s for if you’re a sole proprietor) or

Form P (that’s for a partner in a conventional partnership).

For your personal income tax (remember that?), you still need to submit Form e-BE online. Remember, LLPs are separate entities from their partners. So they file tax separately.

What do you need to know to do LLP tax filing by yourself (i.e. without paying a tax agent to do it for you)? Basic accounting knowledge, and knowing how to read financial statements.

And here’s LHDN’s Guide on how to fill up Form PT 2016.

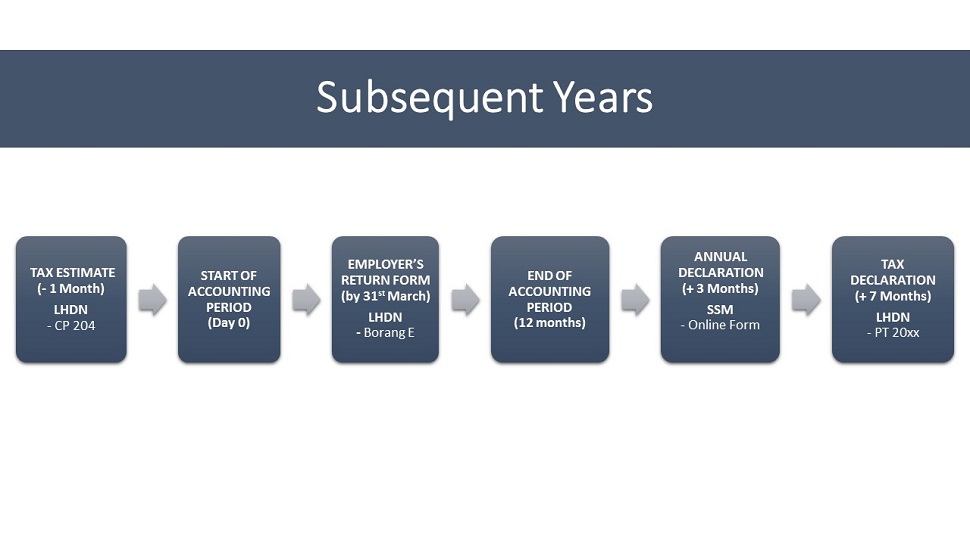

The next Cycle and the Future

Now that we’ve made it through Cycle 1 (phew!), it’s pretty smooth sailing from here onwards:

For subsequent years:

- Submit Tax Estimate (Form CP204) needs to be submitted at least 1 month before the start of your financial year.

- Employer’s Return Form (Borang E) needs to be submitted by 31st March of every year.

- Annual Declaration needs to be done within 3 months of the end of your accounting period.

- Tax Declaration needs to be done within 7 months after you’ve closed your books.

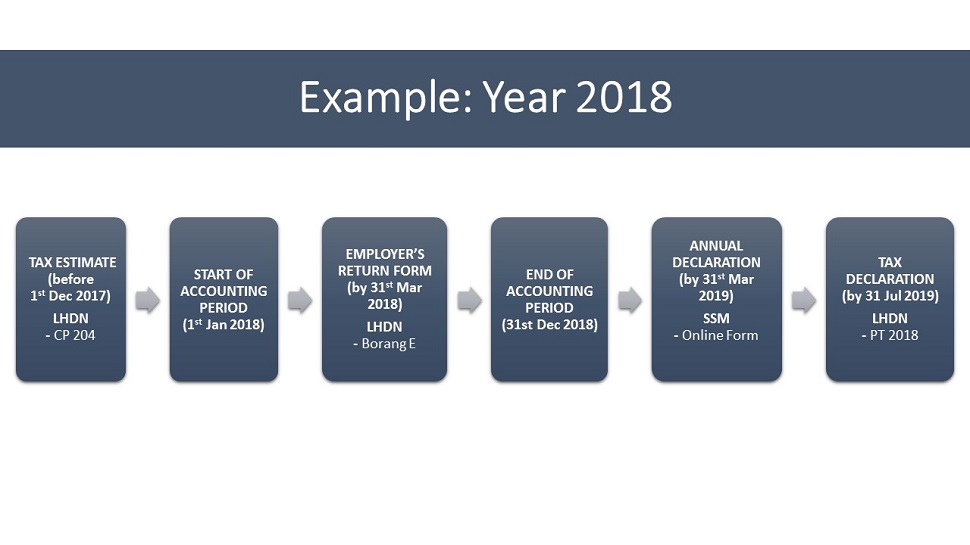

And just to demonstrate how this looks, here’s an example for an LLP whose financial year is from 1st January to 31st December for next year:

How Can I Get More Information?

LHDN has a pretty good website, where you can download all the forms necessary, and read official documentation regarding tax.

SSM‘s website is pretty good too, though not as well-maintained as LHDN’s one. But the reporting requirements for LLPs are simple — so you probably only have to deal with SSM once every year.

If you have any other burning questions, comment below and I’ll try to answer asap. Plus, some of my beloved readers sometimes help answer questions too. Thanks guys!

Finally, if you’ve made it this far, you either work for SSM/LHDN, you’re writing a thesis on LLPs in Malaysia, or you’re genuinely interested in starting a DIY business.

Whichever it is, I wish you the best — and hope you make tons of money.

– – –

Of course, if all the above sounds like a lot of boring, meaningless work — you can always pay someone to do it for you. Reach out to my partner here, or email info@axecute-consultancy.com for a quote; and get a discount just because you know mr-stingy. LLP packages start from RM 1,200.

Pics from Pexels, Pixabay and Pexels.

Hi Mr.Stingy Regarding the e-filing for LLP, i have registered through e-Daftar and got my No. Rujukan, but i cannot find where i can file online for LLP.

Could you advise where do i do so?

Hi Vicky,

Been quite a long time since I did this. Might need to check at Help center on the website, or perhaps give them a call to advise?

All the best!

I forgot to ask you this. My LLP had a net profit of about RM10k. I personally don’t have any income. My friend told me that I should declare to LHDN that my LLP made no profit because it paid me ‘management fee’ of RM10k. This means my LLP does not have to pay tax. Since I have no other income then I don’t have to pay personal tax on that RM10k. So no tax for me or my LLP! But I’m not sure if my friend is giving good advice. What do you think?

I think you might need to refer to an accountant (or tax professional) about this.

As far as I understand, remuneration paid to partners of LLPs are not tax-deductible. (Meaning your LLP probably needs to pay tax on that RM 10K.)

Thanks for the excellent write up. So very useful. Does the annual declaration to the SSM have to be audited? If not, then how accurate do you think it has to be? I have limited accounting knowledge but I don’t want to spend money on accounting fees. I’m tempted to do it myself. I run a very small business with only a net profit of RM10k last year.

Thanks Alex,

The annual declaration to SSM does not need to be audited. It however needs to be true. 😀 I think you might benefit from working with an accountant to make sure all your accounts are correct.

Dear Aaron, thanks for the good write up. I have few questions needing help:

1. If initial start contribution by partner 1 is RM900 and partner 2 RM100. Where should i register the contribution in my accounts? is it under Equity –> Capital Contribution by Partner 1 RM900 and Equity –> Capital Contribution by Partner 2 RM100?

2. If declare profit to partners, Profit is under Expenses of accounting? Profit has to be in proportion of contribution of capital? (eg. Q1 above, of 90% and 10%)

Dear Sally, thanks for dropping by:

1. Yes, I think you’ve got that right.

2. Profit should be Revenue – Expenses. Profit should be in proportion of capital contribution, unless you have agreed otherwise in your partnership agreement.

p.s. take what I say with a pinch of salt. I’m not a professional tax/secretarial advisor.

Just went to lhdn for step number 4 but was told that I didnt need to register for that since the only staff that takes salary is also one of the partners. I was told by the staff that apparently for LLP’s if the partners renumeration is below RM3700 you do not need to even register for KWSP. Can someone confirm these or was the staff just trying to get me outve there

Thanks Ryan for dropping by,

Hopefully someone will have the answer to this one. Thanks!

I got to print form CP600PT from your pages. Would you believe it: LHDN’s site does not carry it!

I like the way you present a very dry subject with everyman’s language. Information and advice is succinct. Doing a great job.

May the mighty one above reward you.

Thanks David,

Really appreciate your kind words here.

Hi Mr-Stingy,

Thank you for the informative blog, I’ve learned even more from the comments too! I’m looking to start up a small F&B, my question is:

For a startup of say… RM300k, I can only contribute 5% capital, the rest comes from one partner and several sleeping investors. The partner and I will be 100% full-time managing the biz, while investors solely contribute to capital, and probably get profit distribution in the future as per agreement. Is LLP a suitable way to bring everyone on board to start the biz?

Hi Kent,

Thanks for reaching out. I don’t think the form of business (whether it’s Sdn. Bhd. vs LLP) matters as much here vs larger questions around how you’ll agree to responsibilities/leadership/splitting of profits.

Sorry couldn’t help more, but probably worth speaking to some lawyers around this to get professional advice.

Hi Mr Stingy 🙂

I have just incorporated my LLP company and trying to figure out if it is necessary to have the financial start on the date the LLP was incorporated.

Hi Pauline.

Congratulations! Nope, it’s not necessary to have the financial date match the incorporation date.

Most likely easier to go with something traditional like 1st January or 1st April.

All the best!

In the LHDN’s REGISTRATION FORM FOR EMPLOYER’S NUMBER, there is a field called “Jawatan tertinggi * / Highest position *”. So my question is what is the highest position in LLP? Director? But as I understand, LLP do not have director. Main partner? This sound funny.

Highest position from my understanding is “Main partner,” or perhaps “Managing partner.”

Hi Mr. Stingy, do you declare yourself as the employee in Form E, or just fill in as zero employee?

Hi Steven, I don’t consider myself an employee. But I also don’t take a salary…

Hi there, I’m still a bit confuse, I have scenario below need your kind opinion:

1. I have remuneration arrangement in LLP Agreement for all partner, including myself, do I need to report those remuneration received from my LLP in Form e-BE?

2. If the LLP have profit distribution to all partner, including myself, do I need to report those profit received from my LLP in Form e-BE?

Thank you.

Hi Jason. My thoughts:

1. Yes, you need to report remuneration (since it’s kind of a salary).

2. No, you don’t need to report this any more under personal income tax. Think of it this way, your business (the LLP) has already been taxed on the profits. On the after-tax profit distribution to partners, there’s no need to “double tax” it again.

Hi there, do you have any idea about using LLP to hold Sdn. Bhd. shares?

If I have 5 investors interested to invest in my company, and I intend to put them all into LLP and there have equal shareholding to my company.

Hi Charles,

Apologies. This is a bit too in depth for me. Might need professional advice for this one from a company secretary.

LLP can definitely be used for JV by other corporations (Sdn Bhd and Bhd) for a project etc, but from what you’re describing, it sounds like you should be able to get them to invest in your Sdn Bhd directly and sell out your portion of shares until all have equal shareholding without using an LLP.

Hi Mr Stingy, is Steph here..

Is the 1st year dormant company (dormant more than 12 months) required Annual Declaration too?

By just filling in only the Capital investment part & other remain zero? Is the dateline for Annual Declaration same as ruling?

Hi Steph, I think so, Yes to all your questions.

(Not 100% sure though, so please double check if still in doubt.)

Hi Mr Stingy,

Currently, we have an LLP with 2 partners in it. We understand that it is not compulsory to draw up a LLP agreement and if we choose not to do so, the standard LLP Act will apply for our LLP. We also read online that in order to pay salary to one of the partners, we will need to include this term in our LLP agreement.

1) Is the above true and will we be able to pay a partner’s salary if we do not do anything?

2) Can we simply draw up a simple agreement between the 2 of us and include this partner salary term inside and both of us sign on this agreement? Will this be sufficient enough and binding?

3) In any case, I tried to send an email to your Lawyer friend which you advertised on your blog but the email address doesn’t seem to be in use anymore. Do you know have any other lawyer recommendations who are able to help draw up a simple and cheap LLP agreement for us?

Thanks and regards

Hi Lee,

Some thoughts:

1. I’m not 100% sure about this, might need a professional company secretary to help you check.

2. As above.

3. So sorry about that, my partner has moved on to other ventures. Perhaps you can shop around for some other firms providing company secretarial services.

1) Yes it’s true. You can still pay salary to the partners without it being mentioned in the LLP agreement, but you will not be able to get tax deduction. See Public Ruling 3/2014, I quote “remunerations or similar payments to partners of LLP are not allowable for deduction if not specified or provided for in the LLP agreement.” Partners will still need to pay tax on that salary too.

2) Yes you can, but you’ll need to ensure all the minimum requirements of an LLP agreement are met. See same Public Ruling above, where it specifies you’ll at least need name of LLP, nature of business, capital contribution by each partners and remunerations to each if any. Also some banks will require you to state explicitly in the agreement the ‘resolution’ open account etc, so need to ensure all of that are covered. Best to get a pro/lawyer to help out.

3) I used the service of my lawyer cousin, I’ll ask if she’s interested in doing this for others and post her email here later.

If we don’t hire any employee but we pay ourselves (partners) salary, do we need to fill borang E, pay KWSP & SOCSO?

Not 100% sure, but I don’t think so.

Hi, Mr-Stingy,

Does fixing the first financial period of LLP, will be following the same law as forming an Sdn. Bhd., which could be up to a maximum of 18 months?

Hey Brian,

I think so.

Yes I believe so too. However, seems like tax basis period will still be ending 31 Dec every year per Public Ruling 4/2017, so will still be separately assessed. Sounds like best to keep everything (accounting & tax periods) aligned to end Dec if possible.

Why do we need LLP agreement at the first place?

Helps protect everyone involved and clearly lays out what everyone owns.

Just to add on, if you intend to pay yourself and partners salary, and to deduct tax, it is compulsory to have LLP agreement.

Mr. Stingy, your response to my enquiry seem to contradict with your own write-up in first para item 4 (Employer’s File and Employer’s Return Form) where you state that LHDN requires all LLPs to register Employer’s File and submit Employer’s Return Form (Borang E) every year, even if no employees, as in your case. Kindly clarify.

Hmmm,

Perhaps I’ve made a mistake. I haven’t been filing Borang E anymore recently though (thought it’s not required because of 0 employees). However I could definitely be wrong — am no expert here.

as i know LHDN already enforced employer need to submit form E although the company do not have employee. just submit 0

If salary/wages pay to director, contribution to EPF / Socso is a must.

Thanks for sharing Jennifer!

Hi Mr. Stingy, firstly thank you very much for perhaps the most comprehensive and useful blog on LLPs in Malaysia. I have the following questions that you or anyone else reading this blog may respond to:

1) Is it mandatory to fill up Borang E even if we do not have any employees employed by the LLP?

2) Is it mandatory to send online the Borang E for LLP or can we still send it manually to LHDN before March 31 2021?

I tried to send the Borang E online but the LHDN system will not submit the form unless we complete employee details in form CP.8D even though we indicate 0 employees. Anyone else encountered this problem and how did you resolve it?

Hope Mr.Stingy or anyone in the know can respond. Thanks.

Hi Richard,

I don’t think you need to submit Borang E if you don’t have any employees at all.

Mr Stingy, hope you can update this on your article. What a bad experience I had today. So I have prepared my LLP agreement and went to LHDN office for stamping. To my surprise, the payment counter for stamp duty only open until 12pm and it has been closed by the time I reached. The LHDN staff asked me to buy stamp hasil at Pos Office as the stamp hasil is not sold at LHDN? What kind of logic is this? LHDN not selling stamp hasil? After the bought the stamp hasil, I need to go back to LHDN office again to matikan stamp.

Sorry to hear about the bad experience…

Hi, may i know where you get your LLP agreement done up. Appreciate your recommendation. Thanks.

Mark

Yes unfortunately the same everywhere during MCO. Had mine done in LHDN Shah Alam and was quick if you arrive early before the ‘SOP’ queue starts building up. A few ways to get stamping done:

1) The old way, buy hasil stamp at Pos office (yes only sold here no where else), paste it and get it stamped at LHDN.

2) The ‘newer’ way (digital franking) where you can just show up at LHDN and fill up information online on their computer and get a green stamp on the doc. You can optionally download the app and pre-fill the info and get a QR code so that when you arrive at LHDN they will just use the info directly to get it stamped. You might need to know which type of agreement (suratcara) to use in the app etc, so might be easier to let officer there do all these this for you, which was what I did.

3) Both above will go away pretty soon, maybe June this year if I heard correctly, replaced by their latest STAMPS system – https://stamps.hasil.gov.my/stamps/. Similar to digital franking in that you can fill up all info and pay online and even print it yourself apparently, without going to LHDN based on my reading. At the moment only firms can use this I think.

How many copy of LLP agreement is needed when submitted for stamping? And is it still cost RM 10 now?

Probably a few copies so that every partner has a copy. Yes I believe the cost is still RM 10.

Very useful article – can an LLP be used as a holding “entity”, are there requirements to prepare consolidated accounts if it is a holding LLP? Not sure if there is requirement to be audited in this case

Hi Jia,

I’m not sure. You might need to ask a professional corporate secretary on this one.

Hi Mr. Stingy,

My LLP has operated for a year but have not submitted tax file to LHDN (90 days), so we do not have tax registration number yet, would you have any advise or contacts that could help us in this process?

We have just submitted our annual declaration*

Your help is much appreciated thanks.

Hi William,

In my experience LHDN officers are quite helpful. You can give them a call directly or even pay a visit to their office, and they’ll be able to help.

Hi William and Mr. Stingy,

My LLP was operated since last year March, and I just registered my file tax last 2 weeks without any issue. I think you can visit the LHDN office and fill up the form. Remember to bring your LLP certificate, partner ID photocopy. After submission, you will receive a letter within 2 weeks.

Thanks Vincent!

Thanks for your amazing efforts!

If I already have a partnership, can I somehow upgrade my existing partnership to a LLP? Is this possible? What are the steps?

Hi Nicholas,

Thanks. I’m not very sure about this. Perhaps you can check in with SSM?

I really like this article!

The way you explain was quite funny and makes me doesn’t feel boring when going through all the information. Besides, it helps me a lot especially about the Tax File, and Employer File sections. Previously I’m quite confused about what must be done after register LLP to avoid getting trouble or fined by the LHDN.

By the way, I’m just 18 and want to start a business with my friend, but lack of knowledge in this field. Glad that I found this article from Google search! You save my life Mr Stingy! XD

Hi Jeremy,

Thanks so much for your kind words and all the best for your business!

Hi Mr. Stingy,

Does this guide apply to a digital agency business? I’m setting up an online creative agency and I’ll be the only ’employee’ for now, is LLP a good option?

Hi Lynn,

An LLP can apply to most forms of businesses. I think LLP is good because of limited liability and the ability to split business personal expenses/taxes. However a sole proprietorship probably has less admin-related tasks.

Hi Mr.Stingy! Great article you have here, been following you for a few years and it has always been very pleasant reads.

Regarding the e-filing for LLP, i have registered through e-Daftar and got my No. Rujukan, but for the life of me i cannot find where i can file online for LLP. the only page i kept going back to is the page for personal income tax filing.

Could you advise where do i do so?

Hi CC,

Thanks for your kind words. The login is the same page as personal income tax filing here: https://ez.hasil.gov.my/ci/Login.aspx?page=02

You still use your MyKad number to login, however the password you use for business filing is different. That’s how the system recognizes if you’re logging in for personal or business account.

Do you have any LLP agreement template to share?

Hi JT,

Unfortunately I don’t. Best to speak to a lawyer around this.

Hi Mr. Stingy,

Is the LLP agreement a must?

Hi Ngee Tan,

Not a must to get started — there’s no legal obligation. Just that it helps you work out arrangements with your partners.

My partner and I are like you, we are the owners as well as the staff. How do you pay yourself a salary, epf and socso? I learned that partners’ remuneration is not liable to tax from LHDN website. Not sure how to go about doing taxes. Any advice based on your experience to share? Thanks in advance!

Hi Adeline,

It’s a bit easier for me as I don’t pay myself any of the above (salary, EPF, SOCSO). However if you are doing it, your computation for tax must NOT include these as expenses then.

Hi Mr-Stingy,

Since you mentioned you didn’t pay yourself salary, how do you get money from your LLP?

Hi Thang,

I haven’t gotten any money from my LLP. If it so happens that I’m wildly profitable one day, then I can declare profits to be distributed to partners.

Hi,

Great site, very informative…

Have a question, hope you can advise me.

I already have a PLT company, just 1 year old, dormant.

Am thinking to close/wind it up, how do I go about it.

Thanks in advance

Lee

Hi Pat,

Thanks for dropping by. I haven’t done it myself, so perhaps you can check in with the SSM for the procedures. All the best!

Hi Mr Stingy,

Thanks for your post, it’s really helpful for me setting up my LLP.

I have recently started my LLP operation on late February, but I am quite confuse to determine my financial accounting period and first annual declaration. Please correct me if I’m wrong if I can do below?

Financial year: 1st Jan – 31st Dec

First accounting period: 28th February 2020 – 31st Dec 2020

First Annual Declaration: 28th February 2020 + 18 months = by 28th Aug 2021 (Can I do first declaration by 28th December 2020?)

Thanks

Hi Peter,

You can do your annual declaration in line with your financial year and accounting period (IMHO just makes everything easier). So after 31st December 2020, just go ahead and do your annual declaration in January 2021.

The information are damn useful , I had gone thru this page and truely understand the process

Thanks Qin Peng!

Hi Mr. Stingy,

Thanks so much for this great info.

I have a question would like to further check with you.

If I am employed and I also get paid from my LLP, how should i fill the income tax ?

Thanks

Hi Wendy,

Thanks for your kind words.

When filing your personal income tax, you should combine both the earnings from your day job and your LLP into the final sum.

Thanks for your reply.

Will my personal income tax number be change from SG to OG or C ?

The way I did it is to still use my SG income tax number

Hi, thank you for such a comprehensive article.

Sorry for the noob question but I’ve recently graduated so I do not have a personal income tax account.

Do I need to register for a personal income tax account prior to filing the CP600E?

I do not have an income yet.

Hi Simmy,

Not 100% sure, but I think no harm for you to register a personal income tax account number first (even with no income).

Hi Mr Stingy,

Do I need register for the employer’s file number and submit form E although my LLP is still dormant?

Thank you!

Hi Peter,

Might be best to check with a professional services firm, but I don’t think so.

Hi,

First of all, your writing is a huge help for me. Glad that i come across this!!

I have some questions here,

1. If I already have existing business and now I wish to expand it some more by forming LLP with a partner. Do I have to share profits in my existing business as with my partner?

2. Can I have a partner who only contribute to the capital but did not manage the business?

Thank you

Thanks Farah,

1. It depends entirely on your arrangement with your partner. There’s no rules set on profit sharing.

2. Yes

Hi there, I must thank you for the excelent information you put in here.

I stumbled upon your site here while googling up if an LLP MUST appoint a tax agent.

Part E of CP600PT form asking for particulars of tax agent. Can we leave it blank?

Thank You

Oh I just saw a similar question from the comments below.

Thanks Rizal — I left mine blank 🙂

Hi there, I have doubt regarding the employer file’s and employer return form.

1. Do every partner in the LLP need to file this individually?

2. When I wish to get this employer file’s done through e-daftar online, I am not so sure what is it meant by the column ”employer highest designation”. I hope someone can explain this to me if anyone have any idea about it.

3. I have a partner who was still a student, but when I doing the tax filling through e-daftar, the tax number was required for every partners, what can I do?

Hope someone can answer my questions.

Thank you

Hi Sean,

My thoughts:

1. I think employer file and return form is submitted by the company, not by each partner individually.

2. Not sure about this

3. Not sure about this

Hope someone else can help!

I try to click SSM’s comprehensive guide on how to do Annual Declarations, but the link is not working. I registered my llp in April 2019 and now need to do annual declaration. Any advice how to do it? Need professional accountants to do?

Technically you don’t need professional accountants to do annual declarations. It’s as simple as filling up an online form.

You will however need to know information like your assets, liabilities and profit/loss. These can be calculated yourself if you know accounting principles though

Hi Mr Stingy,

Great article! Thumbs up for your great work!

Question: I’m trying to apply for e-filing through the E-Daftar function. Can I leave tax agent detail blank if I’m not hiring a tax agent? And I can do e-filing by myself without tax agent right?

For the traditional partnership, can I also lodge the tax return myself without hiring a tax agent? Previous year I have hired one to do our tax return. Thought of doing it myself this year if possible.

Thanks!

Thanks. Appreciate it. Yeah 100% absolutely you can do e-filing by yourself. All the best! 🙂

I have register my LLP to obtain the tax number and got it already. Now I have to login for my e-Filling. How do you get first time login for LLP as I remember them before, for my personal tax, I have to use my IC number with PIN to apply for first time login?

In this website, https://ez.hasil.gov.my/CI/LoginKaliPertama.aspx it still request the IC number with the PIN for first time login, but it didn’t stated anything specific for company.. I hope I make sense as I’m totally confused as I know that LLP is separate entities from the partner, hence our IC will not be used for tax filling for LLP. Right?

Any explanation about the LLP e-Filling will be good. Thanks

Hi Fatin,

The last time I did this, I had to go to LHDN branch to get PIN for LLP e-Filing. So you will have 2 different passwords, using the same IC number: 1 for your personal, 1 for your LLP.

All the best!

may i know what are the documents required to request PIN for LLP e-Filing?

Hi, I think you just need to visit the LHDN office to get the PIN.

can you recommend company that provide service for LLP registration, preferably in PJ. Thanks

Hi Natalia,

Unfortunately I don’t have any recommendations for the above…

Here my sharing for register LLP type of company,

most of the bank in malaysia don’t recognize LLP as “company”, they threat them as partnership for opening account, so any change of particular (any add, remove, amend on directors) will need to remove the account WHOLE ACCOUNT. Bank inform that, only SDN BHD own it identity. So if this is your concern, LLP not that flexible. I end up make another account and all registered online payment gateway just affected and pay few thousand of fees to amend them.

anyone who know which bank treat LLP as a identity, please share with me.

so far CIMB, Maybank threat LLP as partnership, every single director will need go to bank for opening account, no such board meeting document for opening bank account. They not accept that.

Hi Aaron, great write up. Took some time to read up everything including the comments. I am looking to set up 1 LLP soon. Grateful that I stumbled upon your blog post when I was doing my research.

By the way, Merry Christmas and Happy New Year to you and your family. And congratulations on your wedding.

If you don’t mind me asking some questions during your honeymoon/holidays/new year mood,

1. I would like to ask, during incorporation, do both partners start off with equal shares? 50%-50%? Or can it be like 70%-30%?

2. If say a new partner comes in, and both initial partners agree to give the new 3rd partner a 10%. It means the initial 2 partners will dilute 10% from their initial shares, correct? Making it 45%, 45% , 10% ?

3. Does the 3rd partner come in for free? Or must buy in?

Thanks!

Hi Marc,

Thanks so much for your kind words:

1. You can start off with any kind of partnership percentage you like, whether 50-50 or 70-30 or anything else.

2. This is possible, yes, but it doesn’t have to be this complicated. In your agreement you can just state what’s the percentage moving forward.

3. I think this is really up to the partners to decide. But it would seem very weird if someone managed to enter a business without putting in any capital. Just my opinion.

All the best!

Hello Sir,

I want to know if i don’t have LLP agreement.

and my partners get basic salary then this salary need to add back in tax?

If add back in tax my partners personal tax still need to pay for this salary in his personal tax?

Need to pay for double tax?

Hi Peng,

As far as I understand, LLP doesn’t allow salary for partners to be tax exempt. So yes, I think if you do it this way, then your partner still has to pay personal income tax.

Hi ,

Seems Hasil had roll out e-filling ,E-PT for LLP

http://lampiran1.hasil.gov.my/pdf/pdfam/ProgramMemfailBN_2019_2.pdf

I just register and waiting for the nombor cukai for LLP

http://edaftar.hasil.gov.my/index.php

E-filling get the extra 1 month grace period.

This is my first financial year to summit PT form

My deadline to summit the PT 2018 form are 30 NOV .( Accounting End 30 APR )

Finger crossing now ,dont know choose to wait for the nombor cukai,then try the e-filling

Or proceed with the conventional ,manual summit via postal ??

HaHA

Hi BadGirl,

Sorry for the late reply! I just did the e-filing myself last year. It’s pretty fast, so I recommend you give it a try!

I submitted mine via manual post to bangi last year for PT2018. But i check inside e filing (just got the login with efiling feature for E-PT last month) it looks like it doesnt registered in the system yet. do i have to refill in the e filing for PT2018?

Hmmm.. I’d suggest you give LHDN a call then to clarify.

Rather comprehensive info. Thanks for this. Not many articles that provide such information from a single source.

Thanks Rajan

Hello sir,

I need a guide for conversion Sdn. Bhd. to LLP. Can you assist me to process it?

Thanks

Hi Lynn,

As far as I understand, there’s no direct way to convert from Sdn. Bhd. to LLP. You have to start a new one…

Mr Stingy!

What if I’ve started my LLP in October 2018, but I’ve not registered for a Tax File with LHDN. What should I do?

Kindly advice.

Thank you

Hello Shawn,

Your first year for declaring tax can stretch to as long as 18 months I believe. So you can file taxes from the period of October 2018 – December 2019. That should be filed within 7 months after December 2019 (which is in July 2020).

Hi Mr. Stingy, can I prepare the LLP agreement only after two years of incorporation?

Hi SY,

You can prepare it anytime!

Hello Mr.Stingy!

I’m planning on starting a LLP as a designer to take on small designing job, currently both me and my partner are employed under a designer firm.

It is stated clearly under my employment agreement contract, that unless a written consent is made to my employer(which I wouldnt), I shall not be engaged in any other business directly or indirectly has conflict of interest with my employer company(which in my case is a direct conflict of interest).

Would my employer able to find out that I have a LLP doing designing job, through LHDN/SSM when doing employee EA submission? Or is there any other way that I would potentially got busted and cry the hell for losing my permanent job?

Hello Danny,

When doing EA submission, I don’t think your employer would be able to find out you have an LLP. Unless they specifically go and search for your company name (or your personal names) with the SSM then only they might find out. Not sure why they would do that though…

really thanks for your info bro!!

can i know how you prepare your profit and loss , balance sheet and other accounting related document?hire some one to do it or just DIY??

really thanks for your time !

Thanks Max,

I use a free software called “Wave Accounting Software” and do it DIY! https://www.waveapps.com/

My accounting knowledge is only SPM level + 1 course in university. But with that possible to DIY already!

Hello Mr. Stingy,

First of all would like to thank you for such a great post on this guide you provided *thumbs up* Really helpful for us to follow your guide in registering LLP company.

Anyways, im having an issue with dissolving my current llp company. Currently have two llp company with my partners and one of the llp is not active which i would like to close. I have reached out to SSM customer service and their instructions are quite complex and unclear.

Appreciate if you can reach out to me or create a post on how to close existing llp company.

Regards,

Nurhakim

Hi Nurhakim,

Unfortunately I haven’t experience in closing down LLP myself. If the SSM customer service officer isn’t very helpful may I suggest you try speak to his/her superior? Also, the documentation on SSM website may be helpful. So sorry I couldn’t help more.

Hello there! This has been really helpful. Do you know if it is possible to add partners to a LLP say after we have started running the LLP? Perhaps I found someone else who wants to play a major role in the company etc.

Thanks!

Hello Bobby,

Thanks. Yeah, you can definitely add on partners once you’ve started. Just need to inform SSM.

Hey Mr.Stingy,

How do you find LLP now comparing to 2 years ago?

Hey Jason,

From what perspective? I think more banks and institutions are familiar with LLP now, so it does make things slightly easier.

Hi ,

Thanks for all the sharing. Was wondering what should we do if the director’s remuneration increase in future as we need to declare the initial remuneration at the LLP agreement?

Thanks.

Hello Hendry,

I’m thinking you would need to make an amendment to the agreement.

Hi Mr Stingy,

Thanks for your reply. Does LLP agreement is compulsory and do you have any LLP agreement template?

Thanks,

Hendry

Hey Hendry,

Nope it’s not compulsory. And unfortunately no, I don’t have an agreement template.

Hi, thanks for the great writeup! Have a question here, may i know whether can i claim director fee as expenses for LLP? Thanks in advance!

Hello John,

Nope, you can’t use partner’s remuneration to reduce the LLP’s tax.

Hi Mr Stingy,

Are you certain we can’t have director fee for LLP?

Cannot reduce company(LLP) income tax with director fee?

Hi Josh,

From all my readings about LLP (unless something has recently changed), I’ve never seen anywhere which gives the LLP an ability to pay directors fee (to reduce the LLP tax). In fact, the LLP itself does not have directors like a Sdn. Bhd. (they are instead called partners). As such, I would suggest you to tread cautiously on this point. May be worth speaking to a professional tax consultant about this…

I think i’ve came across somewhere mentioning that if you’ve mentioned in the LLP Agreement for partner’s remuneration then it’s tax-deductible.

Hi Chyi,

I’m very confident that the LHDN guidelines say that partner’s remuneration is not tax-deductible. After-tax profits paid to partners however — that’s not taxable to the partners on individual level.

Dear Mr Stingy,

I just called up LHDN, Director Fee can be done in LLP. They said once perjanjian done with your partner in SSM (while establishing LLP), your partner can choose not to receive any monthly allowance/basic salary. Then, at the end of the financial year, while doing company(LLP) income tax, director fee can be given as expenditure to reduce company(LLP) income tax. So if your company profits fluctuates (up n down), it will be more flexible to adjust your director fee accordingly.

Hi Josh,

From all my readings about LLP (unless something has recently changed), I’ve never seen anywhere which gives the LLP an ability to pay directors fee (to reduce the LLP tax). In fact, the LLP itself does not have directors like a Sdn. Bhd. (they are instead called partners). As such, I would suggest you to tread cautiously on this point. May be worth speaking to a professional tax consultant about this…

How do I cease one of the partner in LLP?

Hello,

I think you just need to inform SSM and update it in your partnership agreement.

Thanks for the info! I have registered LLP about 18 months ago but i did not start the business yet, do i still need to file for annual declaration?

No prob SL. As a matter of principle I’d suggest you file for annual declaration anyway, however do look out for any clauses in the rules saying that there’s exemption for those who haven’t started? Also, you could call SSM if you’re unsure…

Hai,

We have choose to voluntary winding up LLP, may I know what is the correct procedure?

This LLP is less that one year period.

Hi Carson,

I think a company secretary would be able to assist you with this. Unfortunately I haven’t done winding up of an LLP myself so I have no personal experience.

Hi,

How long does it actually take for the MyLLP account to be activated?

I went to the SSM office for IC verification and was told to wait for the confirmation of activation email.

I thought that the activation was on the spot? (Or at most within few hours). My attempt to login recently was met with an error saying no login details found.

Hi Vincent,

If I recall correctly, it was within a few days once the confirmation email was sent. Do give them a call if nothing changes.

hi, just started an LLP and it took 2-3 days for them to access your submission. If everything is clear, you should get an approval email. However if certain things are not in order, they will send you a queried submission (which in my case i left out the postcode).

If you get that, change the stuff you need to change, go to summary and resubmit. There weren’t an instruction on how to do it, they just say please reply to the query. Found it out by going all the way to SSM for them to show me how to do it. Good thing is LLP no queue

Thanks so much Loong — really appreciate this.

Hi there,

First of all, thanks for compiling the most comprehensive guide for LLP.

I was just wondering, how long does it actually take for the MyLLP account to be activated? I have verified my ID at SSM office and still haven’t receive the confirmation email regarding activation yet and couldn’t log in to the account.

Hi Vincent,

Thanks for the kind words and comment. Already replied in the other comment. All the best!

Hi Mr Stingy,

May I know for LLP is it required to have certain amount of profits to be retained in the company or can we distribute all the residual profits to the partners?

Thank you.

Hello Kung,

I’m not aware of any minimum amount of profits to be retained.

Hey, thanks for the great write up! Really informative.

I missed the 90 days deadline to set up my tax file after I got my LLP setup. Is there any consequences to that?

Thanks.

Hello KarFei,

I think as long as you do it ASAP you should be fine.

After I submit my PT20xx form. How do I how much am I taxed? And where do I pay my taxes?

Hi Duane,

You’re supposed to calculate the tax owed on the PT20xx form itself. And you can pay your taxes directly where you submit PT 20xx form, which is an LHDN branch.

Thank you for replying. I tried that. They asked me to register for an online account. Which is odd. Can’t I just fill the form and pay offline?

Hi,

Can I check with you if a LLP company is allow to hold shares of a Sdn Bhd? Or if a LLP company is allow to open a Sdn Bhd with another party?

Thank you

Hi Peggi,

Might be better to check with a company secretary/lawyer who’s well-versed in this. But it should be possible as LLPs are legal entities that can have assets too.

Hi Stingy,

Can I know on the tax declaration to LHDN, column B1 Aggregate Statutory Income from Business is it the net Profits after deduct all the expenses?

Thanks,

Ong

Hey Ong,

Yeah, that’s net profits (income) after deducting allowable expenses.

I would like to share my experience regarding Borang PT 2017. That day i went to LHDN Sarawak to ask regarding on how to fill the form, page one (Bahagian B: pendapatan berkanun, jumlah pendapatan etc). The staff there told me to leave the columns blank if we’re not sure on what to fill in and make sure to fill in page 2 information Bahagian C: Maklumat Kewangan. And just send the form to Bangi. It my first time to send the form and he said for Tax estimate just wait for them to send the form to my company.

I kept note of the name of the lhdn staff that advise me in case of any problem in the future.

Thanks William,

Really appreciate your sharing!

Hi Mr-Stingy

Thank you for sharing all these information. So far i have successfully registered an LLP using your steps.

Q: Can i develop my own partnership agreement based on sample from the internet? Is it acceptable by LHDN?

Thank you

Thanks Zul,

Hmmmm… Quite a tough question. Perhaps something that lawyers/tax advisors would be better suited to answer I think…

Thanks for having this portal and your sharing. Very useful information indeed.

Does anyone manage to obtain a loan from banks when an LLP is newly set up and is able to purchase a property under LLP?

Thanks Lotus — keen to hear if anyone has a loan under an LLP too!

Great sharing. Very informative. Thank you!

But I think there’s a slight mistake on the annual declaration part.

“Your first annual declaration needs to be done within 18 months from your LLP’s registration date.”

I think not necessarily. It is UP TO 18 months from the LLP’s registration date, BUT must be within ninety (90) days from the end of the financial year.

So based on your example, if the LLP was registered on 12th July 2017, and financial year end is 31st Dec 2017, the first annual declaration will be due 90 days from 31st Dec 2017 i.e. 31 March 2018, instead of 11th Dec 2018.

And if financial year end is 31st March 2018, the first annual declaration will be due 90 days from 31st March 2018 i.e. 30 June 2018, and so on.

In short words, the annual declaration must be submitted within 90 days from the end of the financial year of the LLP, AND not later than 18 months from the date of the registration of the LLP for the first annual declaration.

Got the information from here (Page 3 & 4): http://www.ssm.com.my/Pages/Register_Business_Company_LLP/LLP/LLP-Document/LLP%20-%20Practice%20Note%20on%20Annual%20Declaration%20(Final).pdf

Correct me if I’m wrong! 🙂

Hey Nabil,

Thanks very much! Appreciate it.

Yeah, I think what you’ve put here is the most accurate way to describe it: “the annual declaration must be submitted within 90 days from the end of the financial year of the LLP, AND not later than 18 months from the date of the registration of the LLP for the first annual declaration.”

Hi Mr Stingy, great information. by the way, how do we get the resolution format for LLP? so difficult to get it.

Thanks kevin. Some of the banks might give it to you if you ask them. There’s also a link in my article for a sample.

Hi, thanks for the great writeup! Have a question here, may i know where can i find the list of deductible/exempted expenses for LLP, so that i can pay lesser income tax? Or is there anyway to distribute higher profit sharing to the partners before paying the tax?

Hey JR,

You can only distribute profits after tax. As for the list of deductible expenses, it should be any legitimate expenses when running a business. Look for Sdn. Bhd. guidance — it should be similar.

What a great information. I have a concern here, how we terminate the LLP license online? I can’t find any link there. Thanks.

Thanks Rex. The procedure is actually listed in the LLP Act. If you give the SSM a call also, I think they can explain the process further.

Hi there,

If a partner decides to leave the company, how do we get their name off LLP?

Hey Miza, I’m not entirely sure. Perhaps a company secretary can help you with this, or you can directly ask the SSM?

Hi Mr-Stingy,

What are the steps for change of partners? Say the existing partner A is selling/transferring his existing share to new partner C. How to determine the value of the share?

Hi SL,

Unfortunately since I haven’t gone through this process, I don’t really know. Perhaps a company secretary can help?

Hi SL,

Is there a LLP Agreement entered between the partners? If there is LLP Agreement, you may check whether is it stated in the Agreement on the procedures for change of partner. Methods to determine the value of the holdings might be listed in the Agreement too.

Thanks.

Thanks Ming for the helpful comment!

Hi Mr-Stingy.

I learned so much from this.

But I have one boring question.

Do we need to submit the tax declaration only to LHDN Bangi?

Why can’t we submit it to other branch?

Is it because LHDN Bangi is easier to deal with?

Hello Fadhilah! Tax declaration for LLP, last time I checked needs to be submitted to Bangi. I think you can post it there if it’s too difficult to go. Or you can also call them up and ask where to submit…

Hi Mr Stingy,

As i know the LLP biz registration cert only have the registration date and company name but do not have the partners name and company address, so what would be the other documents required to show these? is it LLP agreement ( i don’t have yet)? I am asking this as i foresee that the bank officer would request these info when i open bank account.

Thanks in advance.

Hi Shawn,

There is a document you can purchase which shows things like address and partners name. I think it’s called “business profile.”

Great Info. I have one ultimate question. For all the forms CP204, PT20XX, should we just wait for LHDN to send the forms to us or personally download from lhdn website and submit the documents?

Thanks. Erm, I think LHDN will eventually send them to you. But why not download them yourself and submit on time?

Hi All, just want to share my experience, as my situation is not same with author so somethings not the same, just want to share my experience as I notice a few people in the comment section may have same situation as me.

If you setup a LLP and have not started to trade yet, unlike most people, day 0 is what you make of it in your CP600PT form, not day 0 of the day you receive your registration from SSM as far as LHDN is concerned.

If you had a LLP setup in SSM and did not use it as planned like me, you do not need rush to get your tax file number within 90 days, you can submit later. I made the error of submitting the CP600PT form in LHDN Bangi and put in the trading date as the same day I went there as I thought i’m late (like 10 months late). Since it is Bangi, I can submit the CP204 in the same place. the CP204 officer ask me if I havent start trading why I go get tax file number, now I have to submit CP204 and then do so yearly. I only need to get tax file number and submit cp204 when start business. The company can lie dormant. To remove my “tarikh mula operasi” I have to send letter now to the branch where my registered address is. So I just let it be, guess I’ll just have to do yearly submission to LHDN. . (also LHDN Bangi do need copies of IC, but dont need the LLP agreement for me)

So if you are like my case, setup the company but the business got postpone, dont need go LHDN yet.

just do the annual declaration for SSM using the online account (it tell you when the submission is expected as well online). That what was advise by me by the officers doing the CP204 forms.

18 Sep 2018

(I dont visit this site often, so i might not reply, sorry)

Thanks a lot for these tips! Appreciate it!

Thanks for the sharing!

So for those LLPs that have yet to commence business, we do not need to fill up the Income Tax File Registration Form (CP600PT) right?

Hi Ming,

I don’t think so. 😀

do we need to do SSM annual declaration though? if did not actually start the business?

I think you still need to sir.

Hi Mr. Stingy,

Thank you so much for the articles and the information provided. Very, very helpful indeed.

I am seeking a clarification with regards to the Monthly Tax Deduction (MTB or PCB).

I have just started an LLP and I understand points 2 & 6 in CP204 does not need to be included (for SME’s) until 2 years of operation. But the Explanatory Notes in CP 204 also state that new companies need to start paying MTD by the 6th month of operation.

This is a little contradictory, I thought and was hoping if you could share some of your experiences in dealing with this scenario.

Thanks.

Sugan

Hi Mr Stingy,

First of all thanks for this awesome guide on setting up a LLP. My partner and I got ours running pretty much based on the advice here.

We have now submitted our first LLP’s tax estimates and is supposed to start paying for the monthly installments. Question is, I’m kind of stuck at the “Kod Jenis Bayaran” or “Payment Code”. Basically, I got lost trying to choose the right code…

Reference: http://www.hasil.gov.my/bt_goindex.php?bt_kump=5&bt_skum=1&bt_posi=2&bt_unit=5000&bt_sequ=7

Could you kindly advise whether I should use “095 – Income Tax Payment (excluding instalment scheme)”?

Thanks!

Thanks for the kind words Seet!

Personally, I think it should be this one:

086 Bayaran Ansuran Cukai Syarikat

First time submitting LLP tax.

I need to submit tax for last year (Jul-Dec2017).

They sent me PT2018 to fill in to submit by 31July2018.

Using PT2018 form and not PT2017?

Sounds a bit off to me. If it’s your first year of business, you could potentially combine it to be Jul 2017 to Dec 2018 and just do it one shot next year (up to your own strategy of course).

I believe PT2018 is for tax years ending in 2018 BTW. If you wanna submit for 2017, can ask for PT2017 I think.

B13 Apportionment of Chargeable income

My chargeable income is roughly RM28,500.

How and where do I find out how to apportion? 18%, 24% ?

Where do to get the Jadual 1 ACP 1967?

Mind explaining how this works?

First time doing this.

Thanks a lot. Have to submit by 31 Jul 2018.

Hey Jerry — for an LLP there are only two rates. Either it’s 24%, or 19% if your LLP is classified as an SME.

Hi, i submiting plt tax for the 1st year. I found that pt2017 form need certified firm to sign?

If the accountant prepared by our own staff internal accountants,can we sign ourself?

I think so — I filled up my own PT form by myself too. 😀

Are you not supposed to be using PT2018 instead of PT2017 for 2017 tax?

They just sent me PT2018 for my 2017 tax.

I think this might depend on when your accounting period ends?

But I submitted PT 2016 for year 2016 and PT 2017 for 2017. My accounting period is Jan-Dec though, so it’s very clear cut.

Great write up, i am just about to register a new business under LLP. Hope everything goes smoothly. 🙂

All the best!

Hi Mr Stingy – love the website, Thanks a lot for the enlightment

1 question does PLT gives out divend once the year end?

Any idea for Sabah rules and regulation which is different for PLT opening ?

Hey Jason, thanks.

PLT doesn’t declare dividends as such, but it can do sharing of profits with its partners. Not aware of any difference in Sabah rules…

Thank you SO MUCH for taking the time to write this post. It’s been extremely helpful. I can’t thank you enough!

I have 3 questions. If you’re able to answer these I would be extremely grateful!

a) Are LLP partners considered employees of the business for Borang E purposes?

b) Do LLP partners have to pay EPF?

c) Can LLP pay out a profit (before tax) to partners and partners then pay personal income tax on the respective profit?

Thanks Rhea,

A. Not necessarily. However if you wanna appoint them as an employee also can.

B. If you appoint them as an employee, then you have to pay them EPF.

C. Nope, you only get to share after-tax profit with your partners.

Dear Mr. Stingy,

Great piece ! Thank you.

I registered my PLT in late 2015.

I have a signed Partnership agreement but it was not tendered to SSM or LHDN . It was not stamped. It states the amount of salaries and allowances payable to a partner.

Is this agreement valid ?

Will the salaries / allowances paid to partners be treated as allowable expenses for tax purposes or have i made a mistake in my tax filing? I did my own taxes .

What remedial action , if any, can i do?

Also , must i pay the same amount of salaries / allowances each year to partners even if the business fluctuates

i.e. can i change the salaries payable year to year ?

thanx.

Kanjoos.

Hi, thanks for the kind words!

Is this agreement valid? >> not sure, but why not get it stamped then?

Will the salaries / allowances paid to partners be treated as allowable expenses for tax purposes or have i made a mistake in my tax filing? I did my own taxes. >> salaries and allowances are allowable expenses for the LLP’s tax filing (but doesn’t include EPF/SOCSO/insurance).

What remedial action , if any, can i do? >> I think you can always put in any undeclared income to “remedy” it in next year’s tax filing.

Also , must i pay the same amount of salaries / allowances each year to partners even if the business fluctuates

i.e. can i change the salaries payable year to year ? >> you can probably change the salaries with proper documentation in the LLP agreement.

*please feel free to double check my suggestions above with a professional tax person. I’m not one. 😀

If the LLP company is dormant does it still need to submit income tax etc?

Hi Z,

I’m not sure about that unfortunately…

Hi there. I am a foreigner and me and my investor friends ( 70% Malaysian and 30% foreigner) are planning to buy property under LLP as we want to hold for 5 years and yearly maintenance of LLP is cheaper. Only issue we require Malaysian compliant officer! It seems my Malaysia friends are reluctant to be compliant officer as if anything goes wrong responsibility come on them.

Mr. Stingy Any other way to form LLP by a foreigner?

Hi Abby,

Perhaps you can hire a company secretary (or a company that provides secretarial services) to be your compliance officer.

Hi Abby, we are chartered company secretary. We might able to assist you. If interested, please communicate further to my email. Thanks

Eddie. Cant see your email. Pls let me know

Hi, love your article!

I have a question – does part time employees count? Do I need to declare them as my employees? They do not receive EPF or SOCSO.

Hi Cass,

Thanks for the support. Ermmmmmm — gut feeling is probably No, but I don’t know enough about this to give a confirmed answer though…

I registered my LLP last year June 2017. It has been dormant since then and I actually started business operations on January 2018. Will I be penalised for not submitting any files to the relevant authorities until now?

Hi Eddie,

As a matter of practice, I think you still need to declare the minimum documents. There are some penalties for failing to be compliant.

Great jon Mr Stingy.

I wld like to highlight and get reaffirmation that GST is a separate subject and will also be applicable to LLP if it decides to register so. .? Thx

Thanks Al,

Yeah GST is a totally separate subject. And if LLP decides to register for it then it’ll be applicable too.

Dear Mr stingy,

Very good info. Very appreciated

. thanks!

Thank you Melissa!

Thanks for the details. I started my LLP a year ago but didn’t submit CP204 but have registered as employer with LHDN. What should I do now? Should I just submit CP204 now? Thanks!

Hey Laileng — yeah just go ahead and submit it when you can…

Hi Mr Stingy,

Great blog. But I’ve encounter some problem when I pay my visit to LHDN.

I got SSM certificate as well as the LLP agreement. But the counter says I need a list of partners. May I know where I can get this document?

Hey Jackson,

Erm — I’m unsure if there’s an “official” document for this. Maybe all they need is for you to write down your partners names on a piece of paper?

You could get it online on your ssm portal, it is called the LLP current profile enlisting details of all your partners and their addresses

Thanks for the tip cherry!

Hi Mr. Stingy,

1. In Section 3: Registering for Tax File

Question: Can it be done in 1 day?

“Getting the tax file number and submitting the tax estimate”

Or does it take a while to do a tax estimate?

I have no idea how well or not well the business will do so how is an estimation done?

2. In Section 4: EMPLOYER’S FILE & EMPLOYER’S RETURN FORM

Question: To register for LLP for an Employer’s File, I have to go to LHDN and not KWSP center?

I called KWSP and Mila, who attended to me said if I don’t have any employees or if I as Director of the Company is not withdrawing any salary, I do not need to register and contribute to EPF.

If I register too early, I will get penalized.

3. What is the best way to manage company and personal taxes?

I’ve had advice to charge living expenses and write it as company expenses and pay ourselves a minimal salary.

4. Do you know what can be charged and labelled as company expenses?

Hi Kenneth,

1. Registering tax file — definitely can be done in one day (if you go the right place). Try Jalan Duta one. I got it in fifteen minutes. Tax estimate — you might need to ask a tax consultant on this. Good question.

2. Correct, if you do not have employees — then no need to do the employer’s part.

3 & 4. Hmmm, the best way is to understand what is allowed under company expense, and what should be under personal expense. May need to do some research here, or again — maybe hire a tax professional to help.

Hello there,

Your page has been incredibly handy in helping me get everything in order 🙂

I was wondering if you would happen to know if there are any implications or penalty for a delay in filing for tax file and CP204 Form. According to LHDN there are none, but business owners are advised to file ASAP. Wondering if you have come across this in your research..

Hey Sha,

Thanks for the comment!

Nope — I’m really not aware of any delay penalties. I’m thinking since LLPs are so new, they’re probably not very strict on them yet (especially if just a small business). However, I also think if you already have a tax file, and you delay tax submission — that would likely be more severe.

Hi Mr. Stingy,

Thank you so much for putting this up. I have been following your blog on-and-off, from the last year when I first set up my LLP, until today when I’m scratching my head, trying to figure out how to file my taxes properly.

Unfortunately the only thing I didn’t do is submit CP204. Honestly, I didn’t know that needs to be done. The LHDN site does not give you a proper to-do list.

Your articles are incredibly simplistic to understand, and also left me chuckling while handling my taxes. Again, my gratitude for your aid, and hope for success in your endeavors!

Hi Rachel,

Thanks for dropping by and your kind words. Wishing you much success in your business too!

Hi Mr-Stingy,

Thank you so much for your time and effort in putting this guide up.

Questions.

As a company owner of a LLP, how do you withdraw the profits? If income is banked in from COMPANY to PERSONAL account, would the PERSONAL account be taxed as well?

Or does the company owner register himself as an employee of his own company and receive a monthly salary?

Would that not also be TAX on LLP level and PERSONAL level?

Hello Kenneth,

Thanks for the kind words. Partners of LLP can get paid from profits of the LLP (after tax). If done that way, then the partner doesn’t need to pay tax on the profits.

If the partner is paid a normal salary, then that is taxed like normal income.

Thanks for your article, it’s been of great help!

So… we went to LHDN Bangi yesterday to submit our CP204 and took the opportunity to ask some questions (since we usually cant get a straight answer from anyone). The person at the counter connected us to a pegawai in charge through the phone and to our surprise, she said that for LLPs, the SME category does not apply. SMEs only apply to Sdn Bhds. Meaning we still have to submit our tax estimates with sections 2 and 6 filled up. This obviously doesn’t make sense to us since there’s no need to submit the PT form for the first 2 years right?

Thanks Trixie,

Hmmm… this is the first time I’m hearing SME category doesn’t apply to LLPs. If it’s true that it doesn’t apply — then you would need to submit PT form every year.

I just opened a PLT in August 2017. Now I’m trying to open a bank account. Went to Bank Islam and there a lot of documents I have to prepare. The manager of the bank told me it will take about a month or so to approve as it will involve getting some kind of info from SSM by the bank (as a counter-check measure). The Bank Islam branch I approached told me, so far only 2 PLTs have opened a bank account with them (for that particular branch) because without proper documentation, it will be rejected. The documents needed to open an account with them is as follows:

* MyKAD of compliance officer and partner(s) – no issue here

* Extract of Minutes of LLP Meeting(s) – huh? never did any official meetings.. All meetings have been over teh tarik

* Resolution of Limited Liability Partnership – the only resolution I know is my monitor. Its 1920×1080.

* Business Information (original and photocopy) – no issue here.. but as mentioned in ur article, it has to be purchased separately

* Information of current partner(s) (original and photocopy) – also no issue. can be purchased separately

* Registration Certificate issued by Registrar of Limited Liability Partnership (original and photocopy) – see above. need to be purchased.

* Latest Annual Declaration – just opened business.. declare what??

* Limited Liability Partnership Agreement – although i understand this should be officially done by a lawyer, having a template should save money and time.

* Annual Practicing Certificate / Annual Certificate of Registration issued by the Registrar of the profession’s governing body eg. if local LLP is a frim of professionals governed by specific legislation

* All documents must be Certified True and Accurate by the Compliance Officer of the LLP

* SSM Search (ROB) which is printed by the bank

The question is? Are all Banks required such an extensive amount of documents before a bank account can be opened? Is there a bank which requires only a minimum amount of documents?

Thanks Nik,

Appreciate the detailed comment very much. Some other readers have been saying that RHB is very easy. My partner also has had very good experience with Public Bank. You might wanna try those?

Does anyone know if an LLP agreement is mandatory ? I called LHDN, and one person says yes n one says no. I can understand if partnership with friends/colleagues, but plan to have PLT with husband.

Hey Nurin,

It depends on which LHDN branch you go to. I went to Jalan Duta one — they didn’t ask for the LLP agreement, even though the form asks for it.

MR Stingy,

Probably the best write up explanation for PLT/LLP. Perhaps you have something similar for SDN BHD, Partnership and Sole Proprietor?

Thanks Long,

Unfortunately I don’t have any personal experience on any of the other 3 — so it would be hard for me to write…

Hi Mr-Stingy, thanks for your detailed explanation on LLP. They are all very informative.

Do you know if it is a must for partnership agreement for an LLP for tax filing to LHDN ?

Hey KC,

Thanks for your kind words. Officially need partnership agreement. In actual practice, it depends on which LHDN office you go to…

Hi Mr-Stingy,

Do you have any tax agent that you can recommend?

Thanks!