So I recently incorporated mr-stingy as a Limited Liability Partnership (LLP) in my home country of Malaysia.

I looked for information online before I started, but couldn’t find anything comprehensive. So for the benefit of everyone who’s interested to start their own company, I decided to write this guide. Here’s everything I know about starting an LLP.

Why a Limited Liability Partnership?

If you haven’t heard of an LLP before, it’s a new business model — the love child between a traditional private limited (Sendirian Berhad) company and a partnership. An LLP offers benefits of a private limited company without its painful reporting requirements.

Private limited companies are great, but they cost a lot, especially for small business owners. Search online, and you’ll find companies offering to help set up a private limited company for about RM 1,500. And it costs at least RM 2,500 per year to maintain (for mandatory expenses like secretary fees, auditor fees and accounting fees).

On the other hand, you can set up an LLP for the price below:

- Company name reservation: RM 30 (Update 14th Dec 2015: Company name reservation is not mandatory)

- Registration fees: RM 500

- Certificate fees: RM 21.20, including GST (Update 14th Dec 2015: This used to cost RM 47.70. Details in Step 14 below)

(The RM 500 registration fees don’t include your LLP certificate. As to why someone would register a company without wanting a certificate beats me, but anyway…) - Total: RM 521.20

And it’ll cost you this much to maintain it yearly:

- Annual declaration: RM 200

It’s a lot cheaper because you don’t need to do things like have an Annual General Meeting, hire a company secretary, and submit audited financial reports.

But why not form a sole proprietorship or partnership instead? They cost much cheaper. Only RM 60 per year to start and maintain (RM 30 if you’re not creative and use your own name).

Because an LLP is a separate legal entity from its partners. It declares its tax separately from its partners (important, because it can help optimize the tax you pay). And then the most important point of all: like a private limited company, an LLP offers limited liability to its partners.

Meaning even if the LLP is sued and goes bankrupt one day, creditors cannot come after your personal assets. But in a conventional sole proprietorship or partnership — they can and they will.

Why Not?

Like many things in Malaysia — the idea behind LLPs is good. But the implementation hasn’t gone so well.

Most people only know the traditional business models like sole proprietorship and private limited, so getting things done can be a pain.

Prime Example: I went to buy a car for my LLP recently and the officers at the Road Transportation Department (Jabatan Pengangkutan Jalan) didn’t know how to do the vehicle transfer. They had never heard of an LLP before. I had to have several discussions and trips to the JPJ office before I could finally get it done.

But anyway, that’s partly why I’m here. To try new things, rough it out, and write about my experiences — hopefully it’ll make some other person’s journey a smoother one.

So here’s how you start a Limited Liability Partnership in Malaysia.

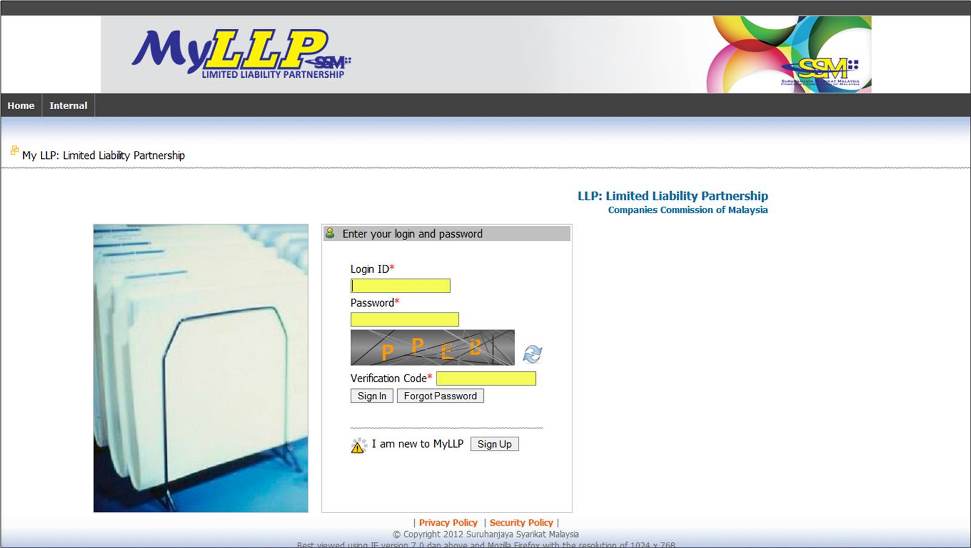

1. Register on the MyLLP System

Start by creating an account on the MyLLP system by going to their website here.

*Update 14th Dec 2015 — SSM has upgraded to MyLLP 2.0 so a lot of the screens you’ll see will be different from my screenshots below.

Click on the “Sign Up” button beside “I am new to MyLLP”. Then enter your identification number (can be IC, Army or Police) and details.

Important: For “User Type,” make sure you select “Verified User” (instead of General User), otherwise you won’t be able to continue with the LLP registration.

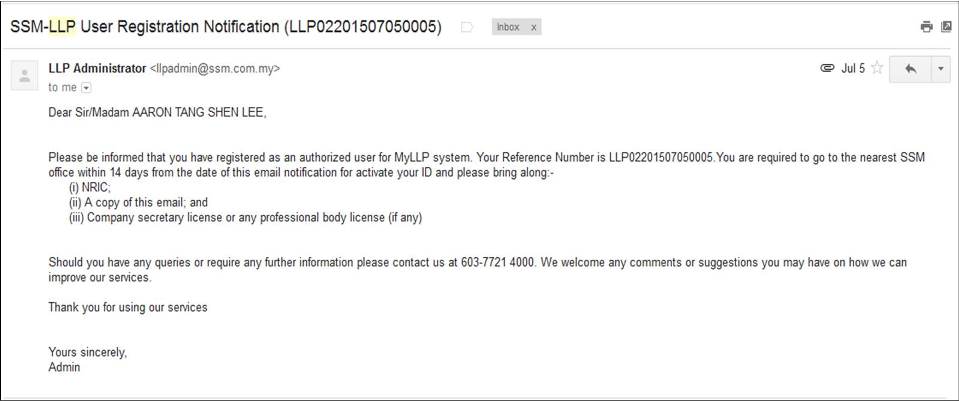

Once you’ve successfully registered on the system, they’ll email you something that looks like this:

Print a copy. You’ll need it for your visit to the Companies Commission of Malaysia (Suruhanjaya Syarikat Malaysia, SSM) office.

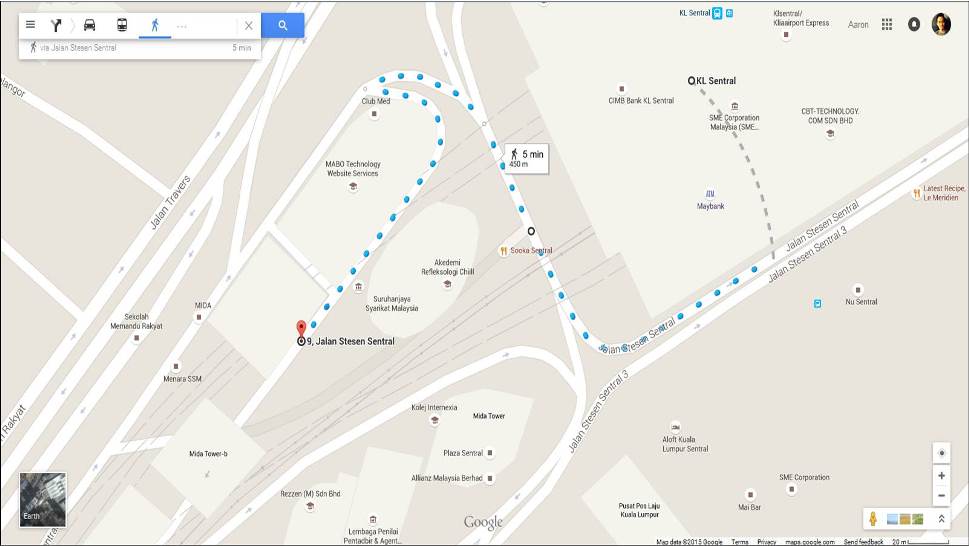

2. Make Your Way to Your Nearest SSM Office

You can find a full list of SSM offices here.

The most convenient one for me is the head office at Menara SSM:

Menara SSM@Sentral

No 7, Jalan Stesen Sentral 5

Kuala Lumpur Sentral, 50623 Kuala Lumpur

Operating Hours: 8:15 AM – 5 :15 PM

It’s about five minutes’ walk from the KL Sentral LRT station:

You don’t need to register at the main counter on the ground floor. Just grab the lift and head to Level 17 for LLP matters.

3. Take Your Number and Wait for Your Turn

In my experience the staff at Menara SSM are efficient. I’ve never had to wait more than half an hour. And usually my number gets called within ten minutes.

Pass the email you printed in Step 1 (and your IC) to the friendly person at the counter. She will verify your registration and then give you your Login ID and Password.

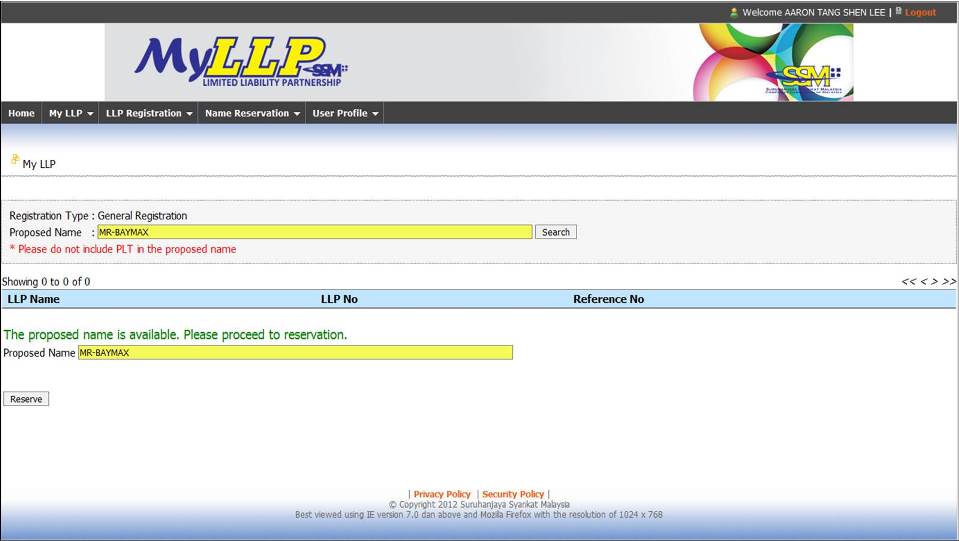

4. Login to the MyLLP System & Reserve Your LLP Name

*Update 26th Sept 2015 — One of my readers (Thanks Jason!) just told me that Steps 4 & 5 are not mandatory. Meaning you can actually go straight to Step 6. I recommend you do it — it’ll save you RM 30!

At Menara SSM, there’s a bunch of computers already hooked up to the MyLLP system. Login to the system using your newly obtained Login ID and Password.

(You could probably do this at home too, but since I was already there — I used the computers provided.)

Click on “Name Registration” and check if anyone else already has your company name. If not, reserve the name and make the RM 30 payment. I used the credit card option to pay.

(The verification and payment steps are identical to the ones in Step 7 and below, so I decided not to include them here)

(The verification and payment steps are identical to the ones in Step 7 and below, so I decided not to include them here)

5. Logout, Go Home and Wait

I initially thought that I could complete the registration in one day.

But after paying to reserve the LLP name, I couldn’t find the next step. There was no “Proceed to Registration” button.

Confused, I went to the counter to ask for help.

“You have to wait for three working days,” the lady at the counter said, “and then you can do the registration online.”

6. Login to MyLLP and Register

So I waited a few days. Kept logging in to see the status, but it kept saying “Pending Payment”.

The strange thing was the system never emailed me or sent me an alert saying my name reservation was complete. Remember what I said about good ideas, but poor implementation?

*Update 26th Sept 2015 — It seems like this is a common problem if you use SSM’s computers to do the payment in Step 4. My girlfriend used her personal computer for Step 4, and she immediately got approval to proceed.

This is what I recommend now: Skip Steps 4 and 5. And use your own computer to do everything.

Anyway, after a week I couldn’t wait any longer so I decided to try anyway.

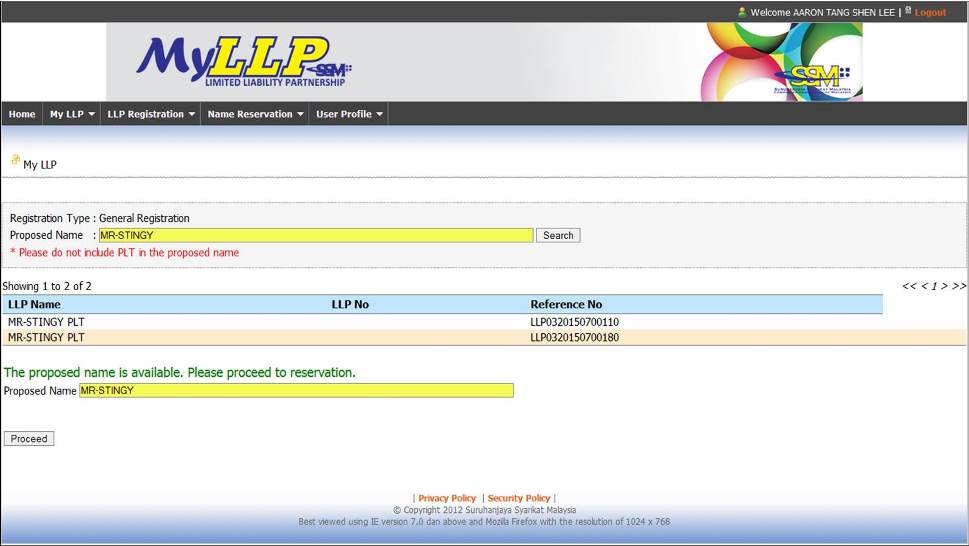

I logged back into MyLLP and clicked on “LLP Registration” >> “General Registration”

Then I entered my “Proposed Name” and hit “Search”. (The same name I reserved in Step 4).

This time, there was a line in green saying “Please proceed to reservation”.

Click on “Proceed”.

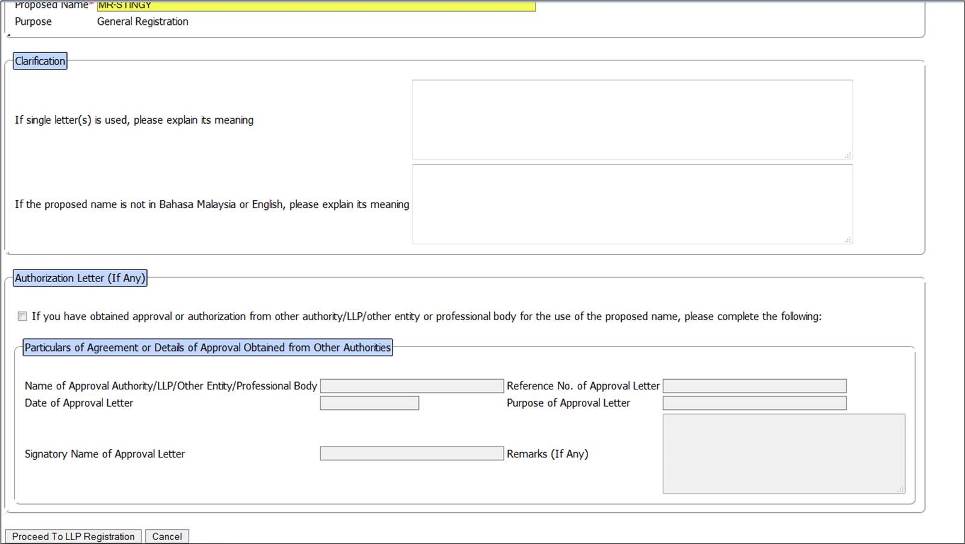

7. Clarify Your LLP Name

The next screen is to clarify your LLP name — if the name is unclear or if it’s not in English / Bahasa Malaysia.

It also allows you to add details of an authorization letter. For example, if you use a name that needs permission from a professional body (accountants, lawyers, secretaries).

Leave this blank and click on “Proceed to LLP Registration” if you’re just registering a simple LLP like me.

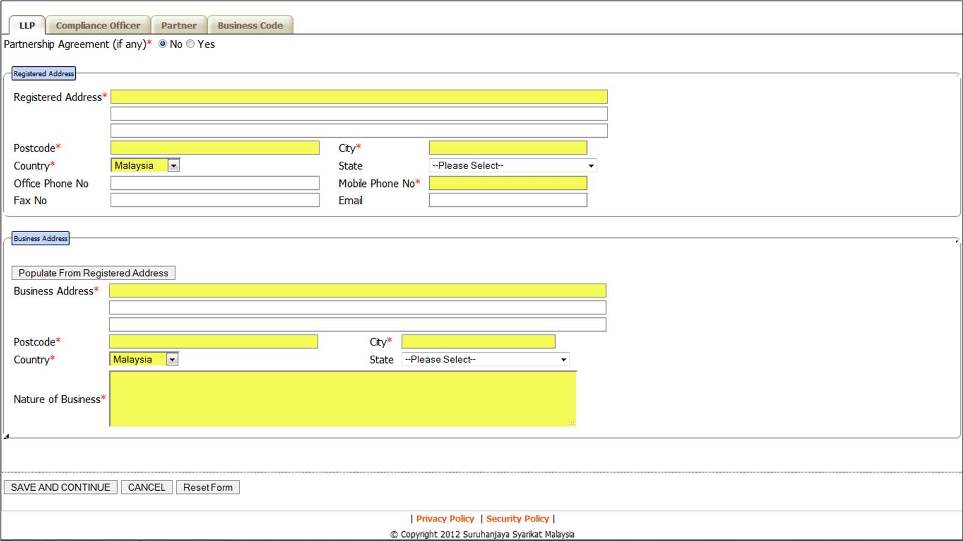

8. Enter Your LLP Details

The first tab consists of basic information about your business: partnership agreement, address, and nature of business.

And yes, for you solopreneurs — you can use your home address.

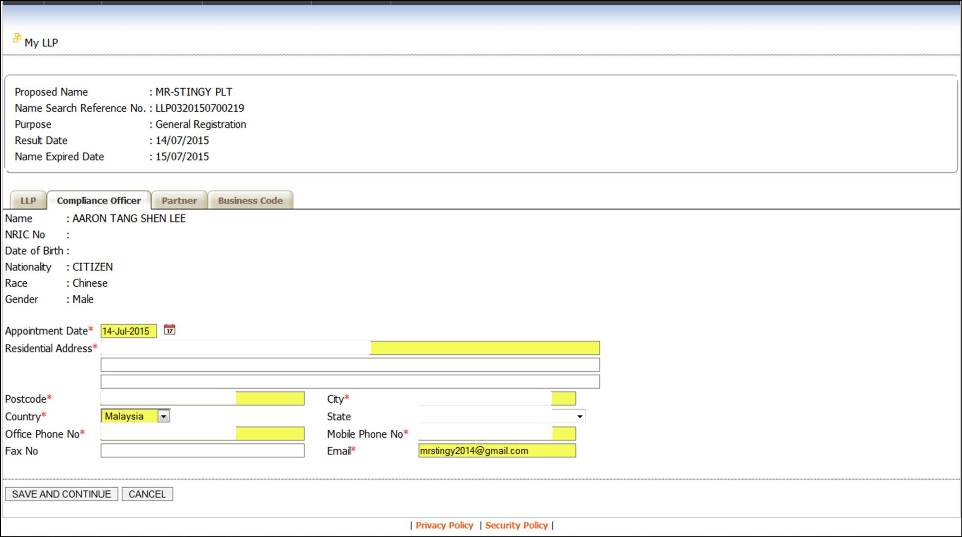

9. Enter Compliance Officer Details

If you’re a solopreneur, this means you

If you’re a solopreneur, this means you

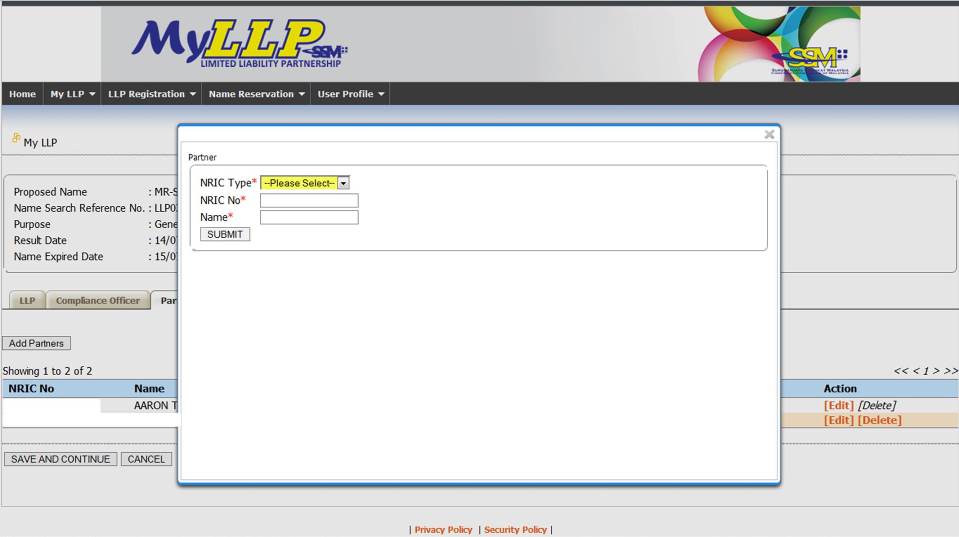

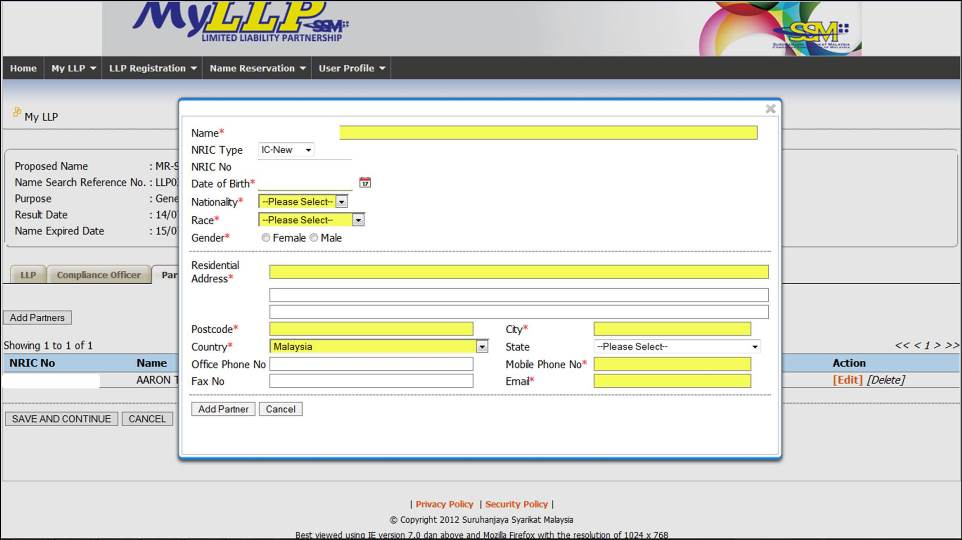

10. Add Your Partner(s) Information

An LLP needs to have at least two partners…

An LLP needs to have at least two partners…

But the total number of partners is unlimited!

But the total number of partners is unlimited!

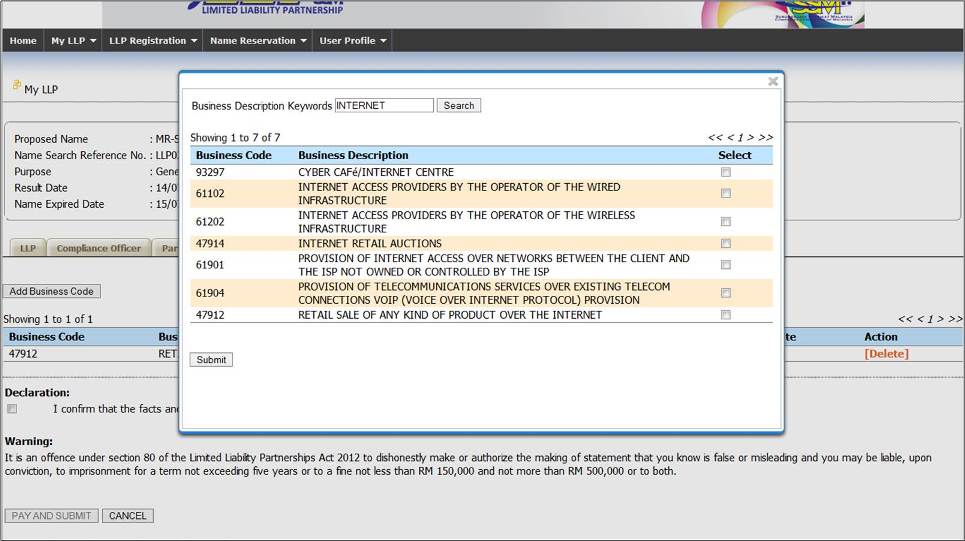

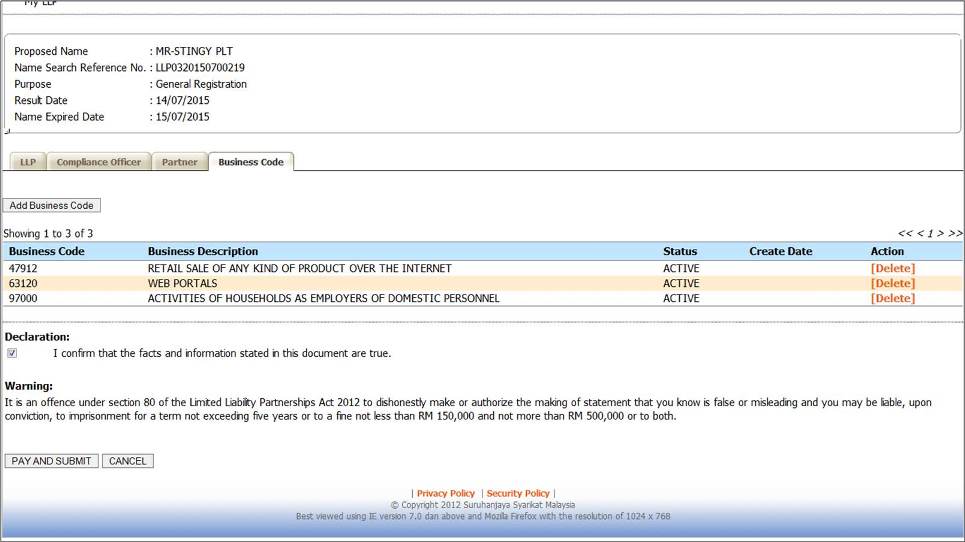

11. Enter Your Business Code(s)

Business codes are numbers which help SSM classify what kind of business you’re involved in.

You can search for business codes directly on the MyLLP system by keying in keywords. Or find the complete list here.

The closest thing I could find for a blog was “Web Portals”.

Once you’re done, declare that you aren’t lying, and click “Pay and Submit”.

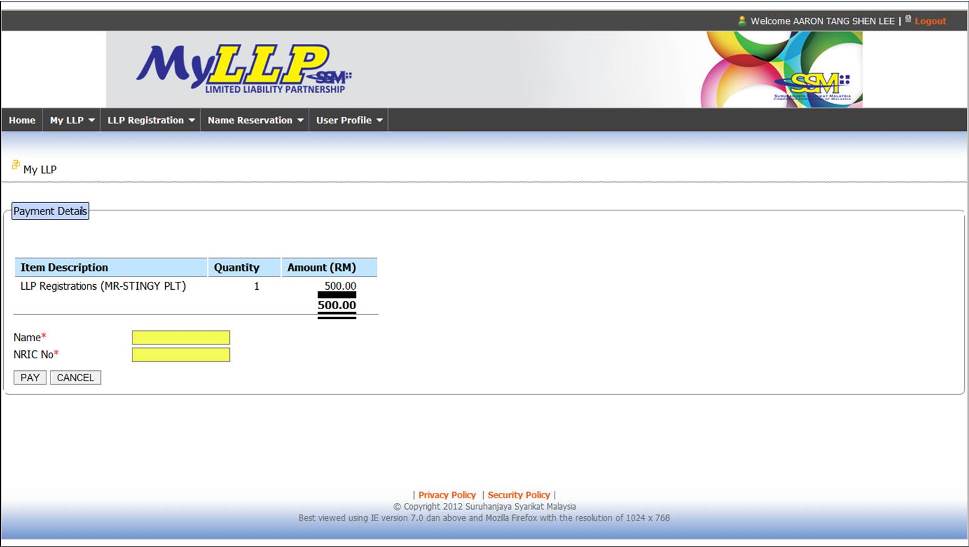

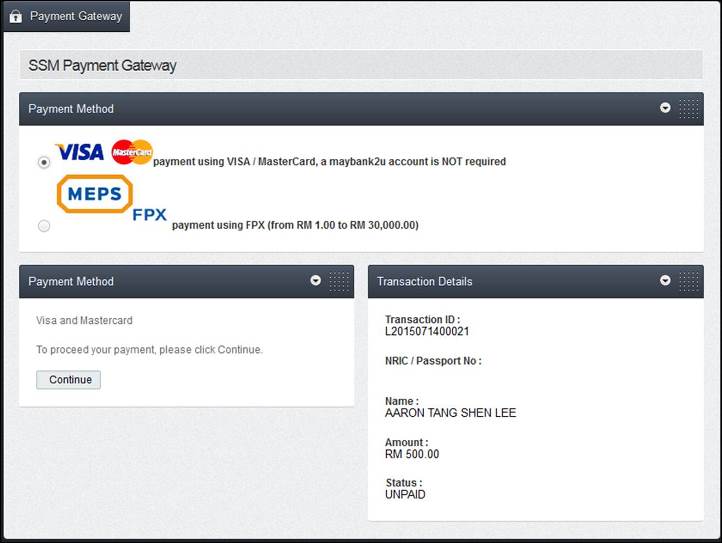

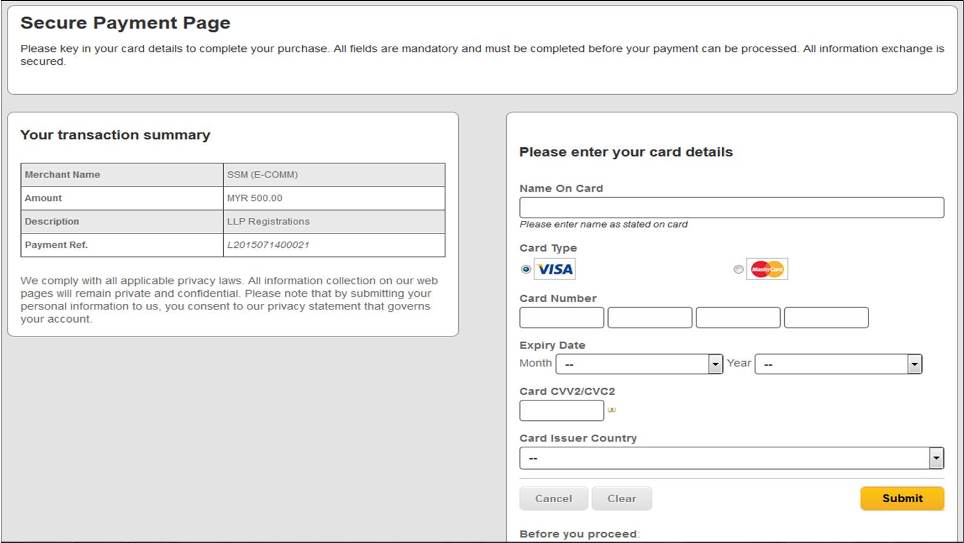

12. Make Payment

It costs RM 500 to register an LLP. You can pay either via credit card or online fund transfer:

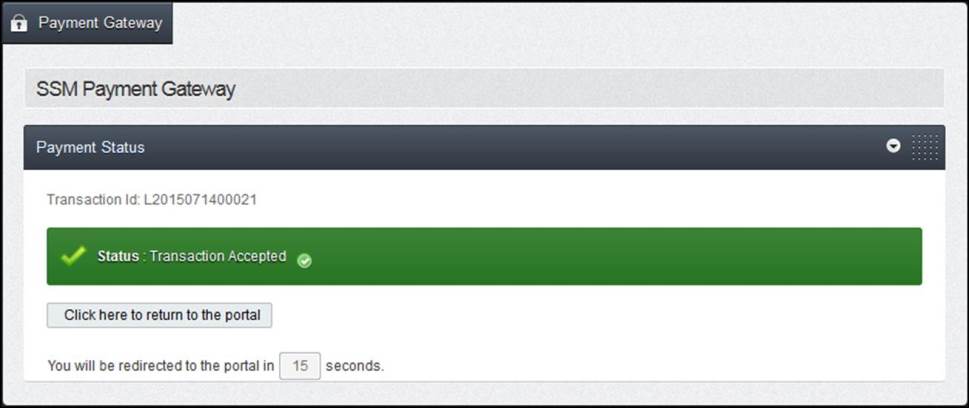

Success!

Success!

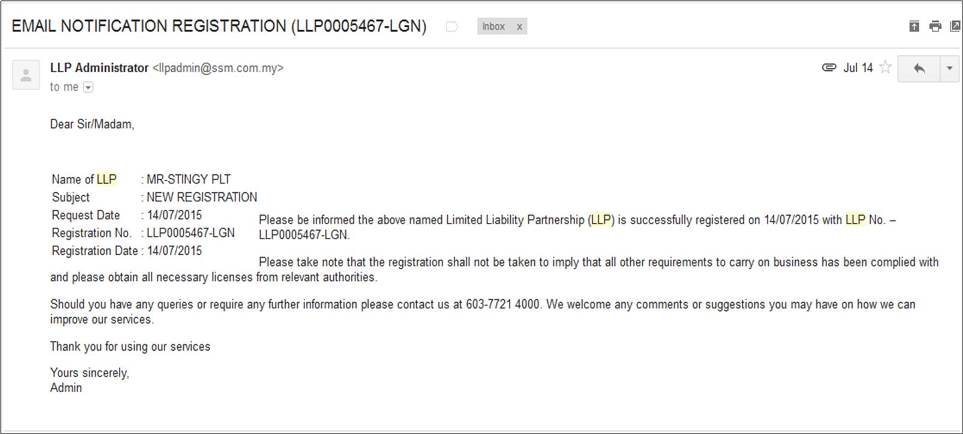

13. Check Your Email

Once you’ve successfully made payment, Mr. LLP Administrator will send you two emails. The first tells you that you’re now RM 500 poorer. The second is the one below:

Congratulations, you’re now the proud owner of a company!

Congratulations, you’re now the proud owner of a company!

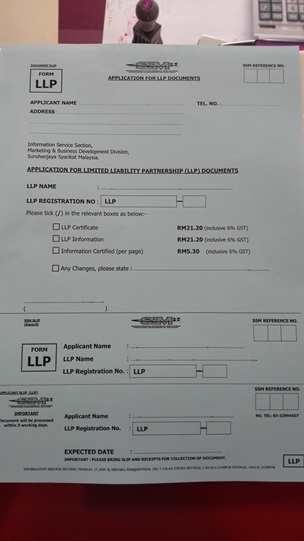

14. Go Back to SSM for Your Certificates

So you’re now the proud joint-owner of a Limited Liability Partnership. Except that you have no proof — other than Mr. LLP Administrator’s email. How will you do things that a company needs to do — like opening a bank account and buying assets?

Right — you’re gonna need your company certificates. But they’re not going to be automatically sent to you. You have to specifically request for them at SSM.

Go back to Level 17, and look for the form below:

Take a number, submit the completed form, and make payment (cash only) at the counter.

It’ll take three working days to process. So you’ll have to come back… again!

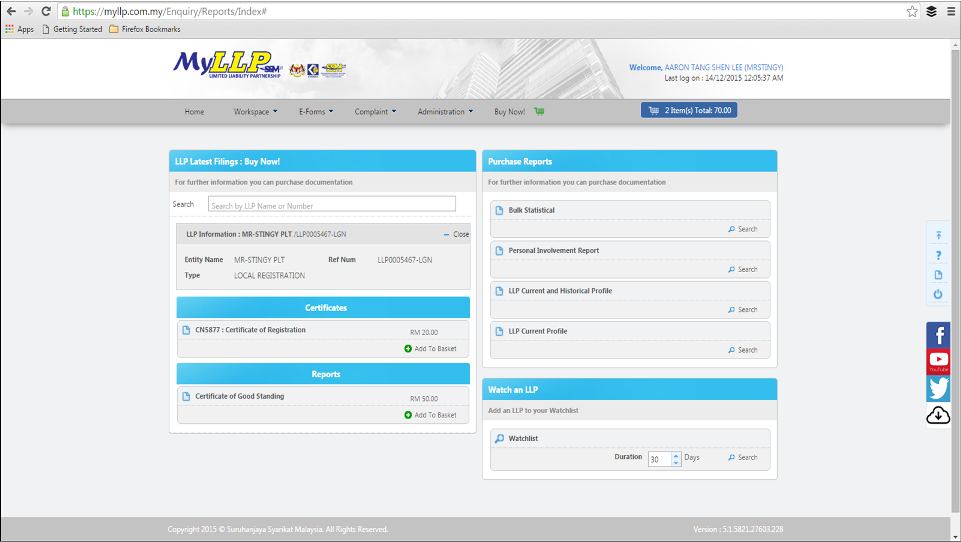

*Update 14th Dec 2015 — You can now purchase a Certificate of Registration (CN5877) directly on the new MyLLP system. It costs only RM 21.20. And saves you a trip to SSM. Basically point number 14 above is no longer valid.

It looks like this:

15. Visit Your Friends at SSM 3 Working Days Later

Since you’ve spent so much time at SSM, you’ve probably already made some friends there. Go back and pay them a visit.

Take a number, wait for your turn, and collect your certificates at the counter. It should take less than five minutes once it’s your turn. Like I said before, Menara SSM staff are really efficient.

And then you can give everyone a goodbye hug. Because you’re finally done!

Final Thoughts

So after RM 577.70 and multiple visits to Menara SSM, I finally got everything done. Overall, it was a good experience. The staff at Menara SSM were courteous and professional. The MyLLP system worked OK too. Just a few points for improvement — which I’ll send to SSM:

- There’s no notification once your Name Reservation is successful.

- You have to separately apply for LLP certificates. (Do people really start companies without wanting the certificates?)

- The whole process seems disjointed — half online, and half over-the-counter transactions. Would be good if it was fully online.

- There’s little documentation on how the process really goes. There’s a lot forms and FAQs online, but no flowcharts showing the full process and timelines. How does the man on the street actually know what to do?

*Update 14th Dec 2015 — SSM has recently upgraded the MyLLP website. I haven’t tested it in detail yet, but it looks like some problems above have been fixed. And my very helpful readers have been commenting below on the new changes. Thanks guys! Please keep the info coming.

Finally, if you’re thinking it’s such a hassle to go through the whole process — there are companies that will do everything for you. It’ll just cost you a bit more.

And if you’ve made it this far — you’re probably interested in setting up your own company too. Let me know if you have any questions. I wish you the very best.

For further information: SSM

Picture from Pexels

Hi.

Do you have a sample of letter of appeal for LLP compounds?

Thank you so much!

Sorry Josh,

Unfortunately I don’t have that.

Hello Mr Stingy,

Great information and thank you for taking your time for sharing this information.

Just got a few questions :

– how do I close a LLP if I never used it or open any bank account ? Any fast and cheapest way ? how long does it take ?

I did open my LLP a year ago but got distracted for personal reasons.

thank you

JS

Hi Jas,

I’ve been told that closing down an LLP isn’t very easy. I haven’t done it myself so unfortunately no personal experience.

Perhaps this page could give you some guidance? https://wecorporate.com.my/guides/how-to-close-llp-in-malaysia/

All the best!

Hi Mr.Stingy, I would like to ask that after getting the certificate of registration I needed to create a “business profile”, but what is a business profile? how and where do I create one?

Also, I am not very clear as where can I get a stamp for my LLP partner’s agreement.

Hi Eu Gene,

I’m not 100% sure but sounds like business profile is something that SSM can generate for you. Might be able to do it directly from the system or give them a call (very helpful people when I tried).

Stamp — I think this is just a typical company stamp that you can create yourself.

Update : i believe we can’t pay for the LLP certificate online anymore, i can’t find the option anywhere.

Thanks for the update Peter!

Appreciate your information. Very useful. Thanks.

Thank you!

Hi Mr Stingy. If I understand correctly section LLPA 2012 allows any two or more persons, consisting of, wholly or partly, individuals or bodies corporate, associated for carrying on any lawful business with a view to profit in accordance with the terms of the limited liability partnership agreement to form LLP.

My question is can conventional partnership form LLP? What is the procedures involved ?

Hi Azi,

I’m not very sure about this. Might be worth checking with a professional company secretary. Thanks!

Will do Mr Stingy. Thank you for the info ya.

All the best Azi!

Hi, during FMCO, the step of going to SSM office is not required. One can just submit the necessary documents to ubmhq@ssm.com.my, and wait for the activation. Refer to the SSM FAQ for more details.

Thank you Celine!

Dear Mr. Stingy

Seriously how can I address you ?

Where are you ? Are you in Penang ?

Hope to get to know you .

Hi John,

Feel free to contact me via email/social media, as that is my preferred way of communication.

Thanks!

Hey MR Stingy, i’ve been discouraged to sign up for a LLP because

1) it is very hard to open a bank account

2) people can still sue you and not the company as compared to a sdn bhd.

Could you provide some insights to the cons of a LLP?

Hi Mark,

I find the two points mentioned quite interesting:

1. Many people have opened a bank account using LLP in recent years (many in the comments to this thread), so I’m not sure where this is coming from.

2. The name of LLP itself “Limited Liability” or in Bahasa PLT “Liabiliti Terhad” suggests that liability is limited, unlike a traditional partnership. Is there any precedence of partners getting sued for what their PLT has done?

Hey Mr Stingy,

Thanks for writing back.

1. me too hahaha its just one of those hear says. The person who told me also has a LLP which he registered back in 2012 if not mistaken. He said that banks then didn’t know what to do. I guess things have changed over the years.

2. Again the same guy told me that apparently his got sued but instead of his LLP getting sued, they sue him as an individual or something (i dont have the exact details).

I currently have a sdn bhd and am looking at starting a LLP for my side business. The biggest selling point for me for LLP is that we do not have to submit audit report.

Perhaps you can share with me what are the other cons? of having a LLP

Confuse Kajang Boy

PS – I appreciate your expertise

Thanks for sharing. I don’t know any other cons of an LLP really.

It’s probably slightly harder than Sdn. Bhd. to get certain things done as it is much newer, but I do believe with a bit of persistence, they can be solved. For example, if one bank officer says no, ask them to refer to their superior, or perhaps head to a different branch.

All the best!

Hi Mr Stingy,

First and foremost, I would like to say, thanks for the insightful article, really appretiate it.

I would like to ask whether can the partner for my LLP be a foreigner (non-malaysian PR nor citizen) ?

Thanks!

Thanks Mike,

Appreciate your kind words. Yes, I think partners can be foreigners, as long as one of the partners is a Malaysian citizen. Best to check the SSM website though, as it’s been quite a while so my knowledge isn’t fresh in my memory anymore.

Dear Mr Stingy,

Thanks for sharing your experience.

I’m trying to convert my conventional partnership to an LLP. However, I’m stuck when the system asked me to enter the “Entity Number” and “Check Digit” at a pop-up window for “Reserve Name – Conversion from Conventional Partnership”.

Do you know what I should enter for said two parameters?

I’ve tried entering the registration no. for my conventional partnership, but the system says invalid number.

Hi Steady,

Sorry I’ve not encountered this before. Perhaps you can check with the SSM team by phone or email? Their support is normally quite good.

Hi, thank you very much for the great guide !

Just one question, I have now registered an LLP, but do i need to have a “Certificate of Good Standing” before opening a bank account ?

Also, I received a certificate within 5 minutes via email, but is this adequate, or is there another certificate that I need to go and collect in person?

Many thanks

Hi Dylan,

I haven’t heard of a “Certificate of Good Standing” before. As to what certificates are okay, that would depend on individual bank procedures I think.

Hi Mr Stingy,

Thanks for your awesome rundown on setting up a LLP.

Just wanted to ask that if this LLP company I formed was to invest into a Sdn Bhd and get dividend/profit in return, should it be taxed? Assumed that the profit from Sdn Bhd that my LLP invested was already taxed once before distribute.

Thanks Zach,

Quite unsure about this. You might need to refer to a tax consultant.

Dear mr-stingy,

Pursuant to Section 26(1) of the LLP Act 2012, a LLP may assign its interest. I would like to know what do interest consist of (does it includes shares or stocks?) and how do I execute the transfer? What are the procedures involved and the Forms to be used? Also, what are the rates of the stamp duty for this type of transfer in a LLP?

Hi Janice,

I’m so sorry but I haven’t looked into this in detail before. Might need professional consultation here.

Hi,

I stumbled upon your blog post on LLP in Malaysia and must say that it is very well written and comprehensive.

In your article you stated “Finally, if you’re thinking it’s such a hassle to go through the whole process — there are companies that will do everything for you. It’ll just cost you a bit more.”

Where can I find one of these companies?

Another question:

Being a Malaysian expat based overseas, do I need to register an LLP or any other business structure if my online services (via my website) is aimed at Malaysian companies?

Hi Faith, these companies are normally known as “company secretary” services. They help new companies set up. Feel free to Google and shop around.

To your second question, it sounds like you’ll only need a local business entity in Malaysia if the companies you’re doing business with require it. Otherwise, I don’t see why you couldn’t serve Malaysian customers from Australia.

Hey Mr Stringy!

Can I know do all partners need to create an LLP account? or just one of them?

Also, among all the steps you have listed above, just one should be done together for all the partners or all of them can be done by only one partners?

Thank you for your help!

Hi William. One partner representing the rest should be enough.

hi hi , can i ask how to get certificate of good standing ?

Sorry, not sure about that boss

Hi,

Would like to ask if my proposed name has been rejected by SSM, will I get refund? Thank you!

Hi Hogan,

Sorry I’m not sure about this unfortunately.

to answer this, no refund. you have to redo and pay again. yeah, a bummer! haha

Thanks!

Hi,

All partners need to be verified user or only one person will do?

One is enough

Hi,

Can I know if proposed name has been rejected, could we get refund from them?

Sorry I’m not sure about this.

Hi, can you do a rundown on the registration for Sole Proprietorship in Malaysia? It’ll be nice to have an expert like you running it through with extreme care, and thoroughness.

Hi Michel,

Unfortunately I don’t have personal experience running a sole prop, hence probably I’m not the best person to write this. Thanks for the suggestion though.

Hi Mr Stingy, I want to ask you about the step of registering the LLP form, I saw there is some attachments column in it that required a supporting document, do you know anything about the documents? Thank you~

Hi Natasha,

I’m thinking that’s for supporting letter if you’re doing something related to a professional body (accounting, engineering, etc.)

Feel free to leave it out if not applicable.

Hi,

Thanks for the detailed write up. Really helpful. I am an expat and I am a partner in LLP. I want to know that can I apply for Visa to stay in Malaysia and operate as a partner to do business under LLP.

Hello,

I’m sorry I don’t have the answers to Visa questions. Might need to give the immigration department a call…

Hey Nikhil,

I formed an LLP/PLT with my Italian partner, (I’m Malaysian myself) we were looking for ways to get him a working visa through our PLT. However, from our own extensive research and asking several hiring professionals in Malaysia, unfortunately, LLP/PLT does not have the right to give out working visas to foreign workers unless your company is registered under Sdn Bhd or Bhd.

The only solution was to get an HR firm to hire my Italian partner for our PLT. Due to the pandemic, the government has closed most visa applications for foreign workers.

Probably try this way out after the pandemic? But it’s not cheap having the HR company involved for this process. All the best!

Thanks for sharing Mitzy!

Really appreciate the effort you put into making this complete ‘How to register your company’. Great job and well done. Will try it soon. Cheers!

Thanks Joseph — all the best!

In the email they mentioned need Original Company Secretary License or Professional Body Membership Certificate, being a layman where to get this?

That’s only for professional body like accountants/company secretaries. Other types of businesses wouldn’t need it.

dear mr stingy, can a LLP has only one shareholder who is also a foreigner?

Hi Shulan,

An LLP needs at least 2 partners (what you refer to as shareholders I think). At least one of them needs to be a Malaysian resident (the compliance officer). There may be other ways to structure this but I’ve not looked very deeply into the topic.

Hi Aaron..

Thank you for your complete tutorial on LLP101. Very much appreciated.

Just registered my LLP on this beautiful date 01012020.

Thanks Knight!

Really wish you the best on your LLP and for 2020 ahead!

Hi, can you make a blog post about the more details on what to do after registered the LLP,

I mean the open bank account progress in details or from your point of view about what need to prepare and how much money need to prepare for opening a business bank account?

Thanks

Chris

Hi Chris,

I think these will help:

https://www.mr-stingy.com/ultimate-guide-new-llp-malaysia/

https://www.mr-stingy.com/bank-account-limited-liability-partnership-malaysia/

Hello Mr.Stringy,

You mentioned that you bought a car with your LLP. My question is, can we get a car loan right after when we first established a LLP company? Doesn’t it have to wait for 2 years to do so? Also, I am currently on a Conventional Partnership, with my accounts a little messed up. Would you suggest shutting down the conventional partnership and opening a new one or convert?

Thank you for your advice in advance.

Hi Ian — i’m not sure if you can get a car loan easily with an LLP. Perhaps if the company financials are very strong, then the bank would allow it? For my part, because I was buying second hand, I bought the car without a loan.

As for conventional partnership vs LLP, I can think of quite a few advantages that LLP has over normal partnerships. But I probably don’t know enough about your situation to give more advice than this. Hopefully this helps a bit.

Hi Mr Stingy

Is there a requirement for LLP to have a common seal for execution of documents?

Hi Azlina,

I’m not 100% sure, but it does sound normal for a company to have a “company chop” for documents.

Thank you so much for this article. It was super helpful. I used this information to register my LLP company. Keep up the good work.

You’re welcome All the best!

Hi Mr-Stingy

Do you think that name like …….DK capital PLT (it some sort like investment advisory or investment management ) will that have to complied with any related rule and regulation?

or what do you think on what is the proper way to apply? Thanks in Advance

Hello DK,

If you’re doing investment advisory or management, for sure you will need to apply for a license. You can register the name and an LLP no problem — but before you start business activities, you’ll need to get a license (probably from the Securities Commission).

1. Will a foreigner be able to Be a partner?

2. If I have a sole proprietorship am I able to transfer it to an LLP or must we start from scratch?

Thank you so much for the super comprehensive write up. Can’t tell you how much help you’ve been!

Hello Pei Shern,

1. Yes

2. No, you’re unable to transfer. You gotta start from scratch.

Thanks for the kind words and all the best!

Hi. Mr-Stingy

Say if i open an account in MyLLP, can i use it to help other to register their company under LLP ( i have nothing to do with their bussiness), or they need to start their own account for their company?

Hello Soon,

I haven’t investigated this in detail before, but I don’t think it’s the right way. As far as I understand, each company needs to have its own login (tho I could be wrong).

Hi Mr Stingy,

This is very informative and thanks for your constant update!

Would like to know if you could recommend me any cosec and accounting service provider?

Also, possible to share how to draft the partnership agreement? Do I need to engage legal advisor for this?

Thanks and appreciate your input as this is my first time setting up a business. Would like to do it in the most cost efficient way.

Regards,

Hi Sam,

You’re welcome.

Unfortunately I don’t know any good cosec/accounting service well enough to recommend. For partnership agreement, a lawyer is probably your safest method, unless you have legal expertise yourself. I guess it’s okay to invest a little bit more here just for the comfort?

for COSEC and accounting matters you may contact:-

Puan Aishah @ Aishah & Associates

aisya.mnasir@gmail.com

LLP agreement also she can do.

Thanks for sharing

hi, is there someone that u mentioned who is the professional who can handle end to end – registration to agreement and set up of LLP in malaysia?

Hi Josh,

Unfortunately my partner who does the registration services of LLP doesn’t do it anymore. If you’re looking for someone to help with the LLP agreement, I still can refer you to someone though. Let me know? Thanks!

Hi,

Thanks for maintaining this informative website about LLP. Keep up the good work.

Thanks Michael,

Really appreciate it.

Hello there! Thanks for the amazing guide for registration.

One question tho. I kinda got stuck at the reservation portion. I have already reserved a company name and paid the RM 30.00, but it has been almost 2 weeks yet no approval from SSM. I submitted and paid on 24th of March 2019. Still have got the approval to register the reserved name as a company.

Any advise on how should I proceed with this? Give SSM a call?

Hi Louis,

Yes — I think the quickest way here is to give them a call. Also, perhaps you can straight away move to the next step and try registering the company. I think the “bug” might be in notifications i.e. you already have the name reserved for you, but just that somehow the notification didn’t get to you. All the best!

Hi there, i just recently set up my LLP and there are a few updates:

1) you can now register Tax File and Employer File online via e-daftar on LJDN website. Once you click on e-daftar, head to PLT tab.

2) however, you can only upload registration certificate and LLP current profile ONCE and in JPEG format; you can click on the feedback button and upload your documents in PDF format (remember to state your application reference number).

3) Apparently tax estimate for FY2019 has to be done online. You can do it via e-filing but you must first obtain PIN number from LHDN officers.

Hope the above helps!

Thanks so much for this Wai Mun. Really appreciate these tips! And yes, even LLP tax for FY2018 needs to be declared online already…

Hi Mr. Stingy, can you advice what is the consequences when one of the Partner want to quit in the business (LLP)?

Does the business has to close down when 1 of the 3 Partners want to quit while the other 2 stay in the business?

Hey,

Shouldn’t be a problem. You only need 2 partners, but you will need to make sure the paperwork/registration shows that one of the partners has left.

I think this is where LLP differs from Partnership (in a positive way). If you have a partnership of 3 partners and one wants to quit then you need to dissolve the Partnership and reform a new one with the two remaining partners. So in a way your biz did not “continue”.

With LLP – like a Sdn Bhd – you just need to execute a document to say one of the partners is leaving, the resolution/payout etc and re-draft your new Partnership Agreement.

Same for adding new Partners.

Thanks so much for your helpful comments Jack!

your answer is wrong. for partnerships, there is no need to dissolve the Partnership. if u have 3 partner, and 1 wants to quit… just fill in the form and the business will go as normal..

Even if the partner has only 2 person, the business is still running if 1 is out…only the ownership type will change from Partnership to Sole Proprietorship..unyil u close it or expired more than 1 year..

Thanks Faizal,

Guys I’m not 100% sure what’s correct for a conventional partnership. For an LLP though, the number of partners can change without closing down.

Hi Mr Stingy,

i was submit application for registeration LLP RM500 fees (in progress), due to wrong character in the name. I want change the name, What can i do ?

Thank you

Hi Jiw Leong,

I think best give the SSM a call about this…

Sorry Mr. Stingy, may I answer on behalf.

The name a has to be approved first. Later if you want to change the name of your PLT you can, just like Sdn. Bhd, but of course there are fees charged by SSM.

Thank you!

Hi Mr. Stingy, we were able to register our business based on your info (although some steps are no longer applicable). So, thank you for sharing these information with us for free. Our biggest concern right now is how can we apply for business visa so we don’t have to get out of the country so often. Our LLP is made up of 3 Malaysians and 2 Singaporeans (formerly ex-Malaysians). Do you know anyone who can assist us in this matter? Thanks!

Hi Pei,

Thanks for writing in and your comments. Perhaps you can approach a qualified company secretary? They should be able to help advise you on these matters…

Advice to readers on LLP.

Since LLP is a new type of company and not many audit/acc/tax firms knows about LLP. It is advisable to stick to the conventional partnership or Sdn. Bhd. as LLP comes with its own complications. As LLP is a hybrid (meaning cross between partnership and Sdn Bhd), this type of business is suitable for joint ventures of a larger scale such as accounting firm EY where they have plenty of partners and wants to limit their liability. I know there are plenty of perks in LLP but once you’ve started this type of LLP you will find it a massive headache to handle the various government dept related to LLP namely LHDN and SSM.

Regards,

Ar. Michelle

Current LLP Managing Partner

Architect/Interior Designer

Hey Michelle,

Thanks for the feedback. I would have to disagree that LLP is only suitable for large joint ventures. For smaller outfits, Sdn. Bhd.s are expensive. Conventional partnerships on the other hand do not limit liabilities of the partners, so that’s riskier.

Agreed that like any new service/product, the processes for LLPs are not always 100% ready and can sometimes raise issues. However in my experience handling LHDN and SSM has been a breeze. Specifically for LHDN, it will probably require some knowledge of doing your own taxes — but I wouldn’t call it a massive headache.

There’s also nothing stopping you from engaging a Taxation Professional to do up your LLP tax (if you have significant volume/tax). And even to audit your financial reports.

The thing here is this.. with a Sdn Bhd, you are obligated to engage a Tax Pro and Audit to do up your financials (so that’s fixed overheads) and if you are mostly owners-run/managed, those costs are not necessarily after all you are the only stakeholder in there.

With LLP, these taxation/audit fees are optional. If your LLP has a large num of stakeholders therefore needing more governance into the accounts, or your revenue/tax volume is high, you can certainly afford to spend the taxation/audit fees to ensure you get a proper set of financial reports at the end of the year. The key is that LLP does not impose those obligations by default onto you.

hi,

i was register MyLLP account, but in my CUSTOMER PORTAL no option for register the company. is it register wrongly ?

i able search company name but Register Now button is grey and unable to click.

i was go SSM office, they told me all registration must do online.

Please advice, what is the next step for me ?

thanks in advance

Hi Jiw Leong,

I suspect you might have registered it under the wrong category. I recall some other readers having this problem before. If you scroll through the comments section — you might be able to get an idea.

Hi,

i was register wrong category.

what is below information needed ?

LETTER OF CONSENT FROM OTHERS AUTHORITY No

LETTER OF CONSENT FROM THE RELATED BUSINESS No

COPY OF CERTIFICATE (E.G. FORM 12) No

FOREIGN CERTIFICATE OF REGISTRATION ON INCORPORATION No

OTHERS ATTACHMENT No

where to add my partner information ?

thanks in advance

Hi Sir, currently my firm wish to transfer in LLP. However, we never done it before. May I know how wash the procedure to appoint new compliance officer and resign the existing compliance officer? there need how many days to get the approval ?

Thank you very much.

Hi Xiao Xiao,

I’m not exactly sure about this. I think the best person to check with are SSM themselves.

hi,

the certificate of registration got how many pages ya?

mine only got 1.

is it sufficient (with that 1 page of certificate of registration) to do all the bank account opening and loan financing in the future etc?

thanks

Hey,

The certificate of registration has only one page. Some banks might ask for your business profile, which contains more details. Might be wise to get that too…

Dear Mr-Stingy,

May I know except Menara SSM, can I register LLP in UTC instead?

Hi Pauline,

Sorry as I’m not 100% sure about this. Perhaps you can ring SSM and check with them? They’re very helpful.

Hi Mr stingy ,Thanks for the sharing.Are we going to receive any notifications or email once the certificates have

done?

Hi Win Tze,

You’re welcome. From memory, I think they do email notify you.

Hi, is the virtual/actual LLP certificate in Bahasa(PLT) or English(LLP)?

Can we request for English version?

Hey mr-generous,

The certificate is in Bahasa. I’m not sure if you can request it in English…

LLP certificate available in Bahasa only. I have requested English version at SSM Penang however they are unable to fulfill my request after check with SSM HQ as English version not available in the system. I also requested them to do the certificate manually but they said LLP is fully online and can’t be done offline compared to conventional company or business. They only can certified the copy of LLP certificate over the counter (OTC). Quite disappointed for this since ROC and ROB certificate available in English version.

Anybody have any experience successfully requested for English version certificate?

Hey Jason,

Yeah I think the certificate is only in Bahasa, but if I’m not mistaken the Business Profile can be in English?

Hi Mr Stingy,

Can I register a LLP only with my name? Or the minimum members must be 2?

Hey Pui Cheng — yeah you need at least 2 people.

Thank you so much for the guide. I had mine done few days ago, without your guide I think a lot of people would have to go through a lot of trouble. One question, if a LLP is without form 24, form 9 or whatever forms that a Sdn. Bhd. would have, how do we go into a tender?

Hello Ryan,

I think you can show the equivalent documents i.e. the certificates of the LLP. Worth checking with the tenderer tho — if LLPs are allowed to tender? Perhaps they only allow Sdn. Bhd. or Bhd…

Hi Mr Stingy, it’s me again. I tried to register LLP through online myLLP system. After paying RM500, it requires SSM to approve our LLP, so it takes around 3-5 working days. It’s no longer auto-approve, as mentioned at your step 13.

Thanks Andy for your comment!

Hi.Andy Neo. I have question here.

Will the company registration dates are based on the payment date or the date of approval by SSM?

Thank you.

Hi Mr. Stingy! Thanks for the sharing, it helps my partners and I to understand more of the registration of LLP. Some enquiries:

1. Do all the partners have to be present during the first trip to SSM? We have done the first step and received the confirmation email, and we thought to visit the office on the coming Tuesday.

Thanks in advance, and good day! 😀

Hello Jimmy,

Hmmm, I’m not sure. Perhaps necessary if they want to see your IC? Might be worth giving them a call to ask.

Hi, Mr. Stingy!

Great post! I’m thinking of opening a chemical-manufacturing business with a partner from Thailand (I’m from Malaysia). I was wondering if you know if it is possible for a Malaysian and a foreigner to be partners under the LLP?

Many thanks!

Hi Alyaa,

Yeah, sure you can have a Malaysian + foreigner to partner under LLP. All the best!

Thanks for sharing !

I regards to obtaining a certificate of the LLP, when you say “it will save you a trip to SSM”, do you mean that it include shipping/mailing to you ? Or do you still have to go and pick it up physically after making the purchase online , and you’re saving a trip to hand in the request form?

Thanks in advance for clarifying !

Regards

Hey Jon!

As far as I understand, they only give you a virtual soft copy…

Hi Aaron,

Big fan here. After reading this post a while back, I’m finally getting around to setting up my own LLP. Can you share your friend’s contact — the one who does LLP tax? Would love to have that covered from the get-go.

Thanks so much!

Hi Khai,

Thanks for the kind words. Mmmm… my partner only does LLP setup/agreements actually. For tax, you might need to look for a tax consultant? Sorry, wish I could help more!

Hi Stingy, firstly great work in doing up this post! Will be helpful to many I’m sure.

Can you e me your partner’s email/contact? I’m keen to get her (or him) to do up a partnership agreement for my LLP. TQ

Hi CK< I'm so sorry that my partner currently doesn't do LLP agreements any more. Sorry for the trouble.

Hey Mr. Stingy, I’d like to ask if LLP in Malaysia is what other countries (EX. the US) call as LLC.

Thanks in advance!

Hey — erm not really. An LLC in the USA is similar to our Sdn. Bhd. or Bhd. (I think). Our LLP are more similar with Commonwealth country LLPs like India/Singapore/UK.

Hi great stuff and must tell others about your site. gotta ask, i’m into numbers and need to calculate my company name. In this case its an LLP company as in the forms and docs on the net, but once its done and registered it comes out a PLT yes ? so all biz cards and signage and letterheads are ended in PLT?. thanks

Thanks Gerard. Yeah it comes out as PLT, so I think technically everything should have the “PLT” appearing too.

Hi Mr-Stingy,

Thank you so much for the step by step guide to establish a LLP company.

I have not login to the portal yet for LLP registration as I’m not clear when it comes to registering a compliance officer.

Would appreciate if you can help to clear whom can be the compliance officer and how can I sort this requirement in order to me setup a LLP company successfully.

Thanking you in advance Mr-Stingy!

Hey Logan,

You can appoint either of the partners to be the compliance officer. There are some requirements which you can read in the LLP Act. If I recall correctly — it’s the compliance officer needs to be a Malaysian.

Hi Mr-Stingy good to hear from you,

Alright it’s clear to me now.

Thank you Mr-Stingy!

Thanks Logan. All the best ahead ya!

Hi, must you be a Company Secretary or similar title to be the compliance officer?

Hey man,

Nope — you don’t need any titles…

I’ve just gotten my LLP portal account activated by SSM today. And when I logged into the portal to register my LLP, it will bring me to the name reservation page. I guess they have updated their portal so that you MUST reserve the name, wait for their approval (a message says it will take up to 30 days @.@), and then only you get to register your company. The steps in name reservation are similar to the first few steps you mentioned above, except that I don’t have to key in my partners’ and business’ details. And yes, I was charged RM30 for the name reservation. Just some updates so that others are aware of. Hopefully I’ll get the approval on my LLP name soon!

I just found out that you can still proceed for registration of LLP without paying for name reservation. You need to go to E-Forms > Register LLP > Tick ‘Direct Registration’ and that’s all. I’ve overlooked that little tick box >.< so there goes my RM30. And SSM is really efficient!

Thanks Stacy — really good to know!

and we still get to obtain the name that we want?

Try reserving it in the system. If it’s still there then you can get it!

I’ve a not so related questions which I hope to get some help on.

Would you know the process to wind-up the LLP; or anyone who provides such services?

The process to wind-up LLPs is actually in the “LLP Act.” Also — I think you can get company secretary help for this.

Hi Mr-Stingy,

Thank you for the great info! I’ve registered LLP and planning to open a bank account with CIMB. As I understand that agreement letter between partner is not compulsory. However, do I need an LLP agreement letter to open a bank account?

Thanks

Hello Zamir,

You’re welcome! It depends on the bank themselves. If they need it to open an account, then you’ll have to do it I guess.

Hi, I’ve heard that there’s another new type of LLC that can setup by only one person and no AGM /Audit report required?

Also do you have contact of accountant/tax agent that familiar with working digital worker that have clients from overseas (payment in USD/GBP) – I engaged one last year who was very conventional and didn’t know much about new economy and how to navigate around it.

Hey Candy,

Hmmm… I’m not fully sure about the new form of Sdn. Bhd. Perhaps need to research or check with someone else.

As for accountant/tax agent, perhaps you can reach out to my partner here and see if she can help?: https://goo.gl/forms/meOxaMaIHJfwrj3F2

Hi Mr. Stingy,

Very informative article. Could you please email me the details of your accountant and lawyer for the LLP agreement and also the tax management quotation?

Hey Steve,

Thanks. For a quotation, please fill up this form: https://goo.gl/forms/meOxaMaIHJfwrj3F2

Hi Mr Stingy,

Could you please send a quotation on LLP agreement preparation?

Thank you

Hey Katie,

Fill up this link here: https://goo.gl/forms/meOxaMaIHJfwrj3F2

Halo Mr Stingy, by referring to the helpful information above, I manage to registered our company under LLP. Appreciate this very much.

Anyhow, I do have a question, which is 1 of our partner want to exclude himself from the company, and left 2 of us. Hence, do you have any idea how should I do this and what is the charges / impact if any?

Thank you in advance.

Hey SY,

Sorry for the late reply. I think it’s quite easy to do this. Just fill up a form and inform the SSM. I think you might even be able to do it online…

Dear Mr. Stingy,

First of all lemme take a moment to mention here that I found your posts extremely informative and helping , especially for those who are just willing to step into business ventures but feel hesitant due to being new comers.

I would really appreciate your comment, in case if I don’t have a business partner then what kind of company , I should register as foreigner?

Thanking you in advance,

Khalid from Pakistan

Hey Khalid,

Thanks for this. Perhaps you can look at registering a Sdn. Bhd. company then?

I try signup a new account. Wonder for “Login Name”, I should fill my full name, or just a User ID for future login purpose? Mind to advise. Thanks.

I think a User ID sounds more like it.

Dear Mr.Stingy, izzit ok for you to share with me your sample of partnership agreement template?

Thanks in advance

Hey Samuel,

Unfortunately I think an agreement is too important a document to just use a sample. May I suggest you get a lawyer to help you draft yours, or you can contact my partner (link at the bottom of the article) for a quotation. Thanks.

Mr Stingy, thanks for your detailed write up.

I followed your footstep and setup mine in the exact same format.

by the way, how to get “Original Company Secretary License or Registered Professional Body Membership Certificate”

Thanks Firdaus,

Sorry man — not too sure about that one…

Mr stingy,

I purchased the a Certificate of Registration online and received soft copy .

The question is do i need to take the original copy from SSM?

thanks

Hey Jack,

It depends. If you don’t need the hard copy for anything else, then the soft copy should be good enough.

Hi Mr. Stingy,

Could you email me the contacts of your accountant and lawyer for the LLP agreement and also the tax management quotation?

Thanks!

Hey sk — Emailing you now.

Any updates for year 2017? Are getting business loans still a possible problem for PLTs?

What are the advantages of a Sdn Bhd?

I read a PLT requires a minimum of 2 partners. Can I use a dummy partner e.g. my brother, such that in the partnership agreement, can I transfer 100% of future profits and management rights to myself?

Where can I find out the latest official tax rate?

Thanks.

Haven’t studied too deeply on getting business loans; but my feeling is banks are slowly getting warmed up to LLPs — definitely not as smooth as Sdn Bhd. Sdn Bhd have been in the game for very long — so people are more comfortable doing business with them. That’s the advantage, apart from being able to convert to Public Listed company at some point in future.

Yeah, PLT needs at least 2 partners. If your brother agrees to 100% profits and rights to you, I think it can be put in the agreement.

The latest official tax rate can be found at LHDN’s website. Although I can also tell you here: it’s 25%. But if you’re an SME — it’s 20%.

How does the company stamp look? Is it “NAME PLT” and then in the middle the LLP number as such “LLP9999999-LGN”?

I don’t think there’s a standard “format” for company stamp. As long as it displays the name and number clearly I guess. I’m not sure about address, but I have that in my company stamp too.

Mr Stingy, thanks for your detailed write up.

I followed your footstep and setup mine in the exact same format.

Company name approved within a day.

Kudos and thanks a lot for your kindness to share with the public.

Anytime Alex,

All the best to you!

Hi Mr Stingy!

Really informative post, thank you so much.

Could you please email me the details of your accountant and lawyer for the LLP agreement and also the tax management quotation?

Thank you

Hey Eve,

You’re welcome. I’ll email you now.

Hi Aaron, thanks for documenting this!

Not sure if this question has been asked since there are tons of comments already (I’m half way through it and still didn’t read it yet). The question is what is the average running cost to maintain the LLP?

Another question is if dissolving the LLP is costly and troublesome, how long do you expect to run LLP before it becomes worth it?

I’m in the process of either having my profits channeled to a sole-prop or a LLP. Weighing my options as my sole purpose is on tax savings and possibly owning properties (but this may be 3-4yrs down the road).

Thanks again!

Hi Leslie,

Average running cost for an LLP? Apart from startup fees, just RM 200 per year for annual declaration. Plenty of free tools online to help with things like accounting, etc.

I’ve never thought of dissolving my LLP, so erm… it’s been worthwhile for me since Day 1?

If you’re thinking about tax savings, there is absolutely no tax benefit to running a sole prop (since it’s combined with your own personal income tax anyway), so I think an LLP is vastly superior in that sense.

Unfortunately i’m a (very) lazy & sometimes forgetful person and would like to outsource as many tasks as possible 😀

Alright then! Will lean towards LLP.

Thanks for the reply!

All the best Leslie!

Hi MR-STINGY,

This is really useful for me. I plan to register LLP company. Can i ask you whether LLP agreement is required upon registration? or i can draft it later after registration? Do you have any information how to file Tax for LLP company?

Thank you,

Hey AT,

No, you don’t need an LLP agreement upon registration. You can do it after. I did it that way too.

For filing LLP tax, this article might help you: https://www.mr-stingy.com/ultimate-guide-new-llp-malaysia/

MR-STINGY,

Did you, as compliance officer, update your stamped LLP agreement back to SSM?

Erm — I didn’t actually. No one asked me to. Is it a requirement?

Is it compulsory to have partners in order for me to register under LLP? Can i register LLP without partners?

You definitely need partners to register an LLP.

I am in the process of filing voluntary winding-up from SSM, but it needs the following:

(a) put up a legal notice on a Bahasa Malaysia newspaper (at least RM500++) and another on a English paper (at least RM500++), then attach the scanned legal notices on the myllp.com.my portal;

(b) Statutory Declaration Section 50(3) (this one just fill up the form provided);

(c) Send a notice of voluntary winding-up to inform all your partners by registered post, then attach the scanned proof of posting together with the copies of the notice on the myllp.com.my portal.

(d) Obtain a notice from the Inlan Revenue Board of Malaysia (LHDN)

Withdrawal Fee: RM100

BUT, actual costs for this whole activity would be RM100 + advertisement cost for the legal notices (RM1000++). It is not cheap at all.

The template of the legal notice is already provided in https://www.ssm.com.my/sites/default/files/guidelines/Guidelines%20on%20LLP%20Voluntary%20Winding%20Up%20%28Revised%20on%2007012015%29_0.pdf .

Thanks Max for this very helpful information!

Dear Max,

I’m in the process of winding up the LLP too. May I know how can I obtain a notice from the Inlan Revenue Board of Malaysia (LHDN)?

Regards,

Chun Wen

Wish I could help, but I haven’t done this before. Max — any idea?

Hi Mr Stingy,

Is foreigner can register for LLP?

Hey,

Yeah, but you need at least 1 local partner or a local secretary (to act as your compliance officer).

Hi Mr Stingy,

Great article, just what i needed as a foreigner. Does an LLP have any impact on available Malaysia Grants which met its criteria? And does and LLP also known as SME in Malaysia?

Hi Ibrahim,

Thank you. I’m not aware if LLP has any effect on Malaysian Grants (but I wouldn’t think so). SME definition is usually by amount of annual revenue, not the type of business. So an SME could be an LLP, a sole prop or even a Sdn. Bhd. company.

Hi there,

Appreciate your info here. It was indeed very helpful!

Just a question here, do you know the business code for selling specialty upon the registration for LLP?

Thanks in advance.

Hey Rong,

No problem. Perhaps this document can help you (easily found using Google Search):

http://lampiran.hasil.gov.my/pdf/pdfam/NewBusinessCodes_MSIC2008_2.pdf

Hi again! May I know if there’s any minimum amount of capital required in order to register a LLP? Thanks

Hey Rong,

I think the minimum amount of capital is something ridiculously small like RM 2 (though I’m not 100% sure).

Hi, can I register heavy machineries such as excavator, backhoe, wheeloader, lorry, etc with JPJ under PLT company name?

Hi Adrian — it sounds doable. But how to exactly get it done, I’m not 100% sure. I’m thinking you need a face to face meeting with JPJ for this.

How long did it took for the SSM website to send you an email? It has been 4 days.

Great article …thanks for writing it…

is there a format to write the agreements with partner? and does it has to be duty stamped?

since it needs min 2 partners, can one of it is foreigner (say foreigner is your spouse)?

how many biz types can be registered under llp? in sdn bhd u can reg min 3.

thx again

Thanks Thierry,

There’s no specific format for agreements, but lawyers can help you draft them. Yes, they need to be stamped.

Yes, one of the partners can be a foreigner.

You can register 3 types of business activity at first. I’m not sure if you can add extra, but you’d have to check with SSM.

LLP needs min 2 partners, one of the partners must be Malaysian and it allows to have partners of foreigner. My question is that if there is a requirement of the minimum share the Malaysian partner(s) must hold in the company ?

Hey Hermann,

I don’t think there’s a minimum share the Malaysian must hold. Maybe just RM 1 or some small number like that.

Dear Mr Stingy,

First, let me start by saying how much I love your blog. I stumbled upon it by accident, but I’ve been a fan every since.

Your blogging journey has compelled me to start my own company. Could you email me the contacts of your accountant and lawyer for the LLP agreement and also the tax management quotation?

Thanks 😀

Thanks Su Juin for dropping by and your kind words.

Let me email you asap. Keep writing too!

Hi. Good information. I have registered create account on MyLLP system, but there is still no notification email I received from MyLLP. How long will it takes usually to get the email notification?

Hi Amin,

I’m not very sure — but it should be instant. Have you given them a call to check?

As i called SSM officer just now, it will take 24hrs to get success registration email notification.

Thanks bro!

Hi Amin,

I also encountered the same. Apparently the system is/has been down. I tried calling their customer service hotline and sent multiple emails to enquiry@ssm.com.my. Did it for a month — complete waste of time.

Instead, call 03-22994523 and look for Encik Mokhtar. Alternatively, call 03-22994628 and look for Pn. Maisarah. Their emails are amokthar[at]ssm[dot]com[dot]my and nmaisarah[at]ssm[dot]com[dot]my. They are the officers in charge of LLP.

Once you’ve logged your complaint with them, they should send you an email with a reference number. Print out that email and go to 17th floor at Menara SSM and take a number for User ID verification. Following which, come home and do the name search/ reservation.

FYI, I *just* made payment for registration and not once has this portal actually sent me any verification email. I just keep logging back in, and there’s usually some update on the dashboard. Good luck to all of us, I guess!

And thanks Aaron / Mr-Stingy for all this information! Hope this comment helps others too!

Thanks very much for this Jonathan! Very helpful!

Thanks Jonathan & Thanks Aaron for the clarification.

Yes, I do called their hotline and emailed my complaint to enquiry@ssm.com.my

I guess I just have to call and check with SSM officers you stated.

Thank you again!

Thanks Amin! Hope you managed to sort it out!

Hi,

I’m in the middle of setting up own business company and found your awesome info! Thanks for sharing the details.

I noticed that it require agreement to register LLP, would you mind to share your contacts for getting the agreement done? Appreciate your hardworks & sharing 🙂

Hey Billy,

Thanks for your kind words. I’ll email you now.

How does the partners(owners) paid in LLP?

1. Is it by salary? (Hence, they have to pay individual income tax?)

2. Is it by shares? (For example, the net income of the company will be divided equally to both of them)

Hello Oong,

Both ways are equally valid ways of paying the partners in an LLP.

Hi Mr Stingy,

May i know what is the maximum limit of partners for LLP?

Thanks.

Hello Liz,

As mentioned in the article — the number of partners in an LLP is unlimited.

Hi, I have paid for the cert & current profile and have been waiting for the notification to download them based on your write up above. While searching for other emails, today I realised that there was an email from MyLLP on this but I think I have missed the window to download the cert & current profile. There is a note in the email that ‘The product order will be available within 7 days from the date of product purchase.’ it is now more that 2 weeks after that email & i dont see the files to download is avail in the order link. How do I get to download the cert & current profile now?

Hey Fairul,

Sorry to hear about your predicament. I’m not very sure on how to proceed next — perhaps you can give SSM a call and see?

Hi Mr. Stingy,

I had stop my business(actually not start yet) which registered under LLP.

May I know what is the cancellation procedure for LLP?

What problem will facing if i don’t cancel my LLP?

Thanks in advance. 🙂

Neo

Hey Neo,

Part VII of this document might help: https://www.ssm.com.my/sites/default/files/acts/LLP%20ACT%202012%20-%20For%20Portal_new.pdf

Hi NEO,

Did you end up voluntary winding up or any updates?

As I have registered but did not actually started the business too.

Hi Mr Stingy,

I believed you had done your tax declaration with LHDN.

Can you explain more how you do that?

Thanks.

Hey Hafiz,

Basically it was just filling up Form PT 2016, and then submitting it to the LHDN branch at Bangi. A more detailed post on that coming soon.

Hi, just to check after you sign up as new user on step one, how long you receive email notice from SSM?

Hey Ong,

It was a long time ago for me. But I think it was instant.

It has been 4 days and I haven’t got mine.

Sorry to hear that man — it was a couple of days for me (if I recall correctly). Have you given them a call to follow up?

Hi Mr Stingy,

Could you email me the contacts of your accountant and lawyer for the LLP agreement and also the tax management quotation?

Regards’

Alex Teo

Hey Alex,

Let me email you now.

Hi Mr-Stingy,

Thank you for your very informative article! I am in the midst of setting up an LLP. I would like to know how do I file a doing business as (DBA) name for my LLP?

Hey Jeremy,

Thanks for your kind words! I’m not very clear on your question Jeremy — can you explain further? To my knowledge, you can use any name for your LLP as long as someone else hasn’t used it already.

Hi Mr. Stingy,

Thanks so much for your sharing. Benefited alot from it 🙂

May I know if the company name of LLP will be XXX Sdn. Bhd. as well?

Hey Loh,

You’re welcome. The company name will be XXX PLT (Perkongsian Liabiliti Terhad).

Hi Mr-Stingy,

Could you email me the contacts of your accountant and lawyer for the LLP agreement and also the tax management quotation?

Thanks!

Hey Kok Hong,

Have just emailed you.

Hi Mr. Stingy.

I would love to have your company secretary contact who can form my LLP.

I am foreigner in malaysia on MM2H Visa (Malaysia my second Home)…

I will appreciate your reply.

Thanks

Hey Abbey,

Unfortunately I don’t have a company secretary contact who provides company secretary services. Lots of others do though. Good luck!

Hi May I know how to change compliance office from one person to another?

Can It be done in the LLP portal?

Hey Nursala,

I’m not 100% sure on the process. I see there’s a form on SSM website to do it. So perhaps check the LLP portal first, and if not — may need a visit to SSM? Thanks!

Hey Stingy,

Could you email me the contacts of your accountant and lawyer for the LLP agreement and also the tax management quotation? I would like to know for Partnership LLP company can show the partnership Percentage?

Hey Joanne,

I’ll email you the contact right now.

Hello,

I would like to set up an LLP company in Malaysia – I am not based in Malaysia but I offer It services to various Clients in Malaysia – I currently have a good candidate but would need to employ her locally for her to work in Malaysia.

Can you recommend some not so expensive firms that can facilitate the process for to set up a local company to hire this candidate?

Thank you

Hey Nadia,

Not so sure about hiring the local candidate, but if you need someone to help you set up just the LLP, you can email my partner at info@axecute-consultancy.com for a quotation. Thanks!

Hi Mr. Stingy,

Fantastic post! Im under a MM2H visa and considering setting up an online biz with my girlfriend (she is local). What’s the most logical setup to have to pay myself and not get into trouble with MM2H work limitations?

Could you email me the contacts of your accountant and lawyer for the LLP agreement and also the tax management quotation? I would like to know for Partnership LLP company can show the partnership Percentage?

Many thanks,

SF

Hey SpudFrog,

Thanks for the kind comments. Unfortunately I’m not very sure about MM2H and don’t have any contacts right now for the accountant/lawyer/tax, but I’m sure a good company secretary would be able to help you.

And yes, the LLP partnership agreement can show partnership (and should) percentage.

Hi Mr stingy, may i have the llp further detail?

Hey Gerry,

Have just emailed you my partner’s contact.

Hello and a big thanks for this post ???? ! I am a foreigner here in Malaysia and would like to sell products online, legally. Classical companies don’t allow me trading; anyway LLP seems to be ok with me if I found a compliance officer resident in Malaysia. Would you agree with me? Thank you

Hey Malika,

What’s the reason that normal companies don’t allow you to trade? An LLP isn’t very different from a normal company. If your trading activity isn’t allowed under a normal company, I don’t think it’d be allowed for an LLP either.

Hi Mr Stingy,

My accountant is unfamiliar with the LLP setup. Would you be able to email me contacts of your accountant and lawyer so that I can get a quote for the agreement and also the tax management portion.

Thank you.

Hey Michelle,

I’ll email you now.

Hi mr. stingy, under the LLP agreement, can we replace the existing partner? how long is the process and how much does it costs?

supp question: let’s say, mr A is a partner in LLP A, can he be the partner in another LLP B?

Thanks!

Hey Amanda,

Yeah — of course you can replace the existing partner. I don’t think SSM charges you anything to update the information. The only other cost I can think of is professional fees for amending your LLP Agreement.

Regarding your other question, if mr A is a partner in LLP A, he can be partner in LLP B, C, D, E… No limits as far as I know.

hi i accidentally registered my company “mycompany Perkongsian Liabiliti Terhad” instead of “Mycompany PLT’. Anyone encounter the same mistakes? Will i be able to change it to “PLT” instead? If not in future for anything i will need to write my company in full with the “Perkongsian Liabiliti Terhad’ behind instead of the short form “PLT”..

Hey Carol,

I think it won’t be too difficult to edit the name to what you want. Just need to reach out to SSM…

Lot of useful info here. Looking for contact details of the person you recommend to help start an LLP? Thanks in advance.

Hey Alan,

Thanks. I’ll email you now.

HI there

I am setting up an LLP and they ask me to resubmit 3 times already.

And each time it takes 1 day to get back to me.

So each time they reject, i have to waste another day.

And each time they reject they dont advise, they just say business address misleading. etc.

When i tried to call them, no answer, 5 times till the line cut by itself.

So i am using a service office, but i need to wait for my LLP to be approved so i can use the LLP name to sign for the lease and make payment in LLP name. But SSM says my registered address and biz address is misleading.

Maybe because they did a search and see that there is another company with the same address.

So all those using service office cannot be registered LLP? Doesnt make sense right?

How do people register for a biz with a registered office when they have not even started biz and register w SSM, wouldnt that be illegal biz if you are operating without being a legal entity?

Also i like to add that their online form is not very good to start with.

Some fields have the (*) to show that that field is compulsory, so i did not fill up those fields that didnt have the *.

Then i got rejected the 1st time round, asking me to fill up certain fields, and it wasnt compulsory.

If it is compulsory then why not just put the (*). Seriously.

Hey Noel,

Sorry to hear about that. Must be very frustrating. I’m sure there’s a way to register LLPs using a service office. My only suggestions is perhaps to go to SSM and try to meet someone senior who might be able to help?

thank you for your helpful arricle about LLP.

My questions are :

1-for LLP can I get an ID ( visa on my company name ) ?

2-LLP can. e used to start my barber shop business )

Hello Alaa,

You’re welcome.

1. I’m not sure about visas and LLPs. You’ll need to check with immigration.

2. LLP to start a business — why not? That’s what they’re for.

Hi Mr Stingy,

Could you email me the contacts of your accountant and lawyer for the LLP agreement and also the tax management quotation?

Hey Ken,

I’ll email you now.

Hey, if we purchase the certs online, do we still need to pay if we want to get a hard copy from SSM Office? Official copy looks promising than self-print i suppose. haha

Hi Joshua,

I think the soft copy / self-print version should be sufficient. Not sure if SSM has an option to purchase a hard copy anymore though…

Hi Aaron,

Thanks for your great blog post. I have formed a software development partnership with a friend. I have a few questions.

1. We don’t always work equally on the same project (even sometimes only one of us work on a project). Can we distribute salary on a per-project basis, without a partnership agreement? (but we do agree on specific terms before starting a project).

2. How often can we change the agreement?

3. When submitting the LHDN form, do we submit the agreement? we will submit our first in a few months.

4. Is the tax really 20% of the total income? we don’t make much money it seems like a lot since we both work on this partnership on a part-time basis for the time being.

5. Can we use all the income for salary, thus avoiding the partnership tax & partners need to pay individually?

6. Can you share me your lawyer’s contact as well.

Thanks a lot.

Hello Zul,

Thanks for your kind words.

Here are my non-LHDN/SSM certified thoughts:

1. Salary needs to be distributed based on partnership agreement. I imagine it needs to be paid on a monthly basis.

2. Haven’t seen any restrictions on how many times you can change the agreement.

3. Not sure about this.

4. Tax is 20% on profits. (Not revenue.)

5. It sounds doable, but would I’m not sure on exactly how to do it, and if it would be even worth the effort…

6. I’ll email you my partner’s email who can provide you consultation on LLP agreements.

Hi Mr stingy,

My accountant is unfamiliar with the LLP setup. Would you be able to email me contacts of your accountant and lawyer so that I can get a quote for the agreement and also the tax management portion?

Thank you!

Hey Low,

I’ll email you now.

Hi Mr Stingy,

Would you mind sharing your contact for the tax management portion as well? I assume this would be the tax accountant.

Thanks very much

Hi Edwyn,

I’ll email you now. Not really a tax accountant, but a consultant on finance/tax/LLP.

Hi mr stingy, could you please send me your accountant contact to me too?

Thanks

Hi Daeren,

I’ll email you now.

Hi,

Can you send me the quote for the agreement?

Kind regards,

Esther

Hi Esther,

I’ll email you now.

Hey Esther,

I’m unable to contact you via the email address you provided here. Can you send me your correct one? Thanks.

Hi, Thanks for the info. Can i have a sample set of the LLP agreement? Thanks

Hi Rikc,

Unfortunately I don’t have a sample set of the LLP Agreement, but if you’d like a quotation for someone to help you draft the agreement, feel free to email my partner. Thanks!

I have a couple questions and hope you can help to address:

1) I noticed that there need to be at least 2 partners to establish this company. Can this still work if there is only one person which is myself. I will play both roles – the director and the compliance officer.

2) I am planning to use this as an Investment Holding Vehicle for my properties. What kind of problems do you anticipate if I am going to acquire more properties and park these properties under this company? Are there going to be any tax complications if I were to sell these properties in the future? And if I park my car under this company, I believe I can also deduct my petrol & maintenance expenses and entertainment expenses under this company.

3) Say I have 5 properties under this company; how do I assign shares to my two kids? What’s the procedures to follow? And will this be expensive?

3) As for the LLP Agreement, does it mean that each time we make changes to the remuneration the LLP agreement will need to be amended? And the cost will be similar to when we first create the LLP agreement? Or we can just change it ourselves

Thanks.

Hello Yong,

1. Nope, an LLP needs at least 2 partners.

2. Here are some factors to consider: RPGT for companies, which may be higher than for individuals. Whether the banks would offer financing (assuming you’re buying the properties using loans) to your LLP. Profits from your LLP would also be taxed at corporate income tax rates.

3. LLPs do not have shares. However they have percentage of ownership as specified in the LLP agreement. Yes, every time you make changes to remuneration, the LLP agreement would need to be amended. Assuming the changes are not too difficult, I imagine you’d be able to do it yourself.

Hi,

Found your article to be very useful and informative.

Would like to check with you is LLP required to register with LHDN?

What is the procedure? Can i just register via the link here:

http://edaftar.hasil.gov.my/dafc.php#

Hi Tiffany,

From my reading online, it appears that E-daftar is only for individuals and corporations (Sdn. Bhd.) I believe that LLPs need to physically go to LHDN and submit their registrations there, using the form below:

http://lampiran.hasil.gov.my/pdf/pdfborang/Borang_Daftar_PerkongsianLiabilitiTerhad_1.pdf

i have problem. after my successful registration in the LLP website, i login and search my desire company name and try to reserve but can’t find the reserve button… Not sure what’s the problem. DO i need to go to SSM personally?

TIA

Hi Carol,

Sorry for the late reply. Did you register as a “verified user” (instead of “general user”)? You’ll need to do that, then get verified at a nearby SSM office — before you can proceed with LLP registration.

Hi Mr-Stingy,

1. Can I register 2 LLP in 1 single user (MyLLP system)??? 1st gonna be for my online business (new), 2nd gonna be for my farming business (upgrade from enterprise to LLP)

2. I’ve check with maybank this morning and realize that they didn’t provide online banking service for LLP which bring me to your this brilliant blog. Through out reading ur blog I notice that CIMB and some foreign banks provide online service for LLP but also notice the service is costly. How much does it cost for LLP & enterprise??? Which bank is the best for online banking service for LLP.

Thank you for your essential guidelines here. Really really appreciate.

Hi Jaziemin,

1. I’m pretty sure you can register as many LLPs as you want.

2. Yeah, unfortunately Maybank still doesn’t provide online banking for LLPs. I’mm not sure which is the best bank for online banking service, but you can try checking out these few banks and compare? CIMB, RHB, Public Bank, and the foreign banks (e.g. HongLeong, UOB, OCBC…)

All the best ahead for your business!

Nice blog, I’m also am a fan of MMM.

I set up my LLP bank account with Public Bank easily enough. I can do most stuff online with them. Can’t get a credit card as yet, you need to be with them for a couple of years before they will consider you for one.

Thanks Andy,

I’m hearing a lot of good things about Public Bank. Hope you’ll be back for more articles!

Hi, thanks for your post. I am in the midst of looking for options to get my LLP agreement drafted. I see you’ve emailed the contact you have for drafting this. Could you kindly send me the info of this contact as well, please?

Hey Esjtc,

Let me email you right now.

Hi, thanks very much for your post, it was really helpful. Could I please check if you get a Form 9,24 and 49 with an LLP?

Hi Mrs P,

Form 9, 24 and 49 seem to be forms for Sdn. Bhd. companies. LLPs use other types of certificates.

Hi Mr-Stingy,

Could you email me the contacts of your accountant and lawyer for the LLP agreement and also the tax management quotation?

Hey Tess,

I’ll send you an email now.

Hi Mr. Stingy. Thanks for the great blog on LLP. I would like to enquire whether the first basis period for LLP tax purpose can be longer than 12 months. If yes, what is the maximum period allowed for the first basis period? In addition, do you know the procedure for the voluntarily winding up of an LLP? Also, can I have contact details of someone competent in LLP tax matters who charges reasonable fees. Thanks.

Hey Joshua,

The first basis period for LLP can be longer than 12 months. I think you have up to 18 months (which is also the maximum amount of time you have to do the first LLP Annual Declaration with SSM). I’ve not done any winding up of an LLP myself, but the process described in the LLP Act seems quite straightforward.

For LLP tax — let me email you a contact.

All the best!

Hi Mr.Stingy,

Thank you for the useful article.

Can I also have the contact for LLP tax consultation & partnership agreement?

Thanks!

Hi Eric,

Thanks. I’ll email you now.

For the accounting and book keeping purposes in an LLP, would you think it would suffice to do the accounting on our own or is it necessary to engage an accountant?

Hi Joyce,