I invest in Bitcoin because I think it’s the opportunity of our lifetime: like if you could invest in the Internet or buy a success story like Amazon 23 years ago.

Yes, there’s risk, but your potential losses are limited to however much you’ve invested. On the other hand, it has potential to go up a lot more. That’s asymmetric risk.

A pro investor would say, “Wait! As long as you’re not investing on leverage, that’s true for any moonshot investment.”

Conceptually true, except Bitcoin has several unique features. It’s unlike any other asset today. Why? Let’s look at “Why Invest in Bitcoin?” from an investor’s lens. I’m gonna assume you don’t care about how Bitcoin works, the mind-blowing science behind Blockchain, and why philosophically decentralization is changing the world.

Instead, all we’ll cover today is: “Will it make me money?”

Here’s seven important angles on why investing in Bitcoin might make sense for you:

1. The Inflation Hedge-Digital Gold Angle

With the coronavirus crash this year, central banks around the world have “printed” record amounts of money to rescue the economy.

Let’s consider the USA, the #1 economy in the world. At the start of 2020, the US central bank’s (the Federal Reserve’s) balance sheet was 4.1 trillion USD. As of 18 November 2020, it has added 3.1 trillion of “new money,” reaching a total balance of 7.2 trillion USD.

For context: before the financial crisis of 2008, the Federal Reserve balance sheet had never even reached 1 trillion USD. That’s an insane 8x growth over the past 12 years. And it’s not stopping — central banks are expected to continue aggressive money creation over the coming years.

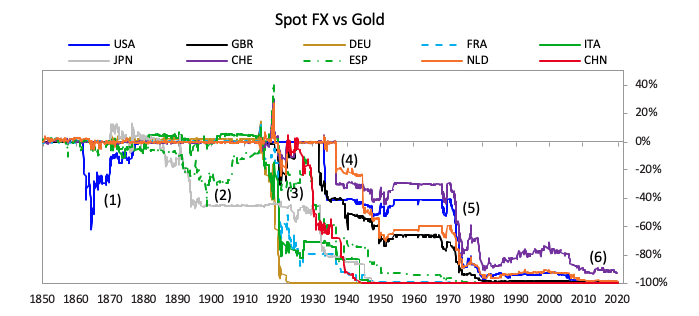

Conventional economics says when there’s an oversupply of something, its value drops a.k.a. inflation. Indeed, Ray Dalio recently presented that over the past 100 years vs gold, most major currencies (including USD, GBR and JPY) have lost >90% of their value.

Yes gold. Historically investors’ choice when it comes to inflation protection. But increasingly in recent times, more and more people have turned to Bitcoin, seeing it as “digital gold.”

The reason? Bitcoin’s maximum supply is limited to 21 million, and the rate at which new Bitcoin is created (inflation rate) is predictable. Today, Bitcoin’s inflation rate (~1.8%) is slightly above gold’s rate (~1.5%). But in four years’ time it’ll fall to ~1.1% — surpassing gold and making Bitcoin one of the most (if not the most) scarce high-demand assets in the world.

Furthermore, Bitcoin’s ledger — Blockchain if we’re being technical — is fully transparent for anyone to audit. Bitcoin looks similar to digital gold. But it’s much easier to certify, trace, store, send and receive.

2. The Currency Devaluation Angle

Circling back to currencies losing value, here’s a related angle to consider.

So far we’ve been talking about the global reserve currency: US dollars. But for those of us living in developing countries, when was the last time your currency gained against the USD? I grew up comfortable with 1 USD = 2.5 Malaysian ringgit. Over the past 25 years, I’ve watched it fall to 1 USD = 4.09 MYR today.

I wouldn’t mind if the dollar loses value and my home currency gains. But if the dollar loses and the ringgit loses further, then I’m really fucked.

Bitcoin is currently valued at 17.88K USD/BTC. That’s the way most mainstream media reports it. So in US dollar terms, Bitcoin is 10% down from its all-time highs of 19.78K USD. But throw in the home currency devaluation angle, and you’ll find something interesting:

Bitcoin has already reached all-time highs in seven developing countries measured in local currency: Brazil, Turkey, Argentina, Sudan, Angola, Venezuela and Zambia.

I really hope my currency doesn’t keep dropping vs the US dollar. I really hope our economies will be strong and our people will prosper. But if it happens as it’s happened before, I want to protect the value of my money by keeping it somewhere strong.

Source: Ray Dalio LinkedIn

3. The Low Correlation-Asset Diversification Angle

Nobel Prize winner Harry Markowitz popularized the concept of diversification to manage risk. In simple words, investors can reduce their overall risk by investing in more than one thing — the investing world’s version of “don’t keep all your eggs in one basket.”

Key to diversification is buying assets which have low correlations with each other. Meaning they behave differently when it comes to returns. You need low correlation because in bad times, you don’t want all your assets to crash together.

Perhaps the most famous application of this theory is the 60/40 portfolio: 60% of your investments in the stock market, and 40% in bonds. During recessions when the stock market goes down, your bonds are supposed to maintain performance and protect you.

In recent years however, people are increasingly questioning their allocations to bonds. Why? Global economic conditions have made it so that bonds in most developed countries are returning close to 0%, if not 0%. Some bonds even have negative interest rates.

This isn’t to say traditional investors are ditching bonds and dumping all their money into Bitcoin. But in this non-traditional world of negative interest rates, people have started questioning if they should tweak their traditional portfolios.

Does it make sense to still 60/40 today? What about 60% Stocks, 39% Bonds and 1% to an alternative asset like Bitcoin? What about 2% or 3% in alternative assets? For some simulation results, read on in the next section.

Remember that oh-so-sexy feature of low correlation for diversification? Bitcoin is king of that right now. This research paper shows Bitcoin having low correlation with basically everything (including the US stock market, bonds, gold, oil, and even Tesla) over the past 10 years.

If you’re thinking about diversifying into an asset which is independent of everything else today, you’ve gotta consider Bitcoin.

4. The Historical Performance-Sharpe Ratio Angle

Ready for some numbers? Everyone knows if you’d bought tons of Bitcoin in 2013 at 100 USD, you’d have 175x-ed your money and become a millionaire. Cool story bro, but not very useful.

But what if you’d bought in more recent times, like immediately before the Bitcoin crash in 2018, and invested just a bit? Would it still be worth it?

For this, I’m quoting (lightly edited) from a recent Bitwise Investments paper where they simulated the effects of adding 1-10% of Bitcoin to a traditional 60/40 portfolio. Some fascinating results:

What would have happened if you had started on December 16, 2017, when Bitcoin hit its all-time high daily closing price of $19,397, and held through the end of our study period on March 31, 2020?

That’s a punishing 66.6% decline for Bitcoin.

Interestingly, even under such an adverse scenario, a quarterly rebalanced allocation to Bitcoin would have delivered a slight, but nonetheless positive, impact on both the cumulative and risk-adjusted returns of a Traditional Portfolio.

For example, a 2.5% allocation to Bitcoin would have increased the cumulative return of a Traditional Portfolio by 0.6 percentage points and expanded its Sharpe ratio by 0.2 points.

Yes, even if you had the worst timing in the world, tweaking a 60/40 plan to include a little Bitcoin had a positive effect.

But what if your timing had been better? If you have time, please read the entire paper for other scenarios, but otherwise, here are highlights:

- As long as you’d held for >3 years, and rebalanced quarterly, adding Bitcoin had a positive effect for ALL scenarios.

- On average, a quarterly-rebalanced, 2.5% allocation to Bitcoin boosted returns by 15.9% (cumulative over 3 years).

- From a risk-reward perspective considering the Sharpe Ratio, a 3-4% allocation to Bitcoin seems reasonable.

Remind Me of the Sharpe Ratio Again?

The Sharpe Ratio measures the performance of an asset against its volatility. Higher numbers are better — meaning you get better performance for less risk.

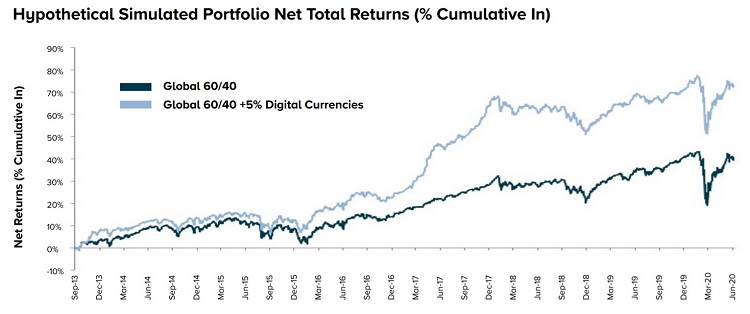

Another paper (yes I’m on a roll) from Grayscale Investments also simulated the effects of adding Bitcoin into a traditional 60/40 portfolio from September 2013 to June 2020.

Different methodology, but again, really positive results:

- 1% allocation to Bitcoin boosted annual returns by 1.1%, and the Sharpe Ratio by 0.10

- 3% allocation to Bitcoin boosted annual returns by 3.2%, and the Sharpe Ratio by 0.28

- 5% allocation to Bitcoin boosted annual returns by 5.3%, and the Sharpe Ratio by 0.44

By adding a little Bitcoin, investors would have outperformed traditional portfolios, and in the case of the 5% allocation, almost doubled their annual returns (from 6.2% to 11.6%) and Sharpe Ratio (from 0.52 to 0.96).

Yes, of course past performance doesn’t guarantee future returns. But it’s a piece of the puzzle that’s becoming harder and harder to ignore as Bitcoin continues soaring.

5. The User Adoption-New Metrics Angle

Perhaps the biggest struggle many investing pros have with Bitcoin is fundamentals. The argument is usually some variation of: “I can understand the value of a stock because I’m buying a piece of a business, but what am I getting if I buy Bitcoin? It’s not even real!”

The trick to understanding Bitcoin is realizing it doesn’t fit neatly into the description of any asset we’ve had before.

So while some might say Bitcoin is a commodity, when was the last time you heard of someone sending virtual wheat to pay someone on the other side of the world? Or if you say Bitcoin is digital cash, when was the last time you heard of a digital cash appreciating 5,223% over the past five years?

I’m not interested to define what Bitcoin is here. My point is you can’t fit Bitcoin neatly into any framework we’ve ever had. Hence, if you try to use a valuation method for something else (e.g. P/E ratio for stocks) on Bitcoin, you’ll struggle.

What valuation method should we use for Bitcoin then? How do we know it’s valuable? For that, let’s consider several new angles for valuing a digital asset:

Valuing Bitcoin: Supply

- Scarcity. Bitcoin’s lifetime supply is limited to 21 million bitcoin (BTC) and predictable. 18.5 million BTC have already been issued.

- Competition: How do we know other cryptocurrencies won’t get created and destroy the scarcity of Bitcoin? In actual fact, there are already thousands of newer cryptocurrencies, and many clones of Bitcoin. But nothing has been able to challenge Bitcoin’s dominance.

It’s like the world of normal currencies and the 80/20 rule: Just because some country decides to issue a new currency, what are the odds people will ditch established currencies like USD and EUR and use that new one instead?

- Security: Bitcoin’s algorithm is completely transparent, public and open source — meaning anyone with a computer and the Internet can check to see everything is working perfectly. Tens of thousands of computers around the world verify this 24/7.

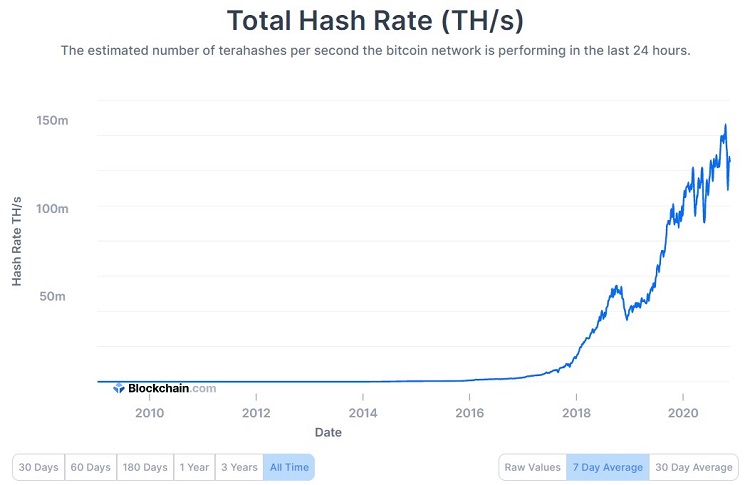

Hash Rate is a metric which shows how much processing power Bitcoin has. You can see below how it’s grown and reached all-time highs in 2020, as more and more people get involved in producing and securing Bitcoin.

Anything scarce with increasing demand will increase in value. So let’s now examine how Bitcoin’s demand has been growing.

Valuing Bitcoin: Demand

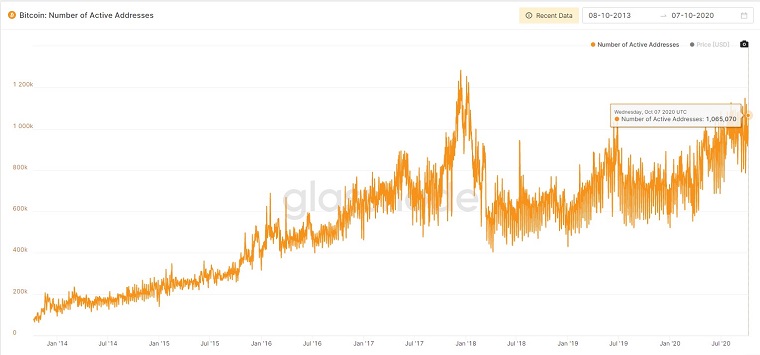

- Usage: Because Bitcoin transactions are public, it’s possible to see how many addresses are actively moving Bitcoin, and use this as a proxy for “how many people use Bitcoin every day?”

Daily Active Addresses have increased from <100,000 to >1,000,000 over the past seven years.

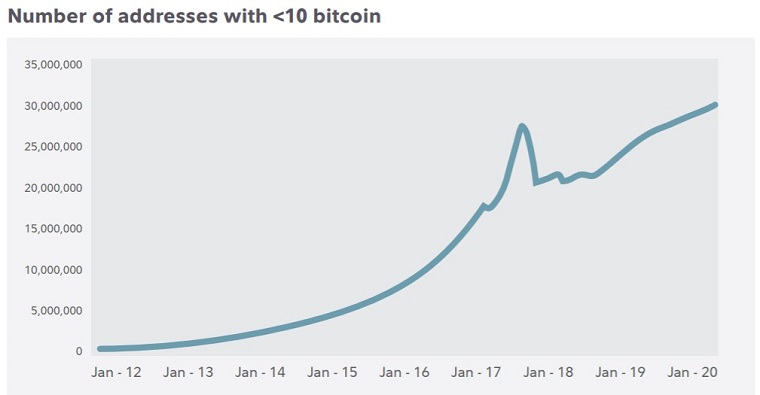

- Retail Demand: Who are these people using Bitcoin? Are they a small bunch of rich drug lords trading black money? Well, because the Blockchain is transparent, we can also see the amount of Bitcoin held in addresses.

Here’s one method suggested by Fidelity Investments to estimate how popular Bitcoin is with individuals: the number of Bitcoin addresses holding less than 10 bitcoins. This has also grown rapidly, reaching an all-time high of ~30 million in 2020.

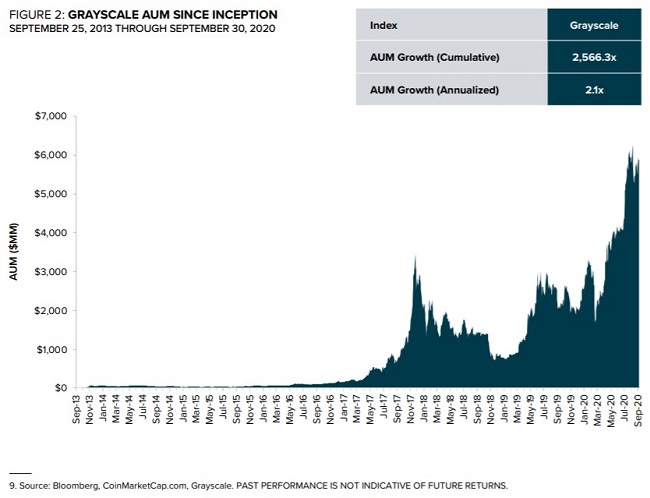

- Institutional Demand: Another common criticism of Bitcoin is, “It’s only individual speculators who’re gambling.” I’ve got good news: institutions are getting into the game too.

Grayscale Investments is the world’s largest digital currency asset manager. Because many institutions (by law) cannot buy crypto directly, they rely on an asset manager like Grayscale. As such, Grayscale’s assets under management (AUM) can be used to gauge institutional interest in Bitcoin.

What a success story that’s been. Grayscale recently announced they had crossed 10.8 billion USD in AUM — with inflows of >1 billion USD in Quarter 3 2020 alone.

Making Sense of (Tech?) Metrics

If some of the above metrics remind you of how tech companies justify crazy valuations (e.g. Active Users), you’d be right. One helpful analogy to deal with the discomfort of valuing Bitcoin is to think about a tech startup.

Consider a success story like Amazon. If you’d looked at Amazon in 1999, you might have passed because traditional valuations said Yahoo! was better. Look where we’re at today, with Amazon being a trillion-dollar company, and Yahoo! recently sold for below five billion.

This isn’t to say the tech startup/growth stock angle is the way to value Bitcoin. It’s just another angle to consider. Cryptocurrencies have been around for just over 10 years, so valuing them isn’t an exact science.

(Though you also have to consider: say, with all the material around valuing stocks over decades, would you consider stock valuations an exact science? Is not anything traded on public markets driven by market sentiment?)

Last note about valuation: I’ve just covered a few metrics I can easily explain myself. If you’re open to new ways of valuing things, feel free to dive into tons of other advanced metrics at sources like: Coin Metrics, Glassnode and Willy Woo.

“Buying Bitcoin is like investing with Steve Jobs and Apple or investing in Google early.”

– Paul Tudor Jones –

6. The Asymmetric Opportunity Angle

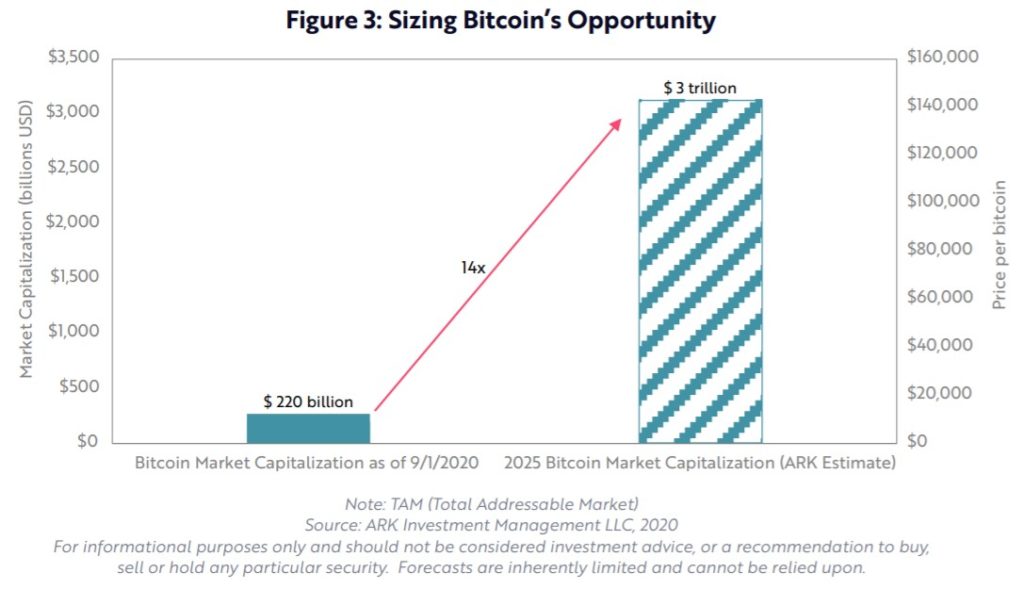

How high could Bitcoin go? How big is the opportunity?

For this, I refer to three angles covered in this excellent ARK Invest paper:

- Bitcoin as digital gold: Research has shown investors (especially younger ones) are increasingly choosing Bitcoin over gold. The total value of physical gold in the world is an estimated 9 trillion USD.

If Bitcoin were to capture 10% of this, that would imply a price of 1 BTC = 42,500 USD.

- Bitcoin as a settlement network: Because Bitcoin can securely transfer large amounts over large distances at low cost, it could be used by institutions for settlement instead of traditional methods.

If Bitcoin were to capture just 10% of the USA settlement volumes between banks, that would imply a price of 1 BTC = 75,000 USD.

- Bitcoin as an alternative currency in emerging markets: Conservatively, let’s say Bitcoin never competes with established currencies like the US dollar, Japanese yen, Chinese yuan and the Euro. Let’s say Bitcoin only catches on in emerging markets — as we’ve already seen in countries like Ukraine, Russia and Venezuela.

If Bitcoin were to capture just 5% of “global money” (apart from USD, JPY, CNY and EUR), that would imply a price of 1 BTC = 115,000 USD.

The really interesting thing? Because Bitcoin is so unique, it could potentially find success in all three angles above. What’s more, it could also find success in other use cases (e.g. seizure-resistant asset, international remittance, global reserve currency) that I haven’t even attempted to cover.

Sometimes when people speak to me about Bitcoin, they give me a list of objections, followed by “Uhm… what do you think about XYZ coin though?”

If the question is really, “Bitcoin is already so expensive, surely it cannot go up 10x anymore right?”

Yes, it can.

7. The Who Else Is in Bitcoin Angle

Interesting fact: for most of Bitcoin’s history, it wasn’t reputable names buying in. It was mostly retail investors, the average guy on the street. Wall Street would call this “dumb money.”

In recent months, this has changed. Perhaps the pivotal moment was when legendary macro investor Paul Tudor Jones revealed he owned Bitcoin in May 2020, saying it reminded him of gold in the 1970s.

Since then, a stunning list of “smart money” billionaire investors have publicly endorsed it, including:

- Bill Miller, whose mutual fund once outperformed the S&P 500 15 years in a row

- Stan Druckenmiller, who famously bet (and won) against the Bank of England with George Soros

There’s also a growing list of publicly-traded corporations who now own Bitcoin, including:

- Square, Inc. (50 million USD)

- Microstrategy Inc. (425 million USD)

- Galaxy Digital Holdings (134 million USD)

And an eyebrow-raising list of “traditional” companies getting involved with Bitcoin, including:

I left this point for last since I don’t think peer pressure is a great reason for investing. But when the data shows such seismic shifts, it’s worth asking “Why are all these big names making these moves?”

And with governments continuing to build regulations around Bitcoin (not banning it like how many once feared), it’s also worth asking: “Does Bitcoin have a place in my investment portfolio today? How much?”

Conclusion

I believe Bitcoin is one of the greatest asymmetric opportunities today, so I’ve personally invested ~5% of my net worth in Bitcoin.

Should you invest in Bitcoin?

Ultimately, it’s your decision. Investing is a deeply personal thing, and you should only ever invest in things you’re comfortable with. Take your time to explore, do your own research, and speak with a trusted advisor if you can.

What I hoped to achieve here is to give you additional perspectives about Bitcoin you might have struggled to find yourself. I’ve also tried to take concepts found in the investment analysis world and explain them in layman’s language.

If I’ve got you thinking, we’ve succeeded.

– – –

If you’re ready to start investing in Bitcoin, the best platform is Luno — where I work. Use my code MRLUNO to get additional RM 50 when you Instant Buy RM 500 of Bitcoin (for new Luno customers).

Further Reading & References

Other Bitcoin articles I’ve written:

- I First Bought Bitcoin at $567. Yesterday it Was $8000. This Is My Story (2017)

- Why I Believe in Bitcoin (2020)

Research papers on the investment case for Bitcoin. I heavily referenced these:

- Fidelity Digital Assets “Bitcoin’s Role As An Alternative Investment“

- Fidelity Digital Assets “Bitcoin Investment Thesis“

- Bloomberg “Bitcoin Trend, Adding Zeros“

- Grayscale Investments “Financial Advisors Toolkit“

- Grayscale Investments “Valuing Bitcoin“

- Ark Invest Coin Metrics “Bitcoin As An Investment“

- Bitwise Investments “The Case for Bitcoin in an Institutional Portfolio”

Articles to address common criticisms against Bitcoin:

- Fidelity Digital Assets “Addressing Persistent Bitcoin Criticisms“

- Lyn Alden “7 Misconceptions About Bitcoin“

Finally, the article that convinced me about Bitcoin’s potential returns:

- Vijay Boyapati “The Bullish Cash for Bitcoin“

– – –

Cool Article and lots of research, thanks.

I guess my only objection to Cryptocurrencies in the current form is that it is deflationary and anti-newcomers. Imagine children being born many years later and their parents did not pass down bitcoins as inheritance. It would create a great wealth inequality in favor of old timers. As per compounding rules, the wealth gap will then widen.

I do have some bitcoin as a hedge against that possibility, but I hope for new generation’s sake that it wouldn’t be so… But I guess it will only encourage current generation people to not miss out on it…

Thanks for the comment Heng.

Appreciate it, and haven’t considered this angle myself. Perhaps because I think we’re still SO early that’s why this hasn’t crossed my mind. Will need to do some further thinking about this one…