Gabe Plotkin — the founder of hedge fund Melvin Capital — lost $460 million in January 2021.

Hedge fund managers lose money all the time — it’s the nature of trading. But what happened here was unprecedented: An army of retail (a.k.a. normal people) traders, connected mostly via Reddit pushed the price of GameStop stock to astronomical levels.

Companies like Gabe Plotkin’s Melvin Capital — who were betting GameStop would go down — lost huge amounts of money. David vs Goliath. Usually on Wall Street, Goliath kills David. Here, David won.

For an entertaining take, check out Netflix’s 2022 documentary “Eat the Rich: The GameStop Saga.”

Ask the mob, and you’ll get a feeling of justice when rich people lose money. “You mad bro?”

In reality, Mr. Gabe is doing just fine.

Public reports say he personally took home $300 million in 2017 and $846 million in 2020.

You almost have to ask: What kind of career can get you almost a billion in a year, but lose you hundreds of millions in the next?

That’s the world of hedge funds baby.

Win big. Lose big.

Range of Outcomes: What Goes up Can Come Down

Many other things work this way.

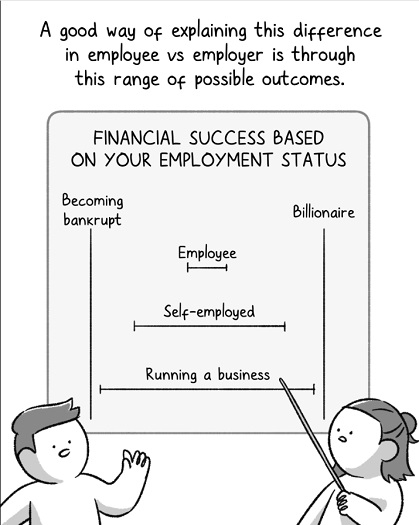

How big you can potentially win is influenced by how big you can potentially lose. One way to understand this is analyzing the “range of outcomes.”

The Woke Salaryman‘s visual is the best I’ve ever seen to explain this:

I love this image because there’s so much said here.

Which salaried employee hasn’t been tempted by stories of how someone threw off their corporate handcuffs and found freedom by launching their own thing?

“Fire your boss. Get rich. Live free.”

It’s everywhere on social media. Usually accompanied by “Buy my course!”

Of course, these inspirational posts typically don’t talk about the large number of struggling ventures, whose owners must have at some point asked, “Should I have just stayed in my job?”

The point isn’t whether getting a job or starting your own thing is better. It’s taking a realistic look at what kind of results you might get.

Win Small, Lose Small

On the other hand, working a salaried job isn’t perfect either. Let’s assume you’re a mid-level employee in an average multinational corporation (MNC).

You have job stability, 18 days paid leave, medical insurance, and a regular income. You have prestige — when your parents talk about you, everyone acknowledges you’re doing well. Even at the very worst, if you lose your job, you can probably find one at another MNC.

What you don’t have is a right to the profits when the company does well. Your upside is limited to salary and bonuses. Maybe some stock options if you’re lucky. At best, you’ll earn millions over your career.

But you’ll never be a billionaire.

By choosing this path, you’re giving up the potential for huge riches for the stability of full-time employment.

Win small, lose small.

Again, nothing wrong with choosing either path. The older I get, the more I feel entrepreneurship and its sacrifices isn’t right for most people. Most people just wanna do a good job at work, have a nice lunch with colleagues, then go home on time to family.

The Upside and Downside of Everything

What other things work along the Win Big, Lose Big; Win Small, Lose Small principle?

It explains:

- How even billionaires can go bankrupt.

- Why a large corporation can give you a comprehensive career ladder. Great for seeing where you might go next; not-so-great if you’re looking to skip levels to the top.

- On the other hand, why you’ll learn more and get promoted faster in a high-risk startup.

- How investing small amounts of money is great for the long term, but the returns feel miserable if you check your account every month.

- How investing large amounts of money in speculative assets can quickly make you rich, but also crush you when the market crashes.

- Why the person you love the most can hurt you the most.

Knowing the above, what are some reasonable actions to take?

Protect the Downside, Aim for the Upside

Stay or Look for a New Job?

“Know what you’ll be like in five years? Look at someone who’s spent five years in this company.”

A mentor once told me this, when I was considering career options. Yes, there’ll always be variance in outcomes, but looking at the “average scenario” can give you an idea.

If your industry pays a low median salary, what’s stopping you from joining an industry where they pay a higher median?

On the flip side, remember not to just look at upside — fancy titles and big money. Consider the downside too — what kind of sacrifices does this career path require?

There’ll always be a sacrifice.

Launching Your Dream Business

One approach to launching your dream business is running it on the side — in the evenings and weekends — while you still perform at your day job.

This way, you’ll still have a regular income, even if your dream business doesn’t work out after years of trying.

When should you quit your day job and go all-in?

I’ve heard some entrepreneurs say only when you’re making double your day job’s salary. Not as inspiring as what you see in the movies, but perhaps a realistic approach for people who don’t have tons of money in the bank or a rich family.

High-Risk Investing

Having worked full-time in crypto for more than five years, I’ve seen firsthand how some people get rich quickly, only to lose it all in a market crash.

It’s a bit of a conundrum — you want the big gains, but you don’t want to lose money either. How does a responsible investor think about higher-risk investments? I started with crypto, but you can apply the same thinking to equity crowdfunding, penny stocks, or your friend’s new restaurant.

My take: I like to limit high-risk investments to a small percentage (<10%) of my net worth.

Hopefully they go 10x and double my net worth. But even if things go to zero, I can shrug off the loss and move on with life.

I don’t know what that percentage should be for your portfolio — maybe it’s 1%, 3%, or 5%. Maybe it’s 15%. (Talk to a financial adviser if you’re doubtful.)

But how you feel should give you a hint: If you’re constantly worried about it, you’re probably over-invested.

Surprise Outcomes

You can apply range out outcomes thinking to many other things. Investing in stocks vs bonds. Whether to take an MBA or not. Joining America’s Got Talent.

Regardless of careful planning though, wild things happen in the real world. There’ll be exceptions. Not only hedge fund managers make millions quickly. People win the lottery.

Carefully considering the range of outcomes doesn’t mean you’ll never be surprised.

But if you plan well, at least your surprises will tend to be pleasant.

– – –

Pics from Pexels: Sharon Wahrmund & The Woke Salaryman

“But if you plan well, at least your surprises will tend to be pleasant.” honestly one of the most reassuring closers I’ve read so far in a finance post or blog!

Thanks so much for your kind words Ethan!