The average NBA basketball player will make 25 million dollars over their playing career.

This comes from a playing career of ~5 years and an average salary of ~USD 5 million a year. Unlike timeless superstars like Jordan, Kobe or LeBron, most basketball players — or athletes for that matter — don’t actually play at the highest level for long.

Still, 25 million is pretty good. Sports writers call this “lifetime earnings.” I used to think it was a sports thing, though I’ve since learned that lifetime earnings is a concept in economics.

Recently, while doing my tax returns, I was reminded how small amounts of monthly expenses can lead to a large yearly amount. Maybe it’s some form of recency bias: you might feel pain spending money on a weekly basis, but you probably don’t realize how big the amount gets every year.

It made me think of an experiment: what if I looked back at my entire history of earnings and expenses? What would the story of my lifetime earnings and spending tell me?

Here’s what I discovered and the lessons I learned:

Calculating Lifetime Earnings and Spending

Estimating your lifetime earnings should be pretty easy, especially if you’ve kept track of your income over the years.

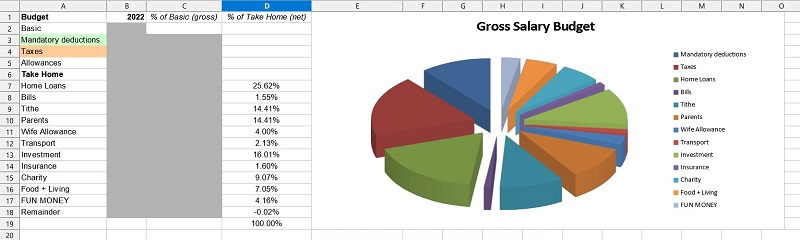

For me, it was looking through all the budgeting sheets I’ve created over my 16-year career. Another more-accurate way: go through your yearly income tax statements.

Lifetime spending was harder.

Depending on how detailed you wanna be, you could spend months looking through bank statements. But as I was doing this, I reminded myself I wasn’t looking for exact amounts. No prizes for 100% accuracy. Rather, just estimates on how I’ve spent my money over the years.

I’ve always used a percentage-based budget. Hence, my source of truth was again my monthly budgeting sheets.

Surprising Things From My Data

Lifetime Earnings: RM x,xxx,xxx

(Note: RM 1 = USD 0.23)

- Seven figures.

- I actually had no idea about my lifetime earnings before this. I mean, I knew it would be a large amount, but if you’d asked me to guess, I’d probably have been off.

- (Also, if you’d told me I’d make seven figures over my career when I was 23 years old, I might have laughed you out of the room.)

- I’m comfortable sharing this now because I’ve been working for a long time. Seven figures is a big number, but average it out over 16 years, and it’s actually not terrifying.

For example, let’s say my lifetime earnings = RM 1.2 million

RM 1.2 million / 16 years / 12 months = RM 6,250 / month - For context, RM 6,250/month is right in the middle of “middle-class” household income in Malaysia, where I live.

- Numbers exclude gains from investments. These are purely earnings from my day job. More on investment gains later.

Lifetime Spending

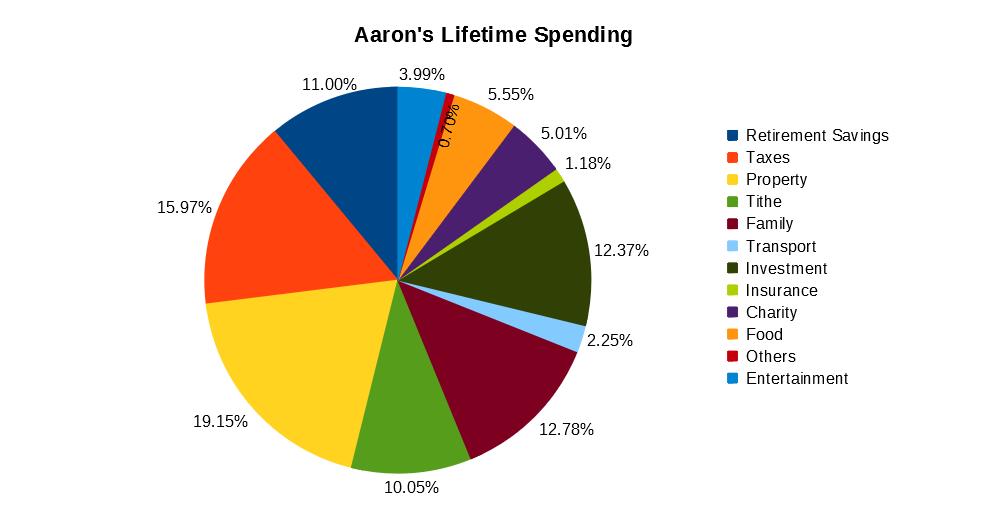

Instead of giving you detailed numbers, I thought showing a pie chart would be better.

Here’s how I’ve spent money over my entire career:

- Initial thought: “The amount of money I’ve saved/invested is meh.”

- But thinking further: 11% (mandatory retirement savings in Malaysia) + 12% (mandatory employer contribution) + 12.37% (investment) = 35%. Nothing a FIRE-advocate would be impressed with, but not too bad I guess.

- Like most people, I’ve spent the most money on home (rental/loan)-related costs.

- Unlike most people, I’ve spent an uncommonly low amount on transportation (2.25%) and food (5.55%). You can credit this to the stingy in me: like driving a basic second-hand car and (apart from date night) not splurging on food.

- Things I’m proud of:

- How much I’ve given to my family.

- How I listened to mom and paid my tithes.

- Giving 5% to charity. Hopefully I can push this much higher someday.

Lifetime Assets

Lifetime earnings and spending tell you one part of the story.

For the other, I compared my findings to my personal balance sheet. Did I accumulate good assets over my career?

Here’s what I found:

- Despite going up 31% over the last 10 years, the value of my condo is only slightly above my lifetime home-related costs. You know what they say about hidden costs with property? True.

- My investments today are ~79% higher than everything I’ve put in. Take out my crypto investments though, and I’m barely break even.

- I’ve been lucky with crypto, but objectively, I’ve not done well investing my own money.

- Thankfully, my EPF retirement savings today are roughly 3x what I’ve ever contributed. (i.e. If I put in RM 100K, it’s now RM 300K).

- How? A big part of it is employers’ contributions, which is mandatory for Malaysian employers. I put in 11% of my salary, the company puts in 12%. The rest? Dividends over 16 years. Perhaps the smartest thing I’ve done is leaving this money mostly untouched.

I’m not financially independent yet, but I’m on a good path. I’m happy. Some of the most boring pieces of advice — live below your means, keep your ego in check, don’t focus on getting rich fast — are a lot more wise than I could have ever imagined.

Some closing thoughts:

Lifetime Lessons Learned

- The total amount of money you’ve earned is likely surprising — in a good way. If you’ve been working for more than five years, I bet you’re already into six figures. Many of you are on track to make at least a million in lifetime earnings.

Don’t doubt your ability to achieve big things.

- A percentage in your monthly budget (e.g. 10%) might feel small. But seeing a large total $$$ number that’s accumulated over the years feels huge.

(BTW this is how some “gurus” try to guilt-trip you into giving up your coffee. 🤷)

- One fun thing to do is look at average lifetime earnings by career. If you’re considering a career change to make more money, this tells you how much you might earn on average. (p.s. It’s why your mother wanted you to become a doctor.)

- When I was younger, I dreamed of being a footballer. Like we discussed, being a pro athlete can make you a lot of money in a short time. With short careers though, you can see why even famous athletes can go bankrupt. Going from a large amount of income to much less is hard.

- It’s popular to shit on “relying on a paycheck” nowadays — especially among the “be your own boss” crowd. But are most people financially savvy enough to manage irregular amounts of income with unpredictable timing? From what I’ve read and discussed with self-employed friends, it’s not easy. If you’re happily employed, having a regular salary is also something to be grateful for.

- You might think you’re a hotshot investor. I certainly thought I was. But once you’ve been investing for more than a couple of years, looking at your track record can tell you. If you’re not even beating a passive index fund (~10% a year), perhaps it’s time to reconsider your strategy?

- What does your lifetime spending say about your past? What have you prioritized in life so far?

- What do your current earnings and spending predict about your future?

– – –

Let me know in the comments if you want some of the lifetime earnings / lifetime spending / monthly budgeting templates I use.

Another way: Work with a licensed financial adviser to get a holistic view.

For my Malaysian friends, feel free to refer to my article: My Experience With a Licensed Financial Planner in Malaysia (includes details on fees plus a FREE consultation session with Wealth Vantage Advisory).

Pic from Pixabay

Thanks for the reply. If I want to invest in US S&P500 ETFs, apart from robo- advisors, what is the best platform in your opinion?

Probably one of the online discount brokers like iFast or RakutenTrade (assuming you’re writing in from Malaysia)

Hi, want to know if you have considered investing in S&P500. If not, why?

Hi V,

Yups I have. I don’t invest directly into it myself, but my investment portfolio decisions nowadays are guided by my financial advisers. Further context here: https://www.mr-stingy.com/investment-portfolio-financial-adviser-2021/

Like. Good original article.

Thanks sir