I recently had the pleasure of finishing Sam Dogen’s latest book: “Buy This, Not That.”

More popularly known as Financial Samurai, Sam’s been writing his personal finance blog since 2009, reaching over 90 million visitors. I can still remember the 31-year-old me — struggling to find meaning at work — fascinated by his story of escaping Corporate America (and getting a six-figure payout while doing it).

Fast forward seven years: Sam just DHL-ed me a hard copy all the way to Kuala Lumpur. Thanks Sam, it’s an honor!

At a hefty 336 pages, “Buy This, Not That” is a detailed read about the many confusing financial decisions we face in our lives.

Here’s 12 of the most important things I took away from the book:

1. The Various Levels of Financial Independence

Sam’s one of the pioneering figures behind the Financial Independence, Retire Early (FIRE) movement. When I hear about FIRE, the image that comes to mind is frugal living — minimizing costs.

But here’s the thing about Sam. He aims for the good life. And when I say good, I mean good.

In 2018, Sam went viral because of his infamous table of how a 300K USD annual salary was “middle class lifestyle.” It was a budget for a family of four, for some of the most expensive cities in the world (e.g. San Francisco or New York City).

While I’ve never lived in any of the above, it reminded me of how I ditched my original FIRE calculations once I started thinking of having kids. I’m okay skimping on myself, but I’d never want to do that to family.

Today, in the FIRE world, there’s Fat FIRE (the good life), Lean FIRE (the frugal life), and Barista FIRE (working a part-time job). Which should you aim for?

“The beauty of personal finance is there’s no right or wrong way to live your lifestyle. There’s only the way you WANT to live your lifestyle, and the steps you’ll take to get there.”

2. Strategy Is Good but Tactics Move You Forward

Here’s criticism I sometimes get about my writing: “LONGGG articles, but he never tells you how.“

I agree. I focus on strategy and principles, and trust people will figure out exact steps by themselves. However, many times people want tactical advice: “I’m confused, what should I do exactly?”

“Buy This, Not That” shines here. Not sure to:

- Job hop or stay in your current company?

- Rent or buy your home?

- Buy dividend stocks or growth stocks?

- Combine finances with your spouse, or keep separate accounts?

- Marry for money or for love? 🙃

Sam shares no-holds-barred opinions on the above (and more) for different stages of your life.

You might not agree with everything you read. For example, Sam recommends job hopping every few years in your 20s-30s to maximize earnings. I’m more conservative — especially if you work for a good company.

But his points are definitely worth considering.

3. How To Use Benchmarks

Staying on the tactical note, “Buy This, Not That” has targets and benchmarks for everything…

- What percentage of your income to save?

- How much house/car can you afford? (probably not as much as you think)

- How much investments do you need to retire?

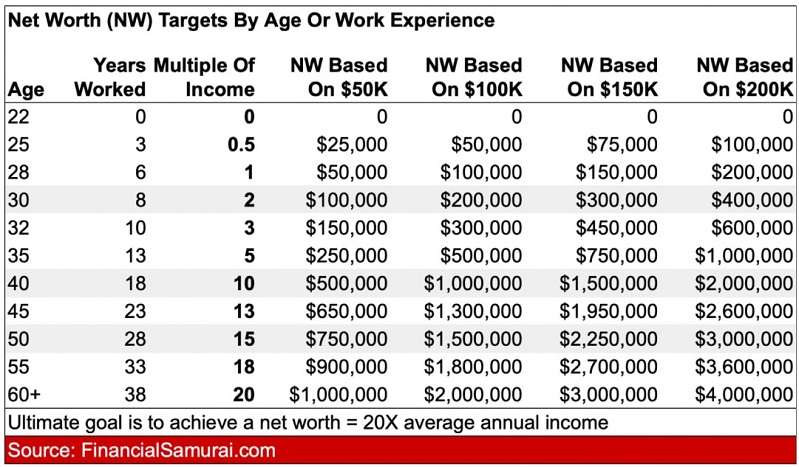

Here’s an example. What should your net worth be by X age?

Reminder: Sam’s an overachiever, so the targets you’ll find are aggressive. If you haven’t reached them, it doesn’t mean you suck.

Put it this way: If you’re an average guy like me, the personal trainers you meet are gonna be much buffer than you. Does that mean you shouldn’t exercise hard even though you’ll never be as buff as Arnold? Nah, it’s not a competition. Look at it as inspiration.

That’s the way you use financial benchmarks.

4. Financial Samurai’s Top #3 Passive Investments

Everyone wants passive income, but is that income really passive? Or is it just another job you’re gonna dread one day?

In “Buy This, Not That,” Sam ranks 8 passive income streams in terms of risk, potential returns, feasibility, liquidity, ease and taxes. I won’t spoil the entire list here, but here’s the Top #3:

3. Physical Real Estate (Properties): A classic way to build wealth, that even your grandparents would approve. The main downsides are liquidity (if you need to sell, can you do it quickly?), and you’ve gotta put in effort for tenants + maintenance issues.

2. Online Real Estate (e.g. REITs): Get the benefits of real estate without the downsides of dealing with shitty tenants and maintenance issues. The main downside is REITs can be more volatile than even the S&P 500. So they might not work as “hedges” against stock market crashes.

1. Dividend Investing: The truest form of passive income. Invest in dividend-paying stocks >> chill >> get paid dividends. The downside is dividend stocks generally don’t return very high rates. So you’ll have to ignore finance bros who just made 100x on the latest meme stock.

On that note, investing in growth stocks is likely better for younger investors (20s-30s). Dividend investing is likely more appropriate for older investors who want stability.

5. Not All Debt Is “Evil”

“When used appropriately, debt can be an extremely useful tool for building wealth.”

A lot of people dream about being debt free, but in reality, the only way most people could ever buy a home is with a loan.

As long as you keep your debt under control — and home loans are the “safest” type of debt — don’t kill yourself to get debt free.

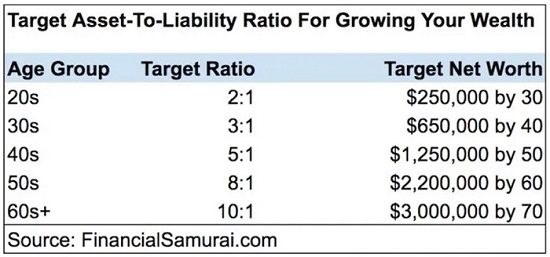

How much debt is appropriate? Consider your asset-to-liability ratio.

Let’s say I have $300,000 in assets and $100,000 in loans (liabilities), that means my asset-to-liability ratio is 3:1. Healthy.

And since we all love benchmarks, here’s Financial Samurai’s target asset-to-liability ratio by age:

6. How To Allocate Your Portfolio

Baseline strategy: Own stocks, bonds and real estate over the long term. Stocks and real estate have historically been terrific beneficiaries of inflation.

Check out the book for three versions of suggested net worth allocation by age. Example: for someone approaching 40 like me, here’s my target allocation:

- Stocks & Bonds: 35%

- Real Estate (including your home): 30%

- Cash: 5%

- Side Hustle: 20%

What about alternative investments like crypto, wine or art? Sam suggests allocating at most 10% of your net worth.

Ultimately, there’s no perfect asset allocation model. It depends on how much risk you’re willing to take. But a good portfolio is well diversified.

After 40, don’t have more than 50% of your net worth in any one asset class.

“Once you’ve built a significant amount of wealth, your goal should tilt more towards capital preservation.”

7. Deciding Where To Stay

Rent or Buy?

Before you’re 30, it’s probably 50-50. Renting provides maximum flexibility, which is crucial at the start of your career.

After 30, it’s likely better to buy your home. You’re wiser, more mature, and have a higher income. You know what you want in life.

Buying gives you a good chance of building wealth — as property prices tend to go up.

Big City or Small Town?

When you’re younger, aim to live where you have opportunities to make big money.

Yes, the world is moving towards remote working. But today, living in a big city still gives you more chances to maximize your earnings.

You can always relocate when you’ve made your money.

Buy Utility, Rent Luxury (BURL)

To optimize your money, aim to buy a practical home. Go ahead and splurge on the Ritz at Bali for holidays. But paying a big premium for your day-to-day home is likely sub-optimal.

This principle works for other large expenses in life:

“…buy the Honda Civic and rent the Ferrari on weekends.”

Your Ideal Family Home

The ideal size per person is about 600-800 square feet. So for a family of four: 2,400 to 3,200 square feet.

Many people downgrade once their kids grow up and move out.

The best time to spend on your “dream home” is when your kids are living with you. Make the most of those ~20 years.

8. Winning the Career Game

Work for Passion or Work for Money?

“Ideally… choose a profession you love that also pays you a lot of money. But if you can’t do what you love, at least do something that pays well.”

As the Asian Parent joke goes: You can either be doctor, lawyer, engineer, or… disgrace.

Jokes aside, I’ve experienced both “work I’m passionate about (but doesn’t pay super well)” and “work that pays well (but I’m not super passionate about).” Without a doubt, work that pays well was much more comfortable. As for passion, I was able to nurture it in my free time.

In fact, while I’m blessed enough to have both (passion + pays well) today, this blog (passion) was started back when I only had (pays well).

What are some industries that pay well? Apart from medicine, law and engineering, consider investment banking, consulting, finance, oil & gas and tech. Check out the book for a longer list + names of multinational companies in each space.

Startup or Big Company?

Your learning will be accelerated at a startup, but you’ll probably make more money working for an established company.

Consider working for a big company when you’re starting out, then only moving to a startup once you’ve built your reputation and experience.

Understand that most startups fail. If you wanna give startup life a try, have realistic expectations.

Other Career Considerations

Job hopping will allow you to maximize your earnings. There’s an implicit cost to being a loyal employee (though you gain other things like seniority and prestige).

Get promoted by both being valuable, and being seen as valuable. Many people ignore the second part because they hate self promotion or think it’s playing politics.

Benchmark: The average time university-educated moms and dads in America spend with their kids is 1-2 hours/day. Because of how important family is, childcare-related benefits from employers are precious.

Most people think there’s only two ways to leave a job: resign or get fired. There’s another: negotiate a severance package. (Inspired by Sam, I tried to do this once in my career, but failed because I was too impatient.)

Read Financial Samurai’s classic post on negotiating his six-figure severance here.

9. Hustle Well To Earn More Money

“There are people out there who are not as talented as you, not as educated as you, and less experienced than you, who maybe even don’t work as hard as you… but they are more successful than you simply because they had the courage to put themselves out there…”

The easiest way to get started is a physical side gig like driving for Uber/Grab.

A better (but harder) way is to work on something scalable. For example, creating a course once and selling it online to large numbers of people.

Your side hustle needs to earn ~30-60% more than your day job to fully replace its income + benefits.

Even if you’re earning good money from your side hustle, it doesn’t mean you have to quit your day job. Nothing wrong with keeping a traditional job with colleagues who you like.

10. Optimizing for Education

Graduating from a top university has its benefits, but you don’t have to chase prestige at all costs.

It’s probably not worth going into six-figure debt just so your kid can graduate from a big-name university. Instead, go for the best education you can afford.

Sam graduated from a modest public university, but still ended up working for Goldman Sachs because of hustle.

Remember, education can come from multiple sources. A mindset of continuous learning is more important.

If you’re still keen to send your kids to private school, here’s Sam’s benchmark for affording it: Household income should be >7x private school fees per kid

So if my kid’s school fees are $40,000 a year, our household should be earning at least $280,000.

11. Money and Your Loved Ones

“The joy of spending money on your partner and kids is often greater than the joy of spending it on yourself. So is spending money on those most in need.”

How important is money in the context of love? ~36% of divorces happen because of financial problems.

So if you love your partner, help them become financially independent. Having separate bank accounts for individual expenses, plus a joint account for household expenses is the best of both worlds.

From Sam’s calculations (on biology and wealth potential), the ideal age range to have kids is 30-34.

Don’t spoil your kids. Give them the gift of learning about money and working their way to success.

12. Money Is Not the Main Goal

Not fame either.

Most people just want respect and love from their loved ones. Money helps smoothen things, but you don’t need a Ferrari for your son to admire you.

Remember:

“All the money in the world means nothing if you don’t have your health.”

Freedom is your ultimate goal. To do whatever you want with the time you have left.

There’re no certainties in life. But if you make decisions with >70% probability of success, you’ll do well.

– – –

“Buy This, Not That” is now available at Amazon, Kinokuniya, and leading bookstores internationally.

Thanks Sam for the book — hope to see you back in Kuala Lumpur one day!

Thank you! Now I am going to grab the same book 🙂

Awesome! Hope you enjoy it.