I get this question all the time, so I finally decided to write this one.

It’s partly about timeless fundamentals of personal finance, but I also included some thoughts about the future, and lessons from the past.

If you’re any of the below, this article was written for you — so I hope you find it helpful:

- Fresh graduates

- Young people in their early twenties

- Students who are just about to start work

(But if you’re older, perhaps you’d like to review what I wrote, and comment if you agree? Or if you have any money advice of your own.)

Young People Problems

Everybody’s got problems, but yours are unique in a few ways. Let’s go through them one by one:

1. Personal Finance Education

Most “adult” people I know still have a surface-level understanding about money. Unfortunately, this applies to people of your age too. If you’d like to test your knowledge, try this basic financial literacy test.

It’s just five very short questions, and you get to see if you’re financially smarter than two-thirds of the world (who failed).

Why isn’t personal finance a mandatory subject in schools and universities? I don’t know, but that’s surely one of the biggest failings of our education system. Instead, young people are left to learn finance from websites, guest speakers and gulp, their friends and families.

It’s not that self-learning is a bad thing. It’s that sometimes even your well-meaning friends and parents could be teaching you poor money habits. And let’s not get into “friends” who “teach” but are actually trying to make money off you.

So your biggest problem really is: No one taught you personal finance. And even if someone did, was he/she teaching you the right things?

2. The Changing World of Jobs

When you were younger, your parents likely told you a version of the same advice they told me: “Study hard, get good grades — and you’ll have a secure job.”

But of course, the world has changed since our parents’ times. Today, the world of secure jobs isn’t so secure anymore. There’s no such thing as lifetime employment. And with huge advances in Robots and Artificial Intelligence every day, the world of jobs is gonna continue to change rapidly. It scares the shit out of me, but here’s the prediction some experts are making: we’re gonna have much less traditional jobs in the near future.

So now you’re now living in an uncertain job market with an even more uncertain future. It’s getting harder to have secure income.

3. Cost of Living and Inflation

You’re likely a Malaysian, so I’m gonna quote a Malaysian example. In the 1980s, you could probably buy a double-story house in KL for about RM 60,000. And your starting salary might have been around RM 1,000.

Today, try buying an RM 500,000 (USD 112,000) apartment on your starting salary of RM 2,100.

The oft-quoted guideline from the World Bank is this: To be considered affordable, the price of your home should be less than 3 times your annual household income. In other words, if your annual household income is RM 54,600 (RM 2,100 monthly salary x 13 months x 2 people), an “affordable” home for you costs RM 163,800 and below.

That RM 500,000 apartment is 9 times your annual household income. The World Bank would call it “severely unaffordable.”

You and I call it f*cked up.

Here’s some more scary data. Because it’s not just the Malaysian economy that’s f*cked. Lets take a look at the economic miracle known as the USA. Well, our young friends there aren’t doing so well either. The Atlantic reports that over the last few years, real (inflated-adjusted) income has fallen for most Americans aged between 18-34. And here’s some data from the Bureau of Labor Statistics:

“Average income for Americans aged 18-35 has gone from $36,000 (in 1992) to $33,000 (today)”

– James Altucher –

You’re rightfully angry at the rising cost of living. Things have gotten more expensive over the years, and salaries (especially for young graduates) have just not kept up.

4. Student Debt

Most of you have some form of student loans to pay off too. But here’s the good news: because Malaysia — for better or for worse — is an extremely forgiving country.

I’m not suggesting you don’t repay your PTPTN education loan and beg for forgiveness from the immigration officers at KLIA before your annual vacation. What I am saying is if you have the will to pay your debts, the environment here makes it easier to pay. We have all kinds of discount schemes; plus when was the last time you heard of someone getting hauled to jail because they missed an education loan payment?

Of course, student debt is still a problem. And I understand how hard it is to plan for your future when you have a big sum of money hanging over your head. I’ve been there too and it feels like shit.

But with that in mind, let’s take a look at the other side. It can’t be all doom and gloom; so what are some advantages that young people have instead?

Young People Privileges

1. Access & Technology

When I was a fresh graduate, I had to call the TM Streamyx guys to come to my home every few months — because my copper wire DSL modem would periodically get fried by lightning. Not only was my wired Internet connection slow, it was unreliable.

Today, the cheapest data plan on your mobile phone is five times faster than my lightning-rod DSL connection of 2007. And as you’re probably aware, the amount of knowledge available for free on the Internet continues to grow exponentially.

What I’m getting at is this: you’re privileged to live in an era of cheap devices and free information. Access to knowledge is not a problem anymore. It’s so common that you and I don’t even appreciate how wonderful it is; that with a few clicks of your mouse — you can check how cheap Malaysian car prices were in 1985. (Hint: if you like imported cars, don’t click on the link.) You don’t even have to open your mouth to ask anyone.

With technology, you can even learn from the world’s greatest minds for (you guessed it) free. And just to prove my point, I’m linking you to Professor Robert Shiller’s course on Financial Markets here. Seriously, why are you still here listening to me, when you can instead learn about Financial Markets from a Nobel Prize winner?

2. The Freelance Economy

Growing up, I wasn’t street smart. I did pretty well in school, but I was never the entrepreneurial kind. Maybe the whole “established path” of school >> university >> corporate job was too well-drilled into my head.

So the only way I knew how to make money was to work for a company and have a boss. Silly me.

Of course, you’re smarter and braver than me. So you’ve likely done some kind of work in your free time during your college days. You probably already know how to leverage your skills and connections to make money.

Which is a great thing. Did you know that freelancers now represent 35% of the US workforce? I could’t find detailed statistics from Malaysia, but it’s a growing trend worldwide. And it especially suits people like you and me who like to work from home in our underwear.

Your ability to use access and technology makes freelancing an easy option for you. You know how the Internet and social media work. Plus with globalization, you can earn some high-value USD if you sell internationally.

All of us are entrepreneurs. I wish I’d learned that earlier in life; but for you young Padawan — the world is yours to conquer.

3. Time

Time is your greatest advantage of all. And here’s an example from history’s most storied investor: Warren Buffett, who’s now worth about USD 73.9 billion.

Did you know that 99% of Warren Buffett’s wealth was made after his 50th birthday? Read that again. Even the greatest investor we’ve known made the majority of his fortune after he was 50.

He started when he was 11, but it took him 45 years to become a billionaire.

Of course, that’s not what people wanna hear. Everyone wants to become the next Mark Zuckerberg — billionaire at 23 years old. But it’s not gonna happen for most people.

Most people need time to achieve significant things in their careers. And most people need the magic of compound interest over long periods of time — to really let their money grow.

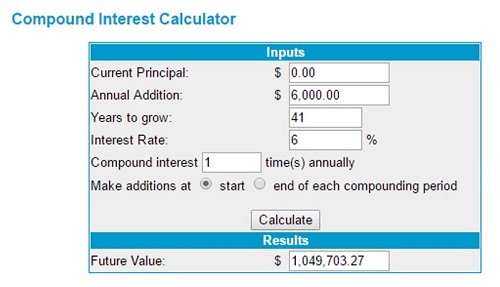

I’ll give you a typical example here: let’s say you earn RM 2,200 and contribute the bare minimum into your EPF retirement fund. Keep contributing as normal for 41 years (till you retire), and you’ll have a cool RM 1 million by the end of it:

And that’s even before you factor in any promotions and salary raises.

You’re young; you have time. But do you have patience?

So What Should Young People Do With Their Money?

1. Budget and Automate

If I could sum up personal finance in one sentence, it’d be this: spend less than you earn, and invest the rest.

Sounds great, but of course then you start getting tempted by how great the latest iPhone looks, and that unbelievable holiday deal from AirAsia. Which is precisely why you need a budget. Because if you spend your money freely without planning — you’ll be bankrupt one day.

You can read further details on how to create a budget here, but the most important thing about budgeting is that it helps build discipline. Without which you will never achieve financial success.

Here’s a final tip on budgeting: Because most of us are so horrible at controlling our impulse to buy things, automate your savings and investments. Set your bank to automatically deduct your salary and invest that money immediately every pay day — so you can’t easily touch it.

Because if you can easily get to that money, I suspect you’ll have a new iPhone soon.

2. Be Ruthless About Expenses

If you were a company, there are two ways to become more profitable: make more money, or reduce your costs.

Both are important, but which one do you have more immediate control over?

Assuming you’re not extremely poor, and your family isn’t totally dependent on you — most young graduates have room to reduce their expenses.

“But I need trendy clothes and hipster cafes to maintain my image,” you say. “And I need vacations overseas to be happy.”

I’m never gonna be the guy who says you should give up your overpriced Starbucks lattes or stop traveling. To each his own. But if you’re really going to control your expenses in today’s economic environment, I guarantee you need to make some tough decisions.

You’re not going to get everything your heart desires. Life is about trade-offs. In time and in money. So spend on those things which are really important to you. Spend more on them and cut out everything else. Ruthlessly.

Hint: When you get to my age, you’ll probably realize a lot of things you thought were important aren’t. So choose wisely.

3. Excel and Diversify

But there comes a point where your expenses are fully optimized. Trying to save more money at this point isn’t going to help much anymore. Instead, to get to the next level, you’re going to have to make more money.

The first way of doing that is to excel at your job. Or if you can’t, finding a job that you excel in. The world of jobs is changing — but are there still great jobs that pay good money right now?

Yes. Remember that life rewards people who bring value to others. The more value you bring, the more you can earn.

The other way is to diversify — to have multiple sources of income. Remember the freelance economy. A lot of you already have side businesses (according to a survey, 44% of millennials aged 25-34 have side jobs; the highest among all age groups). Well that’s the way the world seems to be leaning towards. Maybe your multiple sources of income will be enough so you won’t ever have to work for anyone again.

But if you’re like me and aren’t a natural entrepreneur — this will feel scary. You’ll have to learn important skills like marketing, pitching and sales. You’ll have to deal with tough clients and learn to understand human nature.

And it’ll be a good thing.

4. Try Buying Some Assets

I answer a lot of questions about money, but I don’t see a lot of people taking action with their money. Maybe it’s because people are afraid of losing money — so they’d rather not risk anything. Or maybe people are just afraid to start anything that they didn’t learn in school.

Whatever it is, knowledge without action is pretty useless.

If your idea of investment is giving money to your father so you can forget about it, it’s time for you to make some decisions on your own. You don’t have to get into anything risky; I’m not asking you to study 100 technical analysis graphs and buy something terrifying like a Call Warrant.

But if you’ve never ventured beyond fixed deposits, you could try exploring low-cost mutual funds or REITs. Or even your good old Amanah Saham. But please don’t just read about it. Giving it a try (with small sums of money of course) will teach you so much more.

There is power in taking small actions. For your knowledge and for your confidence.

Win or lose money — you’ll gain something more important: experience.

5. Invest in Yourself

The most important investment of all is you. This means spending money to take care of yourself. Invest in quality food for your body, and quality knowledge for your mind. Buy good books.

Investing in yourself extends to non-personal finance things. Invest in a healthy lifestyle and healthy relationships. Be nice to your friends and family. And use your money to help others; it’s good for your soul.

If you don’t take care of yourself today, you won’t be able to enjoy all that money you’ve made someday.

– – –

I’m sorry if you were expecting a step-by-step plan on how to achieve xx amount of money by a certain age. I’m sorry if you were expecting a “guaranteed plan” that will “beat the system” that you keep seeing on Twitter nowadays.

I wish I could give you a guaranteed plan. But we live in an uncertain world with constant change and disruption. That “Be a Property Millionaire by 30” course might have had a chance of success during the great KL property boom of 2009 – 2013, but is it applicable today? Maybe not.

Short-term strategies and tactics make great case studies, but over longer periods of time — it’s solid fundamentals that will bring you success.

If there’s something I can leave with you today, it’s that ultimately you have to take full responsibility over your financial future. Ultimately you have to make sense of this messy world and make your own decisions about money. So that means no more blaming anyone else for financial troubles, and no more shrugging and saying “But I don’t know what to do.”

I know it’s scary, but let’s look at it this way:

If life is an adventure; a journey on the winding road to your destiny. Then money is the vehicle that you drive; that accompanies you on that journey. Screw up your money management, and it’s going to be a rough ride. Manage your money well, and the journey is gonna be smoother. Plus you might even get to your destination faster.

You’re already halfway along your journey. Regardless of whatever’s happened in the past, you have the power to make your journey better than what it is today. You have the power right now.

Shall we begin?

– – –

Pics from Pexels, Flickr, Flickr, Pexels & Wikimedia

point no 1 is something I can never trully understand since I still live with my parents. But there are times, where I was like, that astro+intrnet fee aint cheap. I dont think I can afford it if its up to me.

After a week reading this post, point no 2 & 3 stuck in my mind like a glue. Its true, what is relevant now will be irrelevant in the near future. Jack Ma just announced that we may hav a robot CEO in the future.

Anyway, I wanted to tell you. That its never too late to struggle/ become an enterprenuer.

Point no 3. This is the ultimate wisdom above all.

“A fisherman always sees another fisherman from afar.” quote from Wall Street.

You need time and the patient.

Thanks. You’re correct — it’s never too late in life to do anything.

Hello, thanks for the good writeup for the youths. I always had a tough time writing these type of articles which targeted young grads because there are too much of grad types that we are talking about and most of them from different ethnicity and have different concerns.

One thing i would like to suggest: perhaps we can focus more on the topic of reduce in spending because i found many youths’ perspective on spending is one of the major hidden factors when comes to financial issues.

A cup of starbucks latte that cost RM12++ is expensive for us, but for them its probably just normal. When the monthly spending goes up to RM1k++ just on food and drinks may leave them putting the blame on low salary and economy.

I’m strongly agree that youths need to learn that some money should not be spent at all. But given the current trend, people have strong desire to spend in order to fulfill inner desires. So focusing on reduce in spending may be a better way to start

Hey Kitty,

Thanks for the thoughtful comment. Yes — definitely controlling spending is one of the key success factors. My secret wish is that everyone — young or old — becomes more mindful of what they’re spending on and why they’re doing it!

Hi Aaron, I’ve been reading this article since you updated it on your website but I am short of time to comment on it. Finally able to get some time to comment upon this article.

Should I suggest that, compared to those who get a headstart, it is thougher for those who don’t get a headstart. For example, like me who have to support my own life, and also probrably in futre, I have to save up the money for my car, my house etc. There are some friend of mine do get supports from their family, such as have their family to bear their living cost when they are in university, thus they could save up some of their money, or those who got their parents bought them a car, hence in some point they get extra space on their personal financial planning. I do knew a few friends of mine who manage to save up quite a handsome amount of money, but based on my observation, they do get some advantages at the begining.

Not that I am complaining, but everytime I part time, the money got into utensills or paying bills such as hostel, my study fees, stuff like that. And being a fresh grad, the starting salary won’t be handsome enough to start off. Not to mention the basic stuff you want to get all by your own.

Just to give you a brief idea on what I am crapping about, see this example. It is my own example, just to be brutally honest.

Fresh grad in engineering, Diploma. Salary, Rm1500. House rental, Rm300. Eat and Drink, RM700.

You only left RM500. And because you don’t have a car, you want to buy yourself a second hand car.

A 20 years old satria/wira/saga is on list, averaging RM5000. So technically you need 10 months to save up for it right?

Hey, don’t forget about your financial product as well? A basic medical card, insurance. That itself might cost RM500 per annum, just for easier calculation we make it RM100 per month ,as contribution for SOSCO, EPF hasn’t count it.

You only left RM400 per month to spare. and you need extra months to save up for an old car. We hasn’t talk about the aftermath, where the car need to be inspected, repair, roadtax, insurance, fuel, maintenance.

We are only talking about an old car by the way.

And it is only a brief calculation. It’s too scary to go into detail realizing how tiny the margin is.

Yeah, I agree with you. We call it, Fxxk up.

Thanks Ceejay,

Appreciate you taking your time to comment here. Yeah, privilege definitely goes a long way to financial security. That’s why it’s so irritating when I read financial advice that disregards how some people are really in very difficult conditions to start with.

My only hope is for those who are privileged to help those who aren’t so fortunate. And for those who are in difficult conditions to never give up — keep striving, look for multiple sources of income, and let time help.

All the best ahead to you man.

Hi there,

I understand this is aimed at young people who are just starting out, would you care to write one for adults in their mid/late twenties who are already working, but still struggling with the (ever) increasing living cost in Malaysia as well? What should they do to achieve financial independence? I’d like to hear your thoughts on it. Thanks.

Hey Ng,

Thanks for writing in. Actually the same advice would mostly apply. Particularly about being ruthless with your expenses and finding multiple sources of income. For people who are in their mid/late twenties I’d also suggest that they be aware of lifestyle inflation (you know, when you earn more money, then you try to uphold a certain image and spend more). Hope this helps!

so well informed. thanks for sharing!

Thank you fivi!

I’m in love with Mr. Stingy. Such good advice. You speak to our hearts!

Thank you Zoe!

Great write-up! My personal favorite point is 3 & 4. There’s only so much you can save when your base salary when a fresh graduate is RM2-3k per month. Gain as much experience and brush up your skills so you can demand for better pay is the way to go. Personally I wouldn’t waste too much time trying to look for ways to reduce expenses through time consuming activities like hunting credit card or shop back deals but rather better spend those time on self-improvement. In 8-10 years 2 fresh graduates with exactly the same academic background and results can have very different prospect depending on where you spend your time on

But yeah, don’t neglect learning about investment. I didn’t start too late in life, but even so, I would be better off if I start as soon as I graduated

Thanks Qi for chiming in with your comments! Yes, reducing expenses is only one part of the bigger picture. Getting a bigger stream of income is the other important part!