I’m going to try and simplify personal finance into 9 diagrams.

It’s an impossible task. Money is an incredibly complex topic that even the most brilliant people struggle to understand, let alone explain. So I’m just going to attempt the absolute basics.

If I had the chance to speak to a young person, try teach them about money, and set them on the right path to a good financial future — these are the 9 diagrams I would show.

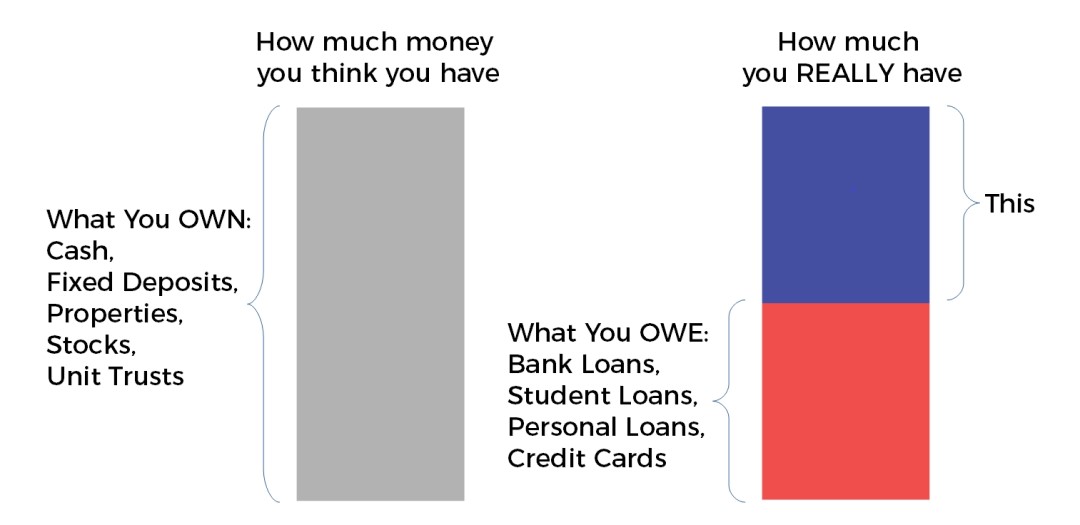

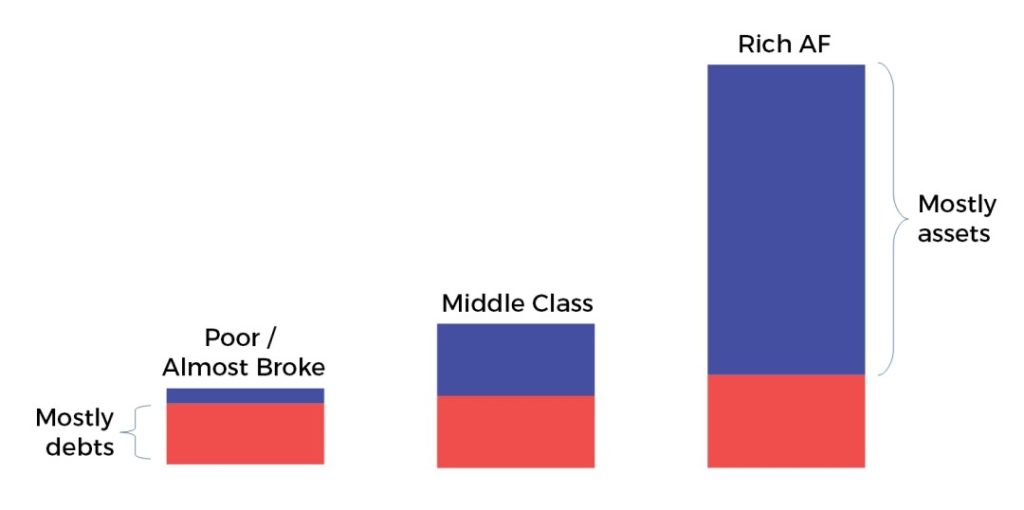

1. What Does Rich/Poor Really Mean?

Your net worth is everything you own minus everything you owe.

High net worth = rich. Low net worth = poor.

Negative net worth = broke.

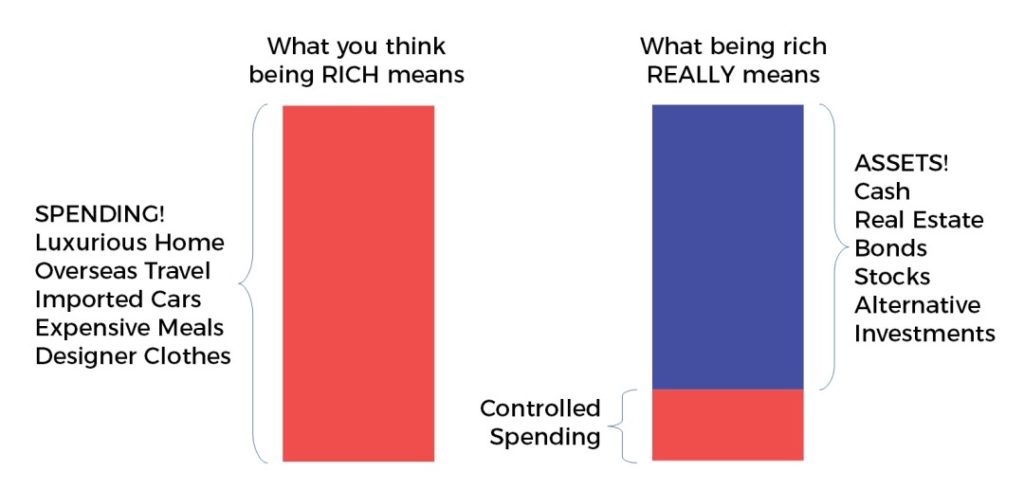

2. What Most People Get Wrong About Being “Rich”

Most people think “rich” is about spending lots of money. Rich is actually about saving (& investing) lots of money.

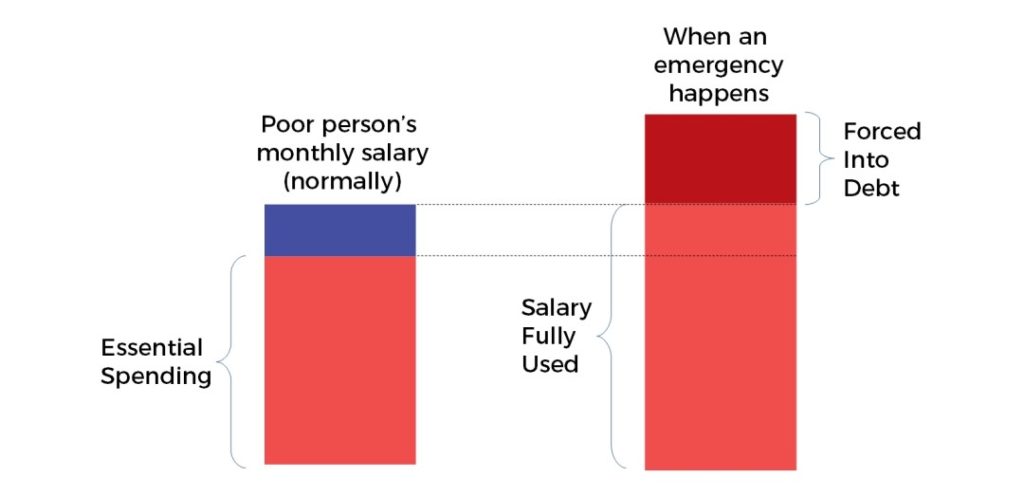

3. Why Poor People Can’t Get Better With Money

When your income is low and you have no savings, you’re one emergency away from going broke (or into debt). It’s an incredibly difficult cycle to get out of. Don’t judge — help instead.

Rich/middle-class people don’t have this problem because they have lots of backup (either from their own savings, or from their family).

4. How to Become Rich Steadily

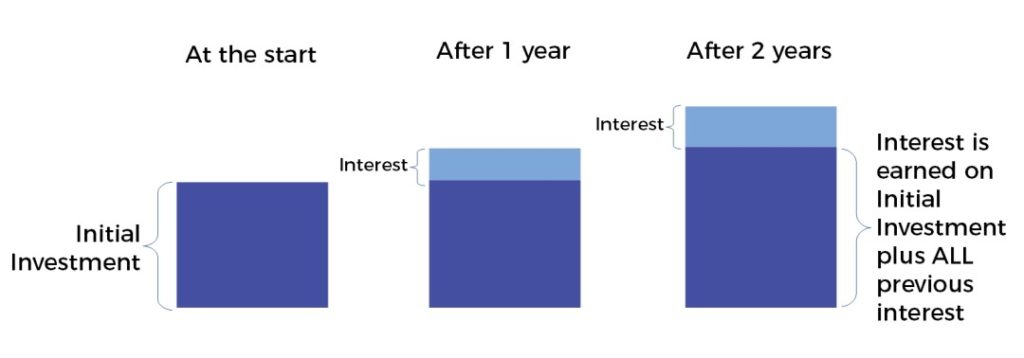

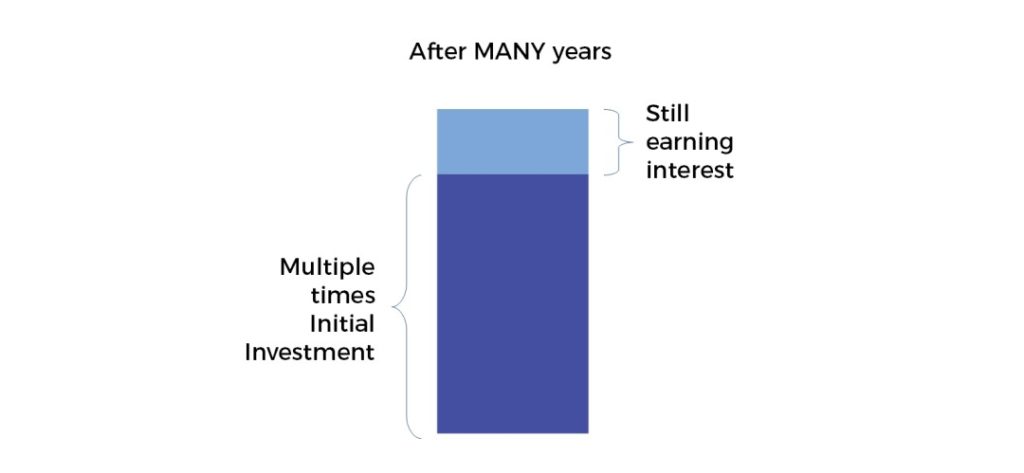

The human mind actually can’t easily understand how interest compounds and grows your money. We think in terms of linear growth, like how a car steadily accelerates.

But compounding is more like a massive ocean ship. Slow to start, but once at full speed, it’s incredibly powerful. The longer you allow it to go on, the richer you’ll get.

If you consistently buy good assets over many years, you’re gonna be rich.

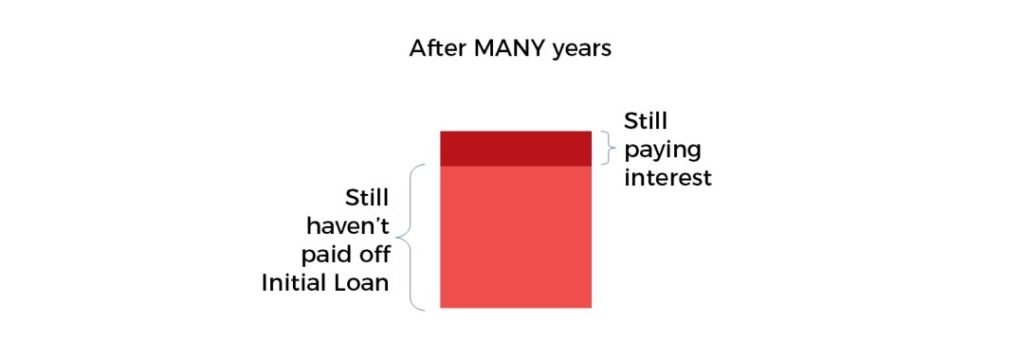

5. Why Debt Can Kill Your Finances

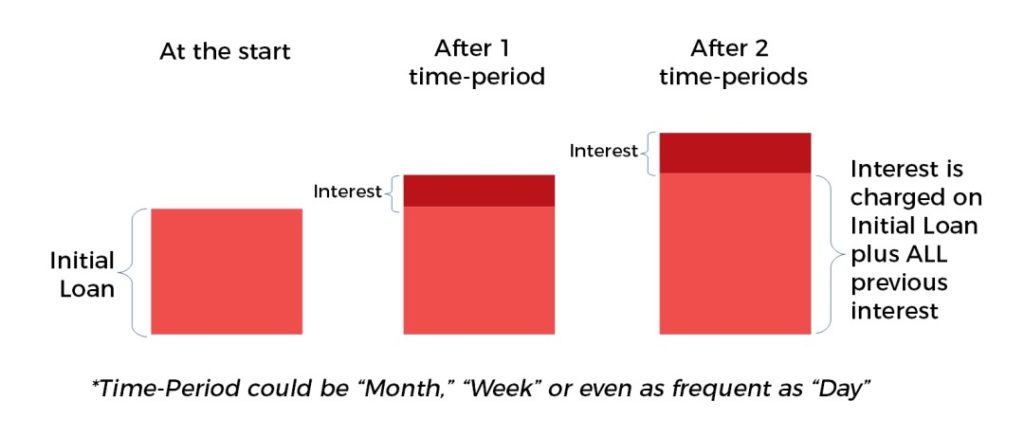

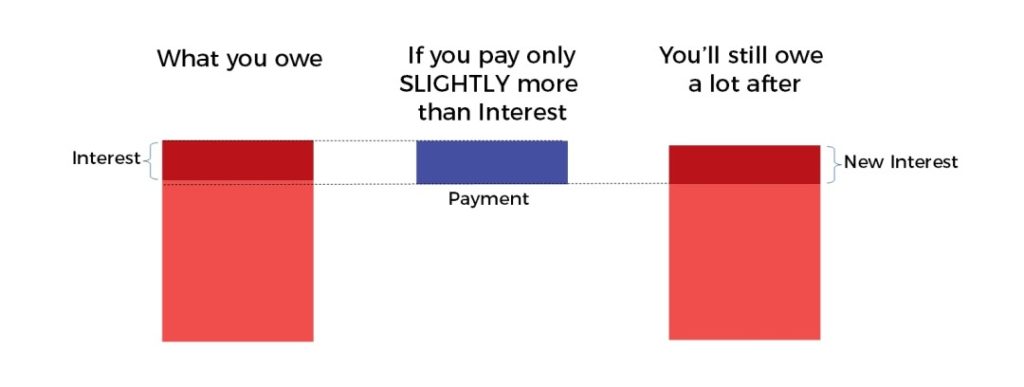

For the same reason, people don’t realize how quickly debt can cripple you.

If you don’t manage your debts properly, you can end up in a deep hole where your hardest efforts just prevent you from falling deeper. This is the highway to hell.

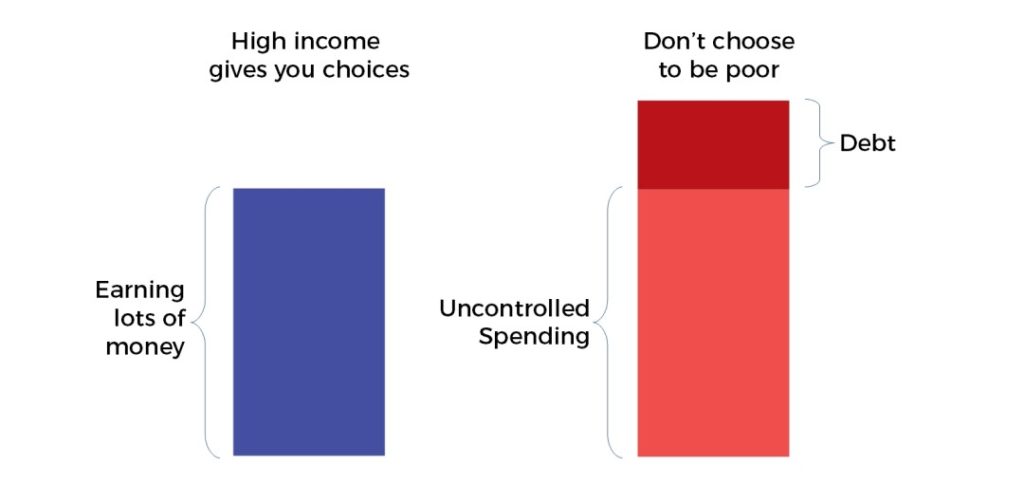

6. How Some People Earn a Lot of Money But Are Still Poor

Making money and keeping money are completely different things. If you blindly spend your money, you may never accumulate good assets.

If you’re the kind of middle-class person who has choices, most personal finance advice is written for you.

“The rich buy assets. The poor only have expenses. The middle class buys liabilities they think are assets.”

– Robert Kiyosaki –

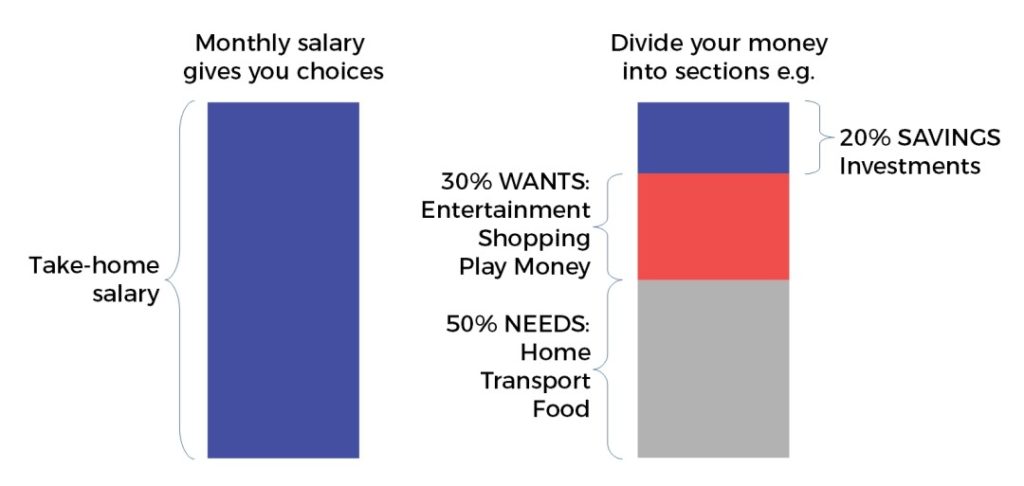

7. Why You Have Less Spending Money Than You Think

Earning an RM 5,000 salary doesn’t mean you get to spend RM 5,000. After all the responsible things to do, your “play money” might only be RM 500.

Budgeting is important. Otherwise how would you regularly save & invest for your retirement?

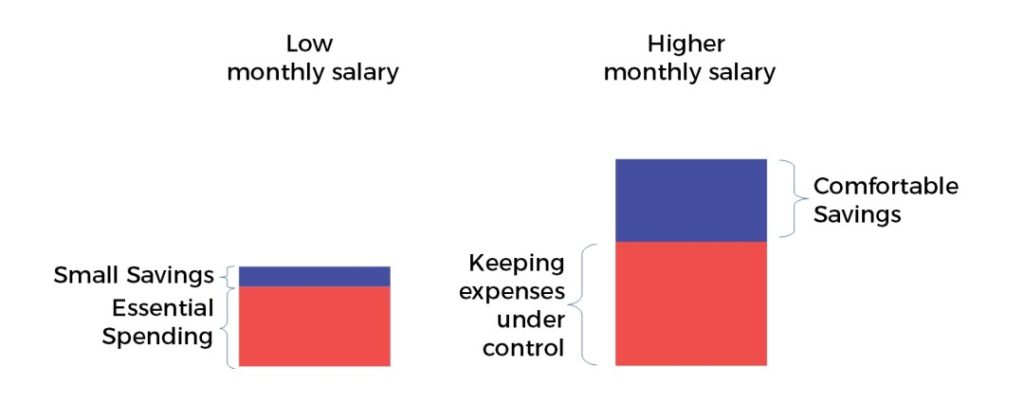

8. Why Saving Money Isn’t Enough

Every city in the world has a level of “basic necessities.” For example, “minimum wage” in Malaysia is RM 1,100 per month. This is supposed to cover a person’s basic needs: food, clothing and shelter.

No matter how disciplined you are, trying to save from an RM 2,000 salary is very challenging.

If you wanna be financially strong, you have to figure out how to earn more money.

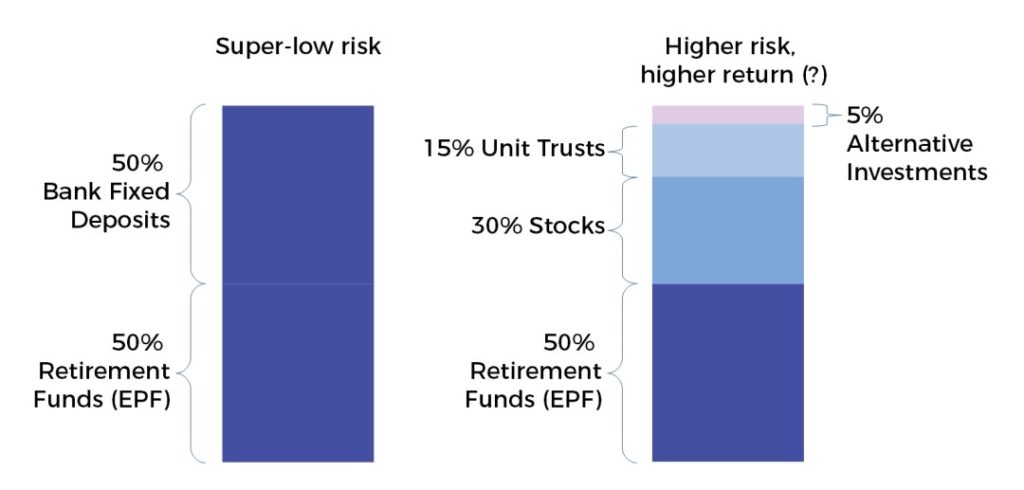

9. What Should You Invest In?

If you want to grow your money faster, you’ll have to take more risk. But exactly how much risk depends on each person’s personality and skill.

Please do your own research before deciding how to invest.

Most investors should keep the majority of their money in safe investments.

– – –

For the purposes of keeping things simple, I’ve oversimplified several things. Example: you might already know that credit card debt and home loans actually behave differently. For a quick introduction to personal finance though, I believe this is enough.

If you’ve found this article useful, please share it with someone who needs to see it.

– – –

Other great sketches on personal finance that have inspired me:

Carl Richards

Tina Hay

Pic from Pexels.

Love these! And cool to see a blogger from Malaysia (I was born in KL)

Thank you!

Congrats on having a wonderful website too. Love it!

I like your graphics. It makes everything easy to understand.

Thanks sir for dropping by.

Hope 2022 will be an awesome year for all of us!

It’s almost Financial Guide for Dummies! Simple, concise and straight to the point! Keep sharing the good stuff! I’m looking up on you!

Thank you so much Desmond. Really appreciate your kind words!

Thanks Mr Stingy for sharing! Looking forward to more money advice!

Thanks SL,

Really appreciate your kind words and support!

Very clean and informative illustration with diagram! I came to know about your blog when I was doing my homework on investments in Malaysia. Love your money advice and writing style! Keep up the good work!

Thanks Marcus — really appreciate the kind words. Great looking site you got there too!