Sometimes, I get requests to write about property investment. Unfortunately I’m neither a big fan of it nor am I smart enough to write about it.

Thankfully, I know some people who can help. My friends at iMoney were recently kind enough to let me republish one of their articles on property investment. If you’re currently spooked by the economic uncertainty in Malaysia, but wondering if you should buy property — I think you’ll like this one.

* * * * * * * *

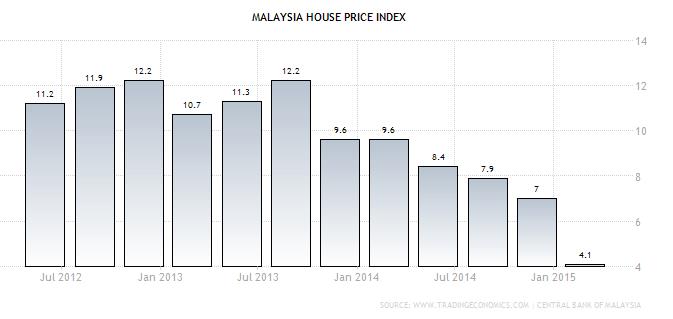

The Malaysian housing market has become something of a ghost town in recent months. The housing price index fell to 4.10% in the first quarter (Q1) of 2015, from 7% in the fourth quarter (Q4) in 2014, and from 12.2% in the third quarter (Q3) in 2013.

Market sentiment has been further bogged down by concerns over potential oversupply amid weakening economic conditions resulting from low oil prices and political tensions.

Though there is evidence that demand for property has remained stable despite market volatility, the million-dollar-question that everyone’s been asking is whether the market slowdown could ultimately cause the property bubble to burst.

What about what happens before that? Are there still opportunities in the current property market? We speak to renowned property gurus Faizul Ridzuan and Ahyat Ishak to get their perspective on the Malaysian housing market, as well as their thoughts on buying property amid economic uncertainties.

and author of WTF? 23 Properties by 30

Faizul is also a regular feature in the property investment speaking circuit, and speaks regularly in public and developers’ events.

1. With the current economic crisis, are there still investment opportunities in the current property market? What are some strategies to go about it?

My best purchases were the ones I made during the 2008 – 2009 crisis. Some of the properties I bought back then have nearly tripled in value today, and command double digit rental yields.

I am seeing significant similarities between 2009 and today.

Today, I run an investment firm called FAR Capital that helps people acquire good properties to meet their long-term financial objectives. The amount of good deals priced at 10% to 30% below bank values that we could find in the last six months has actually kept us very busy.

We are contrarian players, and we prefer to buy at times where most people are not buying.

2. So, now is a good time to buy property? Why?

I believe now represents an excellent time for people to buy properties. General sentiment out there is pretty bad, so there are less buyers looking at properties today, which means less competition.

When demand drops, prices will start falling. We have been able to find good deals almost on a weekly basis now compared to 12 months ago.

Having said that, one must equip themselves with the right knowledge before buying and avoid buying blindly. I believe that if an investor is skilled enough, they won’t have problems buying in a good or a bad market.

3. Are there any advantages in buying property amid economic uncertainties? If yes, what are they?

Of course there are. Anyone who bought properties in 2009 (the last time we witnessed a recession) would be glad that they did.

A decreasing number of buyers and slowing demand will force desperate owners to reduce asking prices to more reasonable prices and allow us to creatively structure deals to our advantage.

This applies to both primary and secondary property markets.

4. What are your thoughts on property flipping?

Actually, I don’t recommend property flipping at all. If you run by the numbers, a property flipper will find it hard to beat returns of someone who buys and keeps maybe five properties for 20 to 25 years.

So I have always advocated buying properties and keeping them for at least 10 to 15 years. With a longer investment horizon, economic cycles and taxes will matter less.

“I have always advocated buying properties and keeping them for at least 10 to 15 years. With a longer investment horizon, economic cycles and taxes will matter less.”

– Faizul Ridzuan –

5. In your opinion, what will be the likely effects of the depreciating Ringgit on the property market?

A few things will happen due to depreciating Ringgit:

- For the primary market, it will mean higher cost for the developer to build something as their imports will become more expensive.

- There will be greater interest from foreign buyers, especially from Singapore.

- Sentiment of local investors will be weak as they will be looking to park their cash in different markets due to the depreciating Ringgit.

6. Has your firm, FAR Capital seen an increase in demand from foreign investors in recent months?

Absolutely. We have received more enquiries about our services from foreign clients in the last three months compared to the whole of 2014.

Confidence from foreign investors has not waned. The current political scenario will not last, and some foreign publication and investors are already under the opinion that the Ringgit was oversold.

The housing price index fell to 4.10% in the first quarter (Q1) of 2015, from 7% in the fourth quarter (Q4) in 2014, and from 12.2% in the third quarter (Q3) in 2013. Screenshot from www.tradingeconomics.com

The housing price index fell to 4.10% in the first quarter (Q1) of 2015, from 7% in the fourth quarter (Q4) in 2014, and from 12.2% in the third quarter (Q3) in 2013. Screenshot from www.tradingeconomics.com

7. It is common knowledge that property prices have stagnated in recent years, and the property market is increasingly congested, so why do developers keep building? Is there actual demand for (residential) property, or are developers targeting mainly investors?

If we look at the recently published Property Price Index, growth in property prices have moderated in 2014 compared to 2013 or 2012. It is still growing, but at a slower pace now.

Developers continue to build even in a slowing market due to the high holding cost of keeping the land.

I hope they will start building more housing projects for the mass market from 2015 onwards as we don’t have enough supply to meet the upcoming urban migration needs.

8. Recent reports indicate that while home prices have stagnated, the value as well as rental rates are showing no signs of declining – are they likely to stay that way?

Rentals have actually started to decline for properties in the medium and high-end categories.

Like many of us, Faizul Ridzuan was a regular employee who aspired to be financially free. By age 30, he bought 23 properties, starting with only RM 2,000 capital and involving the very creative use of credit cards

Like many of us, Faizul Ridzuan was a regular employee who aspired to be financially free. By age 30, he bought 23 properties, starting with only RM 2,000 capital and involving the very creative use of credit cards

9. Last I read in your book, Property WTF, you were headed towards commercial real estate investments. How has that been working out for you? What are some of the investment strategies you’ve adopted?

I am still sticking largely to residential properties, because for most commercial properties out there today, the yields no longer make sense at 3%. I also tend to stay away from properties with a high negative cash flow possibility.

10. Also, some reports suggest that there has been an oversupply of commercial and retail properties – what are the likely repercussions that could emerge from this?

The industry will consolidate and retail space owners will need to be more creative to rent out their unit, fast.

11. Finally, what are your thoughts on the property bubble?

We have been in a property bubble since 2009, especially in selective areas like KLCC.

founder of the Strategic Investor Programme

Popular in the property circles, Ahyat also owns AhyatPropertyTV. He is also known for his workshops, seminars and talks on generating sustainable wealth through property investments.

1. With the current economic crisis, should people still consider buying property?

It’s funny how everyone is talking about the “bad” economy now. Nobody talked about the economy during the “happy period” in 2012, when everybody was buying property. Now, suddenly everyone is concerned about buying now or later.

In reality, the thought process of buying property, whether in good or bad times should be the same – you still need to weigh in the possible risks, including a possible hike in interest rates, static property value, and the possibility that the property could be untenanted if you’re buying it to rent.

Most people make decisions based on the “now”. This is a rather shallow-minded approach because buying property is not like buying stocks. You need to think long-term in terms of what the property market will be like in five, 10, or maybe even 20 years ahead.

Also, while many have the perception that we are currently facing an economic crisis, there has been no official declaration (yet) that we are indeed facing one.

2. So is this a “good” time to buy property?

Any time is a good time to buy property, and any time is a bad time if you don’t assess the risks and neglect proper planning.

However, in bad economic times, people are not just concerned about property value, they are also concerned about their ability to pay mortgages as an economic downturn can threaten job security, especially if they are in the services industry.

“Any time is a good time to buy property, and any time is a bad time if you don’t assess the risks and neglect proper planning.”

– Ahyat Ishak –

3. What are your thoughts on flipping? Is this the right time to flip?

“Flip” is the four-letter word in property. They don’t even do that in mature markets like in Australia, the UK or the US anymore. It only happens in South East Asia.

It became a trend somewhere in the late 2000s, and peaked between 2010 and 2014 when property appreciation saw double digits or more than 10% per annum. It was from then that newbie investors started to make the assumption that the property market has always behaved in such a way.

But if you’ve studied the property market for the past 25 years (outside of the property boom between 2010 and 2014), you will find that the appreciation rate is only about 3% to 4% per year on average. Property prices definitely do not go up as much as they used to today.

I think at the end of the day, you need to have a plan on what you want to do with the property – are you buying it for short-term or long-term? For cash flow or rental? What is the sort of demand in the area? Which segment of property are you looking at? For example, landed property is an entirely different kind of product and behaves differently in terms of market growth compared to an apartment.

More importantly, don’t buy property for the “bad” reasons.

4. What are the “bad” reasons for buying property?

There are a number. They include:

- Buying property because everyone else is buying. This is no joke. A good friend of mine actually bought a property at a bad location just because everyone else was buying it. This is not a wise decision.

- Thinking that buying property is cool. People have told me that they were inspired by my success and they look up to me. So they buy property because they would like to be successful too.

- Thinking that all property investments will increase in value. That isn’t always the case. When you buy property, you need to be clear of your objectives and have a masterplan.

5. In your opinion, what would be the “good” reasons for buying property?

The good reasons would be buying it in “good will”, such as buying property for your kids.

Don’t buy property just because everyone else is buying it. Buy it because it is a good deal, in a good location, comes with a decent price, is suitable for your (state of) finances, and because there will be good demand for it (granted that you’ve done your research).

6. What are your thoughts on the property bubble? Are we finally reaching point break?

Ah, the property bubble. A lot of people have been talking about this, whether to incite fear or to liberate the public from fear. There are three phases in a property bubble:

- Phase 1 – Property value increases rapidly, and it certainly seemed that way during the 2010 to 2014 period.

- Phase 2 – Property value reaches a point where it is no longer affordable, at 3 times or more than that of median annual income. A recent study by (US-based urban development researcher) Demographia found that Malaysia’s housing prices were “severely unaffordable”, at about 5.5 times of median annual income, compared to Singapore’s 5.1 times.

- Phase 3 – Property value declines. As to whether the property bubble will burst, well, nobody has ever been able to predict that. People are only able to say this in hindsight. Also, the term “affordability” varies across different segments of society – there are some who can and will continue to buy property, but perhaps this is not the case for the larger working class.

7. It is common knowledge that property prices have stagnated in recent years, so why do developers keep building? Is there actual demand for (residential) property, or are developers targeting mainly investors?

That’s an interesting question. I think what you need to ask is, does the market always knows what it wants? Take Steve Jobs for example, he recognized that the market does not always know what it wants, and hence he created a demand for his products.

That’s what many of these new developers are currently trying to do. If you take note, many of these new developments are lifestyle or luxury properties.

Also, because many people have trouble getting a loan nowadays, many developers are starting to champion “affordable” housing with smaller build-ups.

I think there is genuine demand for housing at this point in time. Most speculation activities have dried out.

Finding opportunity in uncertainty

Amid market and political volatility, it is understandable why many are cautious about the property market, but for some, this could actually be the right time to buy. Because in reality, the best time to buy could just be when demand is tanking and nobody else is buying.

Prospective buyers have an edge in a down market when property sales are slow and there is a glut of homes for sale. Amid faltering demand, buyers get the opportunity to pick up a house on the cheap. But this doesn’t mean that they are guaranteed to make money from the properties they buy.

The keyword here is “opportunity” and a buyer will still need to assess whether an area represented good value, whether they are buying at the right price and if they are buying for the right reasons.

For example, a 600 square feet apartment may seem just right for you and your partner at this point in time. But if you foresee yourself starting a family and needing a bigger house in three or four years’ time, you might want to consider buying a terrace house instead. This is because the property you purchase may not have increased in value in such a short period of time, and you could even make a loss if you sell it off to purchase a new property.

Finally, buyers should concentrate on whether what they are buying is affordable and if it is the right decision in the long term, rather than panic over house prices or rush out to buy property just because everyone else is doing it.

This article was written by Fiona Ho and contributed by iMoney.my, Malaysia’s leading financial comparison website. To compare and apply for the best financial products, such as credit cards, home loans and personal loans, visit www.iMoney.my

I’m always on the lookout for interesting stories that are meaningful and helpful. If you’d like to contribute to mr-stingy, email me at mrstingy2014(at)gmail.com.

Pic by GuyfromBronx at Wikimedia

Hi Mr Stingy,

I recently came across your blog and I really love the articles you’ve written about money and for young people. I remember reading about Faizul Ridzuan from The Edge some time back and his unusual way of getting his initial capital to buy his first property and I’d like to hear your opinion on that.

From what I understand, Faizul encourages the use of his credit card whenever his friends and family wants to buy something in exchange for cash upfront. The credit card is then used for installation for things like a laptop for example, so the monthly debt is a little less. Taking into account the fact that he was 24 with a RM2000+ salary, wouldn’t that be too much of a risk to take? If it works, how come not a lot of people are doing it then? There must be a catch to it.

Thanks Anne. Appreciate your kind words. I don’t know Faizul Ridzuan personally, and I’ve not actually read much into his material before. I think the key point here is that back in those days the property market was booming, so the potential reward for taking the risk was higher. Also, I don’t know his personal situation, but if you’re 24 years old, have no commitments, in a booming market and have easy access to capital — I guess he was willing to take higher risks. But this might be different for someone who’s in a different position — for example if your parents are retired and depend on you to support the family — your risk tolerance is a lot lower.

Also note that in today’s environment, banks are stricter in giving out credit cards. Long story short, it depends on how much risk you’re willing to take I guess?

Really enjoyed the article thanks. One thing:

“Flip” is the four-letter word in property. They don’t even do that in mature markets like in Australia, the UK or the US anymore. It only happens in South East Asia.”

You may want to check your facts here. Perhaps things have changed since your article. As someone who has just witnessed the biggest flipping bubble in Melbourne and Sydney over the last few years, there is certainly plenty of flipping in Australia

Hello Amiel,

Thanks for writing in. This article was written back in 2015, so some of the writing isn’t up to date. Also, the comment about flipping was made by Mr. Ahyat Ishak (and I can’t edit it without his consent), so will leave this in the archives for now.

Best wishes for 2018!

I wonder what are Faizul Ridzuan’s thoughts about buying a property now. Property market has slowed down since the time the article was written (year 2015), but the prices didn’t fall the way it did back in 2008/09. Prices today have been pretty much stagnant since 2015.

I wonder the same thing Sookie. I think in certain hot areas it’s already dropping — so wonder what the property gurus are suggesting now…