Back in 2014, I was shopping for medical insurance. In case I lost my job (and the medical coverage they give) or something happened to me.

So I looked through as many websites as I could, spoke to as many agents as I could, and read almost every page of the insurance proposals they gave me.

After a couple of months, I finally made my choice. I initially thought it was going to be easy to choose, but boy was I wrong. There’s a lot more to insurance than I thought. Even after countless hours studying, plus discussions with insurance agents and an actuary — I can only claim to understand the basics.

Anyway, I thought all that “research” might be helpful, so here’s my advice on how to choose the “best”; and the thought process behind my choice.

Hopefully it’ll guide you when you’re looking to buy insurance too.

How to Read Your Insurance Proposal

Let’s start with the insurance proposal/quotation. After collecting some basic information from you like:

- Your age

- Your gender

- Your job

- Do you smoke

Your helpful agent will generate you a rather confusing document that’s about 15 pages long.

Here’s a simplified breakdown of the important parts:

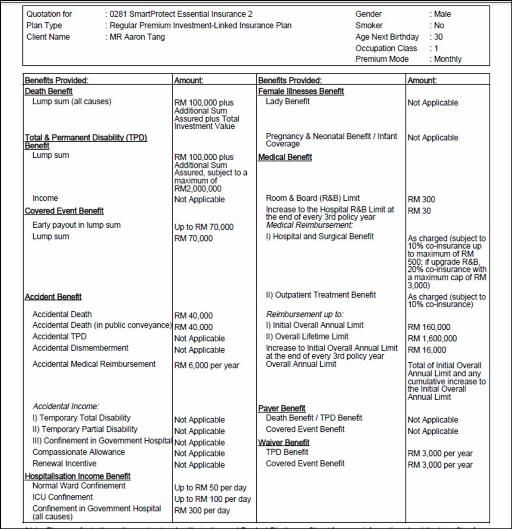

1. Summary

This is the first page, where they typically show you all the money you stand to get, and how much you need to pay.

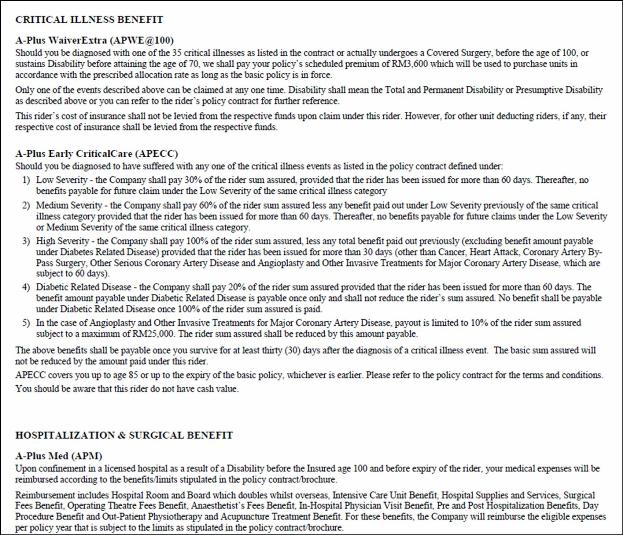

2. Description of Benefits

These pages explain in non-layman-friendly words what kind of benefits you’re getting.

They also explain the limits of your coverage. Most importantly:

- The age your benefit expires (e.g. you’re covered till 100 years old)

- Exclusions (e.g. you don’t get money if you do drugs and get HIV)

- Special terms and conditions (e.g. your overall annual limit will increase by 5% every two years, over 20 years)

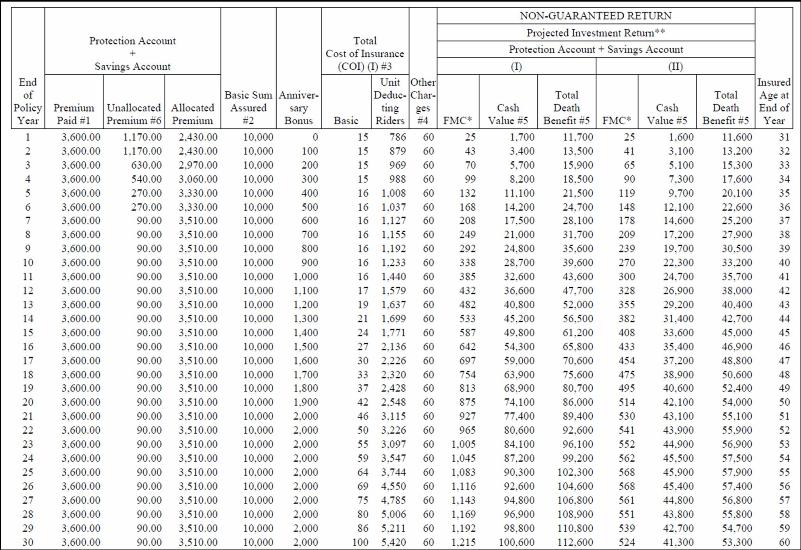

3. Investment-Linked Illustration

This section is for finance geeks like me.

It shows where the money you pay goes every year, how much the company takes from you, and demonstrates how math can fool people into spending money.

Because the first thing an unscrupulous agent will point to is the large number at the bottom: “Ooooo… you’ll have RM 100,600 after 30 years. AND you get ALL this while protecting yourself!”

The important thing here is to not be overly-impressed by the large numbers you see. This will cloud your judgement (because hey, every other insurance company can show you the same large numbers). The other important thing is to see which fund they are planning to invest your money in. Since we’re talking about insurance, and not gambling here — please be conservative and choose something like a balanced fund.

(Actually this part warrants an entire 2,000-word post on its own, but think I’ll leave the details out for now).

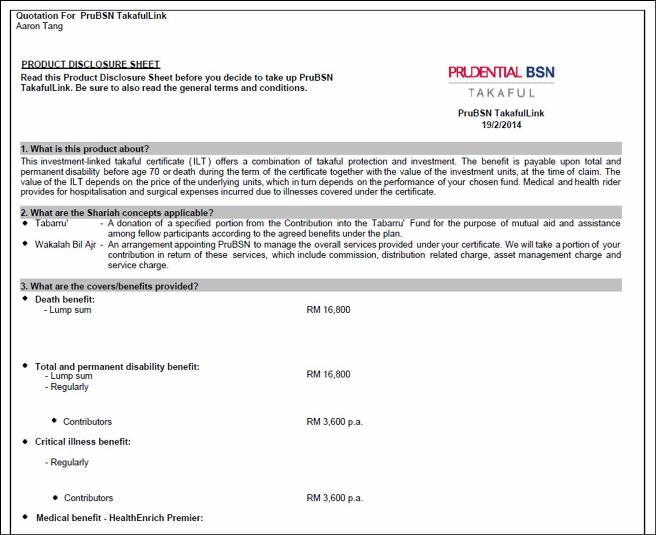

4. Product Disclosure Sheet

The final section reads like an FAQ in more layman-friendly terms.

For example, this question nails it: “How much premium do I have to pay?”

I think Bank Negara requires insurance companies to put this section in, because the above sections are too difficult to read on their own. It’s actually a great place to start from, so some companies will have this sheet right at the front.

(Different insurance companies will structure the insurance proposal differently, but the above four sections will always be included).

p.s. Bank Negara, if you’re reading — we think insurance proposals are still too difficult and confusing to read. We need to make things simpler, and educate people better!

Comparing Insurance Proposals

Now that you’ve read your first proposal, meet with a few other agents and get alternative proposals. And it’s time for mr-stingy’s favorite activity — comparing between alternatives, and choosing the best.

Here’s the thing about insurance plans though. They may have similar features, but each has its own unique characteristics. It’s not like comparing an iPhone to a Samsung Galaxy. It’s more like comparing an iPhone to a digital camera to a tablet.

To add to the difficulty, insurance is a highly personal thing. So a 31-year-old single guy (like me) needs very different insurance from a 50-year-old married lady with three daughters.

Here are the things you should consider anyway:

- The Company

- The Benefits and Features

- The Agent

And just because I hate articles that end with “there is no best, you have to choose what’s right for you”, here’s how I decided on my policy.

Which Insurance Company to Go for?

In their attempts to convince you, agents from insurance companies will tell you stuff like this: “We’re the largest (or 2nd/3rd largest) insurance company in the country. We’ve been operating here before Sir Francis Light discovered Penang.”

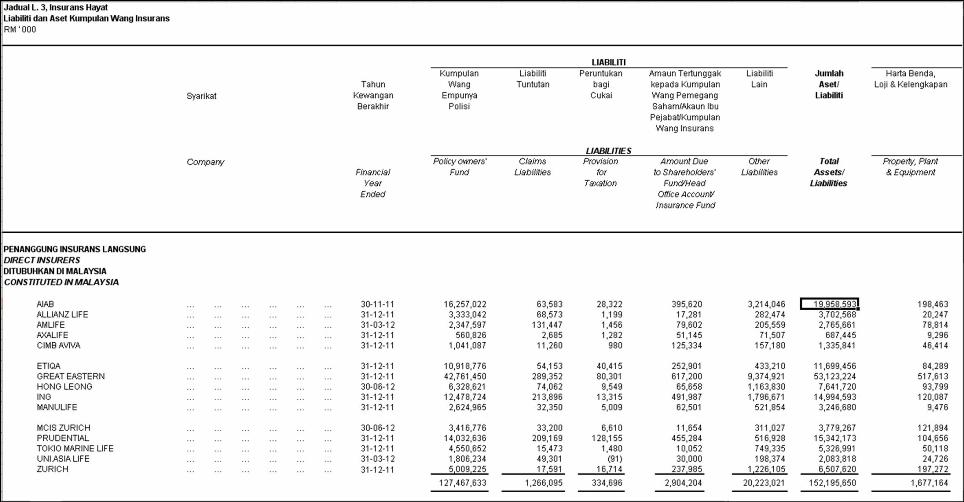

Bank Negara doesn’t publish individual insurance company statistics anymore, but if you’re interested to know how big the insurance companies are, here’s a look at their balance sheets in 2012:

Source: Bank Negara

Source: Bank Negara

But is company size and history really so important?

Not really if you ask me. History just means that the company is great at adapting with the times, that they can continue to make money over different eras. And size just means they’re really good at getting more customers.

What’s more important to me is reputation. Does the company have a reputation for paying out claims quickly, without difficulty? Or do they make things difficult when people need them the most?

If you dive through enough forums on the Internet, and speak to enough people, you can start to make your own conclusions on which companies you should be careful of. Whether it’s the fault of the company, the agents or people who have a grudge against them — I don’t know.

But I really believe in the power of peer reviews. (Anyone wanna start a TripAdvisor for Insurance?)

Beware The Most Common Mistake — Investment Returns

When I was 12 years old, my mom bought a life insurance policy for me — sold on the promise that she would just have to pay premiums for eight years, and then returns from investments would cover the premiums forever. Guess what happened? The stock market crashed in 1997, the “projected investments returns” never happened, and the company never declared the “expected bonus.”

So I’m still paying for the policy now, 19 years later.

I do have some cash value, but this would run out in about eight years if I stopped paying premiums today.

Moral of the story? Unless explicitly guaranteed, investment returns are “projected.” In reality, you never know how well those investments are going to do. So be prepared to pay your insurance premiums for a long time.

Investment-linked Plans or Traditional Insurance?

Up to this point I’ve only spoken about investment-linked insurance. It’s the most popular type of insurance sold today. But there’s actually another type of insurance: traditional.

Critics of investment-linked plans say they are expensive, have no guaranteed returns and you’re better off dealing with insurance and investment separately.

The cheaper alternative to buying investment-linked plans?: buy a standalone medical card + traditional term life insurance. Invest the rest of money in higher yielding investments.

A standalone medical card offers you similar benefits to an investment-linked policy plus a medical “rider.” The only difference is, it’s pure insurance. Same thing goes for traditional term life insurance. You define a term (say 25 or 30 years) and pay only to cover that term.

There’s no investment portion, no fund management charges, and no fancy bells and whistles. You don’t get to tweak your plan once it’s set. The good part? It’s cheaper.

But Here’s Why I Chose Investment-Linked Insurance

1. Insurance companies provide incentives when you package plans together in an investment-linked policy. For example, if I had bought an RM 250 standalone medical policy from AIA, after 10 years the expected cost of insurance is RM 1,617.56. My investment-linked plan (with identical RM 250 medical benefits) is expected to cost RM 1,249 — but it also includes life insurance + a critical illness benefit. In other words, there’s a discount when you package medical plans with investment-linked policies.

2. Certain benefits are unavailable if you purchase standalone medical plans. For example, AIA’s RM 300 and above plans are not available as standalone plans. If you look at their website, Prudential doesn’t even have a standalone medical plan. It needs to be a rider on an investment-linked policy.

3. Word on the street is that standalone medical plans have “guaranteed renewal” when you get them from reputable insurance companies. But more than one agent has told me if you really want “guaranteed renewal”, you have to package it with an investment-linked policy. It looks like a grey area; as to whether standalone medical cards have guaranteed renewal or not.

I wouldn’t want to be in a situation where I got terribly sick, only to have my medical insurance tell me they don’t want to renew my plan next year. With an investment-linked policy — it’s clear. As long as I’m still alive, and the rider is still active — I’m covered.

4. I showed my actuary friend some investment-linked plans. And he told me that they were about 22% more expensive than traditional term plans. Because I’m an optimist, I’m willing to pay 22% more for the chance that my investments will prosper over the next forty years.

5. A standalone medical policy can lapse if you do not make payments on time. When you have a “savings/investment” portion, this fund can be utilized to cover premiums if you don’t have enough cash at that moment.

6. The fund management charges by insurance companies are expensive (~1.5%). But you would be hit with the same charges if you invested in mutual funds.

Will I be able to beat the investment returns by the insurance company if I invested money on my own? I honestly don’t know. And I have just enough faith in the insurance company.

Which Insurance Plan Did mr-stingy Choose?

After months of research, I finally decided on an investment-linked policy which combines life + critical illness + medical. For the following reasons:

Reputation

I spoke to quite a few people within and outside the insurance industry. I scoured Internet forums and websites looking for what people are saying about the insurance companies. For better or for worse, some insurance companies have a worse reputation than others.

AIA seemed the most reputable to me.

Benefits Which Suited My Unique objectives

I’m 31 years old, healthy and have no dependents. My primary objective was insurance that can cover any medical costs when I’m old (~40 years from now). I liked that AIA covers medical till 100 years old.

My agent also recommended me to take Early Critical Illness coverage, and I agreed. This is important, because with just normal Critical Illness coverage — insurance companies don’t pay until your disease reaches a certain severity. I don’t want to have cancer, then be told, “You need it to get worse,” before I get any money.

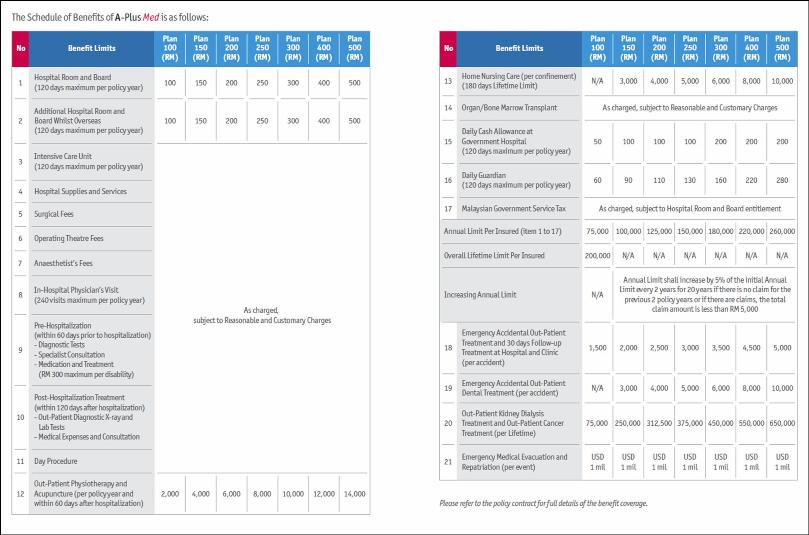

Finally, I decided that the mid-range RM 250 plan was sufficient for now. This one was a bit of a balancing act: Do I buy an expensive package now, so that I’m guaranteed premium medical care when I’m old; or do I buy a really cheap one now, and then run the risk of the company not wanting to increase my coverage later?

I decided to choose the mid-range plan. In twenty years’ if I need higher coverage — I’ll think about it then.

The agent

This was the biggest factor. No disrespect to all the other agents I spoke to. Most of them are my personal friends, to whom I’d refer prospective clients to in a heartbeat.

My agent from AIA was something different though, in terms of presentation, response time and product knowledge. She also offered me the highest level of customization among everyone I spoke to. “Want to add critical illness coverage here, but reduce life coverage here? No problem.” “I’ve increased your savings account contribution here and reduced your protection account contribution here. This is why.”

Can’t help it; I’m an engineer. I love to tinker, tweak and optimize. And I like it when I’m given solid reasons for everything.

The Plan

So, RM300 a month will get me:

- RM 10,000 if I’m permanently disabled (up to 70 years old)

- RM 10,000 to my beneficiary if I die (up to 100 years old)

- RM 100,000 of early critical illness coverage (up to 85 years old), including an RM 300/month waiver of premiums

- RM 250 per day allocation for hospital stays

- Hospitalization and surgical benefits – as charged, up to an annual limit of RM 150,000

Final Thoughts

People used to say:

“Forget about the company, the insurance agent is the most important.”

I didn’t believe it at first. I thought I would take the human element out — go purely on black and white documents and bypass all the agents. I would get the best insurance package ever, and share the story with everyone.

But now I realize there’s a lot of truth in that statement.

My honest assessment of the insurance industry in Malaysia is there’s still a lot of human element involved. Maybe too much. That’s why it’s so difficult to compare. That’s why everyone has different experiences in dealing with the insurance companies. And that’s why sometimes people don’t get paid when they need it the most.

Even if you have the best plan with the best company, when it’s time to submit a claim — if your agent sucks, you’ll have a sucky experience. It’s really the most important factor when it comes to insurance.

You can leave the detailed calculations to nerds like me (heck, if you’re confused about your plan, and want my thoughts — write to me). But my sincere advice is to look for an agent who is knowledgeable, ethical, and looks after your best interests. If you have one who isn’t performing — dump him/her and look for someone new.

There are really good ones out there, and I hope that you find one.

– – –

Update Sept 2020: If you’d like my recommendation for an insurance agent, feel free to contact Elizabeth Ong at seokkin12@gmail.com.

Pic from Pexels

Hi Mr. Stingy, I’ve always liked your reviews, the insights given are so informative and useful for beginners like me to make a decision, in this case an insurance plan. I’m looking for a medical insurance for my baby, and your insurance agent seems to be a good fit, would you mind sharing his/her contact with me? Thank you very much..

Hi Sean,

Thanks for your kind words and dropping by. Please reach out to Elizabeth Ong at seokkin12@gmail.com

emailed but no response

She mentioned she’s emailed you back now.

Hi, it surprises me that you opt for ILP instead of term life considering you live a frugal life. Possible to explain why is this a case? Many have said that ILP is a “scam”, and term life is the way to go in terms of protection….Rest of money can invest elsewhere rather than invest in poor performing ILPs…

Hope to hear from u.

Hey KT,

Some things that influenced my decision-making:

– When I was reviewing plans, I assessed that ILPs had more benefits (not just in terms of cost) vs standalone plans. I can’t 100% remember now what they were, but at that point of time I assessed ILPs were better even if purely based on cost, they were more expensive

– I believe KC Lau (the OG) has written a bit on how he mixes and matches ILPs and standalone plans at different points of his life

– Similarly, today I use a mix of ILPs and standalone plans to give me well-rounded protection

One interesting way you can “minimize” the investment portion of ILPs (and the associated fees) is to reduce the investment amount to the minimum amount possible. In your ILP it will be stated in the T&Cs, how much is the minimum amount.

Hope this helps a little.

Hi! I am based in KL. Is it possible to have your AIA agent’s contact number? I plan to take medical card, my friend too. We are in our mid fiftees. Have checked out other agents in different companies, but wanted to try yours. Thanks so much!

Hello Mano,

My agent’s email contact is in the article above. Feel free to reach out to her there. Thanks!

Hi , can I have ur agent contact number please? Thanks

Hi Cha Yao — just emailed you. Thanks!

Hi Mr Stingy, can i have the contact number of your AIA agent? Thanks in advance

Hi Wong — just emailed you. Thanks!

Hi Mr Stingy, very informative write up.

Would it be possible to share the contact number of your agent please?

Hi Hannah — just emailed you. Thanks!

Appreciate the content. Mind sharing the agents you contacted with and where are they based? Thanks in advance.

Hi KM — just emailed you. Thanks!

Hi Mr Stingy, good write up.

Would it be possible if you can share the contact number of your agent please?

Hey man,

Thanks. Have just emailed you.

Hi Sir,

Would you mind sharing with me the contact number of your insurance agent? Does she covering takaful products also?

Thank you!

Hi,

I’ve just emailed you a contact — not sure if they cover takaful or not though.

Hi Mr. Stingy,

This is my third time reading your article. Thanks so much for your input. I appreciate your time and effort sharing. Can I request your agent contact to understand more on the plan please. Thank you.

Thanks Bernard,

Have just emailed you.

Hi Aaron,

Would you mind sharing with me the contact number of your insurance agent?

Thank you!

Emailed you sir

Great article. Could I have the contact details of your agent please :-)?

Thanks! Emailed you.

Hi great article by the way! I’m currently looking for an insurance agent, would you be so kind to share with me the contact details of your agent?

Thanks in advance! 🙂

Thanks! Will email you now.

Hi there, would you be so kind to share with me the contact number of your agent?I am looking for a good insurance agent. Thanks! Good article, by the way!

Hi CK,

Will send you an email now. Thanks.

Please email to me your agent’s name and contact details.

Sending you now. All the best.

hi stingy,

your article is a good read, perfect for a dumbo like me.

been looking at AIA insurance for a while now, but couldnt find a worthy agent.

mind to share yours?

thanks a lot.

Hi omar,

Thanks a lot for your kind words. Sending you now.

Hey there,

Awesome sharing man. Could you send me the insurance agent mobile number too?

Hi Peter,

Thanks. Sending you now.

Hey there,

Could you kindly share the email address as well?

I’ve been reading several articles about purchasing insurance in Malaysia. In my case, I would like to see if my current policies can be improved. Personally, I think insurance companies could benefit with having less middle-agents that are more interested in upselling certain insurance products and turn a deaf ear when we ask for something more personalised to us.

Cheers,

Jean

Hi Jean,

Fully agreed. Sending you now. 😀

Hi there, would you be so kind to share with me the contact number of your agent?I am looking for a good insurance agent. Thanks! Good article, by the way!

Hi Lena,

Thanks. Will email you!

Hey there, highly appreciate if you could email me the agent’s mobile number?

Hi! A very informative sharing. Thank you. As I myself is currently looking for a good insurance as well, could you kindly share agent details please?

Hi Azi,

Thanks. Will email you!

Hi Mr Stingy, excellent write up! I’m keen on getting an insurance as well. Could you kindly share your agent details, please? Thanks

Thanks JO — will email you.

Hi! Do you mind sharing me the details of your AIA insurance agent? She seems very knowledgeable and helpful. Thanks!

Hi Wan — will email you.

Hey, do you mind sharing the agent’s details? Im looking for an insurance agent as well

Hi Tasha,

Will email you.

Hi Mr Stingy,

Would you mind to send your agent’s contact details to me?

Thanks,

YF

Hi, emailing you now…

Hi! Good write up! I am currently looking for an insurance agent, would you please give me the agent’s contact? thank you so much!

Hi thanks!

Emailing you now…

Could you kindly share agent details please?

Hey, emailing you now.

Hello Bro,

Great write-up and valuable advises. Would you mind sharing your AIA agent’s contact?

Thank you.

Thanks Ganesen,

Emailing you now!

Hi Mr Stingy, thanks for the write up!

I’ve recently met an insurance agent from AIA as well but did not find him very informative & transparent. Could you kindly share with me your agent’s contact?

Thanks!

Hey Jean,

Thanks. Emailing you now.

Hey there! Do you mind sharing me the details of your AIA insurance agent? Rather new to insurance but I do see the importance of having one that is knowledgeable and reliable.

Hey Jules,

Thanks. Emailing you now!

Hello Mr Stingy,

Thanks so much for writing this piece. I quote, “If your agent sucks, you’ll have a sucky experience.” – how true that is.

I’m currently thinking of changing my insurance agent. Hope you don’t mind sharing your agent’s contact details with me, too. Thanks again, and have a great day!

No problem Naddy. Hope it was helpful,

Have just emailed you my contact.

Hi Mr Stingy. May I get your agent’s phone number please? Thank you for your help!

Hey Wei Xian,

Have just emailed you.

Hi. Highly appreciate if you could email me the agent’s no? Thankss

Hi Fifa,

Have just emailed you!

Could you kindly share agent details please?

Hey Lolo,

Have just emailed you!

Would you pleased to share the contact number of your agent? I’m looking for a an insurance agent.

Hi Nadira,

Have just emailed you.

Hi. May I get your agent’s phone number please? Thank you for your help!

Hi Nabil, have just emailed you.

Hi there, would you be so kind to share with me the contact number of your agent?I am looking for a good insurance agent. Thanks! Good article, by the way!

Hi Aeris,

I’ll email you now. Thanks for your kind words!

Hi there Aaron

Thank you for a useful post

Would you mind sharing the AIA product agent’s contact details please?

I am in search of a suitable life policy so will help if I can explore AIA’s offering

Regards

Hi Roger,

You’re welcome. Have just emailed you.

Hi there

Any chance you don’t mind sharing your agent’s contact details?

Regards

Hey K K,

Have just emailed you.

can let me have your AIA agent contact details? i intend to swap fr my Great Eastern medical as d agent was not straight forward

Hi Anna — I will email you.

Hi there, would you be so kind to share with me the contact number of your agent?I am looking for a good insurance agent, had some bad ones in the past. Thanks! Good article, by the way!

Thanks Dr Zaireen,

I’ll email you!

Hi Sir,

In your research….did you manage to find any good purely tern life insurance……Would love to find out more if you have…..

Hey Raj,

At that time, I didn’t find any that really struck my fancy. However if you’re looking for a purely term insurance though — I think there are lots of options out there already. Check out UforLife and also the other options available at an online comparison site like iMoney…

Hi Mr Stingy, excellent write up. Seems like you are anything but stingy! 🙂 I am looking for a good agent, and would appreciate it if you would be so kind to share with me your agent’s contact please? Thank you in advance.

Thanks! Emailing you now.

Hello Mr. Stingy! I’m a 34 year old single guy and just today I decided that I should get an insurance and Google brought me here. I have to say I am very satisfied with all your explanations regarding choosing an insurance policy. However, there are still some terms and things that I need more explanations for. Instead of bothering you with another “All about insurance” for dummies like me, could I have the number of the agent that you signed up with so I could pester her? Could you email/pm me her contact details please?

Appreciate it!

Cheers,

Ben

Thanks Benjamin for your kind words. Let me ask my agent whose details I can share with you. Will email you. 😀

Thank you Mr. Stingy! Looking forward to it!

Cheers, Ben

Hey Ben — emailing you now

Recently, been cutting down my policy coverage. Mainly the “Early” Critical. Reason being, my choice, is I would just want to cover medical cost, hospitality cost, and death benefit only.

“Early” Critical, for me, is a “half-die / almost” coverage and it is investment-linked product. I would choose a different way to have this coverage. (another said: i will not burden myself if I’m in stage of half-die or almost die). The gimmick of this product is to “offer” you an alternative to claim a money to buy “spare part” from other to lengthen your life, so that you can live longer.

Thanks TH. Interesting strategy! And early critical also costs a lot so…

Paying 1.5% to the insurance company for a subpar mutual fund with subpar returns is really a giant scam. Anything above 0.5% in fund fees is ridiculously expensive for investment. Read the book by John Bogle. Malaysians have been scammed enough by the subpar asset management industry in this country. Trust in yourself to make better returns vs the subpar fund managers in this country, if you invest after doing thorough research.

Been waiting for low-cost mutual funds for the longest time… 🙁

Hi, I would like to have your thoughts on my insurance plan: I am 36, healthy female, single and I have an investment linked policy which combines life insurance + critical illness + medical + accident (with Great Eastern). RM270 per month (RM3240 annual premium) will get me 100k basic life / disability, 100k for 36 illness, 15k or accident (death / TPD). Date of maturity: age 99. For the medical/hospital part: Room – RM150, Annual limit – 90k, lifetime limit – 720k, hospital benefits RM50/day, 10% co insurance, cover until age 80.

So because it was an old plan which started since 2010, the medical part covers only till age 80, with co payment required and it came with lifetime limit. I have recently enquired regarding upgrading of the existing medical card. I was told that I can add riders to offset the co payment part (so that no co insurance required), and another rider to increase the lifetime limit to no limit. However I was told that I will not be able to amend the age covered part (only till 80), and if I want to be covered till 99 then I will have to get new medical card… I was also advised to drop the accident rider from the current policy and to purchase a separate personal accident insurance.

So what is your thought / advice? Do you think I should leave it as it is (to be covered till 80)? Or shall I drop the medical card from this policy and get a new medical card instead (perhaps from another company e.g. Allianz Medical Card)?

Hey SC,

It really depends on your objectives. Do you foresee yourself living till past 80, and then having lots of medical bills to deal with. If so, it might make sense to amend the current policy and get a new one for medical.

If you’re comfortable with having health insurance till you’re 80, then I don’t see why you need to buy a new one. You can consider just upgrading. (Not exactly sure why you would upgrade though — it sounds like you’re still very healthy and young — why not just keep it as it is?)

Sorry I can’t give much concrete advice here. But “it depends” is really the best thing I can say knowing the very little you’ve explained here.

Hi. I’m not sure which policy to buy gor my baby girl since there so many plans from different company.should i get an ilp or life insurance or separate medical card?

Hi Prescila,

Could I know what’s the thought process behind buying insurance for your baby girl? The way I look at it is this — if insurance is necessary to take care of your loved ones when one is sick/gone, then perhaps what you need for your baby girl is something else — perhaps a pure investment product instead for her future education?

Good write up bro!

Very informative + not selling an idea + leave the decision to the reader. I like that bit the most.

Keep it up!

Thanks man. Appreciate it!

Bro,

A good write up for a start. Just to share my experience, I think agent is not much of a concern now. We can do online claim now with the necessary form all stated in the website. I did it for my car insurance and my medial claim as well. Within 2 weeks i got my refund.

Else, hopefully with the soon implementing of the online insurance initiative by BNM, the overall cost for the consumer will be lower as the middle man cost will be cut off.

With so many website comparison website available now, if one would be extra hardworking will sure get a great deal from the comparison website.

Thanks for your comment Eddy,

Definitely looking forward to overall lower costs for consumers!

Hey good luck with your next endeavour! It must be mixed of scary & exciting future ahead 😉

As long as you buy from top 3 insurance companies, I believe it should be more a less the same, product wise. The key differences IMO will be in term of claim culture & product innovation. Delivering the claim (& promise) is the most important aspect from our perspective as the consumer – which relates back to the Total Assets/Liability section from BNM statistic report up there. Logic wise, millions of claims payout can’t be translated from thin air, without sufficient money.

When we nailed which company, then the search for the right advisor begins. @LCF I would say changing an agent within the same company, is not a big fuss – write a letter, signed baam. I did that before -3 days max. Hope the bad apples won’t cloud your judgement. Keep looking! There’s good ones in every company.

Note: Don’t go for small new companies, emerged from the merger of smaller under-performed companies.

Believe it or not the policy that we signed today, will be kickin for next 50 years and counting. Nearly a century, not just in 20 years.

Thanks Amir for your wishes and comment. Appreciate it!

I wonder what are the 3 top companies.

My guess: AIA, Prudential and Great Eastern?

And on this “If you have one who isn’t performing — dump him/her and look for someone new.”

Easier to say than done. Practically, when an agent resigns, the policy goes to his upline, which you may not know or he won’t be servicing you anymore if your premium revenue is relatively ‘small’, esp after the 6th year.

Even if you want to ‘transfer’ the servicing rights to another agent from the same company, if the agency manager where your policy is with originally, does not want to sign a transfer, you cannot transfer.

Then it falls back to you – if this happens 10 y from now, do you still pay the policy and bear the the issue of “call the insurer hotline but put on hold for 30 min until the line gets cut off + do claim your own” OR you get a new policy – which is not in your best interest in terms of cost and insurability?

Thanks for this one too. I hadn’t considered the finer details of dumping an agent.

In the case where we’ve been getting unsatisfactory services — what can a consumer do to complain/remedy the situation?

Bro, commendable write up here!

If I may add, you are spot on regarding “My honest assessment of the insurance industry in Malaysia is there’s still a lot of human element involved.”, but mostly for medic cards. For things like Death/TPD coverage, it’s pretty standard like motor ins in terms of ‘features’, if you want to call it. Price diff, not much.

The concept of early CI is good, but practically, when CI (ie cancer) is being detected, it is usually already NOT early stage. The probability of early CI claim during early stage is quite low. I’d rather go for higher normal CI amount, cost being the same.

For your choice of company, medium severity % payout stands at 60%; I’d say one thing you miss is that there are company that pays 100% even at medium severity at a lower premium cost.

And a fair comment is, with all due respect to the agent, which only an independent industry practitioner like myself is aware of – is that, for the past year, the responsiveness of your choice of company has been less than satisfactory. Having a good agent means taking this hassle out of you as policyholder, but does not reflect the company ‘reputation’ entirely.

Just like investment, where historical does not reflect the future, we cannot generalize a company historical claim payout as experienced by feedback you read from forums to be the way going forward. Did you know that another company used to be very ‘gentleman’ in claim payout, but when a new CEO who is an accountant takes over the helm, they become very ‘calculative’ in claim.

Last but not least, you might have missed this one important point in your choice of company when it comes to its medic card product range – it could only be explained in an article which got published in FMT 2 years ago – http://www.freemalaysiatoday.com/category/opinion/2014/04/21/review-your-medical-insurance-every-two-years/

Evidently , engaging diff agents for comparison has its limitation compared to engaging an independent adviser 🙂

Bro,

Thanks for your very helpful thoughts. I’ll be the first to admit that my article comes from the perspective of a “consumer”, and not as a formally-qualified expert. Am sure my readers will find your comments helpful, with further things (that I missed) to think about.

I also welcome further discussion. If there are further experts out there with comments — please comment and let us all know!

Thanks again bro.