Almost exactly one year ago, I signed up with a licensed financial advisory firm here in Malaysia.

It’s been a fun journey that’s gone by in a flash.

Coming from a completely-DIY approach to managing money, I knew I’d learn some new things. But I also learned stuff I’d never even considered. Things you don’t know that you don’t know.

So I thought it’d be helpful to share my journey and what I’ve learned. Some things I’ll cover: How’s the process of drawing out a financial plan? What were the most useful things for me? When is it time to consider working with an adviser?

(I’ll use the terms “adviser” and “financial planner” interchangeably here. To be technical, my adviser’s an Independent Financial Adviser. Meaning they hold multiple licenses and can freely recommend products from any company. If you’d like to learn more about the licenses, check out my article here.)

Here’s how my financial planning journey went.

The Journey

Month 0: Introduction

The journey starts with an introductory meeting, followed by 1.5 hours of fact finding. My financial planners (let’s call them “CS”) asked me a long list of questions covering every angle of my finances. This means everything — including how much money you have in every bank account and investment platform.

I was pretty uncomfortable at first — it felt like I was getting naked publicly — but CS were very professional. I also had concerns about the privacy of my data, but they reassured me my data would be kept secure.

Tip: having the first meeting in person will probably be more comfortable than doing it virtually.

After our meeting, CS kindly emailed me a summary of our discussion, and what I could look forward to in our next meeting. I was also given a bit of “homework” — to provide further info (things I couldn’t answer during the meeting), and do an online risk assessment.

Month 1: Discussing My Financial Plan

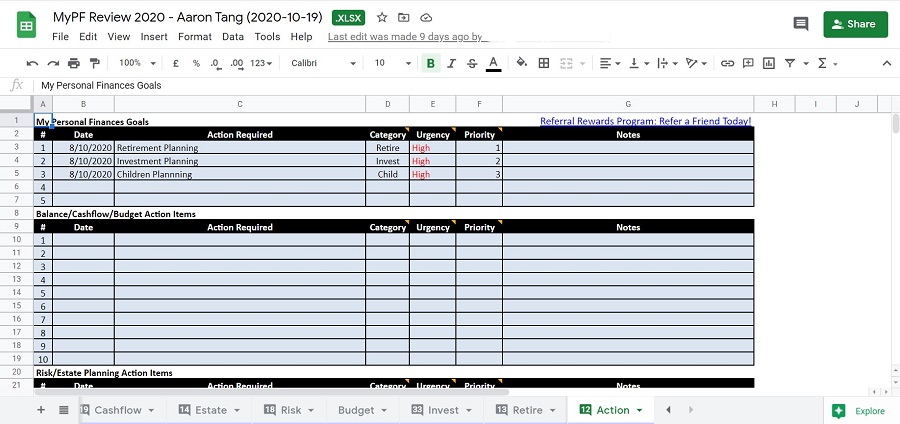

The one document that’s at the core of every meeting is the Personal Finances Review spreadsheet. It looks like this:

Notice the tabs at the bottom, which cover no-brainers like budgeting and investing, but also things we don’t normally talk about like Estate Planning — which is a nice way of saying “What happens to your money when you die?”

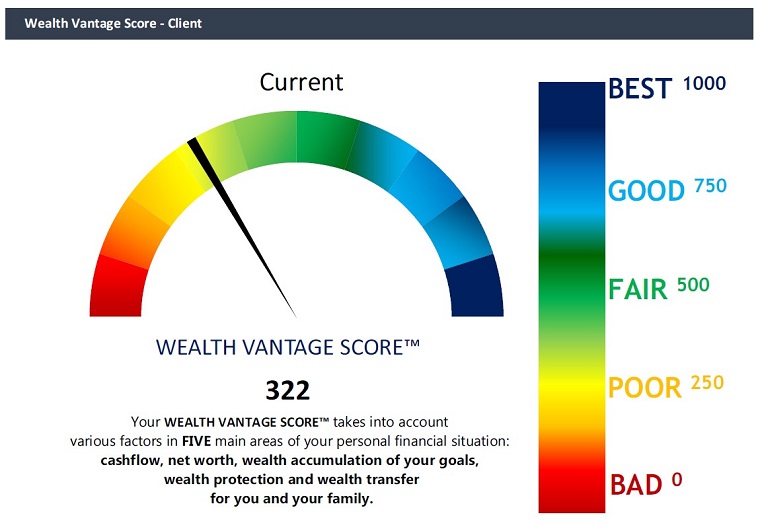

All the information I provided went into this sheet. And based on this, CS created a 22-page Financial Plan. It’s a comprehensive document that shows how you’re doing financially using multiple benchmarks, projections on where you’re going, and suggested actions on how to get there faster.

Here’s one of the sections, which shows my overall score:

Apart from discussing my overall Financial Plan, we also talked about cashflow planning — where my salary goes to on a monthly basis, and is this aligned with benchmarks? Finally, we chatted about planning for kids and investing.

For further details on Month 0-1 of my journey, check out my earlier article here.

The Overall Financial Planning Process

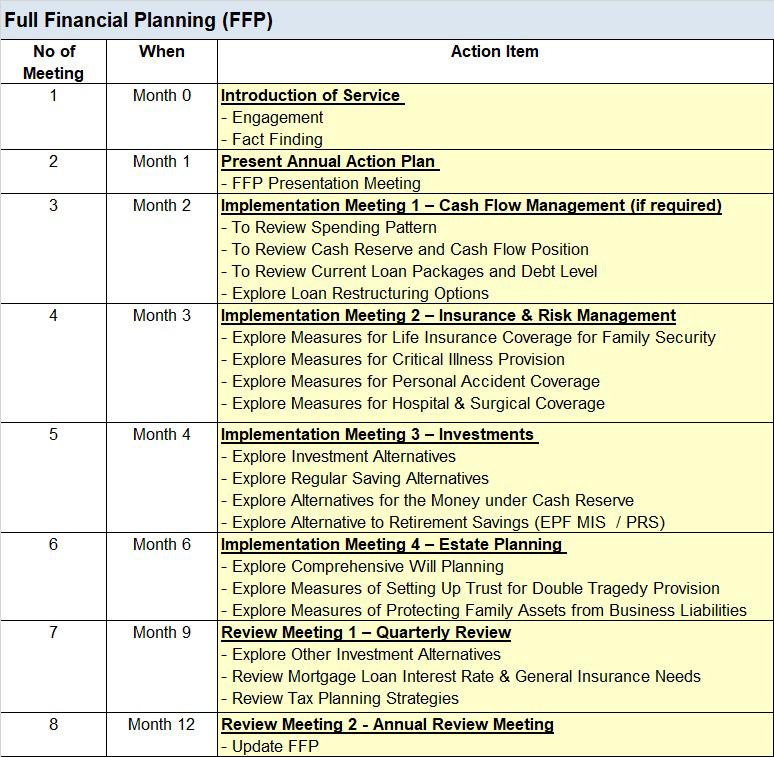

Before I cover what happened in Month 2-3, I thought it’d be helpful to zoom out and take a look at the entire one-year financial planning process.

Here’s the full schedule:

Each meeting is scheduled for 1.5 hours. Broadly speaking, this is what happens:

- Discuss any questions I’ve had since the last meeting

- Topic of the month (e.g. Insurance in Month 3)

- Update Personal Finances Review spreadsheet

- Email summary of discussion + homework to prepare for next meeting

In between meetings, you can also reach out to your adviser by email/phone for further discussion.

Now that we’re comfortable with overall process, here’s what happened in the following meetings.

Month 2 & 3: Cashflow and Insurance

Month 2 & 3 were combined into a single discussion for me in January 2021.

I like to think this is because my cashflow is doing OK, and not because I don’t have enough cash.

Some memorable things we discussed:

- My salary increment and upcoming move to a new apartment — how should I adjust to the new income + expenses?

- Is it wise to take loans to invest in property?

- My (lack of) emergency funds, and how I could structure this better

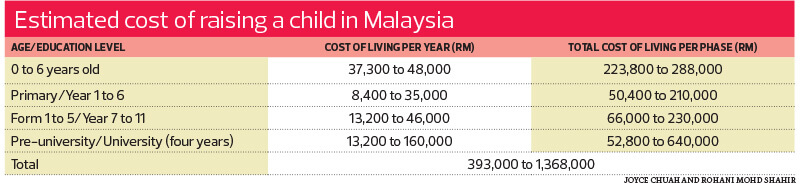

- How much do kids really cost? 😅

For homework, I was asked to locate insurance statements from 2020 and send it to CS for review. I was also asked to reconsider my rather-high budget allocation to “giving” and low-ish allocation to investing.

The good thing is an adviser can only give their advice and recommendations — decisions are for you to make.

Month 4: Investments

Investments was by far my favorite session. I wrote a detailed article about it here:

Revamping My Investment Portfolio With My Financial Planner (2021)

In summary:

- Came up with a plan to increase my emergency savings to 6 months

- Adjusted my robo-advisor investments to a higher risk level

- Predictably, from an adviser’s perspective, I had too much funds in cryptocurrencies. CS proposed a revised portfolio with more allocation to the stock market (equities). I agreed to tweak my portfolio — sold all my underperforming bond unit trusts and parked the money in a managed portfolio instead

I did not agree to sell any crypto. 🙃

Month 6: Quarterly Review

Month 6 is actually for Estate Planning.

But maybe because I had so many questions around investing (Thank you CS for answering my 10 detailed email questions between month 4 and 6), we used this as a quarterly review instead.

It turned into Investments & Insurance Round #2, where we discussed:

- Education planning for kids and options (local, private, international)

- Moving my investments around (away from bonds, more into stocks). Further advice on specific robo-advisor portfolios

- Adding life insurance coverage

At the end of the session, I decided to take up an RM 500,000 (RM 1 = USD 0.24) term life insurance plan to supplement my existing coverage.

CS was able to set up the insurance plan for me online. I merely had to send them some information and fill up a form.

Underrated benefit of working with an adviser: they can be your single point of contact for every financial need — whether it’s advice on international schools, investing or insurance.

Month 9: Estate Planning

What happens to your money when you die?

I was terribly unprepared for this one. Maybe it’s because I’ve lived most of my adult life as a single bachelor. But things are different now — I’m married, planning to have kids, and fast approaching middle age.

So even though it wasn’t my favorite topic, Estate Planning was where I learned the most:

- How much funerals cost (potentially >RM 20K 😪)

- Options for passing on wealth (e.g. a will vs a trust)

- Detailed information and costs for setting up a will

The Estate Planning session convinced me that setting up a will is the responsible thing to do. I’ll get to it in early 2022 — expecting costs somewhere between RM 1-2K.

Full article on this soon.

Month 12: Annual Review

Before I knew it, one year had passed. Time for the annual review, where we covered:

- My overall “scorecard” for the year — how much your net worth has grown

- Expected changes to income and expenses for 2022

- Action items. I was slacking on things I’d promised to do like setting up a will and adding funds into the managed portfolio. A good kick in the butt for me

CS also offered to help my wife (who isn’t their client) invest in a Private Retirement Scheme (PRS) at no extra cost. Remember to claim those tax incentives guys.

At this point, the financial planning process officially ends. Did I agree to extend for another year?

Read on for my thoughts and learnings on the whole process.

The Learnings

1. What a Licensed Financial Planner Can Do for You

Answer any — and I mean any — questions you have about money. Wanna know if you should take the latest loan moratorium? Interested to maximize your Budget 2022 tax benefits? Not sure what “Federal Reserve chairman sounds hawkish” means for interest rates, and how it’ll affect your money?

Ask away. A competent adviser should be able to explain in easy-to-understand language. And even if they don’t immediately know, they’ll be able to find out and answer you later.

To summarize how deep financial planning can go, an adviser can tell you exactly how to spend your money.

Being in the financial services industry myself, I’ve lost count of how many times people have asked me “Is it a good time to buy X?” and I’ve had to tell them: “Sorry, I actually can’t give you specific financial advice because I’m not qualified.”

If you’re looking for someone like that, speak to a licensed financial planner.

2. What a Licensed Financial Planner Won’t Do

- Shill you products from only ONE company. The nice thing about working with an Independent Financial Adviser is they’re not tied to a single company. They’re free to recommend products from any. In fact, they should be surveying the market and finding the best deal for you — whether it’s for an insurance plan or a unit trust.

- Force you to sign up or buy anything you don’t want.

Your adviser can only recommend, but you can always say “No.”

3. An Adviser Amplifies Your Strengths and Covers Your Weaknesses

One thing that took me really long to learn is money is different for everyone. So a 37-year-old guy who’s planning for kids (me) should manage his finances very differently from a 60-year-old couple who’s retiring.

For financial advice to be effective, it needs to be customized to your unique situation.

Pulling an analogy from the sporting world, having a good financial planner is like having a wise coach in your corner.

Sure, you could cover basics by watching YouTube videos and reading articles, but taking it to the next level requires personal attention. Even Lionel Messi has a coach. As does every other world-class athlete.

When it came to investments and cashflow — which I view as my strengths — it was more of discussing ideas than CS telling me what to do. I was already confident in what I was doing, but having professional advice validated some of my thoughts, while pointing out weaknesses I’d missed.

Meanwhile, in things I was clueless about like Estate Planning, it was ~100% me listening and learning.

Regardless of your current situation, a good adviser can help you get better.

4. But You Still Need Discipline

I wasn’t a great client.

It was a nightmare to arrange meetings with me. (Sorry Diana.) I’d also get very motivated to make improvements during the meetings, only to lose interest days after.

Work + crypto have been draining most of my attention this year. Hence, I’ve neglected my financial planning journey and sharing about it here.

To their credit, CS have been really nice about everything. But the one thing they can’t do is force me to get off my ass.

Even the best advice in the world is useless if you don’t take action.

5. What Do Advisers Think About Cryptocurrencies Today?

I’m lucky because CS have a progressive take on crypto.

While we disagree on percentages (CS recommends me to keep 5% of net worth and below in crypto), we agree crypto is a useful alternative asset which investors can use to diversify. We’re also aligned that if you’re gonna dabble in crypto, it should be Bitcoin first.

I’ve noticed other encouraging signs from the “traditional” finance world. I was on a podcast recently with Hann Liew, the co-founder of RinggitPlus and a CFA/CFP himself. Quoting Hann:

“…if you’re in financial planning or investment advisory, ‘I don’t cover/recommend crypto’ is simply no longer an acceptable answer… Ignoring it is not the answer, have a yes/no position, and explain why.”

On the other end of the spectrum, if you’re a hardcore crypto fan you’re likely already sitting on some nice gains in 2021. But what happens if/when the crypto market crashes?

I’m not saying sell all your crypto for inflation-risky dollars. What I’m saying, is it’s wise to consider multiple perspectives, and adjust your portfolio accordingly. Should you have 80% of your net worth in crypto? Should it be 50%? Maybe just 20%?

I can’t say for you, but something worth thinking about.

6. What Were the Most Helpful Things for Me?

- Planning for children’s education

- Estate Planning, and how to get a strong will done

- Adding insurance coverage to better protect my family

On the other hand, I was already comfortable with things like understanding financial metrics, budgeting and managing debt.

You can tell my gaps are in the “defensive” areas of personal finance.

Not surprising, as I tend to admire macho characters who live life on the edge.

wagmi.

7. When Is it Time to Get a Financial Planner?

I’ve been a DIY money manager my whole life. I think I’m doing a good job, but in recent years, I’ve been struggling with:

- Time to manage every aspect of my finances

- Focus. I’d rather spend all my free time dabbling with crypto and play-to-earn games. And once I have kids, I’m gonna need to focus there too. I have zero interest in understanding the will-writing market. Please just tell me what to do 🙏

Working with an adviser lets me free up time and focus on things I really love.

Additionally, you might wanna consider working with a financial planner if you:

- Don’t have friends and family who’re good with money, and need someone to talk to

- Have tried DIY money management but are struggling

- Want to take your personal finances to the next level, but don’t know how

Traditionally, financial planning has been viewed as something for the rich. But with improvements in technology, nowadays you can get financial planning modules done for a couple of hundred ringgit.

Conclusion: Would I Pay For it?

In the process of writing this, I received a complimentary full financial planning package from Wealth Vantage Advisory (WVA), a licensed financial advisory firm in Malaysia.

I sometimes ask myself, if I had to pay for it would I still have signed up?

Fees are:

- Comprehensive financial health check: RM 300 (RM 1 = USD 0.24)

- 1-year modular financial planning: RM 1,500

- 1-year full financial planning: RM 3,000

(The difference between modular vs full financial planning is the full plan covers all of the following: insurance, investments and estate planning. Meanwhile, for modular financial planning you choose 1 out of 3.)

While not the cheapest services in the world, I’ve learned to not just look at price, but also value. And the last one year has indeed been valuable. If I was unsure at the beginning, I’m very confident now:

Yes, absolutely, I would have paid for it. And yes, I’m now on year two of my financial planning journey. Stay tuned for more!

– – –

If you’re also interested to get professional money advice, I’ve got just the thing for you. Sign up here (and scroll to the bottom) for a FREE consultation session with a licensed financial planner from WVA.

No obligations to take any paid services. So perhaps have that free chat and see if it brings as much value to you as it did to me?

Article contains affiliate links. If you sign up for any of the paid services, I’ll get a small reward.

Pic from Pexels: Alex Andrews