People often ask me for investment advice, and 99% of the time, the responsible answer is: “It depends on your situation.” There are no easy answers in investing, and usually the conversation ends up with me asking a ton of probing questions instead of giving a simple answer.

But I understand that’s an irritating response, especially perhaps when you’re a little younger and looking for some structured guidance. In the spirit of that, while I can’t tell you exactly how you should invest your money — here’s how I invest mine. Hopefully it’ll give you some things to think about for your own investing journey.

Unfortunately, I can’t share exact dollar figures as it’s a little too public here. What I will share is percentages of what I’ve invested in. I’m also big on principle-based reasoning, so I’ll briefly mention investing principles I believe in too.

Please take this article at your own risk. It’s certainly not how I think you should invest your money, but this is what’s worked for me.

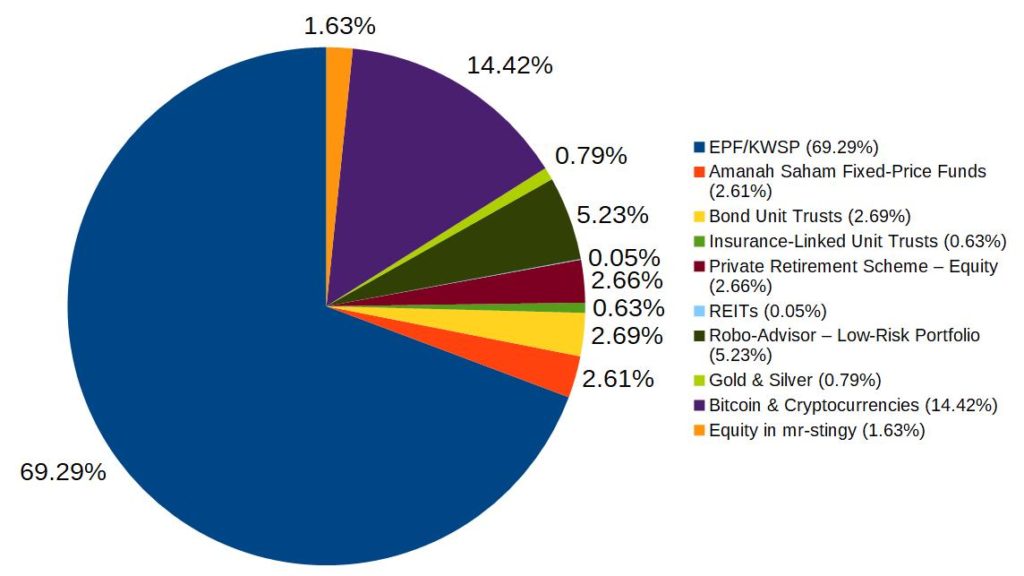

mr-stingy’s Investment Portfolio – July 2020

A. The Safe Stuff

About 80% of my investments are what I consider “safe”:

- EPF/KWSP: 69.29%

- Amanah Saham: 2.61%

- Bond Unit Trusts: 2.69%

- Insurance-Linked Unit Trusts: 0.63%

- REITs: 0.05%

- Robo-Advisor Low-Risk Portfolio: 5.23%

I’ve always considered the Malaysian EPF underrated. Been delighted with their consistent returns (4.5-6.9%) over the past 13 years of my career. So I’m happy to keep most of my portfolio here — I’ve never withdrawn a single sen — and likely won’t until I retire. Not many know this, but the EPF is required by Malaysian law to pay yearly dividends of at least 2.5%.

Next: Amanah Saham fixed-price funds have never disappointed either — only wish I had the quota to invest more when I was younger. If you’re bumi or manage to get some quota, it’s a no-brainer.

Moving on to the unit trusts I have. They’re all in bond funds (via Fundsupermart) as I’m playing safe right now. Historically, I haven’t done well in choosing unit trusts, which strengthens my belief I should leave most of my funds to the EPF and other passive investments.

A very small (0.63%) portion is in investment-linked insurance plans. These are expensive funds with traditional sales charges (5%) and annual fees, so I’m minimizing the amount of money they hold. I’ve moved much of what I used to have here to my robo-advisor. I also have a tiny bit of “experiment” money in a REIT (via Rakuten Trade).

Finally, roughly 5% of my investments are with my robo-advisor (StashAway), set at the lowest-risk portfolio. Loving this because it’s cheap, convenient, and my assets are valued in US dollars — protecting me against Ringgit drops.

B. The “High Risk-High Return” Stuff

The other ~20% of my portfolio is in higher-risk assets:

- Private Retirement Scheme (PRS) — Equity: 2.66%

- Gold & Silver: 0.79%

- Bitcoin & Cryptocurrencies: 14.42%

- Equity in mr-stingy: 1.63%

My PRS funds are invested in Asia Pacific stocks (via Fundsupermart). Returns have been OK (cumulative 31%) over the last seven years, but this one is really for tax benefits.

I also keep a little bit of gold and silver (via Maybank) as hedges against inflation and currency devaluation. Traditionally, I’ve never been a fan of gold, but watching the US Fed (central bank) print money like a toilet paper factory has convinced me otherwise. Planning to bump this up to 1% shortly.

14.42% in Bitcoin (via Luno) and crypto is probably the one where financial advisors get alarmed and cover their children’s eyes. What can I say? I’m a firm believer in digital assets. (Find a detailed explanation of why here.) This portion is also oversized because of gains — cumulatively I’ve invested only ~9%, but my crypto has grown 63% over the last four years.

Lastly, I have a bit of money invested in mr-stingy LLP, officially the entity that runs this blog. It’s been six years now, and I’m finally generating sustainable income. Due to difficult coronavirus times, I’m donating >80% of revenues this year to charity. Do I get to call mr-stingy a social enterprise now? 🤔

Personal Situation

For further context, I wanted to share my personal circumstances. Just so you understand which stage of life I’m at and where I’m coming from. Here goes:

I’m 36 this year. I work a full-time job (which is challenging but I love) for 45-50 hours/week, plus spend another ~12 hours on this blog. I paid off my student loan before I turned 32. The only financial commitment I currently have is my home loan. (I drive a second-hand car which I paid for in cash.) I’m blessed enough to not have any other expensive health or family-related commitments.

My diverse hobbies aren’t expensive and I’m slightly introverted — social engagements more than twice a week tire me out — so mostly I’m reading and writing at home. I don’t consider myself a great success in any particular area, but rather I take pride in maintaining balance in life.

I recently got married and my wife has a good full-time income too. Planning for kids in the near future.

We’re financially stable, but still far from financial independence or early retirement.

10 Investing Principles I Believe In

Closing this one off with a list of investing principles. Actually, this portion probably deserves a future article with detailed explanations, but consider this a teaser for now.

Here’s what I believe when investing my own money:

- Keep expenses as low as reasonably possible. I’m frugal in many ways but I also splurge on things that bring me happiness.

- Be excellent at work. All major income jumps in my life have happened via promotions in my day job. High income + low expenses = more to invest.

- Invest most funds in SAFE assets (e.g. EPF) with LOW fees (e.g. robo-advisor ETFs). This is protection against losing capital.

- Allocate a bit in high-risk, high-return assets. Look for asymmetric opportunities — things where I can gain a lot more than I risk losing (e.g. Bitcoin).

- Never borrow money to invest.

- Passive investing beats active investing (usually).

- Automate as much as possible. I don’t have a lot of extra time or energy — so set up systems (e.g. automatic salary deductions) that remove typical human weaknesses.

- Use technology to make life better. Almost all my investments are done 100% online.

- Invest for retirement. I’m a long-term investor, not a day trader — so don’t worry about short-term market swings.

- Never stop learning. How I invest today is very different from five years ago. It’ll probably change again in the next five.

Remember: Investing Is Personal

Would I recommend anyone to follow my investing principles? I think they’re actually good principles for someone who likes their job, is earning a stable income, and wants a balanced life — with time for family, friends and hobbies.

The only part which isn’t mainstream is the 80-20 (safe vs risky) split, which is my take on Nassim Taleb’s barbell investing, whereas a financial adviser might recommend a conventional 60-40 stocks-bonds ratio. Regardless, the idea is long-term balance — something that allows you to sleep well at night, but still wake up one day 25 years later and say “Wow, I don’t think I’ll struggle with money ever again.”

Of course, if you have different targets — say you’re hustling for FIRE (financial independence, retire early) in 10 years or you wanna become a stock market trading guru, you’ll probably need different principles.

Whatever it is, I hope you think hard about your own investing goals. And get to a point where you’re comfortable enough to decide what really works for you.

Investing is a tough open-ended question, but like most meaningful things in life, that’s what makes it sweeter when you finally find the answer.

– – –

Some of the links above are affiliate links with special offers. I only recommend things I use myself and believe in.

Pic from Pexels: Lukas

I plan to open an account at Fundsupermart, can I have your Referrer’s Account? I have benefited so much from your blog, I think it’s time to contribute back. 🙂

Hi Daniel,

Thanks so much for asking and your support. You can use this link to sign up: https://www.fsmone.com.my/public/account-opening/personal/account-info?referrerRefno=M0009458&referrerName=Aaron Tang Shen Lee

Hi Mr Stingy,

Really like the way you explain about investments in a simple manner.

Can I know if robo-advisors like Stashaway is considered a safe platform to invest in? What are the chances of it suddenly going bust and us losing all the money we’ve put in?

Hi Canny,

Thanks for the comment. It’s absolutely safe because robo-advisors are regulated by the government authorities. Even if the company goes bust the money is recoverable. The assets belong to you, not the robo-advisors, so you don’t have to worry about that.

(Just note that the prices of assets you invest in can go up or down, so it’s not GUARANTEED profits. But you don’t have to worry about the platform closing down.)

Thanks Mr.Stingy!

I would like to see your opinions, especially on the numbers and metrics on becoming a FIRE individual (or with a spouse) in Malaysia!

Hi Zack,

I have just the article for you. It’s my latest one here: https://www.mr-stingy.com/financial-independence-retire-early/

Spoiler: Not easy to reach FIRE on Malaysian type of salaries 🙂

Thank you Mr. Kedekut!

Thanks Zack!

Should vehicles be considered as part of the portfolio? even if it is a depreciating value?

Hi Abby,

I don’t consider vehicles as an investment, so I don’t include it in my calculations. Same as property.

If you’re calculating “net worth” though, it would be common to include vehicles and property market value.

Hey Aaron!

Just curious, how do you calculate the equity value that you own in Mr-Stingy?

Regards,

Yi Xuan @ No Money Lah

Hi Yi Xuan,

Thanks for dropping by. Just calculated using my “Prinsip Akaun” SPM knowledge. mr-stingy is an LLP, so I refer to the balance sheet, and the “Owner’s Equity” is the portion I take this calculation from.

Hahaha, first thing you learn as a Financial Professional/Blogger/Influencer is:

People wants simple answers and they will blame you for their investment underperformance regardless of disclaimers.

It’s tough putting yourself out there, definitely the allocations can draw disagreement from many quarters, but like you said, personal finance is intensely personal.

Yups, and perhaps the best thing we can do is make people think and question.

Hi Mr stingy,

May i know what is your low risk percentage % in stashaway?

Hi Ganaesan,

It’s the lowest. The 6.5 one.

Hi Mr Stingy, I am wondering that why you quitted investing in P2P Lending from Fund Societies? May I know any specific reason? Besides, why you only invested in StashAway Low-Risk Profile instead of High-Risk Profile?

I’ve still got funds in P2P Lending in Funding Societies — but it’s my company funds, not personal funds. Hence I didn’t calculate it in my personal portfolio. I’m in StashAway’s low-risk profile because I think I already have quite a lot of high-risk stuff (e.g. crypto) so trying to find balance here.