I like to think I’m a self-taught money manager.

Yes, I’m influenced by basic money principles my mom taught me, and Introduction to Finance class in uni. But overwhelmingly, most of what I know about managing money comes from self-study and practice.

I’m mostly like this in other areas of life too — whether it’s career, fitness, or hobbies. I’d rather read 50 articles online and buy a book, instead of paying an expert to teach me.

Given the circumstances, I think I’ve done okay.

But maybe this independent streak of mine; believing I can learn anything from the Internet is sometimes a weakness. Actually, it’s kinda arrogant. And if there’s one thing I’ve learned about growing older, it’s you don’t have that much time to DIY anymore. Oftentimes, the smart thing to do is work with an expert, a professional.

So recently, when a friend who’s an Independent Financial Adviser asked if I wanted to go through a one-year financial planning journey, I decided to ditch the “I can do everything myself” act. I said “Yes.”

Here’s what I learned along the way.

What a Licensed Financial Planner Can Do for You

If you’ve explored getting insurance/investment before, you’ve probably heard of titles like “adviser,” “consultant,” “coach,” and “planner” being thrown around. Confusing eh?

There are actually several different licenses in Malaysia — each legally allowing an adviser to do certain things and use a certain title.

If you want the broadest scope of financial advice possible, aim for an “Independent Financial Adviser (IFA).” Which means someone who holds all the following licenses:

- Capital Market Service Representative License — for dealing in financial planning activities, by Securities Commission (SC). Having this license means someone can call themselves a “Licensed Financial Planner.”

- Financial Adviser Representative (FAR) License, by Bank Negara Malaysia. Having this license allows someone to recommend insurance products from any insurance company.

- Capital Market Service Representative License — for dealing in unit trusts and Private Retirement Schemes (PRS), by SC. Having this license allows someone to advise on unit trust and PRS investments.

(The entire licensing thingy is actually more complex, but to keep things simple, I’ll use “financial planner” and “adviser” to mean the same thing: An IFA who has all three licenses.)

What’s cool about this license combo is your adviser isn’t limited to recommending you products from just one company (vs an insurance agent who can only recommend plans from their company). An IFA is unbiased — they can help shop around and propose the best plan for you.

It’s not just limited to insurance and investment though. Your adviser can also advise on things like cashflow management, budgeting, tax strategies, and will planning.

– – –

When I heard about everything we were gonna cover, I was pumped. I was keen to finally understand what a pro financial planner thought about my money situation, and what my blind spots were. Plus what would they say about my investments in Bitcoin?! 😐

Here’s what happened.

Month 0: Introduction

The first meeting is an introduction session, followed by 1.5 hours of “fact finding.” My financial planners (let’s call them CS) invited me to meet at their office, and I’m glad I decided to go.

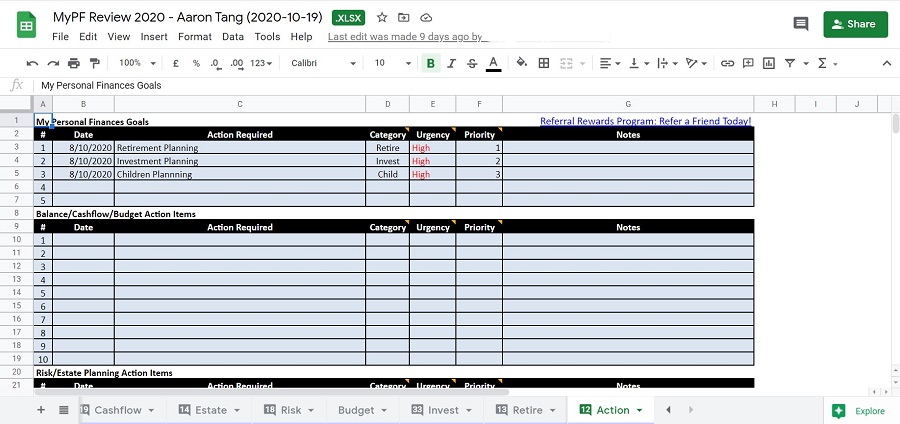

Because the fact finding session is detailed. I would have struggled to fill up the Personal Finances Review spreadsheet myself, which covers important areas of your life including:

- Balance sheet (assets and liabilities)

- Cashflow management

- Estate, legacy & debts financial needs

- Risk management (insurance)

- Budgeting (annual and monthly)

- Investments

- Retirement planning

I was also revealing money details I’d never shared with anyone before, which was very uncomfortable. Hence, having that first meeting face-to-face was helpful.

Additionally, we discussed my overall financial goals, and I was given a bit of homework — to complete the spreadsheet with as much detail as possible, and do an investment risk profile assessment. (Result: Apparently I have average tolerance for investment risk. 🤔)

After the session, CS sent me a summary email, and let me know what to expect for our next meeting: discussing my financial planning report.

Month 1: Discussing the Financial Planning Report

Our second meeting was done virtually on Zoom. It’s better to have the meetings face-to-face, but I was super busy at work, and still cautious about COVID.

During this 1.5 hour session, we reviewed the draft of my financial report, which was created based on Month 0’s fact finding.

What I love about the process is you always have a chance to ask questions and discuss concerns. Your financial planner isn’t a dictator who forces you to do things with your money. Instead, it’s very consultative.

My Areas of Concern

- Emergency Savings: initially it seemed like I didn’t even have enough (6 months) of emergency savings. But I clarified that I actually had extra joint-savings with my family.

- Investments: My investments seemed to be overly conservative, with too much in fixed income assets.

Recommendation: Tweak my portfolio to include more equities, via managed portfolios. Invest some of my EPF Account 1 elsewhere. - Insurance: I already had 2x insurance policies, but the coverage wasn’t enough.

Recommendation: Add another insurance policy. - Will planning: I hadn’t set up a will, so if anything happens to me, it’ll greatly trouble my family.

Recommendation: Set up a will asap.

What I Was Doing Well

- Retirement Savings: I was on track to retire at 55.

- Financial Ratios: My ratio of loan payments vs salary was comfortable. Other ratios (e.g. savings rate) were good too.

- Income Tax Planning: I was optimizing my tax reliefs well.

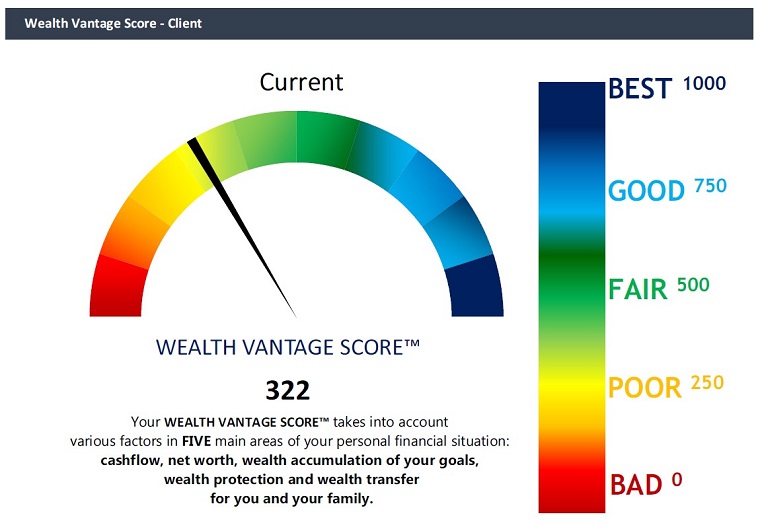

Overall, my score (based on my adviser’s scoring system) was somewhere between Poor and Fair; slightly below average. 🙁

(For comparison’s sake, Yi Xuan from No Money Lah had a way better score #jealous. Check out his experience here.)

Throughout Month 1’s meeting, it was very obvious my biggest interest is investing — I kept swinging the discussion back to that. But of course, there’s a lot more to personal finance.

We ended the meeting by discussing upcoming changes to my cashflow for 2021 (e.g. salary increments and additional loans), and family planning. For those of you with families, it’s better to do financial planning together with your partner.

Yes, your financial planner looks after your family too.

Post-Meeting & Action Plan

As usual, CS sent me an email summary after the meeting, with recommended action points.

I also received my 22-page Full Financial Plan, and am currently considering the recommendations on insurance and investments.

Should I sell all my bond unit trusts and move them to managed portfolios? Do I really wanna touch my EPF money? Hmmm…

What’s Next?

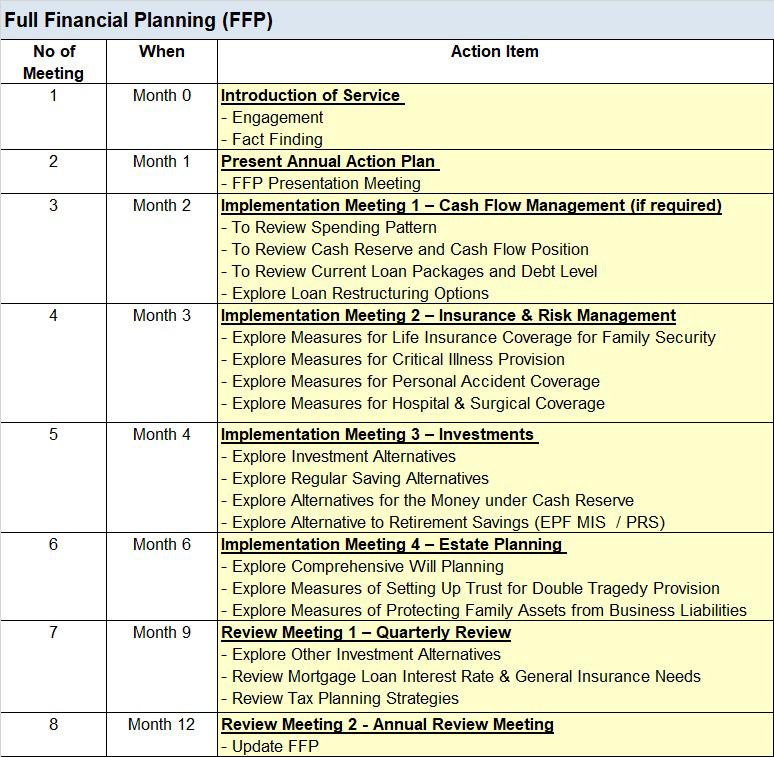

For Month 2’s Meeting (scheduled for January 2021), I can look forward to: Cashflow Management Planning.

The full financial planning journey is actually a 12-month process, shown below:

More from this series:

Revamping My Investment Portfolio With My Financial Planner (June 2021)

My Financial Planner (& Charges)

For my financial planning journey, I’m working with the talented team at Wealth Vantage Advisory (WVA). My personal advisers CS are also the people behind award-winning financial education platform MyPF.my.

Fees are:

- Comprehensive financial health check: RM 300

- 1-year modular financial planning: RM 1,500

- 1-year full financial planning: RM 3,000

The difference between modular vs full financial planning is the full plan covers all of the following: insurance, investments and estate planning. Meanwhile, for modular financial planning, you choose 1 out of 3.

Lastly, if you’re also interested in getting professional money advice, I’ve got just the thing for you. Sign up here (and scroll to the bottom) for a FREE consultation session with a licensed financial planner from WVA.

No obligations to take the paid services. So perhaps have that free chat and see if it brings as much value to you as it did to me? All the best!

– – –

Pics from: Pexels

In the process of writing this, I received a complimentary 1-year full financial planning package from WVA. If you sign up for any of the paid services, I’ll get a small referral fee.

Hi Mr Stingy,

Thanks for sharing your experience here.

After reading, I am interested getting professional advice from an advisor, but am on the fence, as I’m not sure if this is too early for me. I am 5-6 years into the working world, single, and still trying to raise my active income, while saving and investing in the meantime.

Would like to ask your opinion, aside from lack of time to DIY, at what point do you think it is a good time to consider consult a professional?

Hi JT,

Thanks for dropping by. I think getting professional advice could be good to also point out blind spots (a.k.a. “what you don’t know that you don’t know). If you’re looking to improve your all-round knowledge regarding personal finances I think that’s a good reason too.

In other words, if you’ve got a good grasp on your finances (and time to manage), you probably don’t NEED an advisor. Would it be helpful and give you a further edge though? I think so.

Hope this helps!

Wealth Vantage Advisory is really different from other financial firms out there! I was actively contacted after submitting inquiry & was promptly replied – all the way from initial queries to setting up the meeting with advisor. And on meeting a WVA financial planner, I felt really listened too instead of immediately shut down like my experience with some other companies “advisors” or being pushed products. Looking forward to working with a financial planner together with my wife!

So good to hear Khoon. Glad it’s been a great experience!

hi Mr stingy, i am a bit confuse between Mypf and wealth vantage? you are using both company? or only one?

which company you recommend?

thank you

Sam

Hi Sam,

MyPF is the website. Wealth Vantage is the Licensed Financial Advisory firm. If you sign up for advisory services on MyPF, you will automatically get an advisor from Wealth Vantage. In effect, it’s the same thing.

Hi Aaron, I found this pretty useful and will give it a try as well. Dropping a note to tell you that your referral link doesn’t work – leads to issues upon submission, so I had to refresh and sign-up via their free trial link instead and had inputted your referral code separately. Suggest you add in your referral code in the article as well in case the same error happens to others!

Thanks May for letting me know!

Will check in with the team. All the best on your journey.

Hi Aaron, there is a difference between a financial advisor and financial planner generally, even more so in Malaysia. What you have received from WVA is a financial plan.

At this point in time, there are more professionals providing advise than planning.

Thanks Linnet,

Appreciate you dropping by. Hope things are going well for you. What’s the next big priority for FPAM?

Unfortunately Aaron, this recommendation seems to have fallen short. I signed up on mypf.com, emailed them and emailed through the wealth vantage site and no one has contacted me to date. Perhaps they only have time for bloggers giving them publicity :/

Hey J,

Thanks for letting me know. For a period of time they were having some tech migration issues. Your registration might have accidentally fallen through then.

I’ll let them know now to check and follow up with you.

May i know more in detail of FFP programmes like how many days per week and how long for each session?

Thank you 🙂

Hey,

It’s about a 2-hour consultation every month. 🙂

Thanks for sharing. I also signed up for another independent financial advisory service since a few years ago. They did a holistic financial analysis and helped to build my financial roadmap. A reminder for all readers, they need to be fee base and not commission base so that their interest is not against us (i.e. to sell products and get commission from us).

On investment section alone, these financial advisory provides a gateway to invest in best-in-class unit trust funds and able to switch among different fund houses for free. Of course, there are sales charges, account wrap fee and the UT underlying management fee is generally higher (which eats up our profit).

Check out Stashaway Malaysia which invest in ETF globally. Investing in ETF is rivalry to UT as ETF do not have sales charge, no account wrap fee and has very low management fee. However, there is no free lunch, Stashaway will charge a tiered management fee, but still way lower than UT. For me, all of these are temporary solutions, or at best for portfolio diversification.

The ultimate solution is to learn investing and trading stock for long term. This skill is recession proof and profit is scalable. However, it requires time and effort to hone the skill.

Thanks for sharing. Wishing you the very best for 2021 and beyond!

Good sharing.. May I know how do you convince yourself to share all your personal information to a complete stranger? I always have this kind of reservation. thanks.

We did have a conversation around PDPA, and how my data would be used. Also, the fact that they have licenses and work with a licensed entity helps.

End of the day, everything is regulated, so if things go wrong — can take necessary actions.

(But yes, I agree it’s hard)

Thanks Aaron for the insightful sharing.

Thanks for your support!

Wow, that costs more than full body health check

Ah yes. I guess another way of looking at it is it’s an investment 🙂

Would you also be able to share/recommend the name of the financial advisor that you are working with? Thanks

Just head on over to Wealth Vantage Advisory and they’ll be able to recommend you someone. 😀