Five months ago, I wrote an article about how to set up a Limited Liability Partnership (LLP) in Malaysia. If you search for “Limited Liability Partnership Malaysia”, you’ll find it on the first page of Google. Which tells me one thing: there’s huge interest, but there’s also very little information out there about LLPs.

(So here’s my contribution to the local startup community: If you have any information or experiences to share about LLPs, do comment below, or maybe write a blog post about it too?)

Anyway, ever since I wrote that article — I’ve been getting a lot of questions about LLPs. While I would never claim to be an expert, I try my best to help. This article answers one of the most frequently-asked questions I get: how do you set up a bank account for your LLP?

If you meet a bank teller who isn’t well-trained — they might not even know what an LLP is. But I assure you that it can be done. My girlfriend recently got hers approved, and she very kindly provided me the information for this article.

Here’s how to do it:

1. Visit Your Favorite Bank Branch

Sad but true — in this modern age where we get real-time traffic information beamed to our mobile phones via satellite, we still have to physically go to a bank to get some things done.

Setting up a bank account for an LLP is one of them. I suggest you visit your favorite bank branch and ask them for the full procedure, and all the forms required. There’s still too little information online, so I think it’s best to talk to the bank officers face-to-face.

Searching through multiple pages of Google Search only got me the below information:

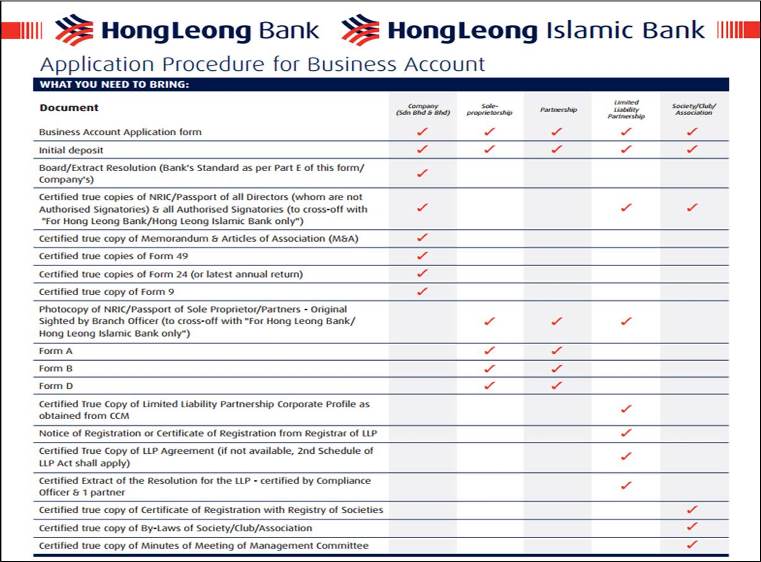

OCBC Bank’s “Application Procedure for Business Account”

HongLeong Bank’s “Application Procedure for Business Account”

Alliance Bank’s “Business Banking Application Form”

p.s. If possible, go to the head branch in your state, or at least a big bank. I hate to be elitist, but hopefully the bank officers there have heard of LLPs before and know what to do. A lot of people still haven’t.

2. Get the Documents Required

From your bank visit and websites above, we now know that you need:

- Certified true copies of NRIC/Passport of all partners and compliance officers

- Original NRIC/Passport of all partners and compliance officers (the bank officers need to see the originals, so you have to drag your partners to the bank with you)

- Certified true copy of LLP corporate profile

- Certificate of registration of LLP

- Certified extract of resolution for LLP (certified by compliance officer and one partner. This is the document that says all the partners agree to open a bank account)

These are optional, depending on your LLP:

- Practicing certificate (for a professional practice e.g. lawyers, accountants and secretaries)

- Letter of approval from governing body (for professional practices like above)

- Certified true copy of LLP agreement (this is the agreement made between all the partners of the LLP. If this is not available, “default LLP rules” a.k.a. 2nd Schedule of the LLP Act apply)

- Annual declaration of LLP (if available)

Let’s take a closer look at the mandatory forms:

Certified True Copy of LLP Corporate Profile

The LLP corporate profile contains all the important information about your LLP, like: business code, contact details, address and partners’ information.

Certificate of Registration for LLP

This is just like your LLP’s birth certificate.

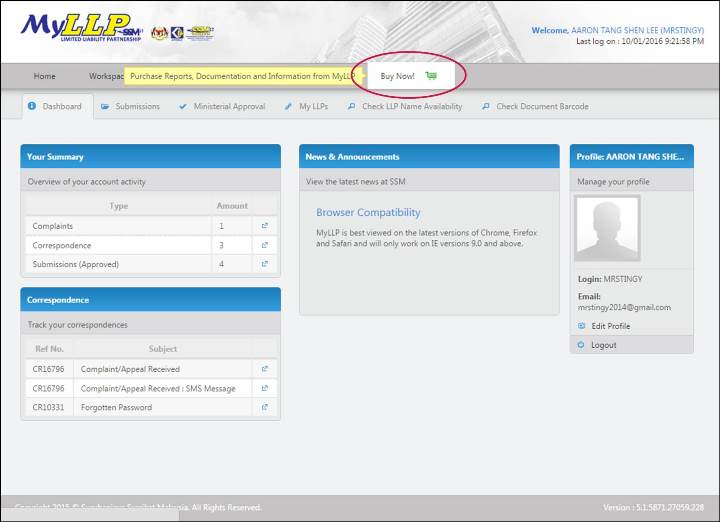

You can buy both these documents from the MyLLP system (although you’ll have to physically collect them from SSM). The process is really fast, and you can collect the documents as soon as you pay.

The screenshots below show the process:

At the main Dashboard, click “Buy Now!”

At the main Dashboard, click “Buy Now!”

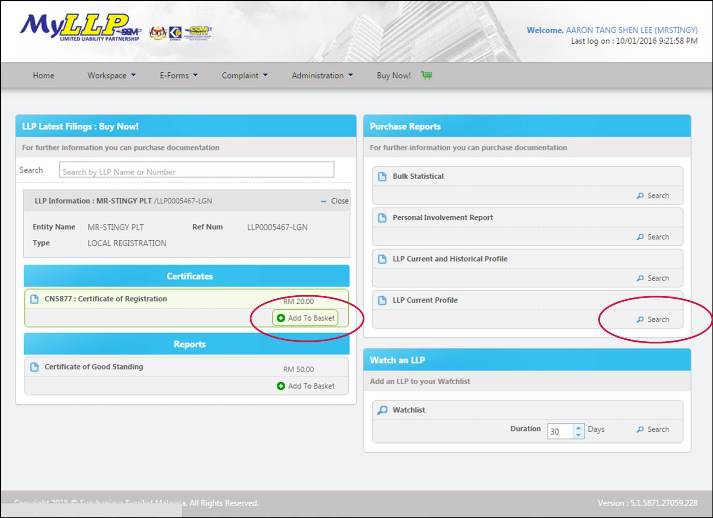

Add “Certificate of Registration” to basket, then click “Search” under “LLP Current Profile”

Add “Certificate of Registration” to basket, then click “Search” under “LLP Current Profile”

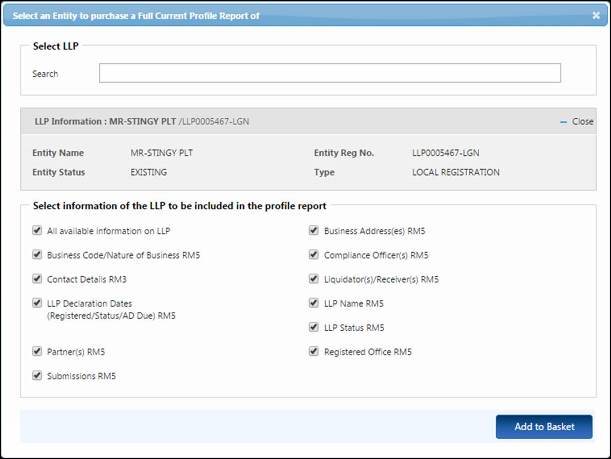

Enter your LLP name, check all the boxes, then “Add to Basket”

Enter your LLP name, check all the boxes, then “Add to Basket”

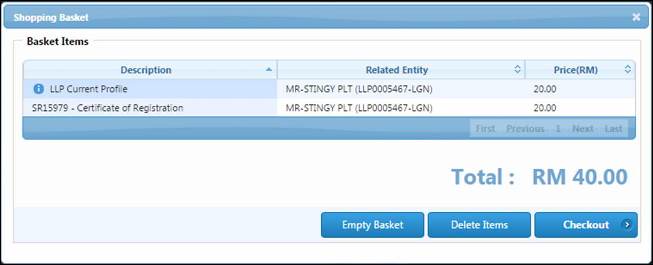

Total price (before GST) for the two documents is RM 40.00

Total price (before GST) for the two documents is RM 40.00

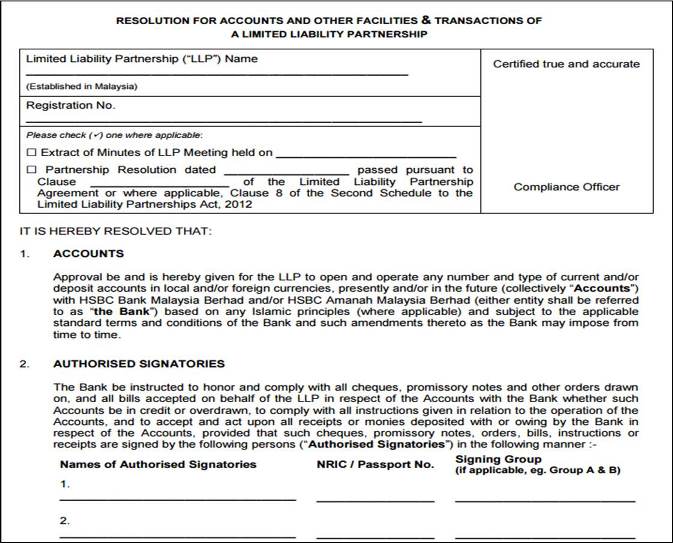

Certified Extract of Resolution for LLP

A “resolution” is a document that tells outsiders what the partners of an LLP have agreed on. In this case, your resolution will say that your LLP is making so much money that you now need a bank account.

Each bank has a “standard format” for this document. Ask your bank officer if he can provide you a sample for you to follow. And just because I’m a nice guy, here’s a link to a board resolution document from HSBC.

3. Fill Up the Forms With Your Partners

Now that you’ve got all documents:

- Fill up and get all the partners to sign the business account application form

- Prepare copies of the partners’ NRICs/passports

- Fill up the “resolution for LLP”

Some of the documents need your LLP’s rubber stamp. So you’ll have to make one if you haven’t already.

Certain banks (like Public Bank) require a current account holder to “introduce” you to the bank. If that’s the case, you need to get your introducer to sign the form too.

(Sorry, I can’t be your introducer).

Finally, if you like online banking, remember to fill up the “online banking application” form. Some banks (again, like Public Bank) don’t include that in the business account application form — so you’ll need to fill up another form.

4. Submit Documents to the Bank

You can now go back to the bank with the completed documents.

To be safe, bring originals of the important documents (especially your NRIC/passport), as the bank might need to physically see the original.

You don’t need to bring your introducer, but remember to bring all your partners along.

And your rubber stamp.

5. Wait for the Bank to Call You Back

The bank needs time to process your documents, so you’ll need to be patient. Even someone as good looking as my girlfriend had to wait three weeks for Public Bank to call her.

But eventually, the bank will call: “Your account is now ready,” they’ll say. “Now please deposit RM 5,000 into account number xxxxx xxxx xxxx to activate it.”

Deposit the money, wait a day, then call the bank. Ask them if they’ve received the money.

Once they’ve confirmed the money is in, and they’ve activated your account — you can go to the bank and collect your checkbook (+ any online banking accessories).

Congratulations — your LLP now has a bank account.

Now let’s make some money.

– – –

*Update 8th Oct 2017: CIMB now offers an Online Business Current Account that LLPs can apply for here. Thanks Cason Yong for the info!

*Update 2nd July 2016: Many of you have been asking about banks which offer online banking for LLP accounts. These banks do: CIMB, RHB, Public Bank, and the foreign banks (e.g. HongLeong, UOB, OCBC…). Let me know if I’ve missed any, and Maybank — time to up your game.

*Update 27th December 2016: If you need a professional consultant to help register your LLP or draft your LLP agreement, my partner can help you out. Promotional prices for LLP agreements start from RM 990, and additional services will be charged separately. For more info, please email info@axecute-consultancy.com.

p.s. If you’ve opened a bank account for your LLP, would you mind sharing your experience in the comments below?

Pic by michael kooiman at Flickr

Hi Mr Stingy!

Thank you so much for this post. because of your super informative post, my partner and I have succeed in registering our LLP on our own!

Our next step is to open a bank account. Do you happen to know is Maybank have accepted LLP now?

and as for the partnership agreement, is it necessary for the agreement to be duty stampped?

Thank you so much!

Hi Azreen,

Congrats and all the best. I’ve heard of Maybank accepting LLPs now, however you may need to ask around the bank a bit (if your initial contact doesn’t know about LLPs). As for partnership agreements, yeah it’s common practice to have them duty stamped.

Hello, just want to say this link https://www.cimb.com.my/en/business/solutions-products/deposit-investments/current-account/online-business-current-account.html for CIMB account does not work for LLP registration number.

I was instructed to download the form separately and send to CIMB

Thanks for sharing Gavin!

Hi,

Regarding Maybank wasn’t able to proceed with LLP because of the 13-digit issue: Last year SSM had produced 12-digit standard number for all ´existing and new businesses https://www.mydata-ssm.com.my/announcement?id=2.

Just went to a branch, they’ve given me these form to fill up:

1. Maybank2u Biz application form

2. Mandate letter (to give authority to different people with different access level to the account)

3. Business account opening form

4. Letter of introduction

Hi Ilyas,

I heard of a couple of people managing to do it through Maybank. See if you can appeal or try speaking to the branch manager?

Very informative. Can anyone advise on the company stamp. should it be round? or it can be any shape? How about the address and telephone number on the stamp?

Thanks. As far as I know — any shape will do. No need for address and number.

Hi, a very helpful article. Question, do you need to certify both LLP Profile and certification? Thanks for the reply

Hi Rajan,

I’m not so sure about the answer to that one. Depends on what you’re using it for I guess?

Hi Mr Stingy, followed your website and like it a lot. Intend to register an LLP to replace my current sole-proprietorship. I’m an insurance agent myself and tried to call a few banks up to enquire about current account opening.

1. Standard Chartered – LLP guidelines is not out yet, so cannot register. Maybe have to wait till next year.

2. HSBC – LLP can register, but insurance agent is not accepted

3. KFH – Enquiring, waiting for them to find out more

4. MBSB Bank – No problem (the only problem is no online banking and ATM/CDM machines are not up yet due to bank is still new)

5. Alliance Bank – No problem (the only problem is online banking token is too expensive)

6. Affin Bank – Haven’t enquire yet, will update

7. Maybank – Haven’t enquire yet, will update

8. CIMB – Haven’t enquire yet, will update

9. AmBank – Insurance agent is not accepted

10. UOB – Insurance agent is not accepted

11. Public Bank – Introducer is required, so no go for me

12. Hong Leong – Haven’t enquire yet, will update

Thanks a lot Andy. Really appreciate it!

Hi guys, adding up to the list. It is worth mentioning that RHB accept PLT company to open account with Online Banking Facility (checker & maker) with RM2k deposit and all the documentation. It took them a week to process (in 2016)

And if no harm in asking, do you know which bank gives loan/hire purchase to PLT?

Thanks Joe — appreciate it very much!

Thank you .. Info is very useful

You’re welcome!

Found your entry very helpful. Let me just share my experience.

Registered my LLP on 1st June (Friday) and got the confirmation of registration on the 5th June.

Right outside SSM Shah Alam, there are sales consultant for Affin Bank promoting Business Current Account without introducer and I submitted my application for LLP to them,they say it might take up to 3 days for checking.

The next day i went to RHB,AmBank and finally CIMB.

Here’s the response from the bank officers;

1. Affin Bank, kiosk SSM Shah Alam – Documents needed – Profile,Notice of Reg (SSM documents) and company stamp. Said might take up to 3 days. Cheque and online banking with Token (might take) RM 2,000 to open account.Agent Hafiz was very helpful

2. RHB Islamic Laman Seri Shah Alam – On top of the two SSM documents, need as well LLP Agreement and doesn’t want my company stamp with address.said might take up to few weeks. Asked me to come back with completed documents (agreement) and gave the form.

3. AmBank Laman Seri Shah Alam – Officer Yus was quite helpful initially said might take 3 days but later found out it could take weeks. SSM Documents minus agreement. RM1,200 to open account. Cheque and Online banking (but need a letter from the company to apply online banking,she said will email me the template)

4. CIMB Plaza Azalea Shah Alam – Officer Shahirah was very helpful. Tried online BCA opening but not possible. so did manual application. Documents needed only the two SSM docs and company stamp. Said up to 3 days to be ready but called the next day saying my account is ready. RM1,000 to open account. Cheque and online banking without token.

Hope this help others!

Wow… thank you so much Budiman! Hope the business goes well yeah…

Thanks for the info.. I shall try with CIMB 🙂

Good luck!

Hi Budiman, thanks for the information. Any idea on the fees and charges comparison between Affin and CIMB? I suspect the lower deposit amount will be ‘compensated’ with higher and frequent charges/fees. Could you advise, please? Thanks.

Thanks for the sharing Mr-Stingy! Great content and help make understanding much easier!

Thanks so much Yee!

Hello, is anyone knows how to make a partnership agreement? any templates? or it got to go through with the lawyer’s stuff?

Better to work with a lawyer on this…

Visited PBB yesterday, they required two kinds of rubber stamps.

1. Company stamp

2. Compliance officer stamp

Did you come across to have compliance officer stamp?

How is the design look-alike?

Thanks

I have no idea actually. I’m sure the stationery/office shops would know though…

Hi, thanks for this helpful blog.

I have opened a LLP with 2 partners (I am foreigner and my 2 partners are Malaysian).

We were told by the bank that all partners must be signatories in a LLP. Foreigners need work permit to be a signatory,

The problem is that I don’t have a work permit (only spouse Visa) and immigration won’t grant me the permit cause the business is not running yet…

Do you know if there is any bank allowing to open a bank account without all the partners being signatories?

Thanks.

Hi Jeremy,

Unfortunately I don’t enough regarding the banks. You might need to check them out yourself. Do report back if you find any positive news? Thanks!

Hi Jeremy same situation here did you manage to open your bank account?

what bank allows foreigners to be partner of the LLP, Im currently working in Singapore and I don’t have any visa or working permit in Malaysia.

What is the requirement of rubber stamp layout? Do you have sample (simplest) layout of the rubber stamp?

There’s no specific format. Just go to any stationery shop and they can do one for you.

Funny parts with maybank account activated, sign few papers for cheque book all done at last notice by officer “ouch” system doesn’t recognise 13 digits registration number. Within 5 mins, close account and get back money that deposited early. How on earth that leading bank in Malaysia such a failure. End up, opening with hong leong bank.

Oh man… Maybank — time to up your game!

Hi Stingy,

What a nice article. Almost read all your articles about LLP and found them very useful. I’ve got a question for you (and your fellow readers), which is…does opening a Current account require an introducer? Or are the banks that don’t require and introducer to open up a Current account? I tried to open up a Maybank account for my LLP but the thing is they require an introducer. I’m just wondering whether all banks are the same? If not, which ones don’t require? My next preferred option would be CIMB and third option will have to go to RHB for now.

Looking forward to your feedback guys. Thanks in advanced!

Thanks Jafry,

Different banks have different requirements. Like I know Public Bank needs an introducer. But perhaps CIMB and RHB don’t need. Been hearing good things about RHB btw.

I visited 5 banks branches before I finally found then right bank for my LLP.

First, I visited 2 Maybank branches to find out that to Maybank, as far as banking facility is concerned, LLP has to use what’s set up for Company. So LLP must pay rm80+ in monthly account maintenance fee.

Then I visited 2 CIMB branches, and found out they don’t accept account opening for e-commerce business.

Finally I went to RHB, and found the best experience there. The staff was updated about LLP and handled account opening efficiently.

Wow thanks so much for the helpful comment. Mind to share which specific RHB branch?

BTW — awesome website. All the best with the business!

Just tried to open an account for my LLP with Maybank last week. Filled up all the forms, brought everything and waited pretty long and the bank officer accepted everything but alas! They called me this morning and said that there is still no LLP internet banking. So I can confirm that as of now, Maybank still doesn’t have internet banking for LLPs. 🙁 I will be trying Hong Leong next week.

Ouch! Thanks for the helpful comment Sean. Appreciate it!

Thanks… very helpful;

😀

i have a few LLP accounts at maybank.

Now they allow internet maybank2u for LLP!

Thanks Richard — that’s really good news to hear!

Maybank still does not have online banking facilities for LLP company. I was told the reason is Maybank system cannot recognise LLP company number which is too long (13 digits). Finally opened an account with CIMB thru online and submitted the relevant documents with the branch. However, still need to submit certified true copy of LLP cert to the bank. Went to SSM to get it certified and paid RM5.30 (GST included) for the certified copy of the certificate. Again, was told certified true copy can also be done online by SSM as they at first reluctantly refused to do it manually. Couldn’t get more information on the process of certification online. maybe someone can enlighten.

Hello Eddie,

A little unsure about getting certified true copy online. Last I checked I didn’t see that option for purchase. If anyone else has some ideas, do share? Thanks!

Hello, does anyone know how to apply LLP account with Maybank? Thanks in advance!

Hey Christina,

I’m not sure if Maybank allows LLP accounts yet. Last time I checked — still no, but Maybank please tell me if I’m wrong!

I want to share my experience trying to open current account for my LLP.

Since I already have house loan with Public Bank, an introducer is not required. The LLP PDF documents (certificate of registration and registration information) printed at home are accepted by the bank without any SSM certification required. But it takes a long time to get bank HQ approval, at least a week.

I also asked CIMB. Approval is faster (3-4 business days). But one problem I have is that the certificate of registration must be certified by SSM. I don’t see how that can be purchased on SSM website. The certified copy of registration information can be purchased for RM15 (add RM0.90 for GST) on SSM website. I hope others can share their experience how to get the certificate of registration certified by SSM.

One thing that I was very impressed is how fast LHDN can create the income tax number for the LLP company. We need to fill CP 600PT[Pin.1/2016] form which can be downloaded from LHDN website. Other documents required are LLP agreement (original with LHDN franking) and SSM’s certificate of registration and registration information which I printed at home. I was also asked to fill the Majikan information. I was given 2 letters stating No Cukai Pendapatan and No Rujukan Majikan within 30 minutes.

Thanks Anwar for the sharing!

Interesting to hear about CIMB asking for certification. I recall having the same problem with JPJ in Petaling Jaya. In the end, I ended up giving them my original copy of LLP certificate (back then you could buy an original copy from SSM). I guess the officers at that CIMB branch weren’t fully familiar with the regulations — still seeing that a lot!

Awesome to hear about the LHDN speed too. Thanks again for sharing!

I am wondering if for LLP, we would need to create the bank account first or income tax file number first? Or the sequence doesn’t matter?

Additionally, hope you don’t mind if I ask – what does LLP agreement mean? Where do I get this? Also registration information – what is this and where do I get it?

Thanks a lot!

Hello KC,

With regards to sequence, this article will probably help you: https://www.mr-stingy.com/ultimate-guide-new-llp-malaysia/

LLP Agreement is the agreement between all the partners. You should probably get a lawyer to help you draft this. At the bottom of my article, there’s a link where you can request for a quote — that might be helpful for you.

Not sure what you mean by “registration information.”

All the best.

Hi Mr Stingy,

How much did you oay to vertify one document by ssm?

Hi PC,

Back then the system was different. I’m not sure how they charge now, but I paid RM 5.30 for verification per page.

Hi, when opening an account with the banks mentioned above, did you have to submit as well the trade license?

Also, are you required to register with lhdn to acquire a trade license?

Hey Sheng,

Nope the banks didn’t require a trade license. Unfortunately I’m not well-versed with trade licenses, so I don’t have a good answer.

Omg this was so useful! Definitely going for CIMB to open a LLP account at usj9 . But I have 2 partners that are currently not here, is it plausible to just have 2 partners to register for the account?

Hey Chester,

I’m not sure — need to ask the bank who they need to be there to register…

Hi, Mr. Stingy,

thanks for your post, it helps a lot. i follow your guide to register LLP too. now bank account. thanks for your articles. Mr. Stingy, do you i ask one more question, the rubber stamp means by you is that individual company stamp right? thank you

Hey Max,

No problem. Yeah — the rubber stamp means your individual company stamp.

Does anyone have experience with opening a bank account if one of the partners in LLP is a foreigner. We just got rejected by Maybank , reason being that needed a work permit. But our foreigner was just a silent investor!

Someone please help Helen out!

Maybank is known to reject foreigners, I suggest you get someone who has a current account (or even better a premium acct) with Maybank to introduce you.

Thanks CR!

My LLP current account applying via Maybank was rejected @ Oct-2018 simply because of the the partner is a foreigner and she has work permit as Admin Exe but rejected because the occupation must be Partner or Managing Partner in work permit!!!

Thanks klse for the helpful comment!

Mr. Stingy, your posting has been really helpful. I practically follow through your instruction to get my LLP setup and now trying to open banking account.

Visited Dataran Maybank this morning for business accounting opening for LLP. The officer is not very clear about the procedure for LLP. She did help me to get information in the end upon checking the user manual from the thick folder, i mean the physical folder. No online banking yet as the LLP registration number prefix hasn’t been integrated into the system. After leaving maybank, i just drop by RHB to try my luck. I got all my information within 10 mins without much hassle. Still i need a partnership agreement for account opening.

can you ping me for your partner’s contact? Thanks.

Thanks Jane for the very helpful information. I’ll email you right now.

Attention Maybank: You really need to up your game!

Hi,

I ended up opening Maybank2E account. Price is quite steep for package that allows viewing and fund transfer (RM78i think). I hate the stupid long LLP registration number. Very syok sendiri kind of number

Thanks for the helpful info Dean!

Hi Mr. Stingy, I register as partnership and plan to convert to LLP end of this year. I have a Maybank account currently, the question is does it have any effect on the bank account after I have convert into LLP? or I need to go to the bank to update the officer?

Hi Roger,

I’m pretty sure you need to go inform the bank that you’ve converted to an LLP. But I’m guessing it won’t be very much of a hassle after that…

Hi,

In your point #3 , the 3rd point; resolution for LLP, what’s it? how to prepare it? What need to be considered?

Hi Eddie,

I believe each bank has their preferred format for the LLP resolution. Best to check with the bank directly, and I’m confident they can give you a sample.

Thanks Mr Stingy for the sharing. I have finally registered LLP. May i know which bank offer most friendly online facility for LLP? As i know Maybank do not offer online facility for LLP. Looking forward for your suggestion

.

Hi Vincent,

Perhaps you can try Public Bank.

I opened Maybank account. They still don’t offer online banking.

However, registering was simple. The document you listed above, company stamp (had this done in Wisma Central) and presence of my Partner. No need of partnership mandate document and partnership agreement.

The most difficult part is to get friend with current account opened >1 year.

I would like to add that the documents listed above (company info & company registration cert) can be printed, once purchased and email to you. Maybank do accept the copies printed from home. No need to go to SSM to get certified copy.

Thanks Dean — that’s very helpful info!

Hi. Thanks for te article about opening LLP. I save rm700 because of your article by registering myself. But here another problem. I heard maybank does not give an Online Banking for LLP account type. So can i ask which bank you open your account and do they give u Online Banking?

Hello Abu,

My girlfriend opened her bank account for LLP with Public Bank, and they allow online banking.

Currently, Maybank is still not ready for LLP business accounts. Online transfer as well as phone banking are not available. Account holder will have to fill out form and go to the counter to transfer pay/transfer via cheque. Bad for overseas based businesses.

Oh, that’s not very good to hear. Thanks for letting us know Mona. Let’s hope they improve soon!

Hi, Mr Stingy,

You write there certified true copy of the documents. May i know whom shall certify for us. SSM office or lawyers or we certify ourself?

Hello marcus,

Which document exactly are you referring to? If it’s documents from SSM — then yes, the SSM office can certify them.

If it’s the other documents — better to check with the bank on what their requirements are.

Hope this helps!

“You can buy both these documents from the MyLLP system (although you’ll have to physically collect them from SSM).” — Is there any issue if we print out the documents ourselves instead of having to go to the SSM office to collect?

Hello Grace,

I don’t think you can print out the documents yourself. (Haven’t tried it myself though — so please let us know if you find otherwise). Thanks!

Hi, when you collected from SSM office does it contain official SSM stamp on the LLP certificate / documents?

Hi topevemi,

I believe you only get official SSM stamp if you specifically request for “certified true copy” when purchasing, and then go to SSM to collect. Otherwise, you can just print the documents directly from home.

Thanks for another great article on LLP.

Is the deposit amount standard for all banks at RM5k?

Thanks Bernard,

Unfortunately I’m not sure — better to check with the specific bank.

Hi Bernard, I’ve recently open current account for my LLP at CIMB for RM1k which comes with online banking. Less hassle, just pick up a form from the branch and submit to the bank officer. All you need to bring is just SSM documents – certificate of registration and LLP current profile. However, you need an introducer to open a current account with them. Hope this helps.

Thanks Felicia for the very helpful comment!

Hi Felicia,

Can you double confirm that you managed to open up LLP at Malaysia CIMB which comes with online banking? I was told that it does not have internet banking yet. It seems that all the foreign banks in Malaysia do offer LLP account and internet banking (OCBC, UOB, etc) but their monthly transaction fee are high.

Appreciate your response. Thanks!

Hi Paul,

Thanks for writing in. Just wanted to add that Public Bank does offer LLP account with Internet Banking.

Thanks for your suggestion on Public Bank Mr Stingy, Do you know if CIMB has it too?

It has not been 100% smooth process applying for LLP. Even registration.

Maybank took us for a ride for 3 weeks for profile check, then when we showed up, they mentioned there is no internet banking. I was shocked, all other business application (sole/partnership/company) has internet bank except LLP?

I later called Maybank phone banking, only then they suggested a Maybank 2E which works for LLP. But the transaction cost are high.. I was suprised the officer at the counter did not even suggest Maybank 2E. Shows that not everyone is educated about LLP process.

Hi Paul,

Sorry for the late reply. Yes, it’s at Malaysia CIMB, specifically at USJ 9. I also initially went to Maybank in Taipan, but was told similarly that they don’t cater internet banking for LLP and the process is long and tedious for registration, requiring to make a company rubber stamp just for the registration. So that trigger me to enquire from other banks, and ended up at CIMB which was super efficient.

Hope this helps.

Thanks a million Felicia for being so helpful!

I’ll add CIMB to the list of “online banking-enabled” banks!

Hi Felicia,

I also just realized that maybank does not offer online banking for LLP which is a big no no. Just want to know do you need to bring along Introducer for opening current account?

Why la I don’t stumbled with this blog, thanks Mr Stingy for a detail comprehensive walkthrough. this blog help lot for LLP process.

You’re welcome Muhammad 😉

Hi Felicia, Just wondering if where do you get the LLP current profile on the SSM website? Is this document needed to submit to CIMB- http://www.cimbbank.com.my/content/dam/cimb-consumer/business/PDF/bizalert/bizalert-application-form-july2016.pdf ?

Thank you.

Hi Li,

For LLP current profile from MyLLP system:

1. “Buy Now!”

2. LLP Current Profile >> Search

3. Enter LLP name, select information required, then “Add to Basket”